Market Overview

The KSA Telehealth Platforms market is valued at USD ~ billion, represents a significant segment of the regional healthcare industry. The market’s demand is driven by the increasing need for accessible healthcare services, especially in remote areas, and the growing integration of technology in medical practices. Telehealth platforms provide an effective solution for reducing healthcare costs, improving patient outcomes, and ensuring continuous care for individuals with chronic conditions or requiring specialized attention. The market is positioned as a cornerstone in the transformation of the healthcare system, focusing on greater efficiency and patient-centered care.

The KSA market is largely dominated by major urban centers such as Riyadh, Jeddah, and Dammam, where advanced healthcare infrastructure and high internet penetration rates make telehealth solutions most viable. These cities also act as hubs for technology development and adoption, attracting investments from both global and regional players. Key international markets, including the US and Europe, influence supply chains, especially in the domains of telemedicine, AI integration, and wearable technologies. These countries lead in platform innovations, setting trends that impact telehealth advancements in KSA.

Market Segmentation

By Component

Software platforms dominate the telehealth market in KSA, accounting for the largest share due to the increasing demand for scalable and accessible healthcare solutions. These platforms allow healthcare providers to offer teleconsultations, remote diagnostics, and follow-up care through video calls, integrated with Electronic Health Records (EHR) and other healthcare systems. Companies such as Vezeeta and Mawid are driving this segment forward with their advanced telemedicine software solutions. As patients seek quicker, more efficient healthcare services, these platforms are becoming a staple for health systems across the kingdom.

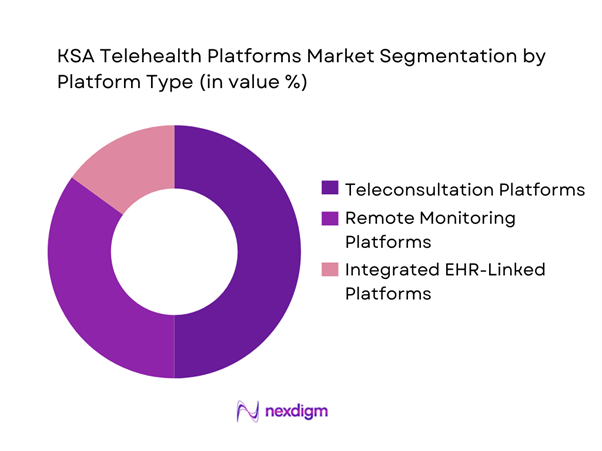

By Platform Type

Teleconsultation platforms lead the market in terms of adoption due to their wide applicability in urgent care, routine consultations, and accessibility in remote areas. This segment is driven by the widespread use of smartphones and increased internet penetration. The convenience of virtual healthcare consultations is encouraging both healthcare providers and patients to adopt these platforms. Companies like Okadoc and Mawid provide seamless teleconsultation services across KSA, playing a crucial role in the market’s growth.

Competitive Landscape

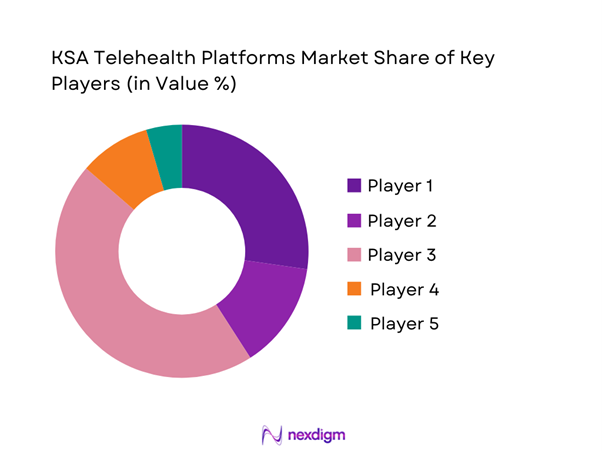

The KSA Telehealth Platforms market is dominated by a few major players, including Medcare and global or regional brands like Aster DM Healthcare, Saudi Telemedicine Company, Seha, and Al-Dawaa Pharmacies. This consolidation highlights the significant influence of these key companies.

| Company | Establishment Year | Headquarters | Platform Type | Active Users (2024) | Revenue Model | Technologies Used |

| Vezeeta | 2012 | Cairo, Egypt | ~ | ~ | ~ | ~ |

| Mawid | 2016 | Riyadh, Saudi Arabia | ~ | ~ | ~ | ~ |

| Altibbi | 2011 | Amman, Jordan | ~ | ~ | ~ | ~ |

| Okadoc | 2018 | Dubai, UAE | ~ | ~ | ~ | ~ |

| Careem Health | 2018 | Dubai, UAE | ~ | ~ | ~ | ~ |

KSA Telehealth Platforms Market Analysis

Growth Drivers

Government Support for Digital Health

The Saudi Arabian government plays a crucial role in the growth of telehealth by strategically investing in digital healthcare infrastructure. Initiatives such as Saudi Vision 2030 focus on modernizing the healthcare system and promoting telemedicine as a means of delivering accessible care across the country. Policies and funding have been directed toward increasing the availability of telehealth platforms, especially in rural and underserved areas. This government support ensures that digital health solutions become more accessible, helping bridge the gap between healthcare providers and patients in remote locations. As a result, telehealth adoption continues to rise.

Increasing Healthcare Infrastructure Investments

Substantial investments in healthcare infrastructure are critical to the growth of telehealth in Saudi Arabia. The modernization of hospitals, clinics, and telemedicine platforms plays a vital role in expanding telehealth service delivery, particularly in underserved and rural areas. These investments ensure that healthcare facilities are well-equipped to adopt telemedicine solutions, facilitating the seamless delivery of remote healthcare services. This expansion of infrastructure not only boosts telehealth adoption but also ensures the long-term sustainability and scalability of these solutions. By improving both physical and digital healthcare infrastructures, Saudi Arabia is positioning itself as a leader in healthcare innovation.

Challenges

Regulatory and Policy Barriers

While the telehealth market in Saudi Arabia continues to grow, regulatory and policy barriers pose significant challenges to its rapid expansion. Uncertainties related to the regulation of telemedicine platforms, such as those governing cross-border healthcare provision and licensing requirements, hinder market progress. These regulatory complexities, especially in terms of legal frameworks for telemedicine services and data sharing, create an environment of uncertainty for service providers. Addressing these issues through clear policies and regulatory guidelines will be essential for overcoming barriers and fostering greater market growth. A unified approach to regulation will help create a stable foundation for telehealth.

Data Privacy and Security Concerns

Data privacy and security concerns are major challenges for the adoption of telehealth in Saudi Arabia. As telehealth services expand, the amount of sensitive health data being shared electronically increases, raising concerns over unauthorized access and data breaches. Patients and healthcare providers alike worry about the safety of their personal and medical information, particularly when using telemedicine platforms. Ensuring the implementation of robust cybersecurity protocols and secure data management systems is essential to building trust in these platforms. Regulatory standards for data protection and secure technology adoption will help mitigate risks and improve telehealth service acceptance.

Opportunities

Expansion in Rural Healthcare

A key opportunity in the KSA telehealth market lies in expanding healthcare access to rural and remote regions. Telehealth solutions are particularly beneficial in areas with limited access to healthcare professionals and facilities. Government policies that prioritize healthcare accessibility are encouraging the growth of telemedicine services in these regions. By enabling remote consultations, diagnostics, and follow-up care, telehealth helps bridge the healthcare gap in underserved areas. As infrastructure investments increase and telemedicine becomes more widespread, rural healthcare will experience substantial improvements in care delivery, leading to better health outcomes across the country.

Integration of AI in Telehealth Solutions

The integration of artificial intelligence (AI) in telehealth platforms presents a promising opportunity for the KSA healthcare market. AI can significantly enhance the quality of care by improving diagnostic accuracy, automating administrative tasks, and personalizing patient care. AI-powered solutions, such as virtual assistants and predictive analytics, can help optimize healthcare workflows and provide more efficient patient management. As AI technology advances, it will play a central role in transforming telehealth services, making them more intelligent and responsive. The growing adoption of AI in telehealth will not only enhance patient experiences but also lead to more accurate and timely medical interventions.

Future Outlook

The KSA telehealth market is poised for continued growth, driven by technological advancements, regulatory support, and shifting consumer expectations for more flexible and accessible healthcare options. By 2030, telehealth platforms are expected to play a central role in the healthcare system, complementing traditional in-person services and improving healthcare delivery across the country.

Major Players

- Medcare

- Aster DM Healthcare

- Saudi Telemedicine Company

- Seha

- Al-Dawaa Pharmacies

- Daman Healthcare

- CareTech Solutions

- Novo Health

- Virtual Clinic

- Tawuniya

- Al Rajhi Hospital

- Health Insights

- Advanced Care

- Watani Health

- MyClinic

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies (country-specific)

- Healthcare providers

- Insurance companies

- Medical device manufacturers

- Technology solution providers

- Healthcare professionals

- End-consumers

Research Methodology

Step 1: Identification of Key Variables

Identification of relevant market factors, such as technological advancements, regulatory environment, and healthcare needs.

Step 2: Market Analysis and Construction

Comprehensive analysis of the telehealth platforms, focusing on current trends, key players, and service types.

Step 3: Hypothesis Validation and Expert Consultation

Engaging with experts in the healthcare and technology sectors to validate assumptions and gather insights.

Step 4: Research Synthesis and Final Output

Synthesis of data collected to present a comprehensive analysis of the KSA telehealth market.

- Executive Summary

- Research Methodology (Market Definitions and Inclusions/Exclusions, Abbreviations, Topic-Specific Taxonomy, Market Sizing Framework, Revenue Attribution Logic Across Use Cases or Care Settings, Primary Interview Program Design, Data Triangulation and Validation, Limitations and Data Gaps)

- Definition and Scope

- Market Genesis and Evolution

- Telehealth Usage / Value-Chain / Care-Continuum Mapping

- Business Cycle and Demand Seasonality

- KSA Industry / Service / Delivery Architecture

- Growth Drivers

Government Support for Digital Health

Increasing Healthcare Infrastructure Investments

Rising Prevalence of Chronic Diseases

Technological Advancements in Telehealth

Consumer Demand for Convenient Healthcare - Challenges

Regulatory and Policy Barriers

Data Privacy and Security Concerns

Adoption Barriers Among Older Populations

Limited Access to High-Speed Internet in Remote Areas

High Initial Investment Costs - Opportunities

Expansion in Rural Healthcare

Integration of AI in Telehealth Solutions

Partnerships Between Healthcare Providers and Tech Firms

Increased Investment in Telemedicine Startups

Globalization of Telehealth Services - Regulatory & Policy Landscape

- SWOT Analysis

- Stakeholder & Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competitive Intensity & Ecosystem Mapping

- By Component, 2019–2024

- By Platform Type, 2019–2024

- By Service Category, 2019–2024

- By End User, 2019–2024

- By Service Type (in Value %)

Telemedicine

Remote Patient Monitoring

Mental Health

Telepharmacy

Home Health Services - By Care Type (in Value %)

Primary Care

Specialized Care

Emergency Services

Chronic Disease Management

Rehabilitation Services - By Technology Type (in Value %)

Mobile Apps

Web-based Platforms

AI-Powered Platforms

Integrated Health Systems

Wearable Devices - By Delivery Type (in Value %)

Cloud-based

On-premise

Hybrid - By End-Use Industry / Customer Type (in Value %)

Healthcare Providers

Insurance Providers

Government & Regulatory Bodies

Private Corporations

End-Consumers - By Region (in Value %)

Central Region

Western Region

Eastern Region

Southern Region

- Competition ecosystem overview

- Cross Comparison Parameters (Technology adoption, platform scalability, customer service, pricing, regulatory compliance, market reach, innovation, funding)

- SWOT analysis of major players

- Pricing and commercial model benchmarking

- Detailed Profiles of Major Companies

Medcare

Aster DM Healthcare

Saudi Telemedicine Company

Seha

Al-Dawaa Pharmacies

Daman Healthcare

CareTech Solutions

Novo Health

Virtual Clinic

Tawuniya

Al Rajhi Hospital

Health Insights

Advanced Care

Watani Health

MyClinic

- Buyer personas and decision-making units

- Procurement and contracting workflows

- KPIs used for evaluation

- Pain points and adoption barriers

- By Component, 2025–2030

- By Platform Type, 2025–2030

- By Service Category, 2025–2030

- By End User, 2025–2030