Market Overview

The KSA Streaming Media Market is valued at USD ~ billion in 2024 with an approximated compound annual growth rate (CAGR) of 5% from 2024-2030, based on comprehensive historical analysis. This expansive market size is primarily driven by the rapid rise of high-speed internet access and mobile connectivity, which have enabled a larger consumer base to engage in streaming services. Additionally, the preference for on-demand content among Saudi consumers reflects a significant cultural shift towards digital entertainment, further propelling industry growth.

Key cities in the KSA market landscape include Riyadh, Jeddah, and Dammam, which dominate due to their robust technological infrastructure and high concentrations of tech-savvy, young populations that prefer streaming over traditional media. Additionally, these cities serve as major business hubs attracting leading streaming service providers, which further enhances the competitive environment and content diversity.

There is a marked shift in consumer behavior towards seeking on-demand content, as evidenced by trends showing that over 75% of viewers in KSA prefer streaming services over traditional television. The preference stems from the desire for flexibility and personalized viewing experiences. The increasing availability of international titles alongside local productions has contributed to this phenomenon. In 2023, spending on content among KSA residents rose to approximately USD 450 million, emphasizing the transition towards on-demand consumption as audiences favor platforms that offer a wide array of choices.

Market Segmentation

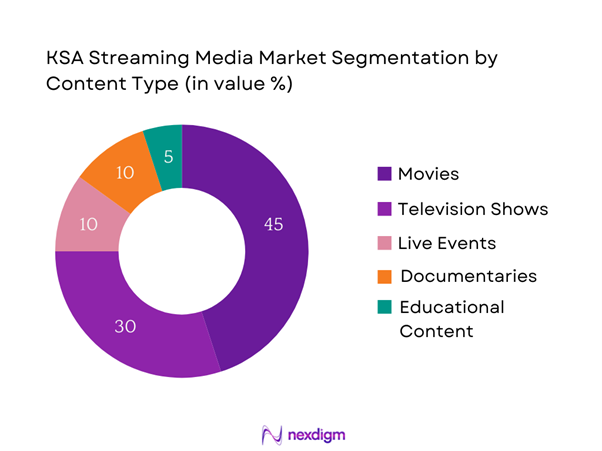

By Content Type

The KSA Streaming Media Market is segmented by content type into movies, television shows, live events, documentaries, and educational content. Among these, movies hold a dominant market share. This preference is largely fueled by the increasing production of local films and the growing availability of international cinematic content. Consumers are drawn to the variety and quality of films available for instant viewing, complemented by platforms actively promoting Saudi cinema, thus significantly bolstering this segment.

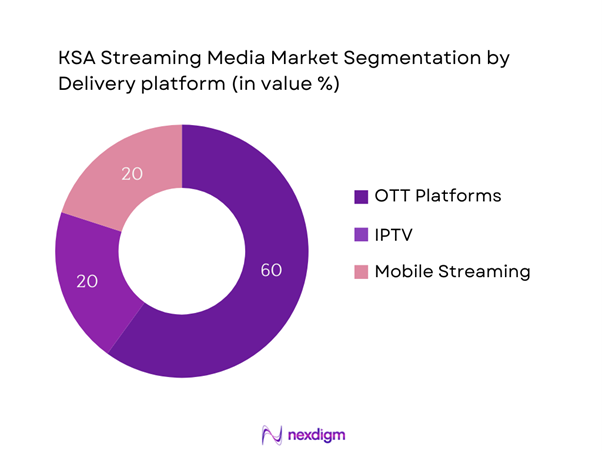

By Delivery Platform

The market is also segmented by delivery platform into OTT platforms, IPTV, and mobile streaming. Currently, OTT platforms dominate the market, primarily due to their user-friendly interfaces, diverse content libraries, and the convenience of subscription models (SVOD and AVOD). The surge in smartphone usage and the availability of data plans at competitive rates have made OTT services particularly attractive, further enhancing their market share in Saudi Arabia.

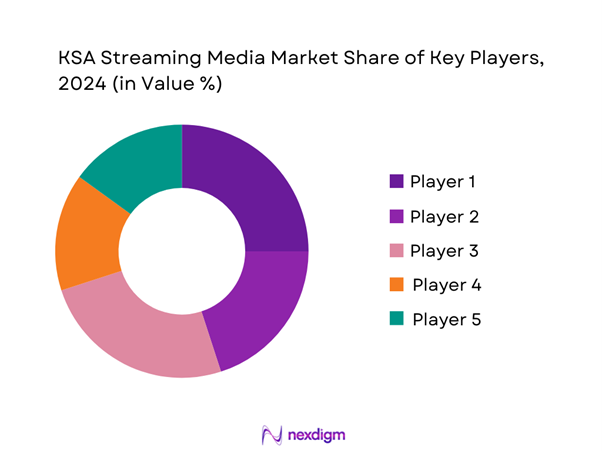

Competitive Landscape

The KSA Streaming Media Market is becoming increasingly competitive with several key players dominating the landscape. Notable companies include local brands such as STC Play and Shahid, as well as global giants like Netflix and Amazon Prime Video. This concentration of leading companies underscores their influence on content delivery, user engagement, and market innovations.

| Company | Establishment Year | Headquarters | Content Offering | User Engagement | Technology Platform | Market Penetration |

| STC Play | 2018 | Riyadh | – | – | – | – |

| Shahid | 2010 | Riyadh | – | – | – | – |

| Netflix | 1997 | Los Gatos, CA | – | – | – | – |

| Amazon Prime Video | 2006 | Seattle, WA | – | – | – | – |

| OSN | 2009 | Dubai | – | – | – | – |

KSA Streaming Media Market Analysis

Growth Drivers

Increased Internet Penetration

The KSA has witnessed a remarkable increase in internet penetration, with about 99% of the population having access to the internet in 2023, according to the Communications and Information Technology Commission (CITC). This widespread connectivity allows consumers to access streaming services seamlessly and is projected to foster higher consumption of digital content. As the government continues to develop technological infrastructure, the increase in fiber-optic internet connections has been pivotal, significantly improving bandwidth and service reliability. The increase in mobile broadband subscriptions has also played a vital role, reaching over 50 million in 2023, further solidifying the foundation for streaming service growth.

Rise in Mobile Device Usage

Smartphone usage in Saudi Arabia reached over 45 million devices in 2023, resulting in more than 60% of the population relying on mobile devices to access streaming content. The increased availability of affordable smartphones has facilitated this upsurge. According to the Ministry of Communications and Information Technology, the country saw a year-on-year growth in mobile device sales, contributing significantly to the digitization of entertainment. This shift is evidenced by the growing number of downloaded streaming applications, which surpassed 30 million in 2023, illustrating a cultural trend toward mobile-first viewing experiences.

Market Challenges

Piracy Issues

Piracy remains a significant challenge for the KSA streaming media market, with an alarming 30% of digital content in the region being accessed illegally. This high rate of piracy creates substantial revenue losses for legitimate streaming platforms. The Saudi Ministry of Culture and Information has reported that combating piracy is a key priority, as violations of copyright laws hinder the growth of the local entertainment industry. Efforts to forge partnerships with international anti-piracy organizations are underway to mitigate this issue, ensuring creators can thrive within a legitimate framework.

Competition from Traditional Media

Despite significant growth in streaming services, traditional media still holds considerable influence over viewers in Saudi Arabia. Television remains a primary source of entertainment for older demographics; about 65% of those aged 45 and above prefer conventional broadcasting methods compared to only 35% who favor streaming platforms. The local TV channel networks continue to innovate with new content offerings to retain viewership, posing a notable challenge for newer entrants in the streaming space. The increasing investment in high-quality local productions by traditional media players emphasizes the competitive landscape, further complicating market dynamics.

Opportunities

Rise of Local Content Production

The surge in local content production presents a significant opportunity for the KSA streaming media industry. With the Saudi Vision 2030 initiative encouraging the development of the entertainment sector, local productions have seen substantial government support and funding, which amounted to around USD 200 million in funding for various film and series projects. Reports indicate that the number of local films produced has tripled since 2022, suggesting that there is a burgeoning market for domestic storytelling. This growth provides platforms with rich content that resonates with local audiences, thus positioning themselves favorably against international competitors.

Demand for Multilingual Content

The KSA’s diverse population creates a rising demand for multilingual content. With 30% of the population being expatriates, streaming services are increasingly seeking to provide content in multiple languages, including English, Urdu, and Tagalog. As of 2023, content platforms reported a 40% increase in viewership for multilingual offerings, highlighting a market opportunity for operators to cater to this demographic. In response to this demand, many streaming services are expanding their libraries to include a variety of international films and series, further enriching their content offerings. This growing interest in multilingual content not only attracts a wider audience but also strengthens the competitive edge of streaming services in meeting consumer preferences.

Future Outlook

The KSA Streaming Media Market is poised for substantial growth, driven by increasing smartphone penetration, expanding internet infrastructure, and evolving consumer preferences toward digital entertainment solutions. As local content production continues to rise and international streaming services expand their offerings tailored to the Saudi audience, the market is expected to flourish, inviting more investments and innovations within the industry.

Major Players

- STC Play

- Shahid

- Netflix

- Amazon Prime Video

- OSN

- MBC Group

- ViacomCBS

- Disney+

- Rotana Media Group

- STARZPLAY

- YouTube

- Fawry

- Anghami

- Wavo

- Tudum

Key Target Audience

- Government and Regulatory Bodies (e.g., Communications and Information Technology Commission)

- Investment and Venture Capitalist Firms

- Major Telecom Providers

- Technology and Device Manufacturers

- Local Film Production Companies

- Advertising Agencies

- Content Distributors

- Media and Entertainment Analysts

Research Methodology

Step 1: Identification of Key Variables

The first phase involves mapping the streaming media ecosystem, identifying major stakeholders within the KSA Streaming Media Market. This is supported by extensive desk research, utilizing a combination of secondary and proprietary databases to gather robust industry-level information, with the goal of defining the critical variables impacting market dynamics.

Step 2: Market Analysis and Construction

This step requires the compilation and analysis of historical data relevant to the KSA Streaming Media Market. This includes evaluating user penetration rates, service distribution channels, and consequent revenue generation. Additionally, service performance metrics will be assessed to validate the reliability of revenue estimates, ensuring an accurate overview of market dynamics.

Step 3: Hypothesis Validation and Expert Consultation

Once market hypotheses are formed, they will be validated through structured interviews with industry experts representing a wide range of companies involved in the streaming media sector. The insights gained from these consultations will provide valuable operational data and financial perspectives, essential for corroborating and refining the market findings.

Step 4: Research Synthesis and Final Output

In the final phase, we will engage with multiple key players in the streaming media sector to acquire detailed insights into content offerings, sales performance, consumer engagement, and emerging trends. This interaction is crucial to verify and enhance the data derived from earlier research steps, culminating in a comprehensive analysis of the KSA Streaming Media Market.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Market Genesis

- Timeline of Major Players

- Business Cycle Analysis

- Supply Chain and Value Chain Analysis

- Growth Drivers

Increased Internet Penetration

Rise in Mobile Device Usage

Consumer Preference for On-Demand Content - Market Challenges

Piracy Issues

Competition from Traditional Media - Opportunities

Rise of Local Content Production

Demand for Multilingual Content - Trends

Shift towards Interactive Content

Growth of Subscription Bundling - Government Regulation

Content Regulation Policies

Foreign Investment Regulations - SWOT Analysis

- Stake Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Subscriber Count, 2019-2024

- By Average Revenue Per User (ARPU), 2019-2024

- By Content Type, (In Value %)

Movies

Television Shows

Live Events

Documentaries

Educational Content - By Delivery Platform, (In Value %)

OTT Platforms

IPTV

Mobile Streaming - By Consumer Demographics, (In Value %)

Age Groups

Gender

Income Levels - By Region, (In Value %)

Central Region

Eastern Region

Western Region - By Subscription Model, (In Value %)

Subscription Video on Demand (SVOD)

Advertising Video on Demand (AVOD)

Transactional Video on Demand (TVOD)

- Market Share of Major Players on the Basis of Value, 2024

Market Share of Major Players by Type of Streaming Media Segment, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strength, Weakness, Organizational Structure, Revenues, User Base, Content Library Size, Unique Value Proposition, Technology Investments and others)

- SWOT Analysis of Major Players

- Pricing Analysis for Key Competitors

- Detailed Profiles of Major Companies

STC Play

Shahid

Netflix

Amazon Prime Video

OSN

YouTube

MBC Group

Rotana Media Group

Disney+

Fawry

ViacomCBS

Wavo

STARZPLAY

Tudum

Anghami

- Market Demand by Segment

- User Engagement Patterns

- Purchasing Preferences and Behaviors

- Needs, Desires, and Pain Points

- Decision-Making Process

- By Value, 2025-2030

- By Subscriber Count, 2025-2030

- By Average Revenue Per User (ARPU), 2025-2030