Market Overview

The KSA tanker aircraft market current size stands at around USD ~ million, reflecting steady procurement activity and fleet modernization momentum. Demand during the period covered has been supported by operational readiness requirements, aerial refueling fleet utilization, and replacement of aging platforms. Procurement volumes recorded during 2024 and 2025 indicate stable acquisition patterns supported by long-term defense planning. The market shows consistent demand from defense aviation programs, with emphasis on mission endurance, interoperability, and enhanced refueling efficiency across multiple aircraft classes.

Saudi Arabia represents the dominant geography due to concentrated airbase infrastructure, centralized defense procurement, and high operational tempo. Key airbases across central and western regions drive demand through training, readiness, and strategic deployment needs. The ecosystem benefits from established defense procurement frameworks, mature maintenance infrastructure, and long-standing supplier relationships. Regulatory alignment, government-backed modernization initiatives, and interoperability requirements further reinforce sustained demand across the national defense aviation landscape.

Market Segmentation

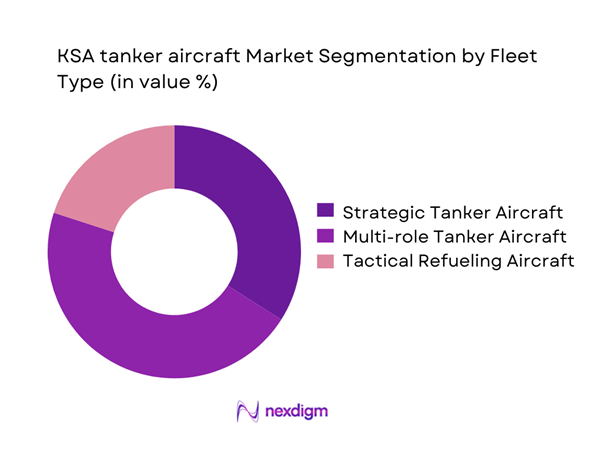

By Fleet Type

The fleet type segmentation is primarily driven by strategic and multi-role tanker aircraft deployments across national air operations. Multi-role tanker platforms dominate due to their ability to support refueling, cargo transport, and personnel movement within a single airframe. Strategic tankers continue to play a critical role in long-range missions, regional force projection, and coalition operations. Tactical refueling aircraft maintain limited deployment, mainly supporting short-range or specialized missions. Fleet selection is influenced by mission versatility, payload capacity, and compatibility with existing combat aircraft. The dominance of multi-role platforms reflects evolving operational doctrines emphasizing flexibility, rapid deployment, and cost efficiency.

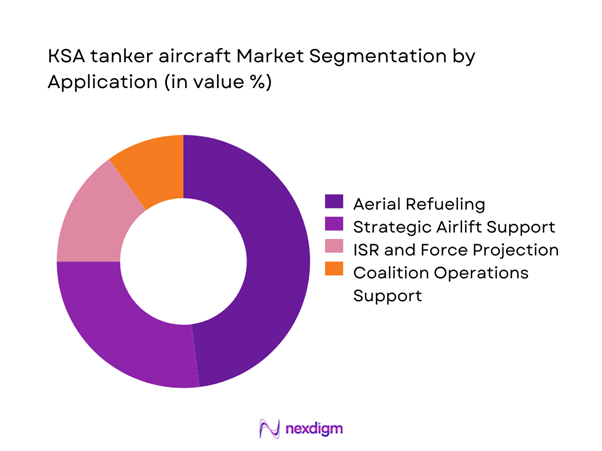

By Application

Application-based segmentation highlights aerial refueling as the dominant use case across the national defense aviation structure. Refueling missions account for the largest utilization share due to extended flight operations and regional mission coverage. Strategic airlift support follows closely, driven by troop movement and logistics support requirements. ISR and force projection applications continue to grow steadily as operational doctrines evolve toward integrated air dominance. Coalition mission support remains a stable segment due to joint exercises and allied operations. Application diversification is reinforced by expanding operational scope and increasing interoperability requirements.

Competitive Landscape

The competitive landscape of the KSA tanker aircraft market is characterized by a limited number of global aerospace manufacturers with strong defense portfolios. Market competition is shaped by long-term procurement contracts, platform reliability, and lifecycle support capabilities. Vendor positioning depends heavily on technological maturity, delivery track records, and alignment with national defense requirements. Strategic partnerships, offset agreements, and localized maintenance capabilities further influence competitive strength. Entry barriers remain high due to certification requirements and long development cycles.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Airbus Defence and Space | 1970 | Europe | ~ | ~ | ~ | ~ | ~ | ~ |

| Boeing Defense | 1916 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| Lockheed Martin | 1995 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| Northrop Grumman | 1939 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| Embraer Defense | 1969 | Brazil | ~ | ~ | ~ | ~ | ~ | ~ |

KSA tanker aircraft Market Analysis

Growth Drivers

Rising aerial refueling requirements for long-range missions

Rising aerial refueling requirements continue increasing as operational range demands expand across regional and strategic defense missions. Enhanced mission duration expectations require reliable tanker support for sustained air operations across extended geographic zones. Increased participation in multinational exercises further intensifies refueling needs across diverse aircraft platforms. Expanding air patrol operations contribute directly to higher refueling sortie frequency. Operational doctrines emphasize endurance and rapid deployment, reinforcing tanker utilization. Fleet planners increasingly prioritize refueling compatibility across aircraft generations. Enhanced surveillance and response requirements further stimulate refueling mission frequency. Airspace monitoring mandates longer airborne durations, driving tanker demand. Defense readiness benchmarks increasingly integrate refueling availability metrics. These factors collectively sustain strong refueling-driven market growth.

Expansion of Saudi Air Force fleet modernization programs

Fleet modernization initiatives remain central to national defense planning and capability enhancement strategies. Aging aircraft replacement programs drive procurement of technologically advanced tanker platforms. Modernization efforts focus on interoperability, avionics upgrades, and improved refueling efficiency. Investment in new aircraft platforms strengthens operational readiness and long-term sustainability. Modern fleets reduce maintenance downtime and enhance mission availability. Compatibility with next-generation fighter aircraft remains a priority objective. Enhanced automation improves refueling precision and operational safety. Modernization programs also support workforce skill development and operational resilience. Government-backed defense strategies reinforce long-term fleet renewal commitments. These initiatives collectively sustain strong demand momentum.

Challenges

High acquisition and lifecycle costs

High acquisition costs remain a significant constraint for tanker aircraft procurement planning. Platform procurement requires substantial upfront capital commitments from defense budgets. Lifecycle expenses including maintenance and upgrades add long-term financial pressure. Advanced refueling systems increase overall ownership costs. Training requirements further elevate total expenditure obligations. Spare parts availability influences ongoing operational costs. Budget prioritization challenges limit rapid fleet expansion capabilities. Long-term service agreements create financial commitments beyond acquisition. Cost sensitivity affects procurement timing and fleet scale decisions. These financial pressures slow adoption of newer tanker technologies.

Long procurement and certification cycles

Procurement timelines remain extended due to regulatory and certification requirements. Multi-year evaluation processes delay fleet induction schedules significantly. Compliance with airworthiness standards requires extensive testing and validation. Certification delays often affect delivery schedules and operational planning. Customization requirements further extend approval timelines. Interoperability testing with existing fleets adds procedural complexity. Government approval cycles introduce additional administrative layers. Lengthy procurement processes reduce flexibility in fleet modernization. Delays can impact readiness during transitional periods. These factors collectively constrain rapid market expansion.

Opportunities

Fleet replacement and modernization initiatives

Fleet replacement programs present strong opportunities for new tanker platform integration. Aging aircraft retirement schedules create consistent replacement demand. Modernization initiatives favor fuel-efficient and multi-role platforms. Government emphasis on defense self-reliance supports long-term acquisition planning. Replacement programs enable adoption of advanced refueling technologies. Lifecycle optimization encourages investment in newer platforms. Improved operational efficiency supports broader mission capabilities. Fleet renewal enhances interoperability with allied forces. Replacement cycles provide predictable procurement visibility. These dynamics create sustained growth opportunities.

Integration of next-generation refueling technologies

Advanced refueling technologies present opportunities for capability enhancement and differentiation. Digital flight systems improve operational precision and safety. Automation reduces crew workload and operational risk. Integration of advanced sensors enhances refueling accuracy. Next-generation systems support broader aircraft compatibility. Improved fuel transfer efficiency enhances mission endurance. Technological upgrades align with modernization objectives. Adoption of smart systems improves maintenance predictability. Innovation enables competitive differentiation among platforms. These developments support long-term market expansion.

Future Outlook

The market outlook remains positive through the forecast period as defense modernization efforts continue. Fleet renewal programs and operational readiness initiatives will sustain demand. Increasing emphasis on interoperability and advanced refueling capabilities will shape procurement strategies. Long-term defense planning and regional security priorities are expected to support consistent investment momentum.

Major Players

- Airbus Defence and Space

- Boeing Defense

- Lockheed Martin

- Northrop Grumman

- Embraer Defense

- Israel Aerospace Industries

- Saab AB

- Turkish Aerospace Industries

- Leonardo

- Dassault Aviation

- Cobham

- Collins Aerospace

- L3Harris Technologies

- Marshall Aerospace

- ST Engineering Aerospace

Key Target Audience

- Ministry of Defense procurement departments

- Royal Saudi Air Force logistics divisions

- Defense procurement authorities

- Government and regulatory bodies including GAMI

- Aircraft maintenance and overhaul providers

- Defense system integrators

- Aerospace component suppliers

- Investments and venture capital firms

Research Methodology

Step 1: Identification of Key Variables

Key market parameters were defined based on fleet composition, procurement cycles, and operational usage patterns. Variables were aligned with defense aviation structures and platform classifications. Market boundaries were established through operational and functional relevance.

Step 2: Market Analysis and Construction

Data was structured using fleet inventories, acquisition trends, and deployment patterns. Segmentation was developed based on application, fleet type, and operational usage. Analytical models reflected defense procurement dynamics.

Step 3: Hypothesis Validation and Expert Consultation

Findings were validated through consultations with aviation specialists and defense sector professionals. Insights were refined through cross-verification of operational assumptions. Market behavior was tested against observed procurement trends.

Step 4: Research Synthesis and Final Output

All findings were consolidated into a structured analytical framework. Data consistency checks ensured logical alignment across segments. Final outputs were validated for coherence, relevance, and strategic applicability.

- Executive Summary

- Research Methodology (Market Definitions and scope alignment for aerial refueling platforms, Fleet classification and mission-role segmentation logic, Bottom-up fleet and procurement-based market sizing approach, Revenue attribution by platform lifecycle and upgrade programs, Primary validation through defense OEMs and regional air force experts, Triangulation using defense budgets procurement data and delivery schedules, Assumptions and constraints linked to classified fleet data)

- Definition and scope

- Market evolution

- Operational role in force projection and aerial refueling

- Ecosystem structure and OEM–air force relationships

- Supply chain and MRO framework

- Defense and aviation regulatory environment

- Growth Drivers

Rising aerial refueling requirements for long-range missions

Expansion of Saudi Air Force fleet modernization programs

Growing regional security and defense preparedness

Increasing joint operations with allied air forces

Emphasis on force projection and rapid deployment - Challenges

High acquisition and lifecycle costs

Long procurement and certification cycles

Dependence on foreign OEMs and technology transfer limits

Maintenance complexity and spare part availability

Budget allocation competition with other defense programs - Opportunities

Fleet replacement and modernization initiatives

Integration of next-generation refueling technologies

Local MRO and offset program expansion

Growth in regional defense collaboration

Upgrades of legacy tanker platforms - Trends

Shift toward multi-role tanker transport aircraft

Increased adoption of digital avionics and connectivity

Rising focus on interoperability with NATO systems

Expansion of in-country maintenance capabilities

Growing emphasis on lifecycle cost optimization - Government Regulations

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Value, 2020–2025

- By Volume, 2020–2025

- By Installed Base, 2020–2025

- By Average Selling Price, 2020–2025

- By Fleet Type (in Value %)

Strategic tanker aircraft

Multi-role tanker transport aircraft

Tactical refueling aircraft - By Application (in Value %)

Aerial refueling

Strategic airlift support

ISR and force projection support

Coalition and allied mission support - By Technology Architecture (in Value %)

Boom refueling systems

Probe and drogue systems

Hybrid refueling architectures - By End-Use Industry (in Value %)

Royal Saudi Air Force

Joint Forces Command

Allied and coalition operations - By Connectivity Type (in Value %)

SATCOM-enabled platforms

Tactical data link integrated platforms

Line-of-sight communication systems - By Region (in Value %)

Central Saudi Arabia

Western Saudi Arabia

Eastern Saudi Arabia

Southern Saudi Arabia

- Market structure and competitive positioning

Market share snapshot of major players - Cross Comparison Parameters (Fleet size, Platform capability, Refueling technology, Contract value, Local partnership presence, Delivery timeline, Aftermarket support, Combat readiness)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Detailed Profiles of Major Companies

Airbus Defence and Space

Boeing Defense, Space & Security

Lockheed Martin

Northrop Grumman

Israel Aerospace Industries

Embraer Defense & Security

United Aircraft Corporation

Ilyushin Aviation Complex

Cobham Mission Systems

Collins Aerospace

L3Harris Technologies

Marshall Aerospace

ST Engineering Aerospace

Turkish Aerospace Industries

Saab AB

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- Post-purchase service expectations

- By Value, 2026–2035

- By Volume, 2026–2035

- By Installed Base, 2026–2035

- By Average Selling Price, 2026–2035