Market Overview

The KSA solid-state batteries market is assessed at about USD ~ million in value, based on a five-year historical analysis of battery and EV investments. This small but strategic base sits within a regional solid-state market of roughly USD ~ million and a wider Middle East battery industry exceeding USD ~ billion in annual revenues. The KSA electric vehicle battery market alone is already around USD ~ million, anchoring early demand for advanced chemistries and creating a natural pull for higher energy density and safety, which solid-state batteries aim to deliver.

Within the KSA solid-state batteries market, demand and ecosystem activity concentrate around automotive and industrial corridors. Lucid’s advanced manufacturing plant in King Abdullah Economic City, with an ultimate capacity of 155,000 EVs per year, and broader plans for 600,000 EVs per year national capacity, position the Western and Northern corridors as anchor hubs. Public Investment Riyadh’s role as policy and commercial center, combined with Eastern industrial clusters and giga-projects such as NEOM, ensures that automotive, grid-scale storage and R&D activity are distributed across multiple high-investment zones, each building demand for solid-state technology in different applications.

Market Segmentation

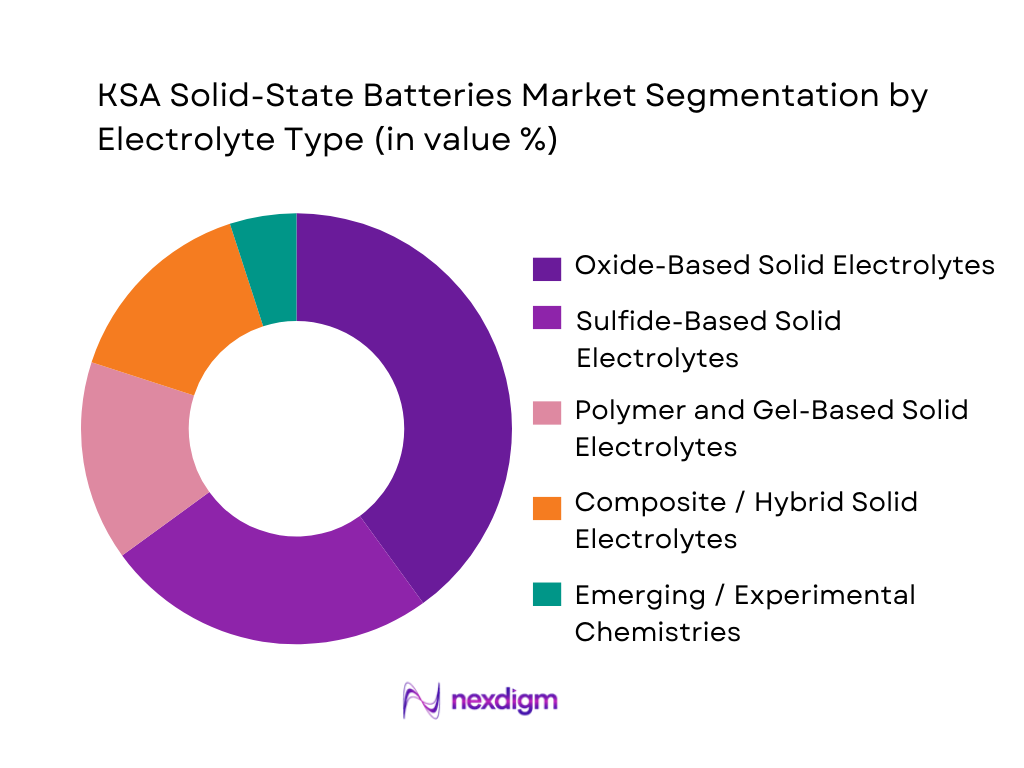

By Electrolyte Type

The KSA solid-state batteries market is segmented into oxide, sulfide, polymer, composite and emerging chemistries. Oxide-based solid electrolytes are expected to command the leading share because they align closely with global automotive solid-state programs run by players such as Toyota, Panasonic and BMW, which prioritize oxide and garnet systems for traction packs. For KSA, where EV battery demand is projected to expand from USD ~ million to several billion over the next decade. Oxide systems also offer better thermal stability for the Kingdom’s harsh climate, where ambient temperatures frequently exceed 40°C, making safety and high-temperature performance critical for both vehicle and stationary deployments.

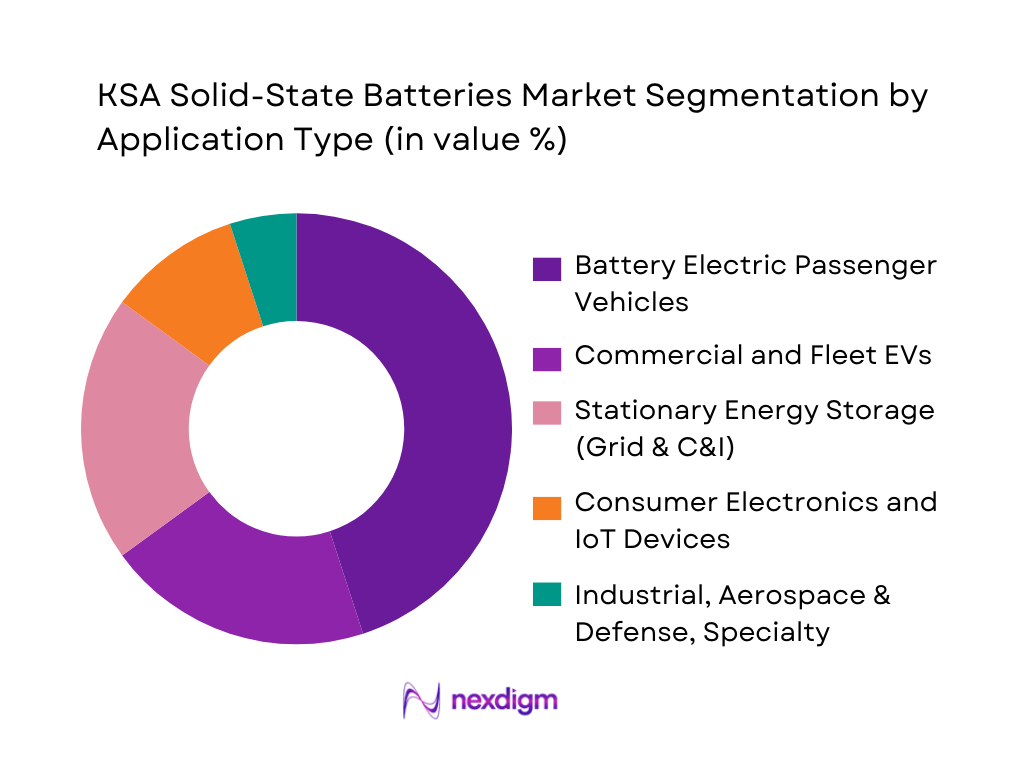

By Application

The KSA solid-state batteries market is segmented into passenger EVs, commercial fleets, stationary storage, consumer electronics and specialty uses. EV applications are expected to capture the dominant share because the Kingdom has committed to making 30% of vehicles in Riyadh electric and targeting 600,000 units of EV manufacturing capacity as part of its industrial strategy, supported by over USD ~ billion of announced EV-related investments. As global EV manufacturers such as Toyota, Hyundai, Tesla and Lucid increasingly explore or pilot solid-state chemistries for longer range and faster charging, EV-centric industrial policy creates a natural landing zone for early solid-state deployments in high-value, premium and fleet segments that demand improved safety and range under high-temperature conditions and long daily duty cycles typical of Gulf mobility patterns.

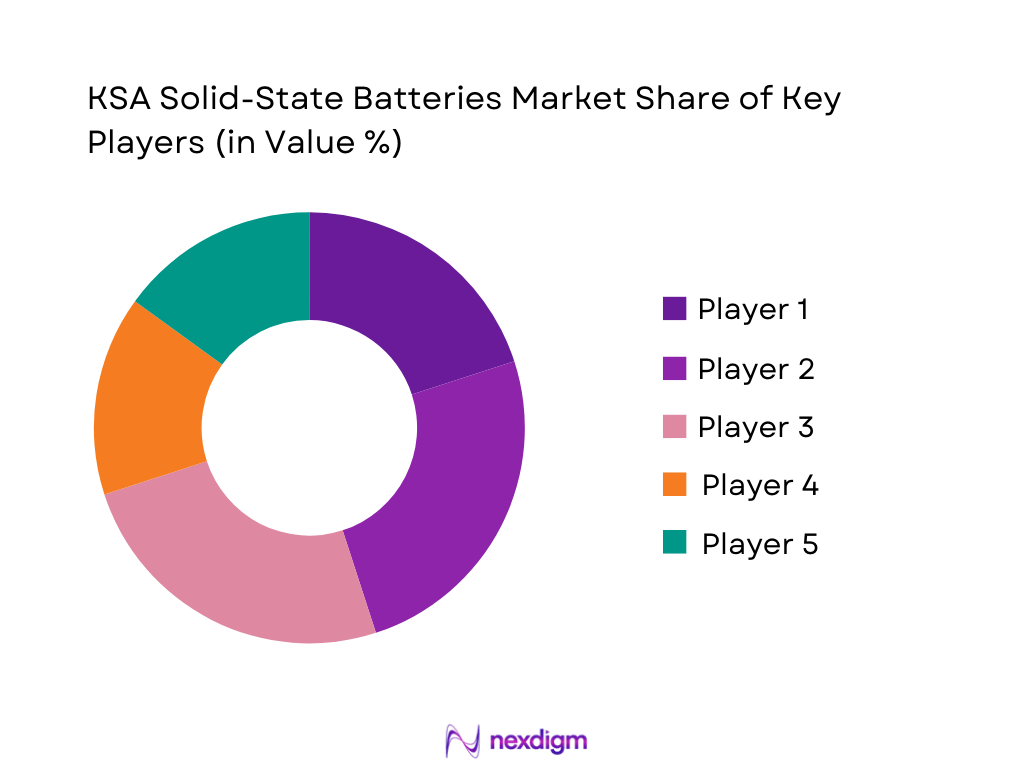

Competitive Landscape

The KSA solid-state batteries market is shaped by a small number of global cell innovators and large Asian battery manufacturers, complemented by EV OEMs and local industrial champions. Names such as QuantumScape, Solid Power, Toyota, Samsung SDI, LG Energy Solution, Panasonic, BYD and CATL dominate global solid-state development pipelines. In KSA, their presence is indirect but increasingly important through offtake agreements, technology licensing and participation in EV and storage projects backed by entities like the Public Investment Fund, Aramco and utilities. Lucid’s manufacturing footprint and strategic partnerships with Saudi institutions add a downstream integration dimension, positioning the Kingdom as a future deployment hub for advanced battery chemistries

| Company | Establishment Year | Headquarters | Core Role in Solid-State Batteries | Electrolyte Focus / Technology Platform | Key Application Focus | Relevance to KSA Ecosystem | Notable Strategic Edge |

| QuantumScape Corporation | 2010 | California, USA | ~ | ~ | ~ | ~ | ~ |

| Solid Power, Inc. | 2011 | Colorado, USA | ~ | ~ | ~ | ~ | ~ |

| Toyota Motor Corporation (SSB Program) | 1937 | Aichi, Japan | ~ | ~ | ~ | ~ | ~ |

| Samsung SDI Co., Ltd. | 1970 | Yongin, South Korea | ~ | ~ | ~ | ~ | ~ |

| Lucid Group | 2007 | California, USA / KAEC, KSA | ~ | ~ | ~ | ~ | ~ |

KSA Solid-State Batteries Market Analysis

Growth Drivers

EV Manufacturing and Adoption Push

Saudi Arabia’s EV push is the central demand driver for solid-state batteries. Under Vision 2030, the Kingdom has committed that 30 of every 100 vehicles in Riyadh will be electric, backed by more than USD ~ billion in EV manufacturing and charging infrastructure investments. The government has also committed to purchase up to 100,000 EVs from Lucid over ten years, with annual orders ramping from 1,000–2,000 units to 4,000–7,000 units. Lucid’s plant at KAEC is planned for 155,000 EVs per year once fully ramped, after starting with 5,000-unit assembly capacity, while only about 2,000 EVs were sold nationwide last year from a base of roughly 101 public charging locations. These metrics highlight the steep EV adoption ramp the Kingdom is targeting, creating strong pull for higher-energy, safer next-generation chemistries such as solid-state to extend range and durability in a hot-climate, long-distance driving market.

Grid-Scale and C&I Storage Under Renewable Programs

Solid-state batteries also align with KSA’s rapidly expanding renewable power base and industrial demand for firm capacity. Total electricity consumption reached about 393 terawatt-hours in 2022, up from 372 terawatt-hours in 2021, and around 423 terawatt-hours in 2023, underscoring a fast-growing, power-intensive economy. Renewable capacity in the Kingdom has risen to roughly 4,743 megawatts, including 4,340 megawatts of solar and 403 megawatts of wind, from almost a negligible base a decade earlier. The Saudi Power Procurement Company recently awarded five utility-scale projects totalling 4.5 gigawatts with investments above ~ billion riyals, while an additional 15 gigawatts of solar and wind projects worth about USD ~ billion are under development with support from the sovereign wealth fund. This build-out, combined with commercial and industrial customers seeking to stabilize tariffs and reliability, creates a strong use case for long-cycle, high-safety solid-state storage at grid and behind-the-meter level.

Market Challenges

High Capex and Manufacturing Complexity

Establishing competitive solid-state battery manufacturing in KSA requires navigating very high capital intensity compared with typical industrial projects. On the macro side, Saudi GDP has been updated to around 4.5 trillion riyals for 2023, with non-oil sectors accounting for about 53.2 of output, and the industrial base is expanding: in a single recent month, the Ministry of Industry and Mineral Resources issued 83 new industrial licences representing cumulative planned investments above ~ million riyals, while 58 new factories worth ~ billion riyals began operations. At the same time, the Kingdom is committing billions of dollars to renewables and EV manufacturing, including multi-gigawatt solar and wind auctions and large EV gigaprojects. Solid-state gigafactories, with requirements for advanced dry-room infrastructure, novel coating lines and precision ceramic or sulfide electrolyte handling, must therefore compete for capital against already substantial industrial and energy opportunities. The scale of investments evident in current industrial and power projects illustrates the magnitude of funding and execution capability required to localize solid-state cell production at meaningful volume.

Technology Maturity, TRL Gaps and Reliability

While global electrification is advancing quickly, solid-state cell technology remains at relatively low technology-readiness levels compared with mature lithium-ion platforms, posing a key challenge for KSA investors and OEMs. Worldwide EV adoption has surged to about ~ million light vehicles in operation by the end of 2023, with expected annual EV sales of around ~ million units in 2024, yet virtually all of these vehicles still rely on liquid-electrolyte cells. In parallel, global electricity demand reached roughly 28,661 terawatt-hours in 2022, underscoring the scale at which any new storage technology must operate. In this context, Saudi Arabia is targeting EV penetration of about 30 of vehicles within a decade, from a base of only about 2,000 EVs sold last year. For local stakeholders, adopting a technology that is still transitioning from pilot to commercial scale introduces risks around cycle-life validation under desert conditions, manufacturability yields, and long-term field performance compared with well-understood lithium-ion chemistries.

Market Opportunities

Partnership Models with Global Solid-State Leaders

Saudi Arabia is already using strategic partnerships to build EV and advanced materials capacity, creating a strong template for collaboration with solid-state leaders. The Public Investment Fund has committed multi-billion-dollar capital into Lucid, enabling a manufacturing plant designed for 155,000 EVs annually and a government purchase commitment of up to 100,000 vehicles over ten years. At the minerals level, Ma’aden has signed a framework with MP Materials to establish a full rare-earths supply chain in the Kingdom, from mining and refining to magnet production—key for electric drivetrains. In parallel, Foxconn Interconnect Technology and Saudi partners are investing in an EV-charger factory, while Saudi Aramco has signed a joint development agreement with BYD for new energy vehicles. With Vision 2030 signalling about USD ~ billion in planned EV-related investments, these figures show that KSA already deploys JV and co-development models at scale. The same instruments can be extended to solid-state cell developers, offering them access to capital, policy support and co-location with fast-growing EV and energy customers.

Localization of Module / Pack Assembly and Testing

KSA’s manufacturing expansion and EV-specific investments create a clear opportunity to localize solid-state module and pack integration even before full cell production is onshore. Lucid’s facility at King Abdullah Economic City has begun assembling EVs with an initial capacity around 5,000 units per year, with a ramp-up path to 155,000 vehicles, and the government’s 100,000-vehicle purchase agreement ensures a stable demand base. Wider industry statistics show the industrial sector’s momentum, with dozens of new factories and industrial licences being issued monthly and billions of riyals of investment entering manufacturing. At the same time, Saudi electricity consumption of over 420 terawatt-hours and strong non-oil GDP growth signal a large commercial and industrial customer base for advanced storage packs beyond automotive. For solid-state suppliers, this means that integrating imported cells into locally engineered packs, thermal systems and control electronics—tested under Saudi grid codes and environmental conditions—can be a practical entry step that uses existing automotive and power-equipment capacity while building experience ahead of local cell gigafactories.

Trends

Electrolyte Innovation and Hybrid Architectures

Globally, both industry and research institutions are accelerating innovation in solid electrolytes and hybrid cell architectures, and Saudi Arabia’s innovation system is increasingly positioned to participate. Worldwide, renewable power capacity additions have reached records, with solar alone adding about 192 gigawatts in a recent year and renewables contributing more than 80 of new power capacity—ramping demand for advanced storage technologies at all scales. Global electricity demand reached roughly 28,661 terawatt-hours in 2022, further highlighting the need for safer, higher-performance batteries. Within KSA, R&D spending as a share of GDP has risen from about 0.46 to around 0.56 across recent years, while patent filings by Saudi residents and non-residents total thousands annually. For solid-state batteries, this macro backdrop supports growing work on sulfide, oxide and polymer-based electrolytes, as well as hybrid designs that combine solid and gel components, aiming to improve manufacturability and high-temperature performance. Saudi universities, research institutes and industrial R&D centres can harness this momentum—supported by national innovation funding and IP growth—to co-develop region-appropriate electrolyte systems optimized for desert climates and grid-storage duty cycles.

Future Outlook

Over the next several years, the KSA solid-state batteries market is expected to expand rapidly from its small base as EV and grid-scale storage pipelines are executed. The Saudi EV battery market, projected to rise from USD ~ million to nearly USD ~ billion, IMARC Group provides a strong demand envelope for advanced chemistries in premium vehicles, high-utilization fleets and grid storage where safety and cycle life are critical. Global solid-state markets are forecast in multiple studies to grow at CAGRs in the mid-30s to low-40s, taking revenues from about USD 1–1.2 billion to well over USD 12–26 billion within a decade. Aligning KSA’s trajectory with this global expansion and the country’s aggressive EV and mining strategies, a high double-digit CAGR for domestic solid-state deployments is a reasonable planning assumption through the end of the decade.

Major Players

- QuantumScape Corporation

- Solid Power, Inc.

- Toyota Motor Corporation – Solid-State Battery Program

- Samsung SDI Co., Ltd.

- LG Energy Solution Ltd.

- Panasonic Energy Co., Ltd.

- BYD Company Limited – Battery Business

- Contemporary Amperex Technology Co. Limited

- ProLogium Technology Co., Ltd.

- Factorial Energy

- SES AI Corporation

- Blue Solutions

- Ilika plc

- A123 Systems LLC / Ionic Materials Collaboration

- Lucid Group – Battery and Integration Roadmap

Key Target Audience

- Automotive OEM Strategy and Product Planning Teams

- Utilities, IPPs and Energy Developers

- Oil & Gas and Industrial Decarbonization Units

- Battery Metals, Mining and Refining Investors

- Investments and Venture Capital Firms

- Government and Regulatory Bodies

- Infrastructure and Industrial Developers

- Technology and R&D Institutions

Research Methodology

Step 1: Identification of Key Variables

The first phase involved mapping the full ecosystem of the KSA solid-state batteries market, including global cell developers, KSA-based EV OEMs, utilities, IPPs, industrial users, mining firms and regulators. Extensive desk research using international battery reports, Saudi EV and energy policies, and academic literature on solid-state chemistries was conducted to identify critical variables such as electrolyte type, cell format, application clusters, installed capacity in MWh, and investment volumes that shape market dynamics.

Step 2: Market Analysis and Construction

Historical and current data on EV battery revenues, regional solid-state market sizes and KSA industrial investment announcements were compiled from multiple sources, including specialist research houses and multilateral energy reports. Penetration of solid-state in different applications, relative to conventional lithium-ion, was assessed through global benchmarks, while KSA-specific deployment scenarios were built by mapping giga-project pipelines, announced EV production capacities and storage tenders.

Step 3: Hypothesis Validation and Expert Input

Initial hypotheses on market size, growth rates, segmentation shares and competitive positioning were validated against insights from industry interviews and secondary commentary, including statements from OEMs, technology developers and Saudi institutions. These sources provided ground-level perspectives on expected adoption timelines, localization potential, total cost of ownership thresholds and risk perceptions around emerging chemistries, allowing refinement of assumptions and calibration of scenario ranges.

Step 4: Research Synthesis and Final Output

The final phase synthesized data-driven quantitative modelling with qualitative insights to deliver a coherent market view. Global forecasts for solid-state batteries were reconciled with KSA’s EV and energy transition plans, producing country-level size and CAGR estimates consistent with both top-down and bottom-up perspectives. The result is a structured analysis that can be updated as new pilot projects, localization announcements and technology milestones emerge, ensuring decision-makers have a robust baseline for strategic planning and capital allocation.

- Executive Summary

- Research Methodology (Electrolyte chemistry clusters, cell formats, application stacks, installed base in MWh, EV & storage pipelines, localization intensity, primary–secondary mix, Market Definitions and Assumptions, Abbreviations and Technical Glossary, Market Sizing Approach, Data Sources and Benchmarking Framework, Primary Research Approach, Validation and Triangulation, Study Limitations and Future Enhancements)

- Definition and Scope

- Technology Genesis and Global Evolution

- Role of Solid-State Batteries in KSA Energy Transition

- KSA Battery Supply Chain and Value Chain Mapping

- Policy and Regulatory Landscape Snapshot (Vision framework, industrial policy, clean energy targets)

- Growth Drivers

EV Manufacturing and Adoption Push

Grid-Scale and C&I Storage Under Renewable Programs

Localization of Battery Metals and Advanced Materials

Safety, Energy Density and Fast-Charging Requirements

Innovation Ecosystem and R&D Collaboration in KSA - Market Challenges (Cost curve, scale-up, supply chain risk, standards)

High Capex and Manufacturing Complexity

Technology Maturity, TRL Gaps and Reliability

Raw Material and Lithium Supply Constraints

Integration with Existing BMS and Vehicle Platforms

Standards, Certification and Bankability Concerns - Opportunities

Partnership Models with Global Solid-State Leaders

Localization of Module / Pack Assembly and Testing

Development of Flexible and Thin-Film Solutions

Export Hub Potential for MENA and Africa - Trends

Electrolyte Innovation and Hybrid Architectures

Pack and System-Level Design for Solid-State

Second-Life, Recycling and Circularity Models

Emerging Business Models (Leasing, Storage-as-a-Service) - Regulatory and Policy Environment

- SWOT Analysis for KSA Solid-State Batteries Ecosystem

- Stakeholder Ecosystem Mapping

- Porter’s Five Forces Analysis

- By Value, 2019-2024

- By Volume, 2019-2024

- Installed Base of Solid-State Batteries in KSA, 2019-2024

- Share of Solid-State within Overall KSA Battery Market, 2019-2024

- By Electrolyte Type (in Value %)

Oxide-Based Solid Electrolytes

Sulfide-Based Solid Electrolytes

Polymer and Gel-Based Solid Electrolytes

Composite / Hybrid Solid Electrolytes

Emerging Chemistries and Experimental Platforms - By Cell Format (in Value %)

Coin and Button Cells

Pouch Cells

Prismatic Cells

Cylindrical Cells

Flexible, Thin-Film and Custom Form Factors - By Capacity Range (in Value %)

Below 20 mAh

20–100 mAh

100 mAh–1 Ah

1–50 Ah

Above 50 Ah - By Application (in Value %)

Battery Electric Passenger Vehicles

Commercial and Fleet EVs

Stationary Energy Storage

Consumer Electronics and IoT Devices

Industrial, Aerospace & Defense, Specialty Applications - By End-User Industry (in Value %)

Automotive OEMs and Tier-1s

Utilities, IPPs and Energy Developers

Consumer Electronics and IoT OEMs

Oil & Gas, Petrochemical and Industrial Users

Aerospace, Defense and High-Reliability Sectors - By Region in KSA (in Value %)

Riyadh and Central Corridor

Western Corridor

Eastern Corridor

Northern and Special Economic Zones

Southern and Emerging Industrial Regions

- Market Share of Major Players by Value and Volume

Market Share by Electrolyte Type

Market Share by Application Cluster

Market Share by End-User Industry - Cross Comparison Parameters (Company overview, solid-state technology platform, electrolyte focus, target applications mix, technology readiness level, Saudi / GCC footprint, key partnerships and JVs, indicative energy density and cycle life bands)

- SWOT Analysis of Major Players in KSA Context

- Pricing and Cost Structure Analysis

- Detailed Profiles of Major Companies

QuantumScape Corporation

Solid Power, Inc.

Toyota Motor Corporation

Samsung SDI Co., Ltd.

LG Energy Solution Ltd.

Panasonic Energy Co., Ltd.

BYD Company Limited

Contemporary Amperex Technology Co. Limited

ProLogium Technology Co., Ltd.

Factorial Energy

SES AI Corporation

Blue Solutions

Ilika plc

A123 Systems LLC / Ionic Materials Collaboration

- Automotive OEM and Fleet Operators

- Utilities and IPPs

- Consumer Electronics and IoT OEMs

- Industrial and Oil & Gas Users

- Aerospace and Defense Stakeholders

- By Value, 2025-2030

- By Volume, 2025-2030

- Installed Base of Solid-State Batteries in KSA, 2025-2030

- Share of Solid-State within Overall KSA Battery Market, 2025-2030