Market Overview

The KSA Surface-to-Surface Missiles market current size stands at around USD ~ million with steady procurement momentum across defense programs. System deployment levels increased across 2024 and 2025 driven by modernization priorities and force readiness enhancement initiatives. Operational inventories expanded through upgrades rather than net-new acquisitions, maintaining controlled volume expansion. Procurement cycles emphasized precision strike capabilities and longer engagement ranges. Budget allocations focused on modernization instead of platform expansion. Demand stability reflected sustained regional security priorities. Technology refresh programs influenced procurement cadence significantly. Lifecycle management expenditures formed a notable share of total spending. Integration with command systems gained importance. The market maintained structured procurement discipline throughout the period.

The market is primarily concentrated across central and western military zones due to infrastructure density and strategic installations. Command centers and missile brigades drive localized demand concentration. Defense industrial hubs support maintenance and integration activities. Policy emphasis on domestic capability development influences regional deployment decisions. Infrastructure maturity enables higher operational readiness in key regions. Proximity to training and testing facilities further strengthens concentration patterns. Cross-service coordination shapes deployment priorities. Regional command structures guide procurement phasing. Security considerations strongly influence geographic distribution. Long-term strategic planning supports sustained regional alignment.

Market Segmentation

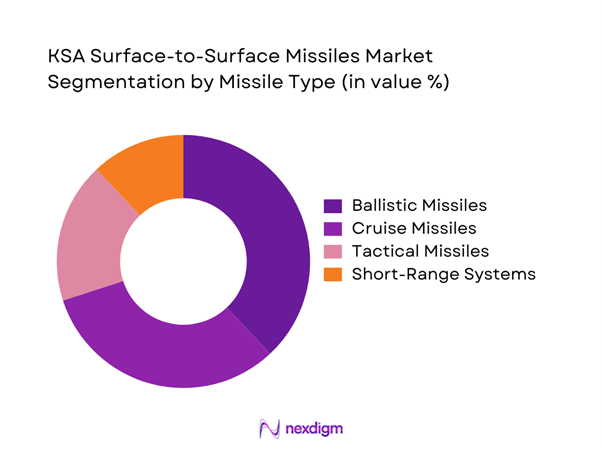

By Missile Type

Surface-to-surface ballistic and cruise missiles dominate procurement due to strategic deterrence requirements and long-range operational flexibility. Tactical missile systems also maintain steady demand driven by battlefield precision needs. Cruise missiles gain preference for accuracy and mission adaptability. Short-range systems support border and tactical operations. Indigenous development programs increasingly focus on modular platforms. Upgrades to guidance and propulsion enhance system relevance. Integration with surveillance platforms improves targeting efficiency. Legacy systems undergo modernization to extend service life. Strategic systems receive priority funding. Overall segmentation reflects operational doctrine alignment.

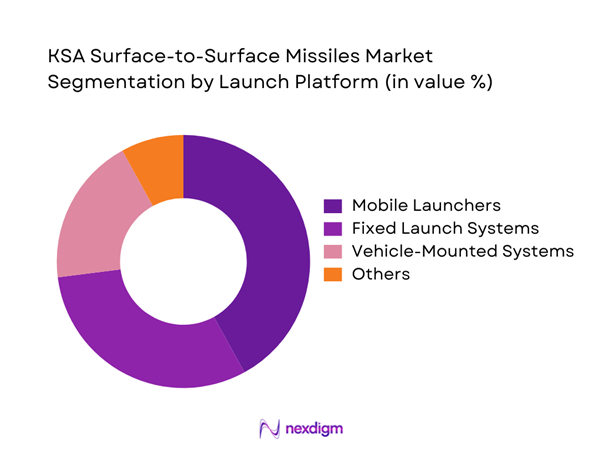

By Launch Platform

Mobile launch platforms account for the largest share due to flexibility and survivability advantages. Fixed launch systems remain essential for strategic deterrence roles. Vehicle-mounted platforms enable rapid deployment across varied terrains. Silo-based systems maintain relevance for long-range deterrence missions. Transporter erector launchers enhance mobility and response time. Platform modernization focuses on automation and survivability. Integration with command networks improves operational coordination. Maintenance considerations influence platform selection. Deployment strategies favor multi-role platforms. Operational resilience drives procurement priorities.

Competitive Landscape

The competitive landscape is characterized by a mix of international defense manufacturers and domestic defense entities. Market activity centers on technology partnerships, system integration, and localized production initiatives. Competitive positioning depends on platform reliability, technological sophistication, and compliance with regulatory frameworks.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Lockheed Martin | 1995 | USA | ~ | ~ | ~ | ~ | ~ | ~ |

| Raytheon Technologies | 1922 | USA | ~ | ~ | ~ | ~ | ~ | ~ |

| Boeing Defense | 1916 | USA | ~ | ~ | ~ | ~ | ~ | ~ |

| MBDA | 2001 | France | ~ | ~ | ~ | ~ | ~ | ~ |

| Saab AB | 1937 | Sweden | ~ | ~ | ~ | ~ | ~ | ~ |

KSA Surface-to-Surface Missiles Market Analysis

Growth Drivers

Rising national defense spending

Defense budgets expanded steadily during 2024 and 2025 to strengthen strategic deterrence capabilities across key regions. Funding prioritization favored missile modernization and force readiness improvement programs. Procurement activity reflected increased emphasis on advanced strike systems. Strategic doctrine revisions supported higher allocation toward missile forces. Defense planning aligned with long-term regional security objectives. Investment focus shifted toward precision and reliability improvements. Military readiness evaluations reinforced procurement momentum. Budget stability enabled long-term contract planning. Procurement schedules aligned with modernization timelines. Sustained spending reinforced industry confidence.

Strategic deterrence modernization programs

Modernization initiatives emphasized replacement of aging missile inventories with advanced systems. Programs targeted improved range, accuracy, and survivability. Technology upgrades supported enhanced operational effectiveness. Integration with digital command frameworks became a priority. Program execution timelines extended across multi-year phases. Capability enhancement remained aligned with evolving threat assessments. Modernization funding remained consistent across planning cycles. Domestic industrial participation increased through joint programs. Modern systems improved deployment flexibility. Strategic deterrence goals drove sustained investment focus.

Challenges

High procurement and lifecycle costs

Missile systems involve significant acquisition and long-term maintenance expenditures. Lifecycle support requirements increase total ownership burden. Complex logistics chains elevate sustainment complexity. Specialized training adds operational overhead. System upgrades require periodic capital allocation. Long development cycles delay return on investment. Budget prioritization becomes challenging amid competing defense needs. Cost containment remains difficult due to technological sophistication. Maintenance infrastructure requires continuous upgrades. Financial planning must accommodate extended asset lifecycles.

Technology transfer restrictions

Access to advanced technologies remains constrained by export controls. Licensing approvals can delay system integration schedules. Limited technology transfer impacts domestic manufacturing depth. Regulatory compliance increases procurement timelines. Dependency on external suppliers affects program autonomy. Restrictions limit customization flexibility. Indigenous development requires extended timelines. Policy alignment influences collaboration opportunities. Technology gaps impact system optimization. Strategic autonomy remains a long-term challenge.

Opportunities

Domestic production and assembly programs

Localization initiatives encourage development of indigenous manufacturing capabilities. Assembly programs reduce reliance on external suppliers. Knowledge transfer enhances technical expertise. Local production improves supply chain resilience. Government incentives support domestic participation. Industrial partnerships accelerate capability development. Workforce skill development strengthens sustainability. Localized maintenance reduces operational downtime. Program localization aligns with national defense goals. Long-term cost efficiencies become achievable.

Joint ventures with global missile manufacturers

Collaborative ventures enable access to advanced technologies. Partnerships support faster capability acquisition. Joint development reduces technological risk exposure. Shared expertise improves system performance. Localization requirements are better fulfilled through partnerships. Collaborative R&D accelerates innovation cycles. Joint ventures strengthen supply chain stability. Market entry barriers reduce through strategic alliances. Operational interoperability improves through shared standards. Partnerships support long-term strategic objectives.

Future Outlook

The market outlook remains positive through the forecast period driven by sustained modernization and strategic defense priorities. Continued investments in precision strike and indigenous capability development will shape procurement strategies. Technological advancement and localization initiatives are expected to define competitive dynamics. Policy support and regional security considerations will remain key influencing factors.

Major Players

- Lockheed Martin

- Raytheon Technologies

- Boeing Defense

- MBDA

- Saab AB

- Thales Group

- Israel Aerospace Industries

- Rafael Advanced Defense Systems

- Northrop Grumman

- Kongsberg Defence

- Hanwha Aerospace

- Roketsan

- BAE Systems

- China Aerospace Science Industry Corporation

- Saudi Arabian Military Industries

Key Target Audience

- Ministry of Defense Saudi Arabia

- Royal Saudi Strategic Missile Force

- Saudi Arabian Military Industries

- Defense procurement authorities

- Government and regulatory bodies such as GAMI

- Defense system integrators

- Logistics and maintenance contractors

- Investments and venture capital firms

Research Methodology

Step 1: Identification of Key Variables

Key variables were defined based on missile types, deployment platforms, and procurement frameworks. Industry-specific performance indicators were identified. Operational parameters and policy factors were mapped.

Step 2: Market Analysis and Construction

Market structure was developed using defense procurement patterns and modernization initiatives. Segmentation was validated through operational deployment analysis. Demand drivers were mapped across service branches.

Step 3: Hypothesis Validation and Expert Consultation

Assumptions were validated through defense domain consultations and technical reviews. Program alignment and capability relevance were assessed. Feedback refined segmentation logic.

Step 4: Research Synthesis and Final Output

Findings were consolidated into a structured framework. Data consistency checks were applied. Final insights were aligned with defense market dynamics.

- Executive Summary

- Research Methodology (Market Definitions and scope alignment for surface-to-surface missile systems, platform and range-based segmentation framework, bottom-up defense budget and procurement-based market sizing, program-wise revenue attribution and contract value modeling, primary validation through defense officials and system integrators, triangulation using SIPRI Jane’s and defense procurement databases, assumptions linked to classified program disclosure limitations)

- Definition and Scope

- Market evolution

- Operational and mission usage framework

- Defense ecosystem structure

- Supply chain and system integration landscape

- Regulatory and export control environment

- Growth Drivers

Rising national defense spending

Strategic deterrence modernization programs

Regional geopolitical tensions

Localization and Vision 2030 defense initiatives

Advancement in precision strike capabilities

Expansion of indigenous manufacturing - Challenges

High procurement and lifecycle costs

Technology transfer restrictions

Export control and compliance barriers

Long development and testing cycles

Dependence on foreign OEMs

Operational integration complexity - Opportunities

Domestic production and assembly programs

Joint ventures with global missile manufacturers

Upgradation of legacy missile platforms

Integration of AI-based guidance systems

Expansion of missile defense interoperability

Increased focus on long-range strike capability - Trends

Shift toward precision-guided munitions

Growing adoption of mobile launcher platforms

Integration of advanced navigation systems

Emphasis on survivability and countermeasure resistance

Rising investments in indigenous R&D

Digital battlefield integration - Government Regulations

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Value, 2020–2025

- By Volume, 2020–2025

- By Active Systems, 2020–2025

- By Average Unit Cost, 2020–2025

- By Fleet Type (in Value %)

Strategic missile systems

Tactical missile systems

Coastal defense missile systems

Ground-launched cruise missile systems - By Application (in Value %)

Strategic deterrence

Battlefield strike

Border and coastal defense

Precision strike missions - By Technology Architecture (in Value %)

Ballistic missile systems

Cruise missile systems

Guided rocket artillery systems

Hypersonic and next-generation systems - By End-Use Industry (in Value %)

Ministry of Defense

Royal Saudi Land Forces

Royal Saudi Strategic Missile Force

Joint defense commands - By Connectivity Type (in Value %)

INS-guided systems

GPS-aided navigation systems

Command and control linked systems

Autonomous guidance systems - By Region (in Value %)

Central Region

Eastern Region

Western Region

Southern Region

- Market structure and competitive positioning

Market share snapshot of major players - Cross Comparison Parameters (product range, missile range capability, guidance technology, production capacity, localization level, contract value, after-sales support, strategic partnerships)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Detailed Profiles of Major Companies

Lockheed Martin

Raytheon Technologies

Boeing Defense

Northrop Grumman

MBDA

BAE Systems

Rafael Advanced Defense Systems

Israel Aerospace Industries

Kongsberg Defence & Aerospace

Thales Group

Roketsan

Hanwha Aerospace

Saudi Arabian Military Industries (SAMI)

China Aerospace Science and Industry Corporation

Saab AB

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- Post-purchase service expectations

- By Value, 2026–2035

- By Volume, 2026–2035

- By Active Systems, 2026–2035

- By Average Unit Cost, 2026–2035