Market Overview

The KSA surface to air missiles market current size stands at around USD ~ million, reflecting sustained defense modernization momentum across multiple operational domains. Procurement activity during 2024 and 2025 remained steady, driven by border security needs, missile defense upgrades, and evolving aerial threat profiles. System deployment focused on layered interception, radar integration, and command control enhancement. Investment priorities favored mobility, response speed, and integration with existing defense networks. Procurement cycles remained centralized, with acquisitions aligned to long-term national defense strategies.

Market activity is primarily concentrated around strategic military zones and critical infrastructure corridors with high defense readiness requirements. Riyadh, Eastern Province, and Western coastal regions dominate deployment due to airspace sensitivity and infrastructure density. Mature command-and-control ecosystems and established defense logistics frameworks support sustained operational readiness. Policy emphasis on sovereignty, deterrence capability, and regional security cooperation continues shaping procurement behavior and technology selection across the kingdom.

Market Segmentation

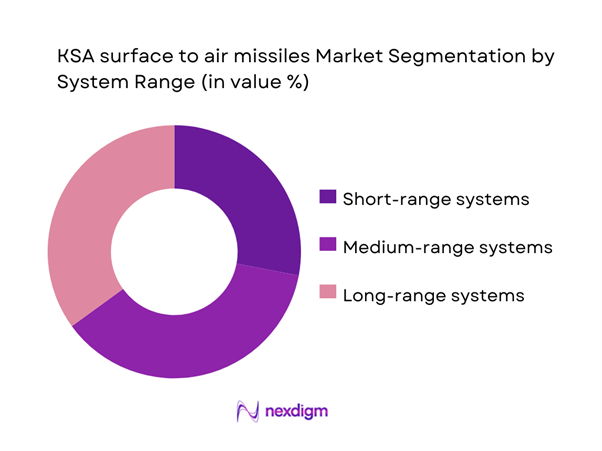

By System Range

The market is dominated by medium and long-range surface to air missile systems due to their strategic role in national air defense. These systems provide layered interception capability against aircraft, cruise missiles, and ballistic threats, making them central to Saudi defense doctrine. Short-range systems are increasingly deployed for point defense and critical infrastructure protection, particularly around energy assets and military bases. Demand growth is also supported by system interoperability requirements, radar coverage expansion, and integration with airborne surveillance platforms, strengthening overall air defense effectiveness.

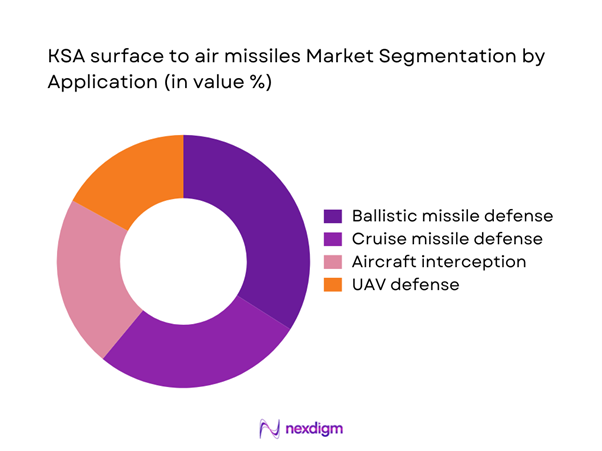

By Application

Air defense against missile and aerial threats represents the dominant application segment, driven by evolving regional security challenges. Ballistic missile interception remains a strategic priority, followed by cruise missile and unmanned aerial vehicle defense. Infrastructure protection applications continue expanding due to the concentration of energy and industrial assets. Integration with national command networks enhances operational coordination, increasing demand for multi-role systems capable of simultaneous threat engagement across domains.

Competitive Landscape

The competitive environment is characterized by a mix of global defense primes and specialized missile system manufacturers operating through government-to-government frameworks. Market participation is influenced by technology transfer agreements, long-term support commitments, and integration capability with existing defense architecture.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Raytheon Technologies | 1922 | USA | ~ | ~ | ~ | ~ | ~ | ~ |

| Lockheed Martin | 1912 | USA | ~ | ~ | ~ | ~ | ~ | ~ |

| MBDA | 2001 | France | ~ | ~ | ~ | ~ | ~ | ~ |

| Thales Group | 1893 | France | ~ | ~ | ~ | ~ | ~ | ~ |

| Rafael Advanced Defense Systems | 1948 | Israel | ~ | ~ | ~ | ~ | ~ | ~ |

KSA surface to air missiles Market Analysis

Growth Drivers

Rising regional missile and UAV threats

Escalating regional tensions have significantly increased demand for advanced air defense capabilities across Saudi strategic locations. The growing frequency of missile and unmanned aerial vehicle incidents has heightened national security prioritization. Defense planners continue emphasizing rapid interception and multi-layered coverage to counter evolving threats. Enhanced surveillance and early warning systems have reinforced procurement justification across defense agencies. Increased joint exercises have highlighted capability gaps requiring advanced missile interception solutions. Regional instability has encouraged sustained modernization of existing defense assets. Cross-border security challenges continue shaping long-term procurement planning and system upgrades. Interoperability between sensors and interceptors remains a critical operational requirement. Threat complexity has driven demand for higher accuracy and faster response systems. These dynamics collectively sustain long-term investment in missile defense infrastructure.

Modernization of Saudi air defense doctrine

Saudi Arabia’s defense strategy increasingly emphasizes integrated and network-centric air defense systems. Modernization efforts prioritize seamless coordination between radar, command, and interceptor platforms. Legacy systems are gradually being replaced or upgraded to improve operational efficiency. Enhanced digitalization supports real-time threat assessment and response coordination. Defense planners focus on adaptability against evolving aerial threat profiles. Investments in command architecture strengthen situational awareness and engagement accuracy. Training programs have expanded to support advanced system operation and maintenance. Modernization initiatives align with national security transformation objectives. Interoperability with allied systems remains a key consideration. These strategic shifts continue driving sustained system upgrades.

Challenges

High system acquisition and lifecycle costs

Surface to air missile systems involve substantial capital expenditure throughout procurement and operational phases. Acquisition costs extend beyond hardware to include training, integration, and sustainment requirements. Long lifecycle expenses place pressure on defense budgeting frameworks. Maintenance complexity increases operational overheads for deployed systems. Spare parts availability and system upgrades contribute to long-term cost burdens. Budget planning must account for extended system lifecycles and technological obsolescence. Cost considerations influence procurement timelines and system selection criteria. High entry barriers limit rapid diversification of defense assets. Financial planning complexity impacts multi-year acquisition strategies. These factors collectively constrain procurement flexibility.

Integration complexity across multi-vendor systems

Modern air defense architectures require seamless integration of platforms sourced from different manufacturers. Compatibility issues often arise due to varying communication protocols and software architectures. System integration delays can impact deployment schedules and operational readiness. Customization requirements increase technical complexity and implementation timelines. Interoperability testing requires extensive validation and certification processes. Integration challenges may affect real-time data sharing and response coordination. Training requirements increase due to heterogeneous system environments. Technical dependence on original equipment manufacturers can limit flexibility. Integration risks influence procurement decision-making. These challenges necessitate robust systems engineering and planning capabilities.

Opportunities

Expansion of layered air defense architecture

Growing threat diversity encourages expansion of multi-layered air defense systems across Saudi territory. Layered architectures enhance interception probability and operational redundancy. Integration of short, medium, and long-range systems improves defensive depth. Strategic assets benefit from overlapping coverage and reduced vulnerability. Advances in sensor fusion support more effective layered deployment models. Command systems increasingly enable coordinated multi-tier responses. This approach strengthens national airspace security and resilience. Expansion projects create opportunities for system upgrades and enhancements. Long-term defense planning favors layered configurations. These developments support sustained market growth.

Localization of maintenance and assembly

Localization initiatives create opportunities for domestic involvement in system support activities. Establishing regional maintenance facilities improves system availability and response time. Local assembly reduces dependence on foreign supply chains. Technology transfer programs enhance domestic technical expertise. Workforce development supports long-term sustainability of defense infrastructure. Localization aligns with national industrial development objectives. Reduced logistical complexity improves operational efficiency. Partnerships with international suppliers enable knowledge transfer. Local support capabilities increase lifecycle value. These factors encourage increased localization investment.

Future Outlook

The KSA surface to air missiles market is expected to maintain steady momentum driven by evolving threat landscapes and sustained defense modernization initiatives. Continued emphasis on integrated air defense, technology localization, and system interoperability will shape procurement strategies. Policy alignment with long-term security objectives will further support investment continuity through the forecast period.

Major Players

- Raytheon Technologies

- Lockheed Martin

- MBDA

- Thales Group

- Rafael Advanced Defense Systems

- Israel Aerospace Industries

- Diehl Defence

- Saab AB

- Kongsberg Defence & Aerospace

- Northrop Grumman

- Boeing Defense

- ASELSAN

- Roketsan

- L3Harris Technologies

- BAE Systems

Key Target Audience

- Saudi Ministry of Defense

- Royal Saudi Air Defense Forces

- General Authority for Military Industries

- Defense procurement agencies

- National security planning bodies

- Defense system integrators

- Investments and venture capital firms

- Government and regulatory bodies such as SAMI and GAMI

Research Methodology

Step 1: Identification of Key Variables

Core variables were identified based on system type, deployment role, procurement cycles, and operational requirements. Market boundaries were defined through defense capability mapping. Data points were aligned with national defense priorities and system classification.

Step 2: Market Analysis and Construction

Segment-level analysis was conducted using procurement trends, deployment patterns, and system modernization activity. Qualitative assessment supported quantitative structuring across application and technology layers.

Step 3: Hypothesis Validation and Expert Consultation

Findings were validated through expert discussions with defense analysts, industry specialists, and system integrators. Assumptions were refined to ensure alignment with operational realities.

Step 4: Research Synthesis and Final Output

Insights were consolidated through triangulation of demand indicators, technology trends, and policy direction. Final outputs were structured to reflect market dynamics and strategic outlook.

- Executive Summary

- Research Methodology (Market Definitions and threat envelope classification, system and interceptor segmentation framework, bottom-up procurement and deployment-based market sizing, contract value and lifecycle cost attribution, primary validation through defense officials and integrator interviews, triangulation using defense budgets and SIPRI data, platform-level assumption mapping for KSA air defense programs)

- Definition and Scope

- Market evolution

- Operational role within integrated air and missile defense

- Ecosystem structure

- Supply chain and procurement channel structure

- Regulatory and defense policy environment

- Growth Drivers

Rising regional missile and UAV threats

Modernization of Saudi air defense doctrine

Expansion of integrated air and missile defense networks

Increased defense spending under Vision 2030

Geopolitical tensions and border security needs

Localization and technology transfer initiatives - Challenges

High system acquisition and lifecycle costs

Integration complexity across multi-vendor systems

Dependence on foreign technology and approvals

Long procurement and delivery cycles

Interoperability challenges with legacy platforms - Opportunities

Expansion of layered air defense architecture

Localization of maintenance and assembly

Adoption of AI-enabled tracking and targeting

Growth in counter-UAS systems

Strategic defense partnerships and offsets - Trends

Shift toward network-centric air defense

Increased demand for mobile SAM systems

Integration of radar and interceptor fusion

Emphasis on multi-layered defense coverage

Rising focus on indigenous capability development - Government Regulations

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Value, 2020–2025

- By Volume, 2020–2025

- By Installed Base, 2020–2025

- By Average Selling Price, 2020–2025

- By Fleet Type (in Value %)

Short-range air defense systems

Medium-range air defense systems

Long-range air and missile defense systems

Integrated layered air defense systems - By Application (in Value %)

Ballistic missile defense

Cruise missile interception

Aircraft interception

UAV and loitering munition defense

Critical infrastructure protection - By Technology Architecture (in Value %)

Command-guided systems

Radar-guided systems

Infrared-guided systems

Active radar homing systems

Network-centric integrated systems - By End-Use Industry (in Value %)

Royal Saudi Air Defense Forces

Saudi Air Force

Strategic infrastructure protection units

Border and homeland security forces - By Connectivity Type (in Value %)

Standalone fire units

Networked C4ISR-integrated systems

Joint-force integrated air defense networks - By Region (in Value %)

Central Region

Western Region

Eastern Region

Southern Region

Northern Region

- Market structure and competitive positioning

Market share snapshot of major players - Cross Comparison Parameters (system range, interception capability, radar integration, mobility, lifecycle cost, interoperability, localization level, delivery timeline)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Detailed Profiles of Major Companies

Raytheon Technologies

Lockheed Martin

MBDA

Thales Group

Rafael Advanced Defense Systems

Israel Aerospace Industries

Diehl Defence

Saab AB

Kongsberg Defence & Aerospace

Northrop Grumman

Boeing Defense

ASELSAN

Roketsan

L3Harris Technologies

BAE Systems

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- Post-purchase service expectations

- By Value, 2026–2035

- By Volume, 2026–2035

- By Installed Base, 2026–2035

- By Average Selling Price, 2026–2035