Market Overview

The KSA Tactical UAV market current size stands at around USD ~ million, reflecting steady expansion driven by modernization priorities and operational demand. Recent procurement activity indicates rising deployment density across surveillance and tactical missions, with fleet expansion supported by increasing defense allocations. Technological adoption levels have advanced notably, with greater integration of sensor payloads, communication modules, and autonomous flight systems. Domestic assembly capabilities have also expanded, supported by industrial localization initiatives and strategic defense partnerships across multiple operational domains.

The market is primarily concentrated in regions hosting major defense commands, airbases, and border security operations. Demand is strongest in areas requiring persistent aerial monitoring, maritime surveillance, and rapid response capabilities. Infrastructure readiness, secure airspace management, and integrated command systems influence deployment intensity. Policy alignment with national defense localization goals further strengthens regional adoption, while ecosystem maturity continues improving through partnerships, training centers, and maintenance facilities supporting sustained operational readiness.

Market Segmentation

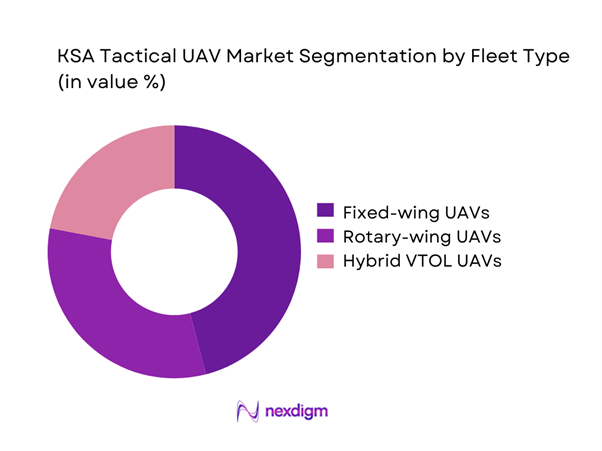

By Fleet Type

Fixed-wing tactical UAVs dominate due to extended endurance, higher payload efficiency, and suitability for wide-area surveillance missions. Rotary-wing platforms maintain relevance for short-range and vertical deployment operations, especially in urban or confined environments. Hybrid VTOL platforms are gaining traction as they combine flexibility with endurance, supporting diversified mission profiles. Defense planners favor fleet diversification to balance endurance, payload, and operational agility. Increasing interoperability requirements further influence procurement preferences, encouraging modular and scalable fleet structures across tactical aviation programs.

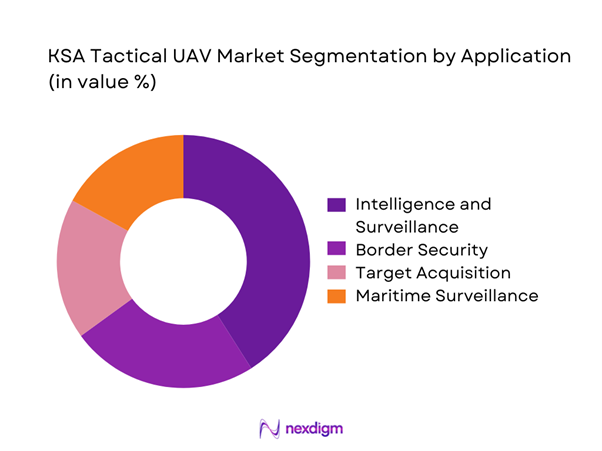

By Application

Intelligence, surveillance, and reconnaissance applications represent the largest share due to continuous border monitoring and security requirements. Tactical UAVs are increasingly used for maritime patrols, target acquisition, and situational awareness. Growth is supported by demand for real-time data transmission and enhanced battlefield visibility. Homeland security and counter-smuggling operations further drive utilization. Increasing integration with command systems strengthens application diversity, enabling faster response and improved operational efficiency across military and security agencies.

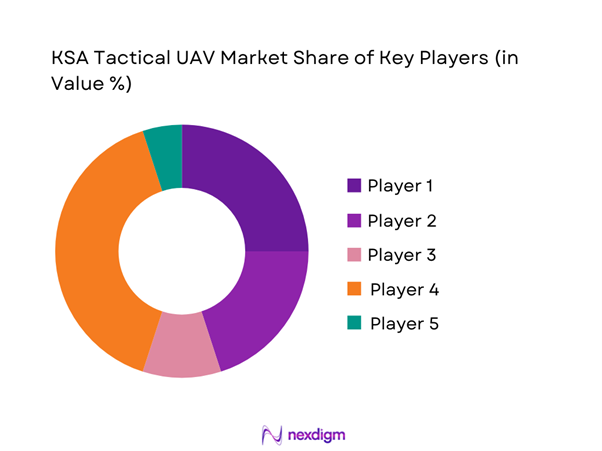

Competitive Landscape

The competitive landscape features a combination of domestic defense manufacturers and international aerospace firms operating through partnerships and localization agreements. Market positioning is influenced by technological depth, platform reliability, and alignment with national industrial strategies. Companies emphasize modular designs, local assembly, and long-term service support to strengthen market presence. Competitive intensity remains moderate, supported by high entry barriers, regulatory oversight, and specialized operational requirements.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Saudi Arabian Military Industries | 2017 | Saudi Arabia | ~ | ~ | ~ | ~ | ~ | ~ |

| Intra Defense Technologies | 2019 | Saudi Arabia | ~ | ~ | ~ | ~ | ~ | ~ |

| Advanced Electronics Company | 1988 | Saudi Arabia | ~ | ~ | ~ | ~ | ~ | ~ |

| Baykar Technologies | 1984 | Türkiye | ~ | ~ | ~ | ~ | ~ | ~ |

| Elbit Systems | 1966 | Israel | ~ | ~ | ~ | ~ | ~ | ~ |

KSA Tactical UAV Market Analysis

Growth Drivers

Rising defense modernization spending

Rising defense modernization spending continues strengthening tactical UAV acquisition across multiple operational domains. Government priorities emphasize upgrading surveillance, reconnaissance, and tactical response capabilities using unmanned aerial platforms. Budget allocations increasingly favor technology-intensive systems supporting border monitoring and asymmetric threat detection. Enhanced interoperability requirements encourage procurement of advanced command-integrated UAVs. Investment emphasis remains aligned with long-term defense transformation goals. Localization mandates further stimulate acquisition volumes through domestic assembly incentives. Capability upgrades focus on endurance, payload versatility, and data integration performance. Tactical UAVs are prioritized for rapid deployment scenarios. Funding continuity supports multi-year procurement programs. Strategic planning reinforces sustained demand momentum.

Expansion of border surveillance programs

Expansion of border surveillance programs significantly drives tactical UAV deployment across land and maritime boundaries. Persistent monitoring requirements favor unmanned platforms capable of long-duration operations. Increased cross-border security challenges heighten reliance on aerial intelligence assets. Tactical UAVs provide real-time situational awareness supporting rapid response operations. Surveillance infrastructure upgrades further accelerate platform integration. Remote terrain coverage needs strengthen demand for endurance-capable systems. Data fusion with ground command centers enhances operational effectiveness. UAV-based surveillance reduces manpower dependency in sensitive zones. Adoption aligns with national security reinforcement initiatives. Continuous monitoring mandates ensure sustained procurement activity.

Challenges

High acquisition and lifecycle costs

High acquisition and lifecycle costs present persistent challenges for tactical UAV procurement programs. Advanced sensor integration increases upfront system expenditures significantly. Maintenance requirements contribute to elevated long-term operational expenses. Specialized training for operators and technicians adds cost pressure. Spare parts dependency affects overall lifecycle budgeting predictability. Infrastructure upgrades further raise ownership expenses. Budget allocation constraints limit fleet expansion scalability. Cost optimization remains difficult due to technology complexity. Lifecycle planning becomes critical for sustainability. Financial barriers restrict rapid fleet modernization.

Dependence on foreign technology and components

Dependence on foreign technology and components limits supply chain autonomy for tactical UAV programs. Critical avionics and propulsion systems often require external sourcing. Export control regulations can delay platform acquisition timelines. Limited domestic manufacturing capability increases vulnerability to geopolitical risks. Technology transfer restrictions affect system customization flexibility. Localization initiatives face long development cycles. Integration challenges arise from mixed-origin subsystems. Maintenance dependence impacts operational readiness. Strategic autonomy goals remain partially constrained. Supply chain diversification remains a priority challenge.

Opportunities

Indigenous UAV manufacturing initiatives

Indigenous UAV manufacturing initiatives create strong opportunities for domestic capability expansion. Local production supports long-term defense self-reliance objectives. Industrial participation enhances technology absorption and skill development. Government incentives encourage private sector investment in UAV programs. Local manufacturing reduces dependency on external suppliers. Platform customization becomes more feasible through domestic engineering. Export potential increases with localized production capabilities. Employment generation strengthens industry ecosystem sustainability. Collaboration with research institutions accelerates innovation cycles. Indigenous programs align with strategic defense visions.

Integration of AI and autonomous navigation

Integration of AI and autonomous navigation unlocks advanced operational efficiencies for tactical UAV systems. AI enables improved target recognition and mission planning accuracy. Autonomous navigation reduces operator workload significantly. Enhanced decision-support systems improve response times. Machine learning enhances data processing efficiency. Autonomous capabilities support swarm and coordinated operations. Reduced human intervention lowers operational risk. AI integration improves mission adaptability across terrains. Continuous software upgrades enhance platform longevity. Technological advancement drives future capability differentiation.

Future Outlook

The KSA Tactical UAV market is expected to maintain steady expansion through the forecast period, supported by defense modernization initiatives and evolving security requirements. Increasing localization, technological upgrades, and autonomous system integration will shape future developments. Continued policy support and strategic investments are expected to sustain long-term growth momentum across tactical aviation programs.

Major Players

- Saudi Arabian Military Industries

- Intra Defense Technologies

- Advanced Electronics Company

- Baykar Technologies

- Elbit Systems

- Israel Aerospace Industries

- Turkish Aerospace Industries

- Leonardo S.p.A.

- Thales Group

- Northrop Grumman

- L3Harris Technologies

- General Atomics

- Saab AB

- Edge Group

- AeroVironment

Key Target Audience

- Defense ministries and armed forces

- Border security and coast guard agencies

- Internal security and intelligence agencies

- Defense procurement authorities

- Aerospace and defense manufacturers

- System integrators and UAV developers

- Investments and venture capital firms

- Government and regulatory bodies such as GAMI and MOD

Research Methodology

Step 1: Identification of Key Variables

The study identifies operational scope, platform categories, application areas, and procurement structures relevant to tactical UAV deployment. Defense capability requirements and system classifications are defined to establish analytical boundaries.

Step 2: Market Analysis and Construction

Data is structured through segmentation mapping, demand assessment, and operational usage patterns. Market behavior is evaluated through fleet deployment trends and capability adoption patterns.

Step 3: Hypothesis Validation and Expert Consultation

Insights are validated through interactions with defense analysts, industry specialists, and operational stakeholders. Feedback supports refinement of assumptions and market structure consistency.

Step 4: Research Synthesis and Final Output

Findings are consolidated through triangulation, ensuring logical coherence and alignment with industry dynamics. Outputs reflect validated insights supporting strategic decision-making.

- Executive Summary

- Research Methodology (Market Definitions and operational scope for tactical UAVs in KSA, platform and mission-based segmentation framework, bottom-up fleet and procurement-based market sizing, value attribution across airframe-payload-software stacks, primary validation through defense OEMs and Saudi MoD stakeholders, triangulation using defense budgets procurement data and flight-hour utilization, assumptions on indigenous manufacturing and import dependency)

- Definition and Scope

- Market evolution

- Operational and mission usage landscape

- Defense and security ecosystem structure

- Supply chain and procurement channels

- Regulatory and defense policy environment

- Growth Drivers

Rising defense modernization spending

Expansion of border surveillance programs

Increasing demand for ISR capabilities

Localization of defense manufacturing under Vision 2030

Growing emphasis on unmanned combat support systems

Advancements in endurance and payload integration - Challenges

High acquisition and lifecycle costs

Dependence on foreign technology and components

Regulatory constraints on airspace usage

Cybersecurity and data sovereignty concerns

Limited domestic UAV subsystem ecosystem

Operational integration complexity - Opportunities

Indigenous UAV manufacturing initiatives

Integration of AI and autonomous navigation

Export potential to regional defense markets

Dual-use UAV adaptation for security agencies

Upgradation of legacy ISR platforms

Local MRO and lifecycle service development - Trends

Shift toward multi-mission tactical UAVs

Rising use of SATCOM-enabled platforms

Increased procurement through joint ventures

Focus on swarm and cooperative UAV operations

Growing emphasis on data fusion and analytics

Adoption of modular payload architectures - Government Regulations

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Value, 2020–2025

- By Volume, 2020–2025

- By Active Systems, 2020–2025

- By Average Selling Price, 2020–2025

- By Fleet Type (in Value %)

Fixed-wing tactical UAVs

Rotary-wing tactical UAVs

Hybrid VTOL tactical UAVs - By Application (in Value %)

Intelligence, Surveillance, and Reconnaissance

Border and perimeter security

Target acquisition and fire support

Maritime patrol and coastal surveillance

Electronic warfare and signals intelligence - By Technology Architecture (in Value %)

Remotely piloted systems

Semi-autonomous systems

Autonomous mission-capable systems - By End-Use Industry (in Value %)

Defense forces

Homeland security

Border guard and coast guard

Intelligence agencies - By Connectivity Type (in Value %)

Line-of-sight communication

Beyond line-of-sight satellite communication

Hybrid communication systems - By Region (in Value %)

Central Region

Western Region

Eastern Region

Southern Region

Northern Region

- Market structure and competitive positioning

Market share snapshot of major players - Cross Comparison Parameters (product portfolio depth, endurance and range capability, localization level, pricing strategy, technology maturity, defense certifications, after-sales support, strategic partnerships)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Detailed Profiles of Major Companies

Saudi Arabian Military Industries (SAMI)

Intra Defense Technologies

Advanced Electronics Company (AEC)

Baykar Technologies

Israel Aerospace Industries

Elbit Systems

General Atomics Aeronautical Systems

Leonardo S.p.A.

Northrop Grumman

Thales Group

Saab AB

Edge Group

Turkish Aerospace Industries

AeroVironment

L3Harris Technologies

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- Post-purchase service expectations

- By Value, 2026–2035

- By Volume, 2026–2035

- By Active Systems, 2026–2035

- By Average Selling Price, 2026–2035