Market Overview

The KSA sniper rifle market reflects a focused segment of the national defense procurement ecosystem, with a recent historical assessment indicating total expenditure of approximately USD ~ million allocated to sniper rifles, associated optics, and support systems. This market size is driven primarily by sustained defense modernization programs, counterterrorism requirements, and border security imperatives under national security planning frameworks. Procurement activity is closely linked to infantry and special forces modernization cycles, with emphasis on precision lethality, interoperability, and lifecycle sustainment, supported by Ministry of Defense budget allocations and long-term force capability development strategies.

Saudi Arabia dominates regional demand due to its extensive land borders, high operational tempo, and strategic emphasis on internal and external security readiness. Riyadh functions as the central procurement and command hub, hosting key defense authorities and decision-making bodies. Domestic industrial centers such as Riyadh and Jeddah support localization initiatives through assembly, maintenance, and integration of facilities. International supplier’s influence remains strong, particularly from Europe and North America, driven by proven battlefield performance, technology transfer agreements, and alignment with national defense cooperation frameworks.

Market Segmentation

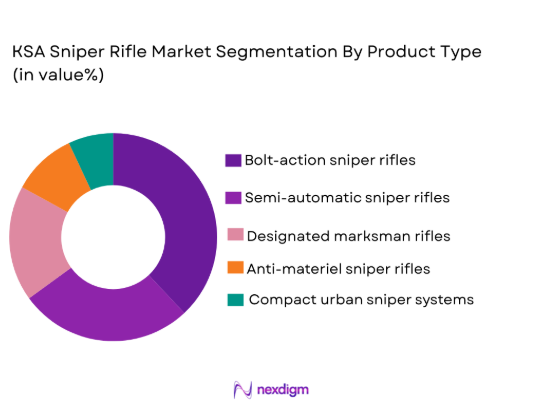

By Product Type

The KSA sniper rifle market is segmented by product type into bolt-action sniper rifles, semi-automatic sniper rifles, designated marksman rifles, anti-materiel sniper rifles, and compact urban sniper rifle systems. Recently, bolt-action sniper rifles have held a dominant market share due to their superior long-range accuracy, mechanical reliability, and lower maintenance complexity compared to more electronically integrated systems. Saudi military doctrine places strong emphasis on precision engagement over extended distances, particularly for border surveillance and overwatch missions, where bolt-action platforms deliver consistent ballistic performance. These systems are widely preferred for harsh desert environments because of reduced sensitivity to dust, heat, and mechanical stress. Long-standing operational familiarity established training curricula, and compatibility with existing optics further reinforced dominance. Additionally, bolt-action rifles are commonly selected for local assembly and sustainment programs, aligning with defense localization objectives and cost-control priorities while maintaining operational effectiveness across multiple force units.

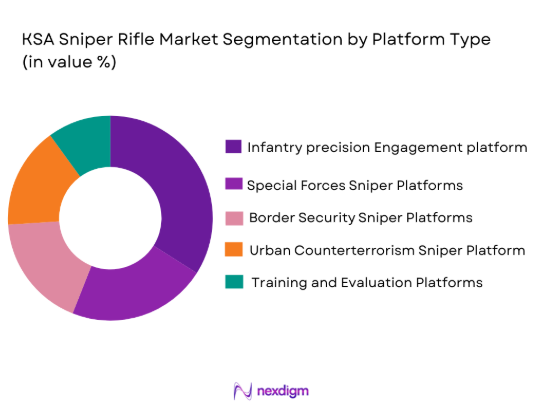

By Platform Type

The KSA sniper rifle market is segmented by platform type into infantry precision engagement platforms, special forces sniper platforms, border security sniper platforms, urban counterterrorism sniper platforms, and training and evaluation platforms. Recently, infantry precision engagement platforms have dominated market share due to their broad deployment across conventional army units and national guard formations. These platforms are integral to standard infantry battalions, providing scalable precision fire capability without the specialized logistical footprint required by elite units. Saudi defense planning emphasizes widespread force readiness, making infantry platforms the primary recipients of sniper rifle allocations. Their dominance is reinforced by standardized procurement models, streamlined training pipelines, and compatibility with existing command-and-control structures. Furthermore, infantry platforms benefit from higher replacement and upgrade frequencies, as they are exposed to continuous operational use during training and field deployments, driving sustained procurement volumes across procurement cycles.

Competitive Landscape

The KSA sniper rifle market is moderately consolidated, characterized by a limited number of global manufacturers supplying advanced systems alongside emerging domestic entities supporting localization and sustainment. Major international players exert strong influence through technology leadership, proven combat performance, and long-term government-to-government agreements, while local firms increasingly participate through assembly, maintenance, and offset programs aligned with national industrialization goals.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Localization Capability |

| Saudi Arabian Military Industries | 2017 | Saudi Arabia | ~ | ~ | ~ | ~ | ~ |

| Military Industries Corporation | 1988 | Saudi Arabia | ~ | ~ | ~ | ~ | ~ |

| Accuracy International | 1978 | United Kingdom | ~ | ~ | ~ | ~ | ~ |

| FN Herstal | 1889 | Belgium | ~ | ~ | ~ | ~ | ~ |

| SIG Sauer | 1853 | United States | ~ | ~ | ~ | ~ | ~ |

KSA sniper rifle Market Analysis

Growth Drivers

Infantry and Special Forces Modernization Programs

Infantry and special forces modernization programs represent a critical growth driver for the KSA sniper rifle market as Saudi Arabia continues to restructure and upgrade its ground combat capabilities to address evolving threat environments. These programs prioritize precision engagement, force survivability, and interoperability across units, directly increasing demand for modern sniper rifle systems. Procurement strategies emphasize replacing legacy platforms with high-accuracy rifles integrated with advanced optics and modular accessories. The focus on professionalization of ground forces drives standardized acquisition across army, national guard, and internal security units. Training doctrine updates require rifles capable of consistent performance across varied mission profiles. Additionally, modernization initiatives are closely tied to long-term defense budget planning, ensuring sustained procurement cycles rather than one-time acquisitions. Localization mandates embedded within modernization frameworks further stimulate demand by encouraging local assembly and lifecycle support. This comprehensive approach reinforces sniper rifles as essential force multipliers within Saudi ground forces.

Border Security and Counterterrorism Requirements:

Border security and counterterrorism requirements are a major driver shaping the KSA sniper rifle market due to the country’s extensive land borders and persistent asymmetric threat considerations. Precision rifles are critical for surveillance, overwatch, and controlled engagement in border regions and sensitive internal security operations. Saudi security doctrine emphasizes minimizing collateral damage while maintaining decisive engagement capability, making sniper systems strategically important. Counterterrorism units rely on precision rifles for urban and semi-urban operations where accuracy and reliability are paramount. Continuous operational readiness necessitates regular equipment upgrades and replenishment. Integration with surveillance systems and command networks further elevates the importance of modern sniper platforms. Government prioritization of internal stability ensures consistent funding allocation for such capabilities. As a result, border and counterterrorism missions sustain long-term demand for advanced sniper rifle systems across multiple agencies.

Market Challenges

High Lifecycle and Sustainment Costs:

High lifecycle and sustainment costs present a significant challenge in the KSA sniper rifle market due to the long service life expectations placed on precision weapon systems. Advanced sniper rifles require regular maintenance, specialized spare parts, and periodic barrel and component replacement to maintain accuracy standards. Environmental conditions such as heat, sand, and humidity accelerate wear, increasing sustainment expenditure. Training costs associated with maintaining skilled armorers and operators further add to lifecycle burdens. Imported systems often rely on foreign supply chains, exposing sustainment programs to cost fluctuations and logistical delays. Budget planning must account not only for initial procurement but also decades of operational support. These factors complicate procurement decisions and may delay upgrades. Consequently, lifecycle cost management remains a central concern for defense planners for balancing capability enhancement with fiscal discipline.

Regulatory and Technology Transfer Constraints:

Regulatory and technology transfer constraints pose another major challenge affecting the KSA sniper rifle market, particularly for advanced systems sourced from foreign manufacturers. Export control regimes and licensing requirements can limit access to specific technologies, calibers, or advanced fire-control components. Delays in approvals can slow procurement timelines and disrupt modernization schedules. Technology transfer negotiations are often complex, involving intellectual property protections and localization of thresholds. These constraints may restrict the extent of local manufacturing and modification activities. Compliance requirements also increase the administrative burden for both suppliers and government agencies. In some cases, regulatory limitations influence system selection toward less advanced but more readily available platforms. As Saudi Arabia expands localization ambitions, navigating these regulatory complexities becomes increasingly critical to sustaining market growth.

Opportunities

Defense Localization and Licensed Production Expansion:

Defense localization and licensed production expansion represent a major opportunity within the KSA sniper rifle market as national policy strongly encourages domestic industrial participation. Establishing local assembly and manufacturing lines for sniper rifles reduces dependence on imports and enhances supply security. Licensed production enables gradual transfer of technical expertise and workforce skill development. Localization also supports faster turnaround for maintenance and upgrades, improving operational readiness. Government incentives and offsetting requirements make participation attractive for international manufacturers. Over time, localized production can reduce unit costs and lifecycle expenses. This opportunity aligns with broader industrial diversification objectives and creates a sustainable domestic ecosystem. As localization capabilities mature, Saudi Arabia may also position itself as a regional hub for precision weapon support and manufacturing.

Integration of Advanced Optics and Digital Fire Control Systems:

Integration of advanced optics and digital fire control systems offers a strong opportunity to enhance value within the KSA sniper rifle market. Modern combat scenarios increasingly demand rapid target acquisition, ballistic computation, and networked situational awareness. Advanced optics, including thermal and night-vision systems, significantly extend operational effectiveness. Digital fire control integration improves first-round hit probability and reduces training time. These upgrades can be applied to both new and existing rifles, expanding retrofit opportunities. Saudi forces prioritize technological edge, making adoption likely across elite and conventional units. Collaboration with technology providers enables modular upgrades without full system replacement. This opportunity supports incremental capability enhancement while maximizing return on existing investments.

Future Outlook

The KSA sniper rifle market is expected to experience steady development over the next five years, supported by continued defense modernization and internal security priorities. Technological advancements in optics, materials, and modularity will shape procurement preferences. Regulatory support for localization will influence supplier strategies. Demand will remain driven by border security, counterterrorism, and training requirements. Overall, the market outlook reflects sustained, but disciplined growth aligned with national defense planning.

Major Players

- Military Industries Corporation

- Saudi Arabian Military Industries

- Accuracy International

- FN Herstal

- SIG Sauer

- Heckler & Koch

- Sako

- Steyr Arms

- Barrett Firearms

- Beretta Defense Technologies

- Desert Tech

- Lobaev Arms

- PGW Defence Technologies

- Kalashnikov Concern

- Norinco

Key Target Audience

- Defense ministries and armed forces

- Internal security agencies

- Border security authorities

- Special operations commands

- Defense procurement agencies

- Local defense manufacturers

- System integrators

- Investments and venture capitalist firms

Research Methodology

Step 1: Identification of Key Variables

Key variables related to procurement volume, platform type, and technology adoption were identified. Demand-side and supply-side factors were mapped. Regulatory and policy influences were incorporated.

Step 2: Market Analysis and Construction

Data was analyzed to structure segmentation and competitive positioning. Historical procurement patterns were reviewed. Market relationships were constructed using validated frameworks.

Step 3: Hypothesis Validation and Expert Consultation

Findings were validated through consultation with defense industry experts. Assumptions were tested against operational realities. Adjustments were made to ensure consistency.

Step 4: Research Synthesis and Final Output

All insights were synthesized into a coherent market model. Cross-checks ensure internal consistency. Final outputs were structured to meet analytical objectives.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average Weapon System Price, 2020-2025

- By Caliber and System Complexity Tier, 2020-2025

- By System Type (In Value%)

Bolt-action sniper rifles

Semi-automatic sniper rifles

Designated marksman rifles

Anti-materiel sniper rifles

Compact urban sniper rifle systems - By Platform Type (In Value%)

Infantry precision engagement platforms

Special forces sniper platforms

Border security sniper platforms

Urban counterterrorism sniper platforms

Training and evaluation platforms - By Fitment Type (In Value%)

Standard infantry weapon fitment

Special forces customized fitment

Vehicle-supported sniper systems

Fixed position and overwatch fitment

Training range and simulation fitment - By End User Segment (In Value%)

Saudi Arabian Armed Forces

National Guard and internal security forces

Border and coastal security units

Special operations forces

Training and military academies - By Procurement Channel (In Value%)

Direct Ministry of Defense procurement

Government-to-government defense programs

Licensed local manufacturing and assembly

OEM and system integrator contracts

Long-term sustainment and upgrade programs - By Material / Technology (in Value %)

Advanced barrel and rifling technologies

High-strength lightweight alloy receivers

Integrated optics and fire control systems

Precision ammunition compatibility technologies

Signature reduction and recoil mitigation systems

- Market share snapshot of major players

- Cross Comparison Parameters (Accuracy range, Caliber flexibility, System weight, Optics integration, Durability, Localization level, Cost structure, After-sales support)

- SWOT Analysis of Key Competitors

Pricing & Procurement Analysis - Key Players

Saudi Arabian Military Industries

Military Industries Corporation

Accuracy International

FN Herstal

Heckler & Koch

Sako

Steyr Arms

Barrett Firearms

Desert Tech

SIG Sauer

Beretta Defense Technologies

Lobaev Arms

PGW Defence Technologies

Kalashnikov Concern

Norinco

- Armed forces prioritizing long-range precision and reliability

- Special forces demanding modular and adaptable systems

- Border units focusing on durability and surveillance integration

- Training institutions emphasizing standardization and accuracy

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035