Market Overview

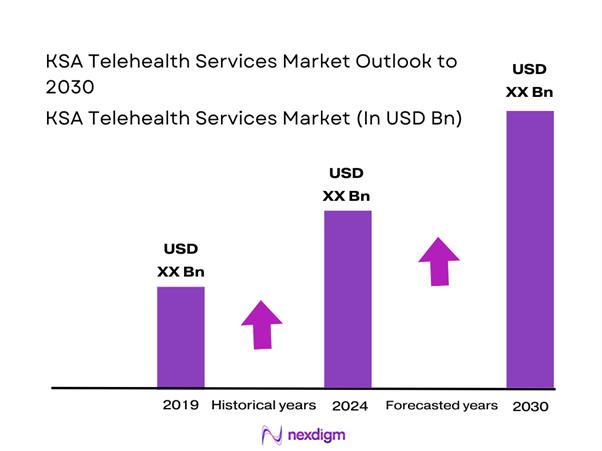

The KSA Telehealth Services Market is valued at USD ~ million, supported by the scale-up of virtual care delivery across public hospitals, payer-led care navigation, and private-sector platform adoption. The comparable 2023 benchmark for Saudi Arabia telemedicine revenue is USD ~ million, indicating a rapid broadening of reimbursable remote-care use cases beyond episodic consultations into remote monitoring, specialty tele-consultation, and digitally enabled referrals. National platforms and virtual-hospital architecture have shifted telehealth from “optional access” to a system capacity lever that reduces inter-city referrals and improves specialist reach.

Riyadh anchors the market because it concentrates national digital-health program governance, tertiary/specialty hospitals, and large-scale virtual-hospital coordination, making it the primary node for specialist supply and pathway design. Jeddah–Makkah benefits from high patient throughput, private hospital density, and pharmacy-led primary care access models that accelerate e-prescription and follow-up tele-consult flows. The Eastern Province (Dammam/Khobar) strengthens enterprise demand due to employer healthcare purchasing and insured populations tied to industrial clusters, supporting virtual primary care, mental health, and chronic-care programs delivered via platforms integrated into provider scheduling stacks.

Market Segmentation

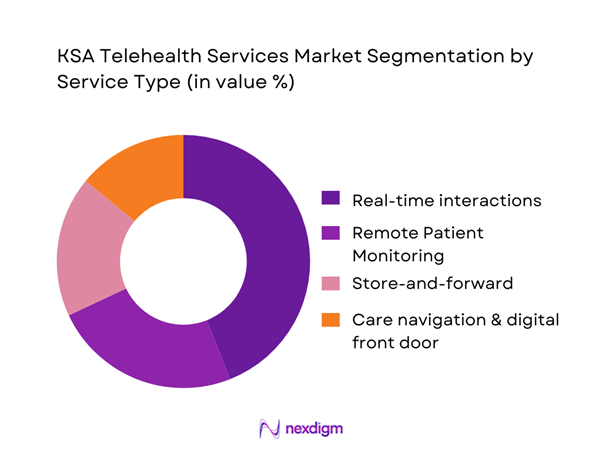

By Service Type

KSA Telehealth Services Market is segmented into real-time interactions, remote patient monitoring, store-and-forward services, and care navigation/digital front door solutions. Recently, real-time interactions hold the dominant position because they map cleanly onto how Saudi patients already access care—quick clinician access, prescription-enabled follow-ups, and convenient specialist consultations without travel. The public sector’s national platforms and virtual-hospital network make video consults a default pathway for many non-emergency needs, while also enabling clinician-to-clinician specialist support. At scale, the “instant consult + e-prescription + referral” loop is easier to operationalize than device logistics for RPM, and it converts faster into reimbursable encounters than async modalities. High user adoption on unified apps further reinforces real-time consult volumes as the first-line telehealth interaction.

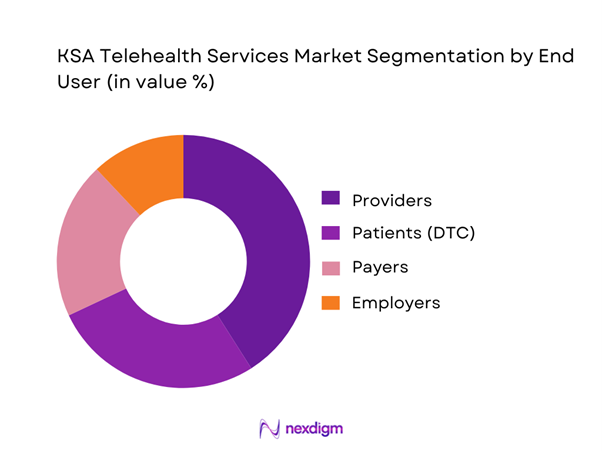

By End User

KSA Telehealth Services Market is segmented into providers, patients (DTC), payers, and employers. Providers dominate because Saudi telehealth is structurally anchored in health-system delivery—virtual outpatient services, specialty tele-consultation, tele-ICU/tele-stroke support, and referral optimization. The national virtual-hospital model amplifies provider procurement by connecting large numbers of hospitals into one specialist backbone and standardizing service lines, clinical governance, and coverage workflows. Provider dominance is reinforced by operational imperatives: reducing avoidable travel, accelerating diagnosis, and smoothing capacity constraints in specialties. Meanwhile, payers and employers increasingly contract for navigation and chronic-care programs, but they still rely on provider networks for clinical delivery and credentialed capacity. Patient-led spend grows via apps and pharmacy ecosystems, yet provider-side budgets remain the primary engine for scaling multi-specialty telehealth across regions.

Competitive Landscape

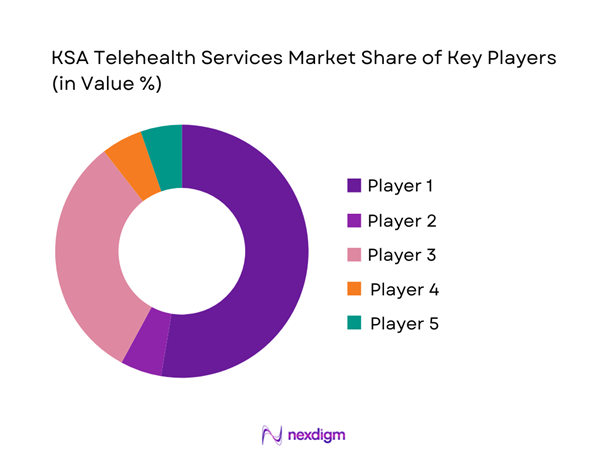

The KSA Telehealth Services Market features a public-sector “platform backbone” (virtual hospitals + national apps) alongside Saudi and regional private platforms and global virtual-care vendors embedded via enterprise partnerships. The result is a hybrid competitive structure: public entities shape national access and standards, while private players compete on specialty breadth, rapid fulfilment, Arabic-first UX, payer contracting, and integration into provider scheduling, eRx, and care pathways.

| Company | Est. Year | HQ | Core Model | Primary Modalities | Specialty Depth Signal | Integration Capability | KSA Operating Footprint | Primary Buyer |

| SEHA Virtual Hospital (MOH) | 2022 | Riyadh, KSA | ~ | ~ | ~ | ~ | ~ | ~ |

| Sehhaty (MOH) | 2019 | Riyadh, KSA | ~ | ~ | ~ | ~ | ~ | ~ |

| Cura (Cura Healthcare) | 2016 | Riyadh, KSA | ~ | ~ | ~ | ~ | ~ | ~ |

| Nahdi Medical Company (digital health channels) | 1986 | Jeddah, KSA | ~ | ~ | ~ | ~ | ~ | ~ |

| Teladoc Health | 2002 | Purchase, NY, USA | ~ | ~ | ~ | ~ | ~ | ~ |

KSA Telehealth Services Market Analysis

Growth Drivers

National virtual hospital expansion

Saudi Arabia has anchored specialist telehealth delivery around the Seha Virtual Hospital model, which connects ~ hospitals and provides ~ specialized services across ~ sub-specialties, creating a national “hub-and-spoke” referral and second-opinion engine that can be activated without moving patients between cities. This scale matters in a country with a mid-year population of ~ people, where centralization of tertiary expertise is a structural reality and virtual pathways reduce time-to-specialist decisions without adding physical bed pressure. The same national buildout is supported by state spending capacity: the Health and Social Development sector allocation is SAR ~ billion in the fiscal budget statement, enabling expansion of clinical networks, command-center operations, and supporting digital infrastructure within government provider systems. In parallel, the national provider base that can “plug into” virtual care is large: the Kingdom has ~ hospitals, with ~ hospitals in Riyadh Region alone, which increases the number of connected endpoints that can refer into virtual specialty models and sustain demand for tele-consult capacity.

Public sector digital health investments

Telehealth adoption in Saudi Arabia is being pulled by public financing and national digital-health platforms, not just private demand. On the fiscal side, the government’s budget statement shows SAR ~ billion allocated to the Health and Social Development sector, covering health care delivery, emergency services, legislation, research, and human resources—exactly the categories that fund public telehealth scale-up. On the demand-enablement side, the country’s digital readiness is unusually high: internet penetration reached ~, enabling teleconsults to work reliably across urban and many non-urban settings, and reducing friction in app-based scheduling, e-prescriptions, and follow-ups. The macro base that sustains public investment is also strong: the mid-year population is ~, and the central government can spread fixed platform costs across a large user base while improving access metrics nationally. Finally, telehealth is reinforced by payer-digitization infrastructure that is closely linked to public policy: the national exchange platform reports ~ total annual transactions in the latest annual volume table, illustrating how eligibility, authorizations, and claims rails are being digitized at national scale—telehealth providers benefit because coverage checks and pre-authorization workflows become “API-like” instead of paper-driven.

Challenges

Clinical appropriateness limitations

A core constraint in KSA telehealth is that not all encounters are clinically appropriate for virtual-only management—particularly first-time assessments that require full physical exam, certain acute presentations, and cases needing immediate diagnostics or procedures. This becomes more operationally visible in a system with ~ hospitals and significant tertiary concentration (e.g., ~ hospitals in Riyadh Region), because many complex cases still require escalation into facility-based pathways even if the first contact is virtual. The national virtual hospital model can optimize consult decisions, but it cannot eliminate in-person dependency for interventions; therefore, the limiting factor becomes how efficiently telehealth can triage into the right physical pathway without generating duplicate visits. Macro scale compounds this: ~ people means large absolute volumes of acute and chronic care—if virtual triage is overly conservative, it can increase downstream referrals and add pressure to already busy outpatient clinics.

High connectivity (internet penetration ~) expands access, but also increases the risk of over-utilization for conditions that ultimately need in-person evaluation, requiring strong clinical protocols and digital triage governance.

Physician adoption and workflow resistance

Even with national investment, clinician adoption is constrained when telehealth adds steps to daily workflows—duplicate documentation, parallel scheduling systems, or unclear rules on what can be resolved virtually. The provider environment is large and heterogeneous: ~ doctors work across ~ hospitals, and workflow standardization across this footprint is hard, especially when different hospital groups run different HIS/EHR stacks. While national platforms and the Seha Virtual Hospital network connect ~ hospitals, real adoption depends on local clinical operations: staffing models, clinic templates, triage protocols, and training for virtual bedside manner and escalation rules. The macro context matters because workforce time is scarce relative to population scale (~ people); if telehealth is perceived as “extra work” rather than substitution, clinicians may resist or restrict usage, limiting the market’s service throughput. Policy-driven digitization can reduce friction (e.g., standardized insurance exchange rails with ~ annual transactions), but that benefit is realized only when provider systems integrate and clinicians trust that eligibility/authorization checks won’t interrupt care flow.

Opportunities

Hospital-at-home program expansion

The opportunity is to move more eligible post-acute and chronic pathways into home-based care models supported by virtual physician coverage, remote monitoring, and pharmacy coordination—without relying on future projections to justify demand. The system has the building blocks now: a national virtual specialist backbone connecting ~ hospitals and offering ~ sub-specialties, enabling escalation to specialists while the patient remains at home under monitored protocols. Provider capacity constraints also make substitution attractive: ~ hospitals serve a population of ~, so freeing beds and reducing avoidable readmissions becomes operationally valuable even at current volumes. Financing and policy headroom exists through public spending: the Health and Social Development sector allocation of SAR ~ billion supports investment in home-care teams, device logistics, command centers, and interoperability work needed for hospital-at-home to scale responsibly. High connectivity (internet penetration ~) supports reliable patient monitoring touchpoints, caregiver training videos, and rapid escalation video calls—making hospital-at-home more feasible at national scale.

Employer-sponsored virtual care models

Employer-sponsored telehealth can scale faster in KSA because it bundles access into workforce benefits, aligns to absenteeism reduction, and channels demand into curated provider networks. The country’s workforce benefits ecosystem is already becoming more digitally “claimable” through national payer infrastructure: the national exchange platform reports ~ annual transactions, indicating large-scale digitization of eligibility checks, authorizations, and claims processing—an enabling layer for employer plans that want low-friction virtual consult reimbursement. On the supply side, there are ~ doctors and ~ pharmacists in the national workforce base, enabling multi-modal models (teleconsult + eRx + counseling) that employers can contract as integrated services. Macro fundamentals support large addressable employee bases (population ~), while high connectivity (internet penetration ~) enables consistent utilization across office, industrial, and distributed workforces. Finally, compliance is a design requirement: PDPL enforceability from ~ pushes employers and providers toward stronger governance, which can differentiate enterprise-grade telehealth platforms in procurement (data controls, auditability, localized hosting decisions).

Future Outlook

Over the next few years, the KSA Telehealth Services Market is expected to expand as virtual hospitals deepen specialty coverage, providers standardize hybrid pathways, and payers shift more care navigation into digital-first models. The market’s growth will be shaped by how fast RPM logistics mature (device provisioning, monitoring protocols, escalation SLAs) and how consistently platforms integrate with scheduling, e-prescription, lab ordering, and referral management. Public-sector scale initiatives will continue to set service standards, while private platforms compete on speed, specialty access, and enterprise-grade governance.

Major Players

- SEHA Virtual Hospital

- Sehhaty

- Cura

- Nahdi Medical Company

- Okadoc

- Altibbi

- Teladoc Health

- American Well

- Philips

- GE HealthCare

- Siemens Healthineers

- Oracle Health

- Medtronic

- Evernorth

Key Target Audience

- Hospital groups and integrated provider networks

- Specialty centers

- Health insurers and payers

- Employers and corporate health benefit buyers

- Digital health platform investors and strategic acquirers

- Investments and venture capitalist firms

- Government and regulatory bodies

- Pharmacy chains and clinic operators

Research Methodology

Step 1: Identification of Key Variables

We develop a KSA telehealth ecosystem map covering public platforms, private telehealth providers, payers, employers, pharmacies, and hospital groups. Desk research consolidates program scope, care pathways, and platform capabilities, and defines variables such as encounter types, escalation rules, and integration depth.

Step 2: Market Analysis and Construction

We compile historical and current indicators of virtual-care activity and monetization, including service-mix construction (real-time vs RPM vs async), enterprise contracting patterns, and provider procurement. We triangulate platform adoption signals with market revenue benchmarks from recognized market trackers.

Step 3: Hypothesis Validation and Expert Consultation

We validate hypotheses through structured interviews with hospital administrators, virtual-care program owners, payer product heads, and telehealth operators. Interview protocols focus on care pathways, utilization bottlenecks, clinical governance, and integration constraints affecting scale.

Step 4: Research Synthesis and Final Output

We synthesize findings into segment-level sizing logic, competitive positioning, and future adoption scenarios. Outputs are cross-checked against public program scope and leading market-revenue benchmarks to ensure internal consistency, defensible assumptions, and buyer-ready insights.

- Executive Summary

- Research Methodology (Market Definitions & Inclusions/Exclusions, KSA Terminology & Care Pathway Mapping, Assumptions & Data Normalization Rules, Market Sizing Approach, Demand-Side Modeling, Supply-Side Capacity Modeling, Primary Interviews (Provider, Payer, Regulator, Platform), Triangulation Framework, Quality Checks & Bias Controls, Limitations & Sensitivity Notes)

- Definition and Scope

- Market Genesis and Evolution

- Telehealth Care Continuum Mapping

- Institutional Landscape and Operating Model

- KSA Digital Health Infrastructure Context

- Growth Drivers

National virtual hospital expansion

Public sector digital health investments

Specialist access optimization

Urban congestion and travel reduction

Chronic disease management demand - Challenges

Clinical appropriateness limitations

Physician adoption and workflow resistance

Data privacy and hosting constraints

Interoperability gaps with legacy HIS

Patient engagement and continuity risks - Opportunities

Hospital-at-home program expansion

Employer-sponsored virtual care models

Tele-specialty and MDT expansion

Remote region access enablement

Outcome-based contracting models - Trends

Shift toward hybrid care pathways

Tele-specialty dominance growth

Integration with digital pharmacies and labs

AI-assisted triage adoption

Experience-led platform differentiation - Regulatory & Policy Landscape

- SWOT Analysis

- Stakeholder & Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competitive Intensity & Ecosystem Mapping

- By Value, 2019–2024

- By Consultation and Encounter Volume, 2019–2024

- By Utilization Mix, 2019–2024

- By Average Realized Fee per Encounter, 2019–2024

- By Channel Mix, 2019–2024

- By Fleet Type (in Value %)

Public telehealth platforms

Independent telehealth platforms

Provider-owned virtual clinics

Pharmacy-led telehealth services

Enterprise telehealth programs - By Application (in Value %)

Virtual urgent care

Scheduled outpatient virtual visits

Post-discharge follow-ups

Hospital-at-home enablement

Virtual specialty referrals - By Technology Architecture (in Value %)

Standalone telehealth platforms

EHR-integrated virtual care systems

Virtual hospital orchestration platforms

Hybrid in-person and virtual care stacks

AI-assisted clinical decision support systems - By Connectivity Type (in Value %)

Video-based consultations

Voice-based consultations

Chat-based consultations

Asynchronous e-consults

Multi-channel hybrid interactions - By End-Use Industry (in Value %)

Public hospitals

Private hospitals and clinics

Insurance companies and TPAs

Employers and corporate healthcare buyers

Direct-to-consumer patients - By Region (in Value %)

Riyadh Province

Makkah Province

Eastern Province

Madinah Province

Other regions including Asir and Jazan

- Market Share Framework

- Cross Comparison Parameters (clinical coverage breadth, virtual hospital integration readiness, insurance workflow readiness, EHR interoperability depth, clinical governance maturity, cybersecurity and PDPL posture, patient experience performance, unit economics levers)

- SWOT Analysis of Major Players

- Contracting and Pricing Model Benchmarking

- Detailed Profiles of Major Companies

Seha Virtual Hospital

Mawid

Saudi Telemedicine Network

Altibbi

Vezeeta

Okadoc

Cura

Medisense

Shifa

Teladoc Health

Amwell

Nahdi Medical Company

GE Healthcare Saudi Arabia

Philips Healthcare Saudi Arabia

Siemens Healthineers Saudi Arabia

- Provider purchasing and adoption behavior

- Payer reimbursement and utilization controls

- Employer telehealth benefit design

- Consumer pricing sensitivity and trust factors

- By Value, 2025–2030

- By Consultation and Encounter Volume, 2025–2030

- By Utilization Mix, 2025–2030

- By Average Realized Fee per Encounter, 2025–2030

- By Channel Mix, 2025–2030