Market Overview

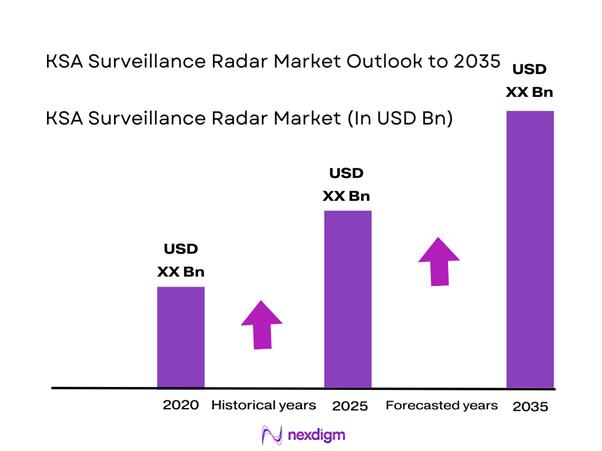

The KSA Surveillance Radar market current size stands at around USD ~ million and reflects steady procurement momentum driven by defense modernization priorities and border security programs. In 2024 and 2025, system deployments increased across air, land, and coastal surveillance applications, supported by national security investments. Radar installations expanded across military bases, border zones, and critical infrastructure sites. Demand has remained resilient due to geopolitical considerations, technology upgrades, and increasing adoption of advanced detection capabilities across multiple operational environments.

The market is primarily concentrated in Riyadh, Eastern Province, and Western coastal regions where defense infrastructure density remains high. Demand is shaped by air defense modernization, maritime monitoring requirements, and protection of critical assets. Strong government backing, defense localization policies, and integrated command systems continue strengthening the ecosystem. The presence of military bases, industrial corridors, and strategic maritime routes further supports sustained radar deployment across regions.

Market Segmentation

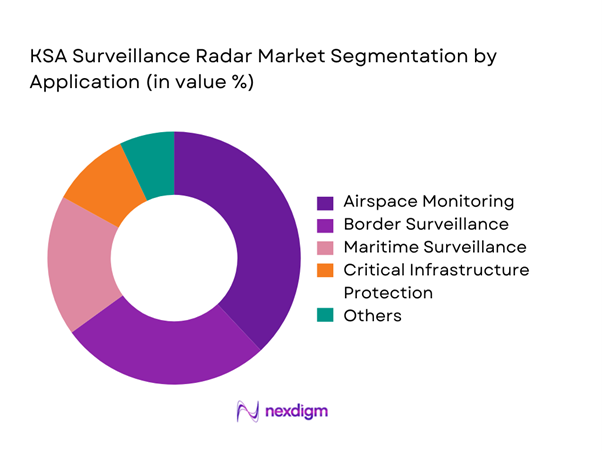

By Application

Airspace monitoring dominates the market due to continuous investments in national air defense systems and early warning infrastructure. Border surveillance represents another major segment, driven by the need to monitor extensive land boundaries and manage cross-border security risks. Maritime surveillance adoption is rising due to increased focus on coastal protection and port security. Critical infrastructure protection continues to expand with radar usage across energy facilities and industrial zones. Defense modernization programs reinforce long-term demand across all application categories.

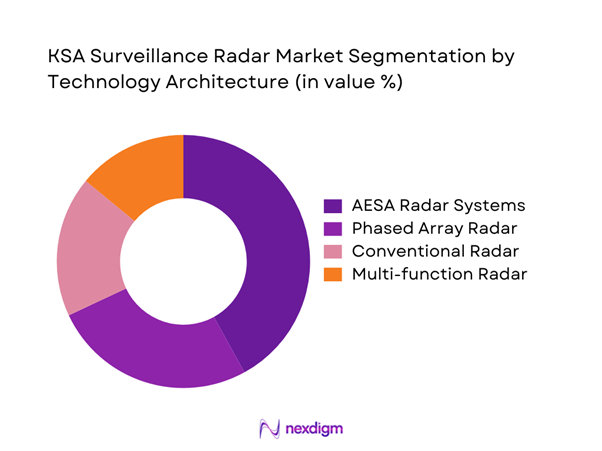

By Technology Architecture

AESA-based radar systems dominate due to superior detection accuracy, multi-target tracking, and electronic warfare resistance. Phased array radars maintain strong adoption for air defense and long-range surveillance. Conventional radar systems continue operating in legacy installations, particularly for perimeter security. Multi-function radar systems are gaining attention for integrated operations across surveillance and targeting functions. Technology upgrades are driven by the need for interoperability, real-time data processing, and enhanced situational awareness.

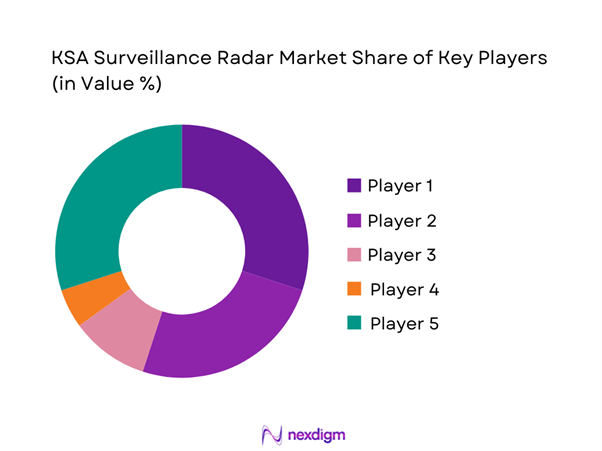

Competitive Landscape

The competitive landscape is characterized by the presence of global defense technology providers and regional system integrators. Market participants compete on technological depth, system reliability, integration capabilities, and long-term service support. Localization initiatives and offset requirements significantly influence contract awards. Strategic partnerships with domestic entities play a critical role in securing long-term programs and government contracts.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Lockheed Martin | 1912 | USA | ~ | ~ | ~ | ~ | ~ | ~ |

| Raytheon Technologies | 1922 | USA | ~ | ~ | ~ | ~ | ~ | ~ |

| Thales Group | 1893 | France | ~ | ~ | ~ | ~ | ~ | ~ |

| Saab AB | 1937 | Sweden | ~ | ~ | ~ | ~ | ~ | ~ |

| Leonardo S.p.A. | 1948 | Italy | ~ | ~ | ~ | ~ | ~ | ~ |

KSA Surveillance Radar Market Analysis

Growth Drivers

Rising border security and airspace monitoring needs

Border security requirements intensified during 2024 due to increasing cross-border monitoring obligations and aerial threat detection priorities. National defense agencies expanded radar coverage to improve early warning response and airspace situational awareness. Increased drone activity encouraged deployment of advanced detection and tracking technologies across sensitive regions. Continuous infrastructure expansion further strengthened radar deployment needs across strategic zones. Integrated command systems improved radar utilization efficiency across air and ground operations. Surveillance modernization programs supported procurement momentum across defense agencies. Enhanced interoperability between radar networks increased operational effectiveness significantly. Border protection mandates sustained investment in long-range surveillance capabilities. Rising regional security concerns further reinforced monitoring requirements across key locations. Long-term defense strategies continue emphasizing radar-based situational awareness systems.

Increased defense spending under Vision 2030

Defense modernization programs under Vision 2030 accelerated radar procurement initiatives across military branches. Budget allocations favored technology upgrades supporting national security objectives and force readiness. Radar acquisition aligned with broader military digitization and modernization frameworks. Multi-year procurement planning enabled sustained system deployment cycles. Investment focus remained on advanced surveillance and detection capabilities. Indigenous defense manufacturing initiatives further supported radar system integration. Government-backed projects encouraged long-term technology partnerships. Increased funding stability enhanced supplier confidence and program continuity. Strategic alignment with national defense goals strengthened acquisition pipelines. Defense spending growth remained a key market catalyst.

Challenges

High capital and maintenance costs

Surveillance radar systems involve high acquisition costs due to complex hardware and integration requirements. Maintenance expenses increase due to calibration, upgrades, and lifecycle management needs. Budget constraints sometimes delay system replacement or expansion initiatives. Long deployment cycles increase total ownership costs for end users. Skilled manpower requirements further elevate operational expenses. Maintenance contracts add long-term financial commitments for operators. Spare parts availability affects operational continuity and cost efficiency. Technology obsolescence risks increase replacement expenditures. Financial planning complexity impacts procurement timelines. Cost pressures remain a persistent adoption challenge.

Dependence on foreign technology suppliers

Heavy reliance on imported radar technologies creates supply chain vulnerabilities for national programs. Technology transfer limitations restrict domestic capability development in some areas. Procurement delays occur due to export controls and regulatory approvals. Limited local manufacturing capacity affects system customization flexibility. Dependence on external maintenance support increases operational risk. Geopolitical factors influence technology availability and upgrades. Localization targets face challenges due to proprietary system architectures. Integration complexity increases when using foreign platforms. Domestic skill gaps hinder rapid localization efforts. Strategic autonomy remains constrained by supplier dependencies.

Opportunities

Localization and defense manufacturing initiatives

Government-backed localization programs create opportunities for domestic radar manufacturing and assembly. Technology transfer initiatives support development of indigenous radar components. Local production reduces long-term dependency on imports. Industrial partnerships encourage skill development and employment creation. Domestic testing facilities improve system validation capabilities. Localization policies enhance supply chain resilience. Defense offsets stimulate private sector participation. Local manufacturing supports faster system deployment timelines. Cost efficiencies improve through reduced import reliance. Localization strengthens long-term defense sustainability.

Integration of AI and advanced signal processing

Artificial intelligence enhances target recognition and threat classification accuracy. Advanced signal processing improves detection in complex environments. AI-driven analytics support faster decision-making and response times. Automation reduces operator workload and improves operational efficiency. Machine learning enhances adaptive radar performance over time. Integration with command systems strengthens situational awareness. Data fusion capabilities enable multi-source intelligence integration. AI adoption improves surveillance coverage reliability. Advanced processing supports counter-drone and stealth detection. Technological evolution drives next-generation radar development.

Future Outlook

The KSA surveillance radar market is expected to maintain steady growth through 2035, supported by defense modernization and border security priorities. Increasing emphasis on localized manufacturing and technology integration will shape procurement strategies. Adoption of AI-enabled and networked radar systems will continue expanding. Strategic defense initiatives and infrastructure investments are expected to sustain long-term market development.

Major Players

- Lockheed Martin

- Raytheon Technologies

- Thales Group

- Saab AB

- Leonardo S.p.A.

- Northrop Grumman

- Airbus Defence and Space

- HENSOLDT AG

- Indra Sistemas

- Israel Aerospace Industries

- ELTA Systems

- ASELSAN

- BAE Systems

- L3Harris Technologies

- Rheinmetall Defence

Key Target Audience

- Saudi Ministry of Defense

- Saudi Arabian Military Industries

- General Authority for Military Industries

- Saudi Border Guard

- Royal Saudi Air Defense Forces

- Defense system integrators

- Aerospace and defense manufacturers

- Investments and venture capital firms

Research Methodology

Step 1: Identification of Key Variables

Market boundaries, system classifications, application scope, and deployment environments were identified based on defense sector structures and procurement frameworks.

Step 2: Market Analysis and Construction

Market structure was developed using technology segmentation, application mapping, and operational deployment trends across Saudi defense sectors.

Step 3: Hypothesis Validation and Expert Consultation

Assumptions were validated through expert discussions, defense sector insights, and cross-verification of procurement and deployment patterns.

Step 4: Research Synthesis and Final Output

Findings were consolidated through data triangulation, qualitative validation, and consistency checks to ensure analytical accuracy.

- Executive Summary

- Research Methodology (Market Definitions and operational scope for surveillance radar systems in KSA, Platform and application-based segmentation framework for defense and security radars, Bottom-up market sizing using radar deployment and procurement data, Revenue estimation through contract value and system lifecycle costing, Primary validation through defense officials and radar system integrators)

- Definition and scope

- Market evolution

- Usage and operational deployment landscape

- Ecosystem and stakeholder structure

- Supply chain and localization dynamics

- Regulatory and defense procurement environment

- Growth Drivers

Rising border security and airspace monitoring needs

Increased defense spending under Vision 2030

Growing adoption of AESA and multi-function radars

Modernization of air defense and surveillance infrastructure

Rising geopolitical and regional security concerns - Challenges

High capital and maintenance costs

Dependence on foreign technology suppliers

Complex integration with legacy defense systems

Long procurement and approval cycles

Skilled workforce and technical training gaps - Opportunities

Localization and defense manufacturing initiatives

Integration of AI and advanced signal processing

Expansion of coastal and maritime surveillance

Upgrades of legacy radar installations

Public-private partnerships in defense electronics - Trends

Shift toward network-centric surveillance systems

Increased demand for mobile and deployable radars

Adoption of AI-based threat detection

Emphasis on multi-band and multi-mission radars

Growing role of domestic defense manufacturing - Government Regulations

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Value, 2020–2025

- By Volume, 2020–2025

- By Installed Base, 2020–2025

- By Average Selling Price, 2020–2025

- By Fleet Type (in Value %)

Ground-based surveillance radar

Airborne surveillance radar

Naval surveillance radar

Border and coastal surveillance radar

Mobile and tactical radar systems - By Application (in Value %)

Airspace monitoring and air defense

Border and perimeter security

Maritime surveillance

Critical infrastructure protection

Early warning and threat detection - By Technology Architecture (in Value %)

Active Electronically Scanned Array (AESA)

Passive Electronically Scanned Array (PESA)

Conventional radar systems

Multi-function integrated radar

3D and phased array radar - By End-Use Industry (in Value %)

Defense forces

Homeland security

Border security agencies

Coast guard and naval forces

Critical infrastructure operators - By Connectivity Type (in Value %)

Standalone radar systems

Network-centric radar systems

Integrated C4ISR-enabled radar

AI-enabled sensor fusion systems - By Region (in Value %)

Central Saudi Arabia

Western Saudi Arabia

Eastern Province

Southern Border Region

Northern Border Region

- Market structure and competitive positioning

Market share snapshot of major players - Cross Comparison Parameters (Technology capability, Radar range and accuracy, Platform integration, Localization presence, Contract value, After-sales support, Compliance with Saudi defense standards, Pricing strategy)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Detailed Profiles of Major Companies

Lockheed Martin

Raytheon Technologies

Thales Group

Saab AB

Leonardo S.p.A.

HENSOLDT AG

Indra Sistemas

Northrop Grumman

Airbus Defence and Space

Israel Aerospace Industries

ELTA Systems

ASELSAN

BAE Systems

L3Harris Technologies

Rheinmetall Defence

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and defense financing practices

- Implementation challenges and operational risks

- Post-deployment support and lifecycle service expectations

- By Value, 2026–2035

- By Volume, 2026–2035

- By Installed Base, 2026–2035

- By Average Selling Price, 2026–2035