Market Overview

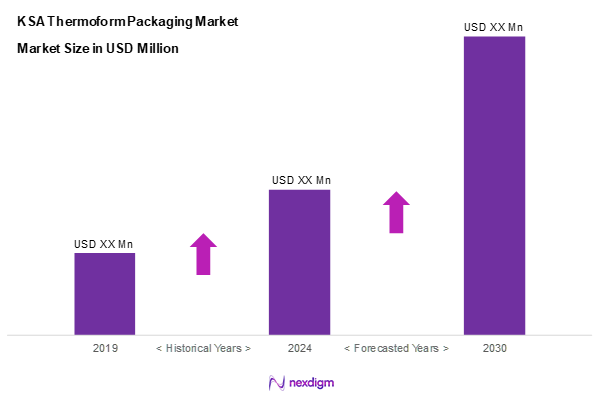

As of 2024, the KSA thermoform packaging market is valued at USD ~ million, with a growing CAGR of 5.7% from 2024 to 2030, reflecting a robust demand fuelled by an uptick in the food and beverage sector, as well as advancements in packaging technology. The boom in e-commerce and increased consumer preferences for sustainable and efficient packaging solutions further drive market expansion. The market is expected to continue thriving as consumer lifestyles adapt to modern needs for convenience and sustainability.

Saudi Arabia’s dominant cities, including Riyadh, Jeddah, and Dammam, are central to the thermoform packaging market due to their significant industrial activities and economic growth. These cities host a combination of food and beverage manufacturers, healthcare facilities, and retail sectors that enhance packaging requirements. Their strategic location, infrastructure development, and government initiatives providing support for local manufacturing contribute substantially to their dominance in the market.

Market Segmentation

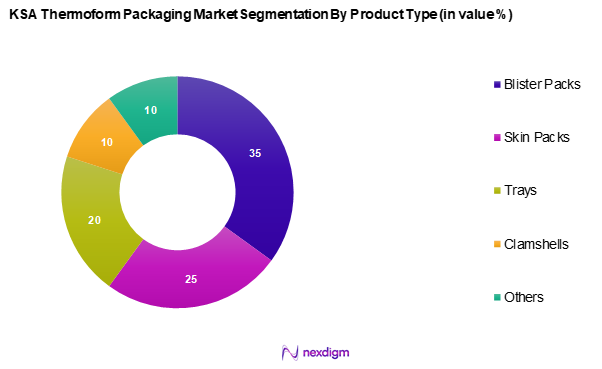

By Product Type

The KSA thermoform packaging market is segmented into blister packs, skin packs, trays, clamshells, and others. Blister packs currently hold a dominant market share, driven by their usage in pharmaceuticals and consumer goods. The appeal of blister packs lies in their ability to provide product visibility while ensuring containment and protection, making them a favoured choice among manufacturers seeking effective, user-friendly packaging solutions. Furthermore, the increasing demand for dosage-convenient packaging in pharmaceuticals continues to bolster the blister pack segment’s prominence.

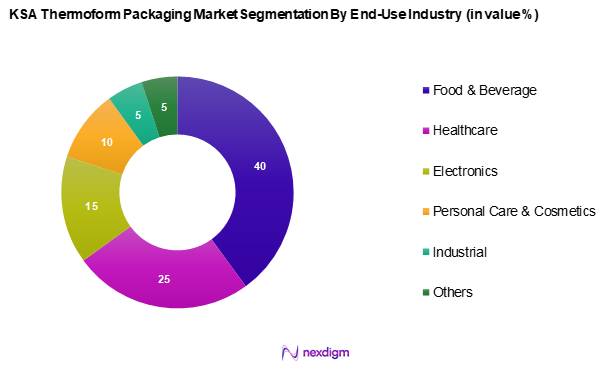

By End-Use Industry

The KSA thermoform packaging market is segmented into food & beverage, healthcare, electronics, personal care & cosmetics, industrial, and others. The food & beverage industry dominates this segment due to the growing demand for packaging solutions that enhance product shelf life and presentation. As consumer preferences shift towards fresh and packaged foods, food manufacturers increasingly adopt thermoform packaging for its efficiency and ability to maintain hygiene, leading to its dominant position in the market.

Competitive Landscape

The KSA thermoform packaging market is dominated by a few major players, including both local and international companies such as Amcor PLC, Berry Global Group Inc., and Sonoco Products. This concentration reflects the significant influence these key companies exert through their innovative product offerings and extensive distribution networks, solidifying their positions as market leaders.

| Company Name | Year Established | Headquarters | Market Share (%) | Product Focus | Annual Revenue

(USD Mn) |

Business Strategies |

| Amcor PLC | 1860 | Zürich, Switzerland | – | – | – | – |

| Berry Global Group Inc | 1967 | Indiana, USA | – | – | – | – |

| Sonoco Products | 1899 | Carolina, USA | – | – | – | – |

| Napco National | 1956 | Riyadh, Saudi Arabia | – | – | – | – |

| Interplast (Harwal Group) | 1981 | Dubai, UAE | – | – | – | – |

KSA Thermoform Packaging Market Analysis

Growth Drivers

Rising Demand in Food and Beverage Sector

The food and beverage sector in Saudi Arabia is projected to reach a staggering USD 63 billion by 2024, indicating a robust growth fuelled by the increasing population and changing consumer preferences towards convenient packaged products. The Kingdom’s Vision 2030 initiative is emphasizing food security and sustainability, mandating investments into local food production and processing capabilities. This heightened focus on domestic production creates an upward trend in demand for efficient and safe packaging solutions, particularly thermoform packaging, which is crucial for preserving the freshness and quality of food and beverages.

Shift Towards Sustainable Packaging

The global trend towards sustainability has significantly influenced Saudi Arabia, with increasing regulations aimed at reducing plastic waste. By 2024, around 40% of the packaging industry is expected to focus on sustainable materials and practices due to consumer demand for environmentally friendly options. Furthermore, the Kingdom’s government has launched various initiatives aimed at promoting green packaging, which includes the use of biodegradable materials in packaging solutions. This movement not only meets global sustainability trends but also aligns with Vision 2030’s goals for environmental conservation, encouraging businesses to innovate in sustainable thermoform packaging options.

Market Challenges

Regulatory Constraints

Regulatory constraints remain a significant challenge for the KSA thermoform packaging market, with strict laws on packaging materials to ensure food safety and environmental protections. The Saudi Food and Drug Authority enforces stringent regulations on material safety, which manufacturers must adhere to, increasing production costs and limiting raw material choices. As of 2024, non-compliance can result in fines reaching USD 300,000 for companies that fail to meet established standards. Navigating these regulations requires significant investment in processes and compliance measures, which may deter smaller manufacturers from effectively competing in the market.

Competition from Alternative Packaging

The ease of accessibility and growing popularity of alternative packaging solutions presents critical competition to thermoform packaging in the KSA. The rise of flexible packaging, such as pouches and stand-up bags, has gained traction, particularly among younger consumers seeking convenience. In 2024, flexible packaging is projected to represent approximately 25% of the overall packaging market in Saudi Arabia, driven by its lightweight nature and minimal storage space requirements. Consequently, thermoform packaging faces pressure as manufacturers evaluate cost-effectiveness and customer preferences, compelling them to adapt or risk obsolescence in a competitive market landscape.

Opportunities

E-commerce Growth

The rapid growth of e-commerce in Saudi Arabia is creating significant opportunities for the thermoform packaging market. With online retail sales projected to hit USD 15 billion in 2024, there is an increasing need for packaging solutions that not only safeguard products during transit but also enhance their presentation. Thermoform packaging is increasingly used in e-commerce for its protective qualities, making it an ideal choice for shipping food, electronics, and fragile items. The demand for aesthetically pleasing, secure packaging is expected to further drive market opportunities as retailers seek to elevate their customer experience through effective packaging solutions.

Emerging End-user Markets

Emerging end-user markets, particularly in personal care and health sectors, present substantial growth opportunities for the KSA thermoform packaging market. With spending on health and personal care products expected to increase to USD 14 billion by 2025, manufacturers are seeking innovative packaging solutions that ensure product integrity and compliance with regulatory standards. The increasing prevalence of health and wellness trends, coupled with a growing middle class keen on quality products, positions thermoform packaging as an effective solution for market players aiming to tap into these burgeoning sectors, driving future market growth.

Future Outlook

Over the next five years, the KSA thermoform packaging market is expected to show significant growth driven by shifts towards sustainable packaging solutions, increasing demand in the food and beverage sector, and the rising influence of e-commerce. The acceleration of health-conscious consumer behaviours will also be pivotal, further expanding market opportunities for innovative and efficient packaging designs that meet the stringent requirements for safety and quality in various industries.

Major Players

- Amcor PLC

- Berry Global Group Inc

- Sonoco Products

- Napco National

- Cristal Plastic Industrial LLC

- Interplast (Harwal Group)

- Nuplas Industries

- Arabian Plastics Industrial Company Limited (APICO)

- Hotpack Packaging Industries LLC

- Alpla Werke Alwin Lehner GmbH

- Alpek Polyester

- Nizza Plastic Company LTD.

- Taghleef Industries

- Others

Key Target Audience

- Manufacturers in the Food & Beverage Industry

- Healthcare Companies

- Electronics Companies

- Personal Care & Cosmetics Brands

- Government and Regulatory Bodies (Saudi Food and Drug Authority, Ministry of Environment, Water and Agriculture)

- Waste Management Companies

- Investments and Venture Capitalist Firms

- Packaging Industry Consultants

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the KSA thermoform packaging market. This step includes extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics, including consumer preferences, regulatory factors, and technological advancements.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data pertaining to the KSA thermoform packaging market. This includes assessing market penetration rates, market sizes, and the resultant revenue generation trends across different packaging types and end-use industries. Furthermore, an evaluation of service quality statistics will be conducted to ensure the reliability and accuracy of the revenue estimates which contribute to accurate forecasting.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through consultations with industry experts representing a diverse set of stakeholders. These consultations will provide operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating the market data obtained from prior research phases.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple thermoform packaging manufacturers and end-users to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction serves to verify and complement the statistics derived from bottom-up approaches, ensuring a comprehensive, accurate, and validated analysis of the KSA thermoform packaging market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Overview Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain and Value Chain Analysis

- Growth Drivers

Rising Demand in Food and Beverage Sector

Shift Towards Sustainable Packaging - Market Challenges

Regulatory Constraints

Competition from Alternative Packaging - Opportunities

E-commerce Growth

Emerging End-user Markets - Trends

Customization in Packaging Solutions

Growth of Eco-friendly Materials - Government Regulations

Plastic Waste Management Policies

Quality Standards for Packaging - SWOT Analysis

- Stake Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Product Type, (In Value %)

Blister Packs

Skin Packs

Trays

Clamshells

Others - By End-Use Industry, (In Value %)

Food & Beverage

Healthcare

Electronics

Personal Care & Cosmetics

Industrial

Others - By Material Type, (In Value %)

PET

PP

PVC

PS

PE

Others - By Thickness, (In Value %)

Thin Gauge

Thick Gauge - By Packaging Type, (In Value %)

Vacuum-Formed Packaging

Pressure-Formed Packaging

Mechanical-Formed Packaging - By Region, (In Value %)

Riyadh

Jeddah

Dammam

Khobar

Makkah

Others

- Market Share of Major Players by Value/Volume, 2024

Market Share of Major Players by Type of Product Segment, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strength, Weakness, Organizational Structure, Revenues, Revenues by Product Type, Supply Chain Efficiency, Market Reach, and Innovations)

- SWOT Analysis of Major Players

- Pricing Analysis Basis SKUs for Major Players

- Detailed Profiles of Major Companies

Amcor PLC

Berry Global Group Inc

Sonoco Products

Napco National

Interplast (Harwal Group)

Cristal Plastic Industrial LLC

Nuplas Industries

Arabian Plastics Industrial Company Limited (APICO)

Hotpack Packaging Industries LLC

Alpla Werke Alwin Lehner Gmbh

Alpek Polyester

Nizza Plastic Company LTD.

Taghleef Industries

Others

- Market Demand and Utilization

- Purchasing Power and Budget Allocations

- Regulatory and Compliance Requirements

- Needs, Desires, and Pain Point Analysis

- Decision-Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030