Market Overview

The KSA Stress Testing Market is valued at USD ~ in 2024. This market is driven by the need for financial institutions to assess and manage risk effectively, given the increasing demand for regulatory compliance, particularly from the Saudi Arabian Monetary Authority (SAMA). The rise of AI and machine learning technologies has enhanced predictive risk assessment capabilities, allowing for more accurate forecasting of potential economic downturns, which is crucial for financial stability. The demand for stress testing platforms, especially cloud-based and hybrid solutions, continues to grow in response to the increasing complexity of financial environments.

Saudi Arabia, particularly Riyadh and Jeddah, plays a pivotal role in the stress testing market due to its position as the financial and administrative hub of the country. Riyadh is the headquarters for most of the major banking and financial institutions in Saudi Arabia, driving the adoption of advanced risk management solutions. Jeddah also contributes significantly to the market with its role as the gateway for international businesses and investment. Globally, regions like North America and Europe, with their long-standing expertise in risk management and regulatory frameworks, influence the technological advancements and best practices that drive the market in KSA.

Market Segmentation

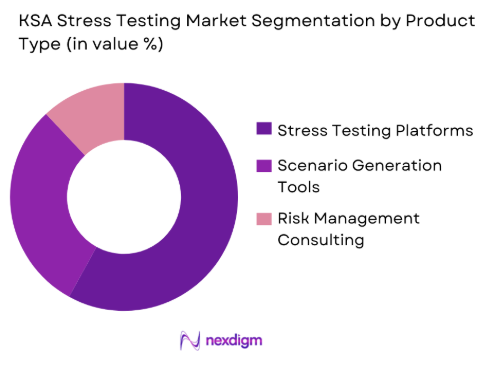

By Product Type

The KSA Stress Testing Market is segmented by product type into stress testing platforms, scenario generation tools, and risk management consulting. The segment for stress testing platforms dominates, as financial institutions seek advanced tools to assess risks and ensure compliance with regulatory standards. These platforms, often cloud-based, allow for real-time risk assessments and provide scalability for both large and small institutions. The growing complexity of financial products and regulations has further boosted the adoption of these platforms, making them the preferred choice among Saudi financial institutions.

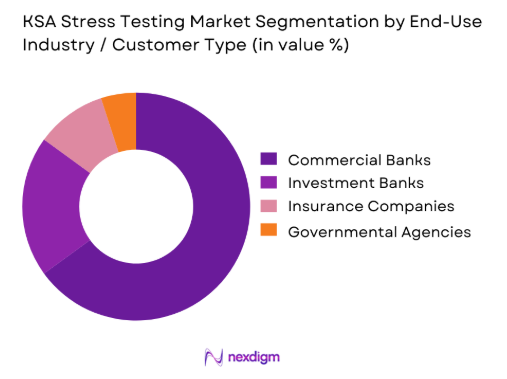

By End-Use Industry

The commercial banking sector holds the largest market share in the KSA Stress Testing Market. The increasing regulatory requirements from SAMA, particularly regarding capital adequacy and liquidity management, have driven banks to adopt stress testing tools to ensure compliance. The rise in systemic risks and financial uncertainties has further fueled the demand for risk management solutions. As a result, commercial banks are the primary users of stress testing solutions in Saudi Arabia, contributing significantly to market growth.

Competitive Landscape

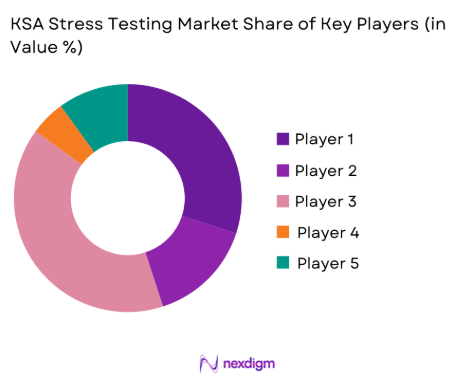

The KSA Stress Testing Market is dominated by a few major players, including Moody’s Analytics and global brands like SAS Institute, FIS, and Oracle. This consolidation highlights the significant influence of these key companies in driving the market forward. These firms provide comprehensive stress testing platforms, risk management consulting, and regulatory compliance solutions that cater to the needs of Saudi financial institutions.

| Company | Establishment Year | Headquarters | Technology Offerings | Regulatory Compliance | Market Penetration | Clientele | Revenue Models | Geographic Reach | Customer Retention |

| Moody’s Analytics | 1900 | USA | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

| SAS Institute | 1976 | USA | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

| FIS | 1968 | USA | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

| Alinma Bank | 2006 | Saudi Arabia | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

| Bank Al-Jazira | 1975 | Saudi Arabia | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

KSA Stress Testing Market Analysis

Growth Drivers

Rising Cardiovascular Disease Prevalence and Aging Population

The increasing prevalence of cardiovascular diseases (CVD) and the aging population are significant growth drivers in the healthcare sector. As lifestyle factors, environmental influences, and an aging global population contribute to the rising incidence of heart-related conditions, there is a growing need for advanced diagnostic tools to detect, monitor, and treat CVD. This rising demand for early detection and management of cardiovascular diseases is driving the adoption of innovative imaging technologies, such as stress imaging systems, to better understand heart conditions and improve patient outcomes. As more individuals require heart disease management, the demand for diagnostic solutions continues to grow.

Expansion of Preventive Screening and Early Diagnosis Programs

There is a growing emphasis on preventive healthcare, including early diagnosis of cardiovascular conditions through routine screening programs. Governments, healthcare providers, and insurance companies are increasingly focused on offering preventive screening to detect cardiovascular diseases before they become symptomatic or life-threatening. These early diagnosis initiatives aim to reduce healthcare costs and improve patient outcomes by identifying risk factors early, allowing for timely intervention. This expansion of preventive screening drives demand for more efficient and accessible diagnostic tools, such as advanced imaging systems for stress testing and other cardiovascular diagnostics, further fueling market growth.

Challenges

High Capital Cost of Advanced Imaging Stress Systems

The high capital cost of advanced imaging stress systems remains a significant barrier to widespread adoption. Stress imaging systems, including those used for cardiac MRI, CT, and echocardiography, can be very expensive, making them a challenge for smaller hospitals and clinics with limited budgets. This cost can limit access to these technologies, especially in underserved regions or in healthcare systems with tight financial constraints. Despite the potential for these systems to improve diagnostic accuracy and patient care, the high initial investment required for purchasing, maintaining, and upgrading these systems can be a barrier for many healthcare providers, hindering their adoption.

Shortage of Trained Cardiac Technologists and Specialists

A shortage of trained cardiac technologists and specialists is a critical challenge in the cardiovascular diagnostics field. These professionals play an essential role in operating complex diagnostic imaging systems, interpreting results, and providing insights into patient conditions. However, the demand for skilled technicians and cardiologists often exceeds supply, leading to delays in diagnoses and potentially suboptimal patient care. This shortage is particularly problematic in regions where specialized training programs are scarce or where healthcare resources are limited. Without an adequate workforce to support the use of advanced diagnostic technologies, the potential benefits of these systems cannot be fully realized.

Opportunities

Modernization of Cath Labs and Cardiac Diagnostic Suites

The modernization of catheterization labs (cath labs) and cardiac diagnostic suites presents a significant opportunity for the adoption of advanced cardiovascular imaging technologies. As healthcare facilities seek to enhance their diagnostic capabilities and improve patient outcomes, the upgrade of cath labs to include state-of-the-art imaging systems, such as advanced stress testing equipment, is essential. This modernization allows for more accurate and efficient diagnostics, enabling cardiologists to make better-informed decisions and provide more effective treatments. By investing in the latest imaging technologies, healthcare providers can improve their ability to detect cardiovascular diseases early and accurately, ultimately leading to better care and lower healthcare costs.

Growth of Stress Echo Adoption as Radiation-Free Alternative

The growing adoption of stress echocardiography (stress echo) as a radiation-free alternative to traditional imaging techniques offers a significant opportunity in the cardiovascular diagnostic market. Stress echo uses ultrasound technology to assess the heart’s function under stress, providing detailed information without exposing patients to ionizing radiation. As patients and healthcare providers become more aware of the risks associated with radiation exposure, stress echo is gaining popularity as a safer, non-invasive option for evaluating cardiovascular health. This trend presents an opportunity for the expansion of stress echo technology, making it a key component of modern cardiac diagnostics, particularly in preventive screenings and routine heart disease evaluations.

Future Outlook

The KSA Stress Testing Market is expected to continue growing as financial institutions invest more in advanced risk management tools to comply with stricter regulations and to prepare for potential financial crises. The market will benefit from the increasing adoption of AI-driven platforms and cloud-based solutions, as well as the continued need for real-time, predictive analytics in risk management.

Major Players

- Moody’s Analytics

- SAS Institute

- FIS

- Alinma Bank

- Bank Al-Jazira

- Oracle

- IBM

- RiskMetrics Group

- Murex

- Quantitative Risk Management

- Wolters Kluwer

- AxiomSL

- Algorithmics

- Finastra

- Deloitte Risk Advisory

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Commercial Banks

- Investment Banks

- Insurance Providers

- Corporate Treasury Departments

- Risk Management Departments in Financial Institutions

- IT Decision-Makers in Banks and Insurance Companies

Research Methodology

Step 1: Identification of Key Variables

In this phase, we identify key stakeholders in the KSA Stress Testing Market, including banks, financial institutions, software providers, and regulators. Secondary data sources, such as SAMA guidelines and market reports, are used to map the key variables that influence market dynamics.

Step 2: Market Analysis and Construction

Data related to market penetration, growth rates, and service trends are compiled to construct an accurate market model. We evaluate adoption rates, user preferences, and service statistics to assess the market size and future projections.

Step 3: Hypothesis Validation and Expert Consultation

We validate market hypotheses through expert interviews with industry professionals, including financial institution executives and technology providers. These consultations help refine the analysis and ensure the accuracy of the data.

Step 4: Research Synthesis and Final Output

We synthesize the findings into a final report, ensuring that all data is corroborated by both primary and secondary sources. This phase involves final consultations with key stakeholders to validate the findings before publishing the report.

- Executive Summary

- Research Methodology (Market definitions and scope boundaries, terminology and abbreviations, stress testing taxonomy across clinical and diagnostic use cases, market sizing logic by procedure volume and equipment installed base, revenue attribution across devices consumables and service contracts, primary interview program with hospitals cardiology centers distributors and regulators, data triangulation and validation approach, assumptions limitations and data gaps)

- Definition and Scope

- Market Genesis and Evolution of Cardiac Stress Testing in KSA

- Burden of Cardiovascular Disease and Preventive Screening Drivers

- Care Pathway Mapping Across Cardiology Clinics Hospitals and Diagnostic Centers

- Public Healthcare Procurement and Private Sector Adoption Dynamics

- Import Dependence and Authorized Distributor Ecosystem

- Growth Drivers

Rising cardiovascular disease prevalence and aging population

Expansion of preventive screening and early diagnosis programs

Growth of private cardiology clinics and diagnostic chains

Government investment in tertiary and secondary healthcare infrastructure

Increasing employer led health screening initiatives - Challenges

High capital cost of advanced imaging stress systems

Shortage of trained cardiac technologists and specialists

Workflow complexity in nuclear and echo based stress testing

Radiation safety and compliance burden for nuclear cardiology

Equipment downtime and service dependency on imported parts - Opportunities

Modernization of cath labs and cardiac diagnostic suites

Growth of stress echo adoption as radiation free alternative

Expansion of mobile and satellite diagnostic services

Service contract differentiation through uptime guarantees

Training partnerships to build local cardiac diagnostics capability

Trends

Shift toward imaging enhanced stress testing for higher diagnostic yield

Growing preference for stress echo over nuclear in low risk patients

Integration of stress testing data into cardiac care pathways

Adoption of AI assisted interpretation and reporting tools

Increasing use of protocol standardization across hospital networks

- Regulatory & Policy Landscape

SWOT Analysis

Stakeholder & Ecosystem Analysis

Porter’s Five Forces Analysis

Competitive Intensity & Ecosystem Mapping

- By Value, 2019–2024

- By Procedure Volume, 2019–2024

- By Equipment Installed Base, 2019–2024

- By Hospital vs Diagnostic Center Revenue Split, 2019–2024

- By Fleet Type (in Value %)

Government hospitals and medical cities

Private hospital networks

Independent diagnostic centers

Cardiology specialty clinics

Corporate and occupational health providers - By Application (in Value %)

Exercise treadmill stress testing

Pharmacological stress testing

Stress echocardiography

Nuclear stress testing

Preoperative cardiac risk assessment - By Technology Architecture (in Value %)

Treadmill based stress testing systems

Cycle ergometer based stress testing systems

Stress echo imaging platforms

Nuclear cardiology stress imaging systems

Integrated ECG monitoring and reporting systems - By Connectivity Type (in Value %)

Standalone stress testing workstations

PACS and RIS integrated diagnostic workflows

EHR connected cardiac testing platforms

Cloud enabled reporting and data archiving systems

Remote service monitoring and uptime analytics - By End-Use Industry (in Value %)

Cardiology departments in hospitals

Diagnostic imaging and testing centers

Sports medicine and rehabilitation clinics

Corporate health and wellness operators

Military and government medical services - By Region (in Value %)

Riyadh Region

Makkah Region

Eastern Province

Madinah Region

Asir and Southern Regions

- Competitive ecosystem structure across imaging OEMs diagnostic equipment suppliers and service providers

- Positioning driven by clinical performance workflow integration and service footprint

- Partnership models between OEMs hospital groups and distributor networks

- Cross Comparison Parameters (diagnostic accuracy and sensitivity, procedure throughput per day, patient safety and comfort features, radiation dose management capability, integration with imaging and reporting systems, service response time and uptime SLA, training and clinical support availability, lifetime cost of ownership)

- SWOT analysis of major players

- Pricing and commercial model benchmarking

- Porter’s Five Forces

- Detailed Profiles of Major Companies

GE HealthCare

Siemens Healthineers

Philips

Canon Medical Systems

Fujifilm Healthcare

Mindray

Esaote

Schiller

GE Medical Systems Arabia

Bayer Radiology

Bracco Imaging

Lantheus Medical Imaging

Cardioline

Burdick by Hillrom

Norav Medical

- Cardiology department priorities for diagnostic accuracy and throughput

- Procurement models in government hospitals and private networks

- Decision criteria for technology selection across treadmill echo and nuclear

- Service expectations for uptime training and lifecycle support

- Total cost of ownership drivers across equipment consumables and staffing

- By Value, 2025–2030

- By Procedure Volume, 2025–2030

- By Equipment Installed Base, 2025–2030

- By Hospital vs Diagnostic Center Revenue Split, 2025–2030