Market Overview

The KSA tele-monitoring services market is valued at USD ~ million in 2024, up from USD ~ million in 2023, based on Saudi tele-monitoring services datasets and the year-by-year chart published alongside it. Demand is being pulled by (i) large-scale virtual care scale-up across public providers and giga-projects, (ii) remote follow-up for chronic pathways (diabetes, cardiac, respiratory), and (iii) behavioral/mental health tele-monitoring (the largest application segment in 2024 per the same source).

Within the Kingdom, adoption is most concentrated in Riyadh (national referral hospitals, payer HQs, program governance, and command-center operating models), followed by Jeddah/Makkah corridor (high outpatient load, private provider density, and pilgrimage-linked capacity planning) and the Eastern Province (industrial workforce health, large employer ecosystems, and strong tertiary care footprint). Internationally, solution influence is strongest from U.S./EU medtech and telehealth stacks because KSA deployments often require mature device ecosystems, enterprise integrations, and clinical risk controls, while regional players win on Arabic-first engagement, local operations, and faster onboarding into provider workflows.

Market Segmentation

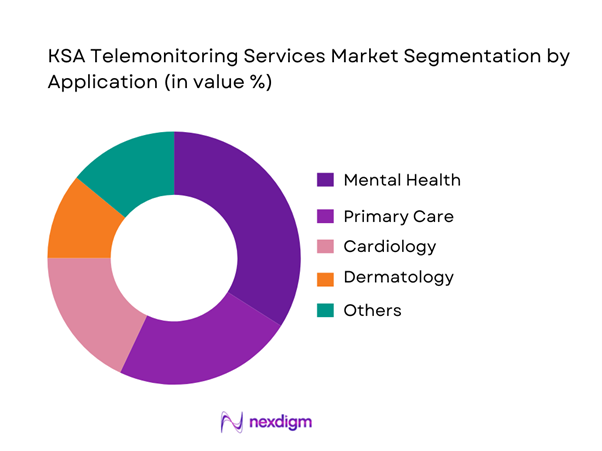

By Application

KSA tele-monitoring services are segmented by application into mental health, primary care, cardiology, dermatology, and others. Mental health is dominating because tele-monitoring programs can run at scale with lighter device dependency, strong longitudinal engagement (check-ins, symptom tracking, adherence nudges), and faster pathway standardization across provider networks. This also aligns with the segment leadership noted for 2024.

By Service Type

KSA tele-monitoring services are segmented by service type into remote patient monitoring (RPM), chronic disease management, post-operative monitoring, and care-coordination/virtual ward monitoring. Chronic disease management is dominating because programs can be embedded into high-volume chronic registries (diabetes, hypertension, heart failure), combining continuous or near-continuous monitoring with escalation protocols and clinician oversight. It is also the most operationally sticky service type: once integrated into care pathways, it drives recurring follow-up cycles, device logistics, and analytics-driven interventions across providers and payers.

Competitive Landscape

The KSA tele-monitoring services landscape is shaped by (i) provider-led virtual hospitals and health systems, (ii) telehealth platforms with local operations, and (iii) global medtech and device ecosystems supplying monitoring hardware, clinical dashboards, and integrations. Consolidation pressure comes from enterprise procurement, national-level digital health programs, and the need for end-to-end delivery (devices, logistics, clinical monitoring, interoperability, and governance).

| Company | Est. year | HQ | KSA operating model | Core tele-monitoring focus | Typical care settings | Device ecosystem | Interoperability surface | Data/clinical governance posture |

| Philips | 1891 | Netherlands | ~ | ~ | ~ | ~ | ~ | ~ |

| GE HealthCare | 1994 | USA | ~ | ~ | ~ | ~ | ~ | ~ |

| Medtronic | 1949 | Ireland (op. HQ in MN, USA) | ~ | ~ | ~ | ~ | ~ | ~ |

| Teladoc Health | 2002 | USA | ~ | ~ | ~ | ~ | ~ | ~ |

| Altibbi | 2011 | Jordan | ~ | ~ | ~ | ~ | ~ | ~ |

KSA Telemonitoring Services Market Analysis

Growth Drivers

Care access gaps and chronic disease burden

Saudi Arabia’s scale makes continuous remote monitoring economically attractive: the population is ~ and GDP is USD ~ trillion moving to USD ~ trillion, supporting large-system care redesign at national scale. Care demand is already high-velocity in core metros: Ministry of Health facilities recorded ~ outpatient clinic encounters and ~ service activity totals at flagship specialty centers. When routine follow-ups and long-tail chronic monitoring are moved to telemonitoring workflows, providers reduce avoidable in-person loads and expand coverage to dispersed populations—especially where specialist capacity is concentrated in Riyadh and Jeddah and high-throughput Ministry of Health hospitals. Telemonitoring also fits Saudi’s health before sickness reform logic, because it converts episodic care into continuous observation (vitals, symptoms, adherence) with earlier escalation triggers and fewer late presentations.

Hospital capacity optimization pressure

Saudi hospitals face throughput pressure visible in operating scale indicators: across all sectors, Saudi Arabia has ~ hospitals and ~ beds; the Ministry of Health network alone has ~ hospitals and ~ beds, with additional capacity in other government providers and the private sector. On the demand side, the Ministry of Health reports ~ outpatient clinic visits and primary care encounters such as ~ PHC visits in Riyadh region plus ~ outpatient visits at Ministry of Health hospitals in the same region—numbers that illustrate why systems look to virtualize monitoring and recovery. Telemonitoring reduces avoidable admissions, shortens inpatient length-of-stay by enabling earlier discharge with monitored vitals, and helps protect ICU beds by escalating only deteriorating patients rather than blanket observation. Macro capacity to invest also exists: Saudi Arabia’s GDP is reported at USD ~ trillion, enabling sustained funding of hospital transformation and digital operating models that reallocate scarce bed-days to higher acuity.

Challenges

Clinical workflow adoption resistance

Telemonitoring fails when it is add-on work rather than embedded into care pathways and staffing models. Ministry of Health activity volumes show why resistance appears quickly: Ministry of Health hospitals recorded ~ outpatient clinic encounters, and Riyadh region alone logged ~ combined PHC and outpatient encounters—environments where any additional clicks, dashboards, and escalation calls can be seen as throughput threats. At the same time, Saudi’s system scale (GDP USD ~ trillion; population ~) means providers run large multi-site networks where standardizing telemonitoring protocols across specialties, languages, and care settings is operationally heavy. Without explicit role design (remote monitoring nurses or command centers), escalation SLAs, and clinical ownership, clinicians may distrust alerts, ignore dashboards, or decline enrollment—especially for borderline patients where liability perception is high and outcomes attribution is unclear.

Alert fatigue and staffing constraints

Telemonitoring creates a signal pipeline that must be triaged, documented, and acted on—otherwise it becomes noise. Demand volumes are already high: Ministry of Health outpatient clinics recorded ~ encounters, and several regions each exceed ~ outpatient clinic visits. If even a fraction of these cohorts are enrolled, alert volumes can overwhelm nurses and on-call physicians unless risk stratification and automation are strong. Staffing constraints are also structural across large bed bases: Saudi Arabia has ~ beds across ~ hospitals, which implies significant continuous staffing needs independent of telemonitoring. The macro context—population ~—means the absolute number of chronic and post-acute patients is large, so telemonitoring programs must invest in command-center staffing, clinical escalation ladders, and alert tuning governance from day one.

Opportunities

Tele-ICU scaling across secondary and tertiary hospitals

Saudi’s hospital footprint—~ hospitals and ~ beds—creates a clear opportunity to centralize scarce critical-care expertise via tele-ICU models (hub command center supporting multiple spokes). Even without forecasting numbers, current utilization intensity supports the case: Ministry of Health hospitals alone recorded ~ outpatient encounters, and a sustained inpatient load sits behind that outpatient funnel; tele-ICU supports earlier intervention for deteriorating patients and standardizes protocols across multi-site networks. Connectivity is not the bottleneck: ~ mobile subscriptions and ~ Mbps median mobile internet speed help support high-reliability audio and video consults, remote device feeds, and escalation communication. With GDP above USD ~ trillion, the Kingdom has the macro capacity for command centers, redundancy, cybersecurity, and clinician training—key requirements for tele-ICU operating models that must run continuously.

Virtual ward and hospital-at-home programs

Virtual wards and hospital-at-home become economically compelling when systems can safely shift suitable patients out of beds while keeping clinical oversight. Saudi’s bed base (~ beds) and high outpatient activity (~ Ministry of Health outpatient encounters; multi-million PHC encounters in key regions) indicate strong demand for capacity relief and post-acute monitoring that prevents readmissions. National digital adoption supports the home-care interface: electronic payment transactions reached ~, reflecting consumer readiness for app-based services, authentication, and digital engagement that virtual-ward pathways depend on (consent, onboarding, reminders, escalation). On the infrastructure side, telecom readiness is validated by ~ mobile subscriptions and ~ Mbps median mobile internet speed. In practice, these conditions enable scaling programs that combine telemonitoring kits, scheduled nurse tele-rounds, and standardized deterioration pathways—using today’s operational data volumes as the justification without relying on market-size claims.

Future Outlook

Over the next five years, KSA tele-monitoring services are expected to expand with virtual hospital operating models, chronic disease scale programs, and AI-enabled escalation and triage embedded into provider workflows. Market expansion will be most visible in virtual wards, home health integration, and payer-backed chronic pathways, as the Kingdom continues to standardize digital care delivery across regions and provider tiers. Using the published KSA trajectory, the implied growth rate across the current decade is rapid, supported by rising acuity management needs and system-wide capacity optimization.

Major Players

- Philips

- GE HealthCare

- Medtronic

- Omron Healthcare

- Koninklijke Philips NV

- Teladoc Health

- AMD Telemedicine

- Twilio

- Nihon Kohden

- Telemedcare

- Altibbi

- Vezeeta

- Okadoc

- Oracle Health

Key Target Audience

- Hospital groups and health systems

- Payers and TPAs

- Home healthcare providers and post-acute networks

- Digital health platform operators and telehealth service aggregators

- Medical device OEMs and monitoring hardware suppliers

- Cloud, cybersecurity and interoperability vendors serving healthcare providers

- Investments and venture capitalist firms

- Government and regulatory bodies

Research Methodology

Step 1: Identification of Key Variables

We map the KSA tele-monitoring ecosystem across providers, payers, device OEMs, platform vendors, and regulators. Desk research is combined with structured taxonomy building (application, service type, care setting, payment model, device mix) to define the variables that most influence adoption, scale economics, and procurement outcomes.

Step 2: Market Analysis and Construction

We construct the market using published benchmarks and country-level datasets, then validate the operating model (command centers, virtual wards, home health logistics) through secondary evidence and provider program mapping. Historical signals are used to separate one-off pilots from scaled services and recurring monitoring programs.

Step 3: Hypothesis Validation and Expert Consultation

We validate hypotheses via expert interviews across hospital virtual care leaders, payer care management teams, device partners, and platform operators. Discussions focus on enrollment funnels, adherence, escalation protocols, device logistics, and integration complexity—linking operational drivers directly to revenue pools.

Step 4: Research Synthesis and Final Output

Findings are synthesized into segment-level opportunity sizing, competitive benchmarking, and buyer-ready recommendations. We triangulate provider and vendor inputs with published statistics, then finalize assumptions and sensitivity checks to ensure outputs are decision-usable for GTM, partnerships, and investment screening.

- Executive Summary

- Research Methodology (Market Definitions and Inclusions/Exclusions, Abbreviations, Telemonitoring Service Taxonomy, Market Sizing Framework, Revenue Attribution Logic Across Care Settings, Primary Interview Program Design, Data Triangulation and Validation, Limitations and Data Gaps)

- Definition and Scope

- Market Genesis and Evolution

- Telemonitoring Care Continuum Mapping

- Business Cycle and Demand Seasonality

- KSA Care Delivery Architecture

- Growth Drivers

Care access gaps and chronic disease burden

Hospital capacity optimization pressure

Government digital health initiatives

Telecom and IoT infrastructure readiness

Provider digital maturity improvement - Challenges

Clinical workflow adoption resistance

Alert fatigue and staffing constraints

Device adherence and patient compliance issues

System integration complexity

Data privacy and clinical liability concerns - Opportunities

Tele-ICU scaling across secondary and tertiary hospitals

Virtual ward and hospital-at-home programs

Payer-led chronic disease management models

Post-discharge bundled monitoring programs - Trends

Virtual command centers and centralized monitoring

AI-based alert triage and risk stratification

Multilingual patient engagement platforms

Hybrid nurse-led and physician-led monitoring models - Regulatory & Policy Landscape

- SWOT Analysis

- Stakeholder & Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competitive Intensity & Ecosystem Mapping

- By Value, 2019–2024

- Installed Base of Actively Monitored Patients, 2019–2024

- Service Revenue Mix, 2019–2024

- By Fleet Type (in Value %)

Continuous vital signs monitoring programs

Episodic remote patient monitoring programs

Tele-ICU and command center monitoring programs

Post-discharge and virtual ward programs

Chronic disease remote monitoring programs - By Application (in Value %)

Diabetes and metabolic monitoring

Cardiovascular and hypertension monitoring

Respiratory and sleep-related monitoring

Maternal and high-risk pregnancy monitoring

Renal and dialysis-adjacent monitoring - By Technology Architecture (in Value %)

Wearables and patch-based sensor platforms

Home medical device-based monitoring platforms

Implantable and cardiac rhythm monitoring ecosystems

Tele-ICU hardware and bedside integration platforms

AI-enabled remote monitoring analytics platforms - By Connectivity Type (in Value %)

Cellular-enabled monitoring systems

Wi-Fi and fixed broadband-enabled systems

Bluetooth to smartphone bridged systems

Gateway-based medical IoT systems - By End-Use Industry (in Value %)

Government hospitals and health clusters

Private hospital groups

Independent clinics and specialty centers

Home healthcare providers

Insurers, TPAs, and managed care programs

Corporate and occupational health programs - By Region (in Value %)

Central Region

Western Region

Eastern Region

Southern Region

Northern Region

- Competition ecosystem overview

- Cross Comparison Parameters (Integration depth with EMR and HIE, Tele-ICU command center capability, Chronic disease pathway library depth, Alert triage and AI maturity, Device logistics and field support coverage in KSA, Data residency and cybersecurity assurance, Multilingual patient engagement capability, Demonstrated clinical and financial ROI evidence)

- SWOT analysis of major players

- Pricing and commercial model benchmarking

- Detailed Profiles of Major Companies

Saudi Aramco Health Services

Dr. Sulaiman Al Habib Medical Group

Saudi German Health

Mouwasat Medical Services

Philips

GE HealthCare

Siemens Healthineers

Medtronic

Abbott

Boston Scientific

BIOTRONIK

Roche

Cerner Oracle Health

Altibbi

- Buyer personas and decision-making units

- Procurement and contracting workflows

- KPIs used for program evaluation

- Pain points and adoption barriers

- By Value, 2025–2030

- Installed Base of Actively Monitored Patients, 2025–2030

- Service Revenue Mix, 2025–2030