Market Overview

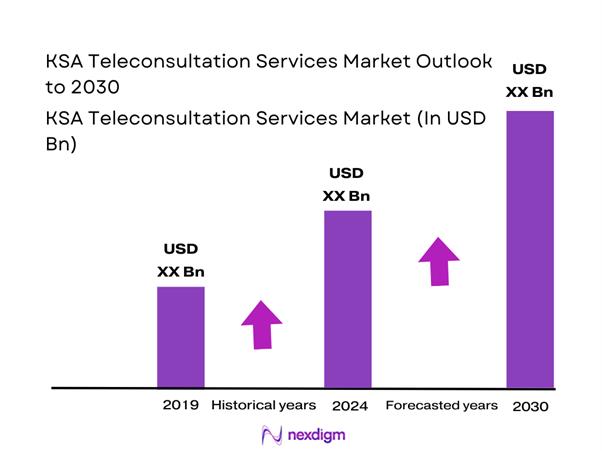

The KSA teleconsultation services market, as part of the broader telehealth/telemedicine ecosystem, is valued at USD ~ million, reflecting steady expansion from healthcare digitalization trends in preceding years. This growth is driven by strong government initiatives under Vision ~ to modernize healthcare delivery, improve access to care in remote areas, and tackle rising chronic disease burdens via virtual care solutions. Investments in digital infrastructure (e.g., nationwide broadband, ~ rollout) and private sector adoption further accelerate teleconsultation uptake.

Major urban centers like Riyadh, Jeddah, and Dammam dominate the teleconsultation landscape due to their advanced healthcare infrastructure, concentrated patient populations, and presence of digital health clusters. Riyadh’s role as the administrative and healthcare hub attracts digital care investments, whereas Jeddah’s position as a commercial center fuels private provider activity. Dammam’s proximity to Eastern Province industries expands employer-sponsored telehealth offerings. These cities also benefit from robust network connectivity and higher digital literacy, facilitating broader adoption of teleconsultation solutions.

Market Segmentation

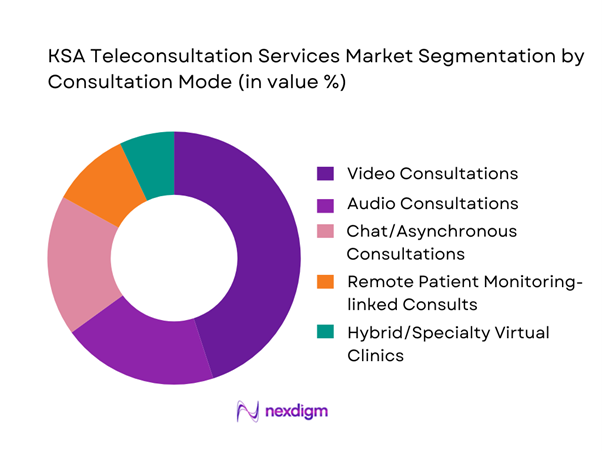

By Consultation Mode

The market’s video consultations segment holds the leading share, reflecting patients’ preference for face-to-face interaction when seeking diagnoses and treatment plans. In a healthcare environment that values clinical clarity, video platforms replicate in-person nuances (visual assessments, non-verbal cues), which enhances diagnostic confidence for providers and comfort for patients. Furthermore, government and payer-backed initiatives have prioritized tele-video platforms with robust security and clinical governance, boosting adoption. Audio consults still play an important role, particularly for follow-ups and elderly users due to simplicity, bilingual accessibility, and lower bandwidth needs in peripheral regions.

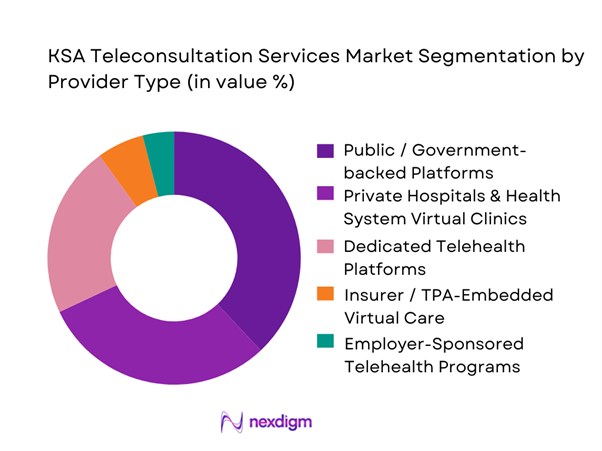

By Provider Type

Government-backed platforms (e.g., Sehhaty, Mawid, Seha Virtual Hospital) lead due to strategic policy deployment and broad population coverage across regions. These platforms are integrated with national health records and leverage scale operationally, which improves access and continuity of care — especially in rural or underserved areas. Public platforms are also fully compliant with national telehealth regulations, facilitating adoption among healthcare providers. Private hospitals and health systems maintain significant share by embedding teleconsultation into broader care pathways, especially for follow-up and chronic care. Dedicated commercial telehealth platforms supplement the market with flexible patient acquisition and multi-specialty offerings, while insurer-linked and employer programs expand employer-sponsored care coverage as digital benefits.

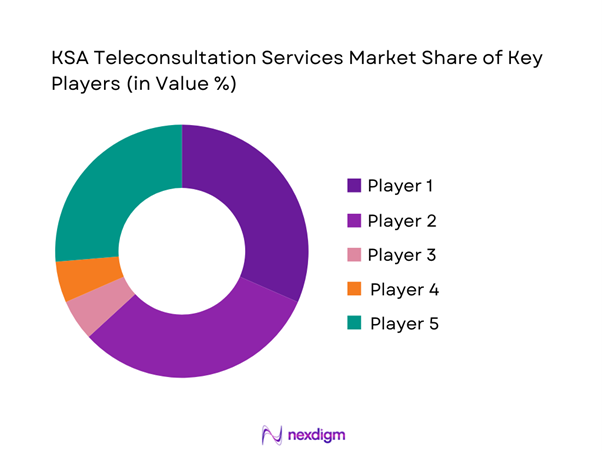

Competitive Landscape

The KSA teleconsultation services market exhibits a competitive mix of public, private, regional, and international digital health providers. A consolidation trend is emerging as major healthcare systems integrate teleconsultation into outpatient operations, while digital-first platforms focus on usability, AI-driven engagement, and insurance connectivity to differentiate offerings.

| Company | Est. Year | Headquarters | Platform Type | Specialty Focus | Integrated EHR | Health System Partners | Claims-ready |

| Seha Virtual Hospital | 2022 | Riyadh, KSA | ~ | ~ | ~ | ~ | ~ |

| Sehhaty (MoH) | 2019 | Riyadh, KSA | ~ | ~ | ~ | ~ | ~ |

| Mawid (MoH) | 2017 | Riyadh, KSA | ~ | ~ | ~ | ~ | ~ |

| Altibbi | 2014 | Amman, Jordan | ~ | ~ | ~ | ~ | ~ |

| Okadoc | 2018 | Dubai, UAE | ~ | ~ | ~ | ~ | ~ |

KSA Teleconsultation Services Market Analysis

Growth Drivers

Virtual hospital scale-up

Saudi Arabia’s teleconsultation supply-side capacity is being structurally expanded through national virtual-hospital infrastructure that pushes specialist reach beyond tertiary hubs. The Ministry of Health’s Seha Virtual Hospital is built as a telemedicine backbone that supports ~ hospitals, delivers ~ basic specialty services plus ~ sub-specialty services, and is staffed by more than ~ doctors, with stated capacity for more than ~ patients annually—a scale that directly expands the available “virtual appointment slots” across regions and reduces the dependency on physical specialist clinics in Riyadh/Jeddah/Dammam. On the demand side, the Kingdom’s macro backdrop enables sustained health-system modernization: Saudi Arabia’s GDP at USD ~ million and GDP per capita at USD ~ support continued public-sector capability-building and provider digitization.

Digital front door expansion

Teleconsultation adoption rises sharply when patients enter care through a unified “digital front door” rather than navigating fragmented appointment booking, call centers, or walk-ins. Saudi Arabia’s macro-digital readiness is unusually supportive: Individuals using the Internet are at ~, and population at ~, implying that national-scale digital entry points can reach a very large addressable base with minimal “connectivity exclusion.” In parallel, MOH has positioned unified platforms (e.g., Sehhaty) as the gateway to digital services—helping normalize identity-linked access to care pathways that include virtual visits, appointment scheduling, and integrated service journeys. This matters because teleconsultation conversion is heavily influenced by friction points at login/verification, appointment discovery, language selection, and continuity of records; a single entry experience reduces abandonment and increases repeat utilization. For providers and payers, a stronger digital front door also improves routing: low-acuity issues can be triaged to virtual consults first, while red-flag conditions can be directed to ED/urgent care, improving system efficiency.

Challenges

Clinical appropriateness limits

Teleconsultation cannot fully replace in-person care because certain conditions require physical examination, procedures, imaging, or immediate escalation, creating an appropriateness boundary that limits virtual substitution. This boundary matters more in systems with high outpatient load: MOH hospitals record ~ outpatient clinic encounters, indicating that a large portion of care still flows through physical OPD pathways where hands-on assessment, vitals, or diagnostics are routine. Even when teleconsultation is used, it often becomes a “front-end filter” rather than final care closure—leading to two-step journeys (virtual then in-person), which can frustrate users if triage rules are unclear or if referral pathways are slow. Saudi Arabia’s national virtual infrastructure is designed to handle many specialties, but the existence of broad specialty coverage does not eliminate appropriateness constraints—rather, it requires governance protocols, red-flag triggers, and escalation workflows to avoid safety risks. Macro indicators contextualize the scale of the challenge: population ~ implies large absolute numbers of cases where virtual care is clinically unsuitable, and GDP USD ~ million supports high expectations for quality and safety. For providers, clinical appropriateness limits translate into operational burdens: maintaining hybrid capacity, building reliable referral loops, and ensuring documentation continuity between virtual consults and subsequent facility visits.

Identity and consent friction

Identity verification and informed consent are operationally non-negotiable in teleconsultation, but they can create measurable drop-off—especially when users must complete multi-step authentication, link records, or navigate privacy prompts in a second language. This friction becomes more consequential at national scale: population is ~, and broad connectivity suggests the constraint is less “access” and more “conversion” (successful completion of onboarding and consult initiation). Public platforms help standardize these flows, but private providers still face duplication: different apps, different KYC requirements, and different consent screens. On the provider side, consent must be captured, stored, and auditable, increasing administrative time per consult and reducing clinician productivity. In addition, identity friction is amplified in cross-facility continuity-of-care: when teleconsultation occurs outside a patient’s primary provider network, linking history and medications requires stronger identity and record matching.

Opportunities

Payer-led virtual primary care

A major near-term growth opportunity is payer-led virtual primary care that routes low-acuity demand into teleconsultation as a first contact, reducing avoidable OPD load while improving continuity and cost control for insurers and employers. The scale case is supported by current system volumes: MOH hospitals alone report ~ outpatient clinic encounters, demonstrating how much appointment demand exists even before including private clinics. Payers can use virtual primary care to manage this flow by building standardized pathways for common conditions with clear escalation protocols and referral booking. Macro indicators show the market can support such models: Saudi Arabia’s GDP is USD ~ million, and population is ~, enabling large risk pools and the operational scale required to run extended-hours virtual primary care networks. Connectivity is also supportive, allowing payers to deploy a single digital entry point for members across regions. The commercial opportunity is therefore structural: payer-led virtual primary care increases teleconsultation utilization by embedding it into coverage design, improving patient confidence, and providing predictable clinical workflows for providers, which supports repeat utilization and enterprise contracting momentum.

Enterprise virtual clinics for hospital groups

Hospital groups and health clusters can expand teleconsultation volumes materially by institutionalizing enterprise virtual clinics rather than treating teleconsultation as an “add-on.” The national blueprint already exists: MOH’s Seha Virtual Hospital supports ~ hospitals, offers ~ basic specialties and ~ sub-specialties, and employs ~ doctors, demonstrating how multi-facility virtual coverage can be operationalized at scale. Enterprise virtual clinics can leverage this playbook inside private hospital groups and large provider networks, focusing on high-frequency follow-ups that reduce physical OPD congestion. The immediate scaling logic is supported by current outpatient volumes: MOH hospitals show ~ outpatient clinic encounters, indicating the magnitude of demand that enterprise virtual clinics can absorb when patients are given a “virtual-first follow-up” option. Macro indicators further support enterprise investment capacity: Saudi GDP USD ~ million and GDP per capita USD ~ underpin continued modernization budgets and patient demand for convenience. This opportunity reflects future growth without using future stats: current system scale, existing virtual-hospital infrastructure, and high outpatient load create a practical runway for provider-led teleconsultation to become a standardized capacity layer across hospital groups.

Future Outlook

Over the next few years, the KSA teleconsultation services market is poised for robust growth driven by sustained government investment in healthcare digitization, expansion of national health infrastructure, and rising patient preference for convenient care delivery channels. Digital-first paradigms such as AI-enabled triage, remote monitoring, and virtual chronic care programs will further enhance service breadth. Moreover, partnerships between tech providers, health systems, and insurers are expected to expand teleconsultation’s role as a standard care access point beyond episodic virtual visits.

Major Players in the Market

- Seha Virtual Hospital

- Sehhaty

- Mawid

- Altibbi

- Okadoc

- 937 Medical Call Center

- Vezeeta

- Cura

- Doctor Una

- Telemedico

- Meddy

- Healthigo

- Careem Health

- Tibbiyah

Key Target Audience

- Potential purchasers of this report include:

- Healthcare Providers & Hospital Systems

- Insurers & Third-Party Administrators

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies

- Digital Health & Telemedicine Technology Vendors

- Employer Health Benefits Managers

- Pharmacy & Laboratory Networks

- Teleconsultation Infrastructure Providers

Research Methodology

Step 1: Identification of Key Variables

Initial research involved defining the KSA teleconsultation services landscape, stakeholder mapping, and service taxonomy through desk review of secondary sources including government publications, industry reports, and verified databases. This step established key demand drivers, service segments, and regulatory context.

Step 2: Market Analysis and Construction

Historical revenue data, segment performance, and adoption trends were compiled from credible market studies. Teleconsultation services were analyzed within the broader telehealth framework using bottom-up revenue builds from service volumes and ARPC indicators, cross-validated against published telehealth/telemedicine market estimates.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses regarding growth drivers, platform adoption, and segmentation patterns were refined through expert consultations with healthcare executives, digital health platform leaders, and clinicians. These engagements provided nuanced insights into operational drivers, payer dynamics, and regional adoption barriers.

Step 4: Research Synthesis and Final Output

The final step integrated all quantitative and qualitative inputs into a validated market model, ensuring consistency with forecast drivers, competitive benchmarks, and strategic outlook. Data cross-checks ensured alignment with credible secondary sources and triangulated expert inputs.

- Executive Summary

- Research Methodology (Market definitions & assumptions, abbreviations, inclusions/exclusions for teleconsultation, service taxonomy mapping, primary interview plan (providers, payers, platforms, regulators), secondary-source triangulation, bottom-up build (consult volumes × specialty mix × ARPC), top-down build (health spend × ambulatory mix × digital channel share), cross-validation using platform utilization proxies, scenario design, sensitivity analysis, limitations & data gaps)

- Definition and Scope

- Market Genesis and Evolution

- Telehealth Service Taxonomy

- Teleconsultation Care Pathways

- Service Delivery Models

- Growth Drivers

Virtual hospital scale-up

Digital front door expansion

Outpatient throughput pressure

Clinician productivity constraints

Travel-time substitution - Challenges

Clinical appropriateness limits

Identity and consent friction

Integration fragmentation

Data privacy and compliance load

Reimbursement variability

Clinician adoption barriers - Opportunities

Payer-led virtual primary care

Enterprise virtual clinics for hospital groups

Women’s health pathways

Behavioral health access expansion

Multilingual expat-focused services

Teleconsult-to-home diagnostics bundles - Trends

AI-assisted symptom intake

Asynchronous triage expansion

Telepharmacy integration

Remote vitals handoff

Specialty virtual clinics

Digital therapeutics adjacencies - Regulatory & Policy Landscape

- SWOT Analysis

- Stakeholder & Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competitive Intensity & Ecosystem Mapping

- By Value, 2019–2024

- By Volume (consultations), 2019–2024

- By Average Revenue per Consultation, 2019–2024

- By Public vs Private Contribution, 2019–2024

- By Platform-led vs Provider-led Contribution, 2019–2024

- By Technology Architecture (in Value %)

Video Consultation

Audio Consultation

Text / Chat Consultation

Store-and-Forward (asynchronous)

Hybrid Consultation Models - By End-Use Industry (in Value %)

Hospital and Health System Virtual Clinics

Clinic Chains and Polyclinics

Telehealth Platforms and Marketplaces

Payer and TPA-Embedded Teleconsultation

Employer and Corporate Health Programs - By Application (in Value %)

General Practice / Family Medicine

Pediatrics

Dermatology

Psychiatry / Behavioral Health

Women’s Health / OB-GYN - By Connectivity Type (in Value %)

Primary Care and First Contact

Specialist Access

Chronic Disease Follow-up

Post-Procedure and Post-Discharge Follow-up

Second Opinion and Care Navigation - By Fleet Type (in Value %)

Government-Funded Pathways

Private Insurance Covered

Self-Pay

Subscription / Membership Models

Employer Contracted Access - By Region (in Value %)

Central Region

Western Region

Eastern Region

Northern Region

Southern Region

- Market Share Snapshot of Major Players

Competitive Benchmarking Framework - Cross Comparison Parameters (specialty coverage breadth and active clinician pool, licensed facility linkage and privileging model, integration depth across EHR, HIE, eRx and claims, consultation SLA performance, clinical quality and audit mechanisms, payer network inclusion and claims readiness, patient engagement and retention mechanics, data residency and consent workflow robustness)

- SWOT Analysis of Major Players

- Pricing and Packaging Benchmarking

- Strategic Moves and Partnerships

- Detailed Profiles of Major Companies

Seha Virtual Hospital

Sehhaty

Mawid

937 Medical Call Center

Altibbi

Cura

Vezeeta

Okadoc

Nahdi Digital Health

Dr. Sulaiman Al Habib Medical Group

Saudi German Health

Mouwasat Medical Services

Fakeeh Care Group

Dallah Health

Teladoc Health

- Patient journey

- Provider procurement logic

- Payer coverage logic

- Employer buying criteria

- Channel preference

- Retention levers

- By Value, 2025–2030

- By Volume (consultations), 2025–2030

- By Average Revenue per Consultation, 2025–2030

- By Public vs Private Contribution, 2025–2030

- By Platform-led vs Provider-led Contribution, 2025–2030