Market Overview

As of 2024, the KSA soft gelatin capsules market is valued at USD 217.4 million, with a growing CAGR of 5.4% from 2024 to 2030. This figure is primarily driven by the increasing demand for nutraceutical and pharmaceutical products across the region, which have become integral due to rising health consciousness and awareness among consumers. The growth trajectory is underpinned by the trend towards dietary supplements and encapsulated medications which offer easier consumption, thereby enhancing patient compliance.

Riyadh and Jeddah are the leading cities dominating the KSA soft gelatin capsules market. The prominence of these cities is attributed to their advanced healthcare infrastructure, large base of pharmaceutical manufacturers, and higher consumer spending power. The presence of numerous production facilities and access to a wide distribution network further contribute to the dominance of these cities in the market.

Market Segmentation

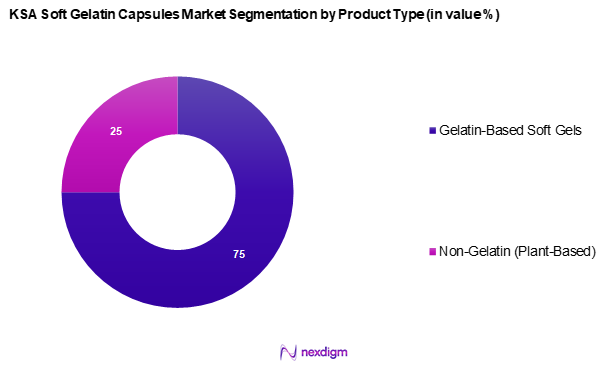

By Product Type

The KSA soft gelatin capsules market is notably segmented into gelatin-based soft gel, and non-gelatin (plant-based) soft gel. The gelatin-based soft gel segment dominates the KSA soft gelatin capsules market due to its extensive versatility and superior bioavailability, which enhances the absorption of active ingredients. Consumers prefer gelatin capsules for their smooth texture and ease of swallowing, making them popular among various demographics, including children and elderly populations. Additionally, the established production processes and strong market presence of leading manufacturers contribute to consumer trust and widespread acceptance.

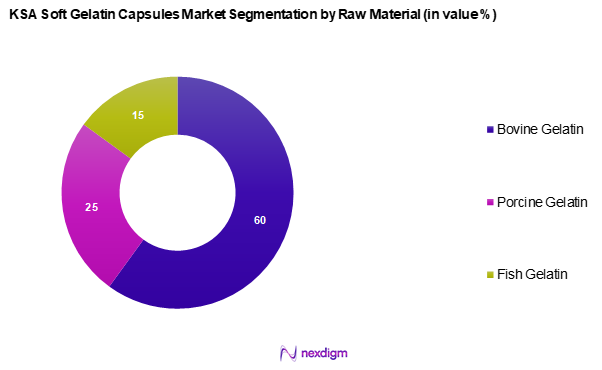

By Raw Material

The KSA soft gelatin capsules market is segmented into bovine gelatin, porcine gelatin, and fish gelatin. The use of bovine gelatin dominate the market due to its robustness and cost-effectiveness, which appeals to manufacturers looking for reliable encapsulation materials. Bovine gelatin is preferred for its neutral taste and versatile applications in multiple drug types, ensuring a steady demand in the pharmaceutical sector.

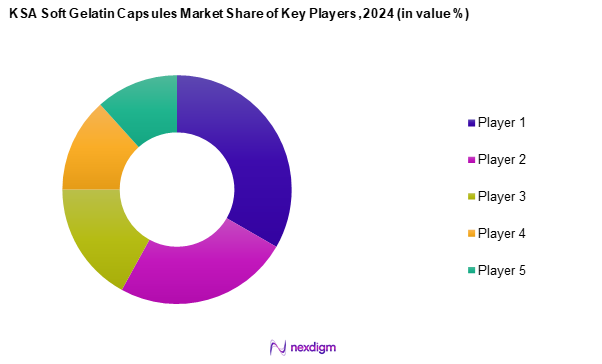

Competitive Landscape

The competitive environment in the KSA soft gelatin capsules market is shaped by a mix of international and local manufacturers who have established significant operations in the region. Major global players and emerging local companies drive the market dynamics through innovation and scalability.

| Company | Establishment Year | Headquarters | Market Share | Production Capacity | Strategic Alliances | Product Variety | Localization Strategy |

| Nature’s Bounty | 1971 | USA | – | – | – | – | – |

| Aenova Group | 2008 | Germany | – | – | – | – | – |

| Catalent Inc. | 1933 | USA | – | – | – | – | – |

| Sirio Pharma | 1993 | China | – | – | – | – | – |

| Capsugel (Lonza Group) | 1931 | Switzerland | – | – | – | – | – |

KSA Soft Gelatin Capsules Market Analysis

Growth Drivers

Increasing Demand for Nutritional Supplements

The surge in demand for nutritional supplements is strongly supported by rising health awareness among the Saudi population. With an increasing focus on preventive healthcare, the consumption of dietary supplements has become prevalent. According to a report by the World Bank, around 35% of health expenditures in Saudi Arabia are directed toward wellness products, indicating a significant trend among consumers seeking healthier lifestyles. Additionally, the Kingdom’s healthcare expenditure is projected to grow from around USD 44.0 billion in 2023 to over USD 49.0 billion in 2024, contributing to the boosted market for nutritional supplements.

Rising Geriatric Population

The aging population in Saudi Arabia is projected to reach approximately 3.2 million seniors by 2025, creating a corresponding rise in demand for health products tailored to this demographic. A report from the Saudi Ministry of Health highlights that older individuals are more likely to use health supplements to manage chronic diseases and improve overall wellness. As baby boomers age, the country’s healthcare policies are focusing on geriatric care, with a spending increase intended for health management strategies, thus driving the need for soft gelatin capsules to support the nutritional needs of older adults.

Market Challenges

Price Volatility of Raw Materials

The soft gelatin capsules market faces challenges due to price volatility in key raw materials, particularly gelatin, which is sourced from animal by-products. Fluctuations in the cost of animal feed and supply chain disruptions have raised the prices of gelatin, as highlighted by reports from the Food and Agricultural Organization (FAO). Current prices have escalated nearly 15% compared to previous years, pressured by rising global demand and localized shortages. Such volatility threatens manufacturers’ margins and leads to greater difficulty in managing production costs, thereby impacting market growth potential.

Regulatory Compliance Issues

Navigating the regulatory landscape poses a significant challenge for manufacturers in the KSA soft gelatin capsules market. The Saudi Food and Drug Authority (SFDA) has stringent regulations governing the production, distribution, and marketing of health supplements. Compliance with these regulations can be resource-intensive; manufacturers often struggle to meet required quality standards, impacting their market entry timelines. Furthermore, according to the SFDA, around 25% of new product applications have faced delays due to regulatory hurdles, hindering manufacturers’ capacity to innovate and adapt to market dynamics in the healthcare sector.

Opportunities

Expansion into Untapped Markets

The KSA soft gelatin capsules market has abundant opportunities, particularly in untapped consumer segments such as women’s health and sports nutrition. Currently, dietary supplements targeting these groups are underrepresented, reflecting the potential for expansion. The General Authority for Statistics indicates that women’s health expenditure is projected to grow significantly over the next several years, driven by increased awareness regarding health risks among women. Moreover, the rising youth demographic is becoming increasingly health-conscious, creating a viable market for sport-related nutritional supplements. This presents a strategic avenue for soft gelatin capsule manufacturers keen on exploring new opportunities and diversifying their product lines.

Increasing Preference for Halal-based Products

Given the cultural inclinations within Saudi Arabia, there’s a notable trend toward the consumption of halal-certified products, including dietary supplements. Reports indicate that over 70% of consumers prefer halal products due to health, ethical, and spiritual considerations. The current halal dietary supplement market is valued at approximately USD 18.0 billion in the region and is expected to expand further as the demand for halal certification increases among consumers. This trend presents a significant opportunity for manufacturers of soft gelatin capsules to develop halal-compliant products tailored to the local market and attract health-conscious consumers.

Future Outlook

Over the next five years, the KSA soft gelatin capsules market is expected to experience robust growth. Key factors driving this include advancements in encapsulation technology, an increase in health and wellness trends, and a growing shift towards nutraceuticals. The market is predicted to witness innovations in raw material sources, particularly towards sustainable and plant-based alternatives, which align with global movements towards greener practices and halal-compliant products. Entities involved are likely to expand their R&D activities to meet these evolving consumer demands and capitalize on rising opportunities.

Major Players

- Nature’s Bounty

- Aenova Group

- Catalent, Inc

- Sirio Pharma Co., Ltd.

- Lonza

- Thermo Fisher Scientific Inc

- Fuji Capsule

- Soft Gel Technologies, Inc.

- EuroCaps

- Amway

- Guangdong Yichao Biological Co., Ltd.

- Strides Pharma Science Limited.

- Dasheng Health Products

- Kern Pharma

- Hunan Kang pharmaceutical Limited by Share Ltd.

Key Target Audience

- Pharmaceutical Manufacturers

- Nutraceutical Companies

- Healthcare Providers

- Retail Pharmacies

- Government and Regulatory Bodies (Saudi FDA)

- Investments and Venture Capitalist Firms

- Soft Gelatin Capsule Suppliers

- Distribution Partners and Wholesalers

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the KSA soft gelatin capsules market. This step relies on extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics, such as trends, consumer preferences, and competitive positioning.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data related to the KSA soft gelatin capsules market. This includes evaluating market penetration, assessing the ratio of marketplaces to service providers, and generating revenue analysis. Additionally, an examination of service quality metrics will be conducted to ensure the reliability and accuracy of revenue estimates within the market.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and validated through Computer-Assisted Telephone Interviews (CATIs) with industry experts representing a diverse array of companies within the soft gelatin capsule sector. These consultations provide valuable operational insights from industry practitioners, which are crucial in refining and corroborating the market data collected throughout earlier steps.

Step 4: Research Synthesis and Final Output

The final phase entails engaging directly with multiple soft gelatin capsule manufacturers to acquire detailed insights into product segments, sales performance, and consumer preferences. This interaction will serve to verify and complement statistics derived from both bottom-up and top-down approaches, ensuring a comprehensive, accurate, and validated analysis of the KSA soft gelatin capsules market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Market Genesis

- Evolution Timeline of Major Players

- Manufacturing Process Lifecycle

- Supply Chain and Value Chain Analysis

- Growth Drivers

Increasing Demand for Nutritional Supplements

Rising Geriatric Population - Market Challenges

Price Volatility of Raw Materials

Regulatory Compliance Issues - Opportunities

Expansion into Untapped Markets

Increasing Preference for Halal-based Products - Market Trends

Innovation in Capsule Encapsulation Technology

Growth in E-commerce Channels - Regulatory Environment

Saudi FDA Guidelines

Import Tariffs - SWOT Analysis

- Industry Stakeholders

- Porter’s Five Forces Analysis

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Product Type (In Value %)

Gelatin-Based Soft Gel

– Animal-Based Gelatin Capsules

– Thermally Stable Gelatin Capsules

– Enteric-Coated Soft Gel

Non-Gelatin (Plant-Based) Soft Gel

– Starch-Based Soft Gels

– Carrageenan-Based Soft Gels

– Pullulan-Based Soft Gels

Vitamin Capsule

– Single Vitamin

– Multivitamin Capsules

– Fortified Vitamin Blends - By Raw Material (In Value %)

Bovine Gelatin

– Halal-Certified Bovine Sources

– Conventional Bovine Gelatin

Porcine Gelatin

– Standard-Grade Gelatin

– Pharmaceutical-Grade Porcine Gelatin

Fish Gelatin

– Marine-Sourced Gelatin (e.g., cod, tilapia)

– Kosher-Certified Fish Gelatin - By Application Sector (In Value %)

Pharmaceutical

– Prescription Drug Capsules

– Over-the-Counter (OTC) Drug Capsules

– Antibacterial/Antiviral Capsules

Nutraceutical

– Omega-3/Fish Oil Capsules

– Herbal and Botanical Extracts

– Dietary Supplements and Immunity Boosters

Personal Care

– Skin and Hair Supplements

– Beauty Enhancing Capsules (e.g., collagen)

– Anti-Aging and Antioxidant Capsules - By End-User (In Value %)

Adults

– Men’s Health Capsules

– Women’s Health Capsules

– General Wellness Capsules

Pediatric

– Chewable Soft Gels

– Flavored Nutraceutical Capsules

– Pediatric Immune Support

Geriatric

– Joint & Bone Health Capsules

– Cognitive Function Support

– Multivitamins for Seniors - By Distribution Channel (In Value %)

Online Retailing

– Brand Websites

– E-commerce Platforms

– Online Pharmacies

Retail Pharmacies

– Chain Pharmacies

– Independent Pharmacies

Hospital Pharmacies

– Government Hospital Pharmacies

– Private Hospital Pharmacy Stores

- Market Share of Major Players on the Basis of Value/Volume, 2024

Market Share of Major Players by Type of Product Segment, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strength, Weakness, Organizational Structure, Revenues, Revenues by Type of Product, Number of Touchpoints, Distribution Channels, Number of Dealers and Distributors, Margins, Production Plant, Capacity, Unique Value offering and others)

- SWOT Analysis of Major Players

- Pricing Analysis Basis SKUs for Major Players

- Detailed Profiles of Major Companies

Nature’s Bounty

Aenova Group

Catalent, Inc

Sirio Pharma Co., Ltd.

Lonza

Thermo Fisher Scientific Inc

Fuji Capsule

Soft Gel Technologies, Inc.

EuroCaps

Amway

Guangdong Yichao Biological Co., Ltd.

Strides Pharma Science Limited.

Dasheng Health Products

Kern Pharma

Hunan Kang pharmaceutical Limited by Share Ltd.

- Market Consumption Trends

- Consumer Spending Patterns

- Awareness and Adoption Patterns

- Preference Analysis

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030