Market Overview

The KSA Tire Pressure Monitoring Systems (TPMS) market is valued at USD ~ million, the rise of consumer awareness regarding tire safety, and the development of more advanced TPMS technology. The market has experienced growth due to the expanding vehicle fleet in KSA, fueled by a robust automotive industry and government initiatives such as Vision 2030 that focus on road safety and infrastructure development. Demand for TPMS is expected to increase as both OEMs and aftermarket suppliers invest in tire safety solutions that enhance vehicle performance and passenger safety.

KSA’s central regions, particularly Riyadh and Jeddah, dominate the market due to high automotive sales and an expanding fleet of vehicles. These cities host the majority of automotive OEM production and distribution activities. In addition, Saudi Arabia’s government fleet, used for public transportation, logistics, and services, is a major adopter of TPMS. This is further supported by the country’s heavy investment in infrastructure under Vision 2030. Additionally, global countries like Germany and Japan influence the supply and technological innovations in TPMS, with key players such as Continental AG, Sensata Technologies, and Schrader Electronics bringing advanced systems into the KSA market.

Market Segmentation

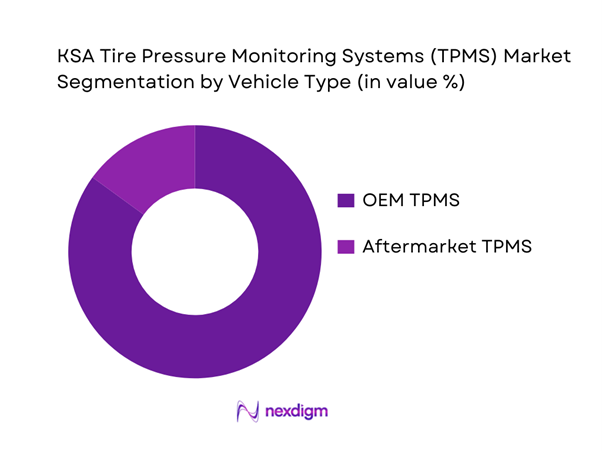

By Vehicle Type

The KSA TPMS market is primarily segmented into OEM TPMS and aftermarket TPMS. OEM TPMS dominates the market, particularly due to stringent safety regulations and the growing adoption of TPMS as a standard feature in new vehicles. The mandatory incorporation of TPMS in new cars, especially in premium segments, has made OEM solutions the dominant type. Moreover, OEM TPMS systems are more reliable, integrate seamlessly with other vehicle systems, and offer higher accuracy, making them the preferred choice for new car manufacturers.

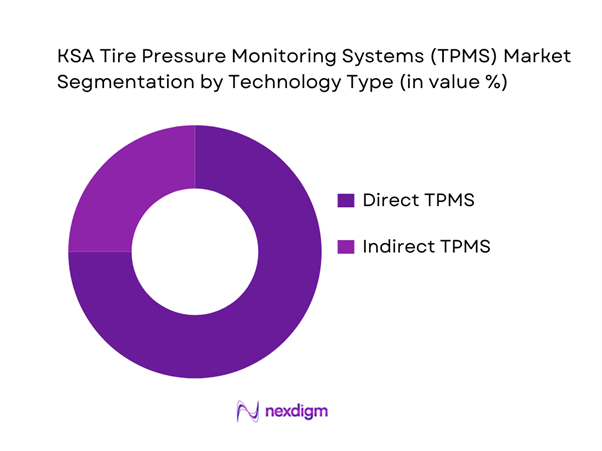

By Technology Type

In the KSA market, direct TPMS dominates the segment over indirect TPMS. The direct TPMS offers real-time tire pressure readings by using sensors inside each tire, making it more accurate and preferred by OEMs for its higher safety standards. This is especially true for passenger and commercial vehicles that require precise data to minimize risks such as tire blowouts and accidents. Direct TPMS is also increasingly favored by luxury vehicles, which are common in KSA’s automotive market.

Competitive Landscape

The KSA TPMS market is dominated by a few major players, including Sensata Technologies, Schrader Electronics, and global brands like Continental AG, Robert Bosch GmbH, and Hella KGaA Hueck & Co. This consolidation highlights the significant influence of these key companies. Their strong presence is supported by long-standing partnerships with automotive OEMs, widespread distribution networks, and substantial investments in R&D. These companies lead the market by offering both advanced direct and indirect TPMS solutions, with additional features like integration with telematics systems for enhanced fleet management.

| Company | Establishment Year | Headquarters | Technology Focus | OEM Partnerships | Distribution Network | R&D Investment | Product Portfolio |

| Sensata Technologies | 1906 | United States | ~ | ~ | ~ | ~ | ~ |

| Schrader Electronics | 1909 | United States | ~ | ~ | ~ | ~ | ~ |

| Continental AG | 1871 | Germany | ~ | ~ | ~ | ~ | ~ |

| Robert Bosch GmbH | 1886 | Germany | ~ | ~ | ~ | ~ | ~ |

| Hella KGaA Hueck & Co | 1899 | Germany | ~ | ~ | ~ | ~ | ~ |

KSA Tire Pressure Monitoring Systems (TPMS) Market Analysis

Growth Drivers

Increasing Vehicle Fleet

The growing vehicle fleet in KSA drives the demand for TPMS technology. With more cars, commercial vehicles, and two-wheelers on the road, the need for safety features, including tire monitoring systems, increases. As urbanization and population growth continue, the number of vehicles is expected to rise, making TPMS a crucial component for ensuring road safety. Vehicle owners and manufacturers are more focused on preventative measures to reduce tire-related accidents, leading to greater adoption of TPMS solutions. This growing vehicle population creates a consistent demand for both OEM and aftermarket TPMS systems across all vehicle types.

Rising Road Safety Regulations

The KSA government has implemented stricter road safety regulations, which include mandates for vehicle safety technologies like TPMS. These regulations aim to reduce road accidents, particularly those caused by tire blowouts or underinflated tires. With such safety mandates in place, vehicle manufacturers and owners are increasingly adopting TPMS solutions to comply with local laws and avoid penalties. As regulations evolve, the demand for reliable safety systems is expected to grow, further promoting the adoption of TPMS in both new vehicles and the aftermarket segment. This regulatory push serves as a strong growth driver for the TPMS market.

Challenges

High Initial Cost of Direct TPMS

The high upfront cost of direct TPMS remains a significant barrier to its widespread adoption in KSA. Direct TPMS systems require additional sensors and hardware, which increase the overall cost of the vehicle. This is particularly challenging for budget-conscious consumers and for markets where lower-cost vehicles dominate. The extra cost of fitting TPMS into both new and existing vehicles is seen as a deterrent, especially in the aftermarket segment where price sensitivity is higher. As a result, TPMS adoption is slowed, especially for older vehicle models that may not come with the technology installed.

Aftermarket Retrofitting Barriers

Aftermarket retrofitting of TPMS is challenging due to technical complexities and the associated costs. Retrofitting an existing vehicle with a TPMS system requires specialized knowledge, proper installation tools, and potentially expensive modifications. Many vehicles, especially older models, are not compatible with modern TPMS systems, which leads to higher installation costs. The lack of widespread availability of retrofit solutions and trained technicians further hampers the growth of TPMS in the aftermarket sector. This presents a challenge to expand TPMS adoption beyond vehicles already equipped with the technology, limiting its penetration in the overall market.

Opportunities

Adoption of Smart and IoT-Connected TPMS

The emergence of smart, IoT-connected TPMS offers a significant opportunity for growth in the KSA market. These advanced TPMS systems allow real-time tire monitoring and can be integrated with other vehicle systems and mobile apps for a more comprehensive user experience. With the increasing adoption of connected vehicles, the integration of IoT-based TPMS solutions provides enhanced safety, convenience, and predictive maintenance capabilities. This opens up new opportunities for both OEM and aftermarket sectors, as consumers seek advanced, technology-driven solutions to improve vehicle performance and safety, while offering potential for continuous innovation in the sector.

Emerging Demand in Commercial Fleets

There is an emerging demand for TPMS technology in commercial fleets as companies seek ways to reduce operating costs and enhance fleet safety. Commercial fleet operators are recognizing the benefits of TPMS in minimizing tire-related breakdowns, reducing fuel consumption, and extending tire life. By integrating TPMS into fleet management systems, companies can ensure better tire maintenance, reduce downtime, and improve overall efficiency. As the KSA logistics and transportation sector continues to grow, the demand for TPMS in commercial vehicles is expected to increase, presenting a lucrative opportunity for TPMS providers to tap into this expanding market segment.

Future Outlook

Over the next five years, the KSA TPMS market is expected to experience steady growth driven by advancements in TPMS technology, increased regulatory pressure for safety, and growing awareness about tire safety. The market will also benefit from the expansion of telematics and smart tire solutions, which are becoming integral to modern vehicles.

Major Players

- Sensata Technologies

- Schrader Electronics

- Continental AG

- Robert Bosch GmbH

- Hella KGaA Hueck & Co

- Tire Pressure Monitoring Systems (TPMS) Ltd.

- Pacific Industrial Co., Ltd.

- Honeywell International Inc.

- Goodyear TPMS Solutions

- Michelin TPMS

- Autoliv Inc.

- Zhejiang VIE Science and Technology Co., Ltd.

- Calsonic Kansei Corporation

- Bendix Commercial Vehicle Systems

- Nira Dynamics AB

Key Target Audience

- Automobile OEM Manufacturers

- Automotive Parts Suppliers and Distributors

- Fleet Owners and Commercial Vehicle Operators

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies

- Automotive Aftermarket Retailers

- Tire Manufacturers and Service Providers

- Technology Integrators for Telematics Solutions

Research Methodology

Step 1: Identification of Key Variables

The first step involves identifying critical market variables impacting the KSA TPMS market. These variables are defined through secondary research and industry reports. The primary objective is to pinpoint key market drivers, challenges, and opportunities.

Step 2: Market Analysis and Construction

In this phase, historical data is collected and analyzed to understand the penetration rates, segment performance, and overall market trends for TPMS solutions in KSA.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are validated through interviews with key industry players, including OEMs, suppliers, and aftermarket service providers. These consultations refine the insights and ensure accuracy in the data.

Step 4: Research Synthesis and Final Output

The final output is generated by synthesizing the research findings and validating them with expert feedback. The report offers detailed insights into the KSA TPMS market, including trends, challenges, and future growth opportunities.

- Executive Summary

- Research Methodology (Market Definitions and Inclusions/Exclusions, Abbreviations, Topic-Specific Taxonomy, Market Sizing Framework, Revenue Attribution Logic Across Use Cases or Care Settings, Primary Interview Program Design, Data Triangulation and Validation, Limitations and Data Gaps)

- Definition and Scope

- TPMS Technology Landscape

- Historical Evolution of TPMS in KSA

- Regulatory Environment and Vehicle Safety Mandates

- Value Chain and Stakeholder Mapping

- Growth Drivers

Increasing Vehicle Fleet

Rising Road Safety Regulations

Advancements in Automotive Technology

Consumer Awareness of Tire Safety

Integration with Telematics - Challenges

High Initial Cost of Direct TPMS

Aftermarket Retrofitting Barriers

Technological Complexity in Integration

Consumer Misunderstanding of TPMS Benefits

Limited Aftermarket Service Availability - Opportunities

Adoption of Smart and IoT-Connected TPMS

Emerging Demand in Commercial Fleets

Expansion of Safety Standards

Government Push for Road Safety Innovation

Growth in Aftermarket Retrofitting Market - Trends

Shift Toward Smart Tire Technologies

Increasing Integration with Telematics

Tire Pressure Monitoring in Electric Vehicles

Sustainability and Eco-Friendly Safety Solutions

Advancements in Sensor and Battery Technologies - Regulatory & Policy Landscape

- SWOT Analysis

- Stakeholder & Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competitive Intensity & Ecosystem Mapping

- By Value, 2019–2024

- By Unit Volume, 2019–2024

- By Deployment Segment, 2019–2024

- By Vehicle Type (in Value %)

Passenger Cars

Commercial Vehicles

TwoWheelers & Other Segments (if applicable) - By Technology (in Value %)

Direct TPMS

Indirect TPMS

Hybrid TPMS - By Installation Channel (in Value %)

OEM Fitment

Aftermarket (Repair Shops, Retailers)

Online & ECommerce Channels - By Distribution Channel (in Value %)

Auto Dealers & OEM Service Centers

Independent Workshops & Franchises

Ecommerce Platforms - By Region in KSA (in Value %)

Riyadh & Central Region

Jeddah & Western Region

Eastern Province

Other Regions

- Competition ecosystem overview

- Cross Comparison Parameters (Technology Adoption, OEM Partnerships, Aftermarket Presence, Distribution Network, R&D Investment, Product Portfolio, Market Expansion Strategy, Regulatory Compliance)

- SWOT analysis of major players

- Pricing and commercial model benchmarking

- Detailed Profiles of Major Companies

Sensata Technologies

Schrader Electronics

Continental AG

Robert Bosch GmbH

Hella KGaA Hueck & Co

Tire Pressure Monitoring Systems (TPMS) Ltd.

Pacific Industrial Co., Ltd.

Honeywell International Inc.

Goodyear TPMS Solutions

Michelin TPMS

Autoliv Inc.

Zhejiang VIE Science and Technology Co., Ltd.

Calsonic Kansei Corporation

Bendix Commercial Vehicle Systems

Nira Dynamics AB

- Buyer personas and decision-making units

- Procurement and contracting workflows

- KPIs used for evaluation

- Pain points and adoption barriers

- By Value, 2025–2030

- By Unit Volume, 2025–2030

- By Deployment Segment, 2025–2030