Market Overview

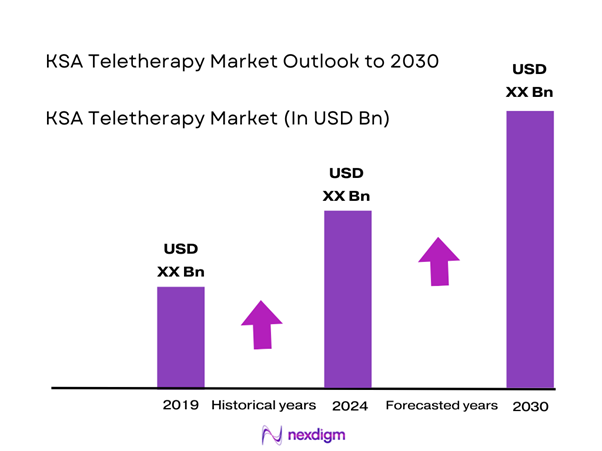

The KSA Teletherapy market is valued at USD ~ million, based on consolidated revenue generated from licensed digital therapy platforms, hospital-led virtual mental health programs, and independent therapist networks operating under the Ministry of Health telemedicine framework. This valuation reflects increased utilization driven by rising mental health service demand, a shortage of in-person psychiatric professionals, and large-scale digital health investments. Saudi Arabia records over ~ outpatient mental health consultations annually, while national healthcare expenditure exceeds USD ~ billion, creating sustained funding and adoption momentum for teletherapy services across public and private channels.

The KSA Teletherapy market is dominated by Riyadh, Jeddah, and Dammam, driven by higher therapist density, advanced hospital infrastructure, and strong digital adoption among urban populations. Riyadh hosts the largest concentration of licensed psychiatrists, digital health startups, and corporate wellness programs. Jeddah benefits from medical tourism spillover and private hospital networks, while Dammam’s dominance stems from employer-sponsored mental health programs linked to the industrial workforce. These cities also benefit from superior broadband penetration, higher smartphone usage, and centralized healthcare governance structures that accelerate platform onboarding.

Market Segmentation

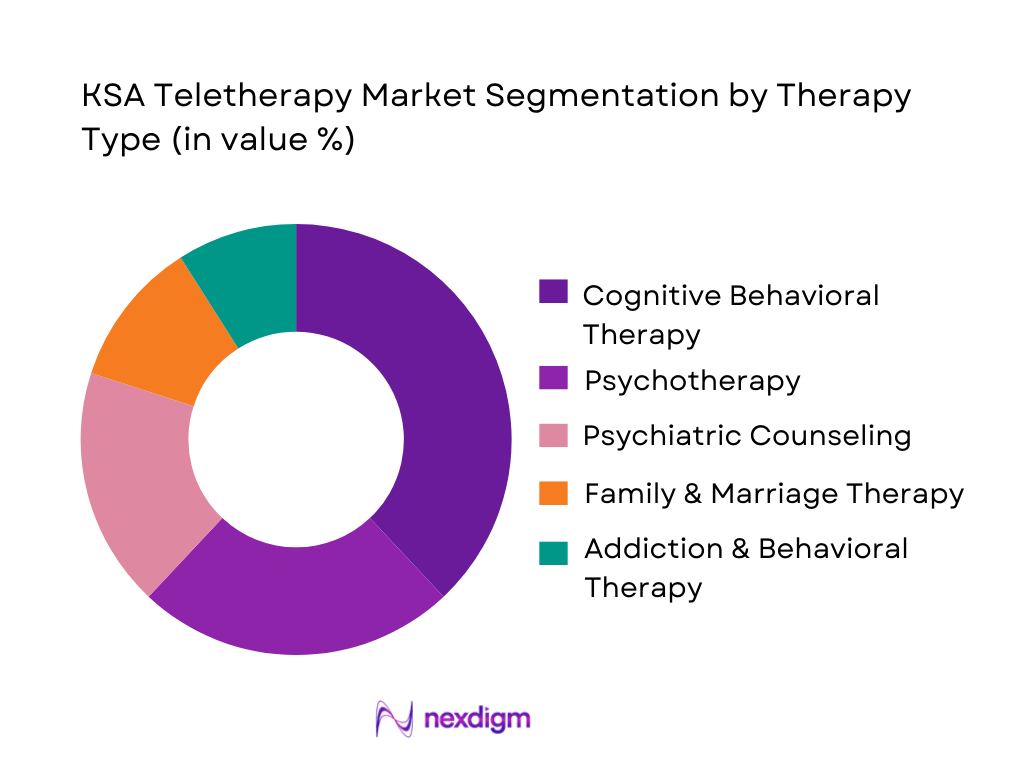

By Therapy Type

The KSA Teletherapy market is segmented by therapy type into cognitive behavioral therapy, psychotherapy, psychiatric counseling, family and marriage therapy, and addiction and behavioral therapy. Cognitive behavioral therapy (CBT) dominates the market under this segmentation due to its structured format, short treatment cycles, and high compatibility with digital delivery. CBT protocols are widely adopted for anxiety, stress, and depression—conditions that account for a large share of outpatient mental health cases in Saudi Arabia. The therapy’s evidence-based nature allows standardized session delivery, making it highly scalable for platforms serving large patient volumes. Additionally, CBT is commonly reimbursed under private insurance plans and employer-sponsored wellness programs, further strengthening its utilization across urban and corporate populations.

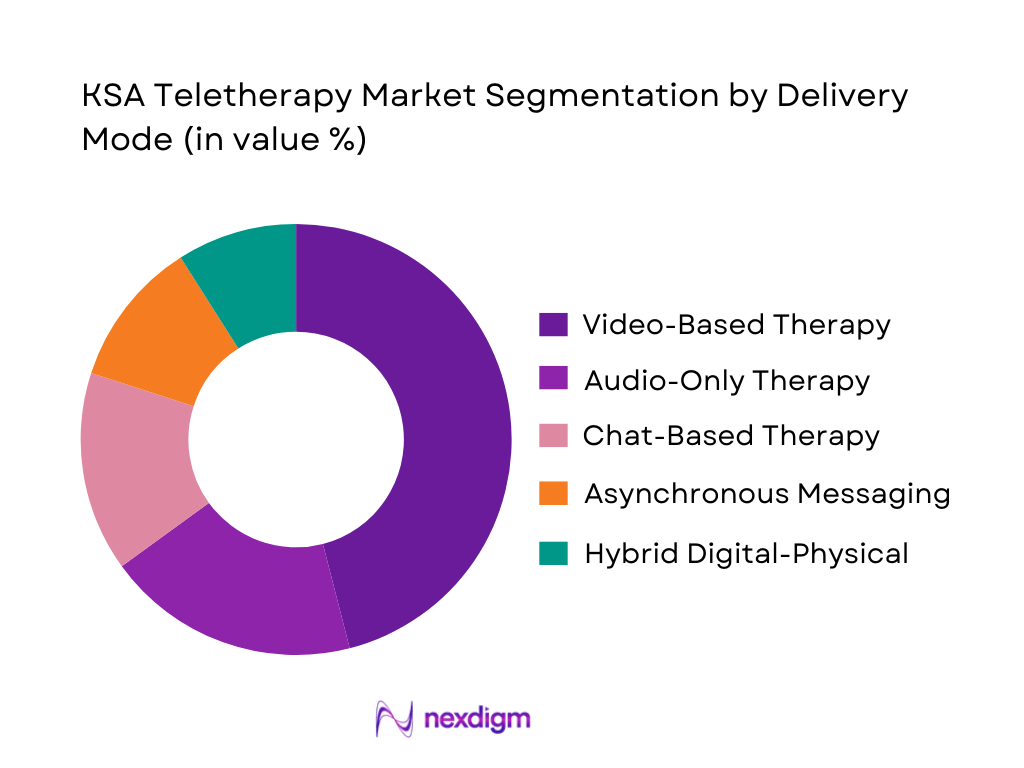

By Delivery Mode

The market is segmented into video-based therapy, audio-only therapy, chat-based therapy, asynchronous messaging, and hybrid digital-physical therapy. Video-based therapy holds the dominant share due to its clinical credibility and regulatory acceptance within Saudi healthcare guidelines. Video consultations closely replicate in-person therapy, allowing therapists to assess behavioral cues and maintain treatment quality. Hospitals and licensed platforms prioritize video sessions to meet clinical documentation and compliance requirements. Additionally, video therapy aligns well with insurer reimbursement frameworks and employer mental health programs, making it the preferred modality for both institutional buyers and individual patients seeking structured mental health care.

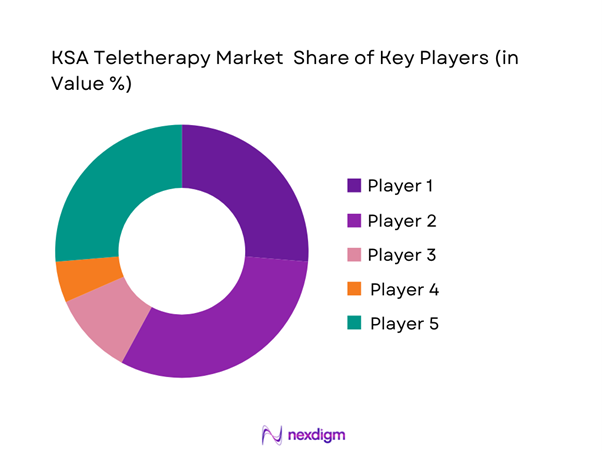

Competitive Landscape

The KSA Teletherapy market is moderately consolidated, with dominance shared between government-backed digital health platforms, hospital-led virtual care programs, and a limited number of regional telehealth providers. Entry barriers remain high due to therapist licensing requirements, data localization laws, and integration with national health systems. Players with Arabic-language capability, insurance partnerships, and regulatory compliance frameworks command stronger market positioning.

| Company | Est. Year | HQ | Service Scope | Therapist Network | Insurance Integration | Language Support | Clinical Governance | Data Hosting |

| Sehati | 2019 | Riyadh | ~ | ~ | ~ | ~ | ~ | ~ |

| Altibbi | 2011 | Amman | ~ | ~ | ~ | ~ | ~ | ~ |

| Cura | 2016 | Riyadh | ~ | ~ | ~ | ~ | ~ | ~ |

| Vezeeta | 2012 | Cairo | ~ | ~ | ~ | ~ | ~ | ~ |

| Okadoc | 2018 | Dubai | ~ | ~ | ~ | ~ | ~ | ~ |

KSA Teletherapy Market Analysis

Growth Drivers

Rising Mental Health Awareness

Saudi Arabia’s scale and macro fundamentals are creating sustained demand for structured, accessible mental-health care, which is increasingly being “channel-shifted” into virtual delivery. The Kingdom’s population is ~ and its economy is USD ~ in output, giving it the fiscal headroom to fund system-wide access programs while employers and households seek more convenient care pathways. In public financing, the Ministry of Health budget is SAR ~ billion and SAR ~ billion in the latest available government series, signaling continued prioritization of healthcare delivery capacity and pathways. On the service side, national virtual-care infrastructure is already being institutionalized: the Seha Virtual Hospital connects ~ hospitals, offers ~ core specialty services plus ~ sub-specialties, employs ~ physicians, and is designed for ~ patients of annual capacity—normalizing virtual clinical interactions in specialist domains that overlap with therapy. As virtual touchpoints become “default” for first contact and follow-ups, teletherapy benefits from lower friction to start care and from a system narrative that positions remote care as a mainstream access lever rather than a temporary workaround.

Workforce Stress Levels

Workforce-scale pressure is a structural tailwind for teletherapy in Saudi Arabia because it expands the addressable need while pushing organizations toward scalable, low-disruption care access models. The Kingdom’s labor force is ~, and the macro economy size is USD ~, indicating a large, diversified employment base where productivity protection becomes a board-level priority—especially in high-intensity sectors. Digital channels matter because they reduce time-cost for employees and the operational cost of HR-driven care pathways: the country’s telecom environment is already instrumented at “mass scale,” with ~ IoT/M2M subscriptions reported by the national regulator—an indicator of broad connectivity infrastructure that also supports distributed workforce models and app-based service delivery. Additionally, public digital health rails such as virtual hospital connectivity across ~ hospitals increase clinical comfort with remote pathways, enabling employer benefit managers to contract teletherapy offerings that can integrate into medically governed ecosystems when escalation is required. The result is a market where workplace-driven demand acts as a steady funnel for teletherapy platforms and provider networks without requiring brick-and-mortar mental health infrastructure expansion at the same pace as workforce growth.

Challenges

Cultural Acceptance Barriers

Teletherapy adoption in Saudi Arabia can be constrained by care-seeking patterns that favor privacy, family-mediated problem solving, and selective engagement with mental health services—creating friction at the first-session stage and increasing drop-off before therapeutic alliance is established. The scale backdrop matters: with ~ residents and a labor force of ~, even small differences in cultural comfort levels translate into large absolute pools of hesitant potential users—particularly outside the most urbanized and digitally habituated centers. Operationally, the market is trying to bridge this through institution-led virtual care normalization; the MOH’s Seha Virtual Hospital model—~ connected hospitals, ~ specialty services, ~ subspecialties—demonstrates national endorsement of remote clinical interactions and can reduce perceived stigma by reframing remote sessions as standard care access rather than a special mental-health-only channel. However, therapy is uniquely relationship-dependent, and patients may disengage if they fear confidentiality breaches or perceive talk therapy as unfamiliar compared to medical consultations. In addition, the relative scarcity of psychiatry capacity, with ~ psychiatry physicians reported in the private-sector specialty table, can indirectly amplify cultural barriers by reducing the chance that a hesitant user finds a suitable therapist quickly.

Therapist Licensing Restrictions

Teletherapy is more sensitive than many telehealth categories because buyers require tight assurance that therapists are appropriately credentialed, practicing within scope, and governed by clinical protocols. Telehealth practice is explicitly linked to credentialing within the Kingdom and set expectations for privileging, which increases compliance overhead for platforms assembling mixed networks. In a market with a population of ~, platforms often attempt to scale by using hybrid models, but licensing constraints can limit provider sourcing, narrow language supply, and slow onboarding of new clinicians. Capacity indicators show why this matters: the private-sector physician specialty table reports ~ psychiatry physicians, which is not a large pool relative to system scale and implies that any licensing friction can quickly translate into appointment scarcity. While national virtual infrastructure increases overall telemedicine legitimacy, teletherapy vendors still must operationalize credentialing checks, documentation, and audit trails to satisfy both healthcare governance and enterprise procurement.

Opportunities

Corporate Mental Wellness Programs

Corporate purchasing is one of the most scalable growth routes for teletherapy in KSA because it aggregates demand, reduces stigma via benefits framing, and supports predictable utilization through HR-led enablement. The macro base is large: the labor force is ~ and GDP is USD ~, which supports a sizeable employer landscape and structured benefits procurement. Digital readiness enables efficient program delivery, evidenced by ~ IoT/M2M subscriptions and national-level virtual care institutionalization via Seha Virtual Hospital with ~ hospitals, ~ core specialty services, and ~ subspecialties. This matters operationally because corporate programs typically require rapid access, scheduled sessions outside clinic hours, and pathway governance. Public health-sector investment also supports this route: MOH budgets of SAR ~ billion and SAR ~ billion underpin the broader system’s virtual-care rails and clinical governance culture, making it easier for employers to justify teletherapy as medically aligned rather than wellness-only. The key commercial opportunity is to package teletherapy into measurable, employer-friendly modules while maintaining strict privacy controls aligned with PDPL enforcement.

Youth Mental Health Demand

Youth and young adult cohorts create a durable demand base for teletherapy because they are digitally fluent, prefer private access channels, and are more likely to accept app-mediated care pathways. Saudi Arabia’s population scale of ~ combined with a digitally embedded ecosystem supported by ~ IoT/M2M subscriptions enables mobile-first therapy models that use chat and video sessions, structured CBT modules, and asynchronous check-ins. National virtual-care normalization also matters: Seha Virtual Hospital’s reach of ~ hospitals and breadth of ~ core services and ~ sub-specialties signals that remote consultations are institutionally accepted, reducing friction for youth and families to view remote mental-health support as legitimate healthcare access. On the supply side, scarcity cues remain, with only ~ psychiatry physicians reported in the private-sector specialty table, making teletherapy the fastest first-step for early intervention. Public funding strength supports ecosystem build-out, helping maintain digital front doors and referral infrastructure that youth pathways can utilize when escalation is needed.

Future Outlook

The KSA Teletherapy market is expected to expand steadily, supported by sustained government investment in digital health infrastructure and increasing normalization of mental health care. Employer-sponsored wellness programs, integration with national insurance platforms, and rising demand for Arabic-speaking therapists will accelerate market penetration. The shift toward hybrid care models combining digital therapy with hospital follow-ups is expected to improve patient retention and clinical outcomes. Regulatory clarity around telepsychiatry and data governance will further strengthen institutional adoption.

Major Players

- Sehati

- Cura

- Altibbi

- Vezeeta

- Okadoc

- Saudi German Health Telecare

- Mouwasat Virtual Care

- DrApp

- Tabibi

- Aafiya Telehealth

- MindTales Middle East

- NPHIES-integrated Providers

- BetterHelp

- Talkspace

Key Target Audience

- Private hospital groups and medical cities

- Digital health platform operators

- Insurance companies and third-party administrators

- Corporate HR and employee wellness program managers

- Investments and venture capital firms

- Mental healthcare service aggregators

- Pharmaceutical and life sciences companies

- Government and regulatory bodies

Research Methodology

Step 1: Identification of Key Variables

The research begins with ecosystem mapping covering digital platforms, hospitals, insurers, therapists, and regulators within the KSA Teletherapy Market. Secondary research is conducted using government publications, licensed healthcare databases, and proprietary industry trackers to identify critical operational and financial variables.

Step 2: Market Analysis and Construction

Historical utilization data, therapy session volumes, and platform revenues are analyzed to construct the market model. Supply-side indicators such as therapist availability and platform capacity are aligned with demand-side utilization trends to derive accurate revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market assumptions are validated through structured interviews with licensed therapists, hospital administrators, and telehealth platform executives. These discussions provide insight into pricing structures, session economics, and regulatory impact.

Step 4: Research Synthesis and Final Output

Primary findings are triangulated with bottom-up revenue modeling and verified through cross-referencing institutional data sources. This ensures a robust, compliant, and decision-ready analysis of the KSA Teletherapy market.

- Executive Summary

- Research Methodology (Market Definitions and Scope Boundaries, Clinical vs Non-Clinical Teletherapy Classification Logic, Saudi Mental Health Regulatory Mapping, Platform Revenue Attribution Logic, Service Utilization Tracking Framework, Demand-Side and Supply-Side Triangulation, Primary Interviews with Licensed Therapists and Hospital Administrators, Platform Benchmarking Framework, Limitations and Forward-Looking Assumptions)

- Definition and Scope

- Market Genesis and Evolution of Remote Mental Health Services

- Evolution of Teletherapy Under National Digital Health Programs

- Care Delivery Transition From In-Person to Hybrid Models

- Teletherapy Value Chain and Stakeholder Ecosystem

- Growth Drivers

Rising Mental Health Awareness

Workforce Stress Levels

Digital Health Adoption Rate

Therapist Shortage

Policy Support for Remote Care - Challenges

Cultural Acceptance Barriers

Therapist Licensing Restrictions

Data Privacy Compliance

Clinical Quality Assurance

Patient Retention Issues - Opportunities

Corporate Mental Wellness Programs

Youth Mental Health Demand

AI-Enabled Therapy Triage

Arabic-First Therapy Platforms

Rural Access Expansion - Trends

Shift Toward Hybrid Care Models

Increasing Demand for Arabic-Speaking Therapists

Integration With Wearables and Digital Diagnostics - Regulatory & Policy Landscape

- SWOT Analysis

- Stakeholder & Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competitive Intensity & Ecosystem Mapping

- By Value, 2019–2024

- By Session Volume, 2019–2024

- By Average Consultation Fee, 2019–2024

- By Fleet Type (in Value %)

Cognitive Behavioral Therapy

Psychotherapy

Psychiatric Counseling

Family & Marriage Therapy

Addiction & Behavioral Therapy - By Application (in Value %)

Video-Based Therapy

Audio-Only Therapy

Chat-Based Therapy

Asynchronous Messaging Therapy

Hybrid Digital-Physical Therapy - By Technology Architecture (in Value %)

Adults

Adolescents

Children

Geriatric Population

Corporate Employees - By Connectivity Type (in Value %)

Telehealth Platforms

Hospitals & Medical Cities

Independent Licensed Therapists

Corporate Wellness Providers

NGO-Affiliated Mental Health Providers - By End-Use Industry (in Value %)

Self-Pay

Insurance-Covered

Employer-Sponsored Programs

Government-Subsidized Programs

Subscription-Based Mental Health Plans - By Region (in Value %)

Central Region

Western Region

Eastern Region

Southern Region

Northern Region

- Market Share of Key Players by Revenue and Session Volume

- Cross Comparison Parameters (Platform Clinical Scope, Therapist Network Size, Saudi Licensing Compliance, Arabic Language Capability, Session Pricing Structure, Insurance Integration Depth, Data Security Architecture, Patient Retention Metrics)

- SWOT Analysis of Key Market Participants

- Pricing Analysis by Therapy Type and Delivery Mode

- Detailed Company Profiles

Sehati (Saudi MOH Platform)

NPHIES-Integrated Telehealth Providers

Cura

Altibbi

Vezeeta

Okadoc

MindTales Middle East

Aafiya Telehealth

Saudi German Health Telecare

Mouwasat Virtual Care

DrApp

Tabibi

BetterHelp

Talkspace

Independent Licensed Teletherapy Networks

- Demand Patterns and Utilization Behavior

- Payment Willingness and Budget Allocation

- Trust, Privacy, and Cultural Acceptance Analysis

- Unmet Needs and Patient Pain Points

- Therapy Selection and Decision-Making Journey

- By Value, 2025–2030

- By Session Volume, 2025–2030

- By Average Consultation Fee, 2025–2030