Market Overview

The KSA UAV Flight Training and Simulation market current size stands at around USD ~ million, reflecting steady expansion driven by defense modernization initiatives. Training infrastructure investments increased during recent periods, supported by higher UAV fleet induction and operational readiness programs. Simulator deployment expanded across military training bases, improving pilot proficiency and mission preparedness. Adoption of virtual and synthetic training environments accelerated due to safety requirements and operational efficiency goals. Demand growth remained consistent as unmanned systems gained wider deployment across surveillance and tactical missions.

The market is primarily concentrated across central and western regions where defense infrastructure, airbases, and training academies are established. These areas benefit from stronger logistics connectivity, advanced simulation facilities, and higher concentration of skilled operators. Government-backed defense ecosystems and localization initiatives further strengthen regional dominance. The presence of command centers, testing facilities, and regulatory authorities supports faster technology integration. Policy alignment and long-term defense modernization programs continue to reinforce regional leadership in training adoption.

Market Segmentation

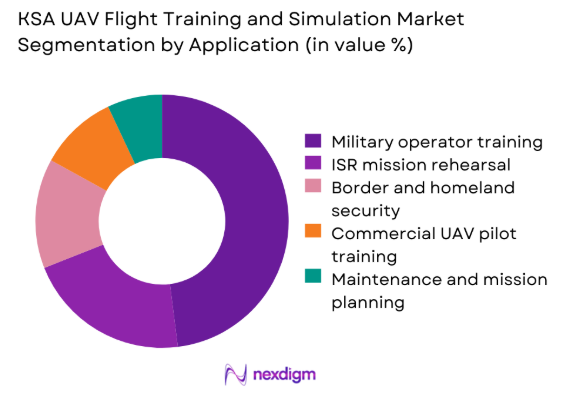

By Application

The application landscape is dominated by military and defense training requirements, driven by expanding UAV deployments across surveillance, reconnaissance, and tactical missions. Training programs increasingly prioritize simulator-based instruction to enhance mission preparedness while minimizing operational risks. Border security and internal surveillance applications further contribute to sustained demand for simulation platforms. Commercial UAV pilot training is emerging gradually, supported by regulatory clarity and growing civilian drone operations. Maintenance and mission planning simulations are gaining traction as operators seek lifecycle optimization and operational efficiency. Overall, application diversity strengthens long-term market stability and encourages continuous technology upgrades.

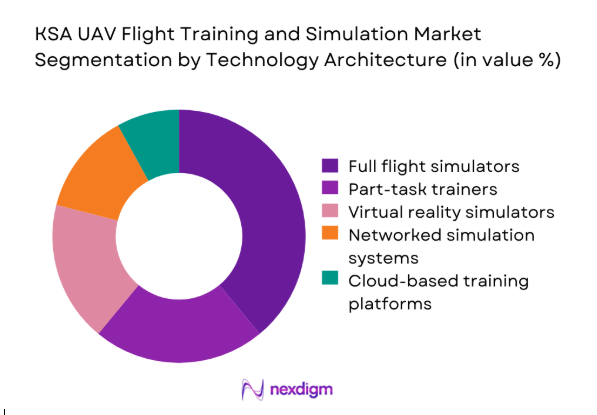

By Technology Architecture

Technology segmentation reflects increasing preference for immersive and networked training solutions. Full flight simulators remain the dominant category due to their realism and certification alignment. Part-task trainers support modular learning and cost-effective skill development. Virtual reality systems are witnessing accelerated adoption as they enable scalable and flexible training environments. Networked simulation platforms facilitate coordinated mission rehearsal across multiple units. Cloud-enabled architectures are gradually emerging, driven by data integration needs and centralized training management requirements.

Competitive Landscape

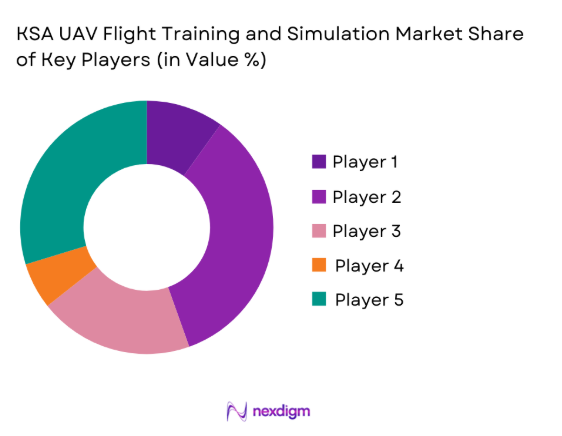

The competitive environment is characterized by a mix of international defense technology providers and regional system integrators. Market participants focus on long-term defense contracts, customization capabilities, and compliance with local training standards. Strategic partnerships with government entities and defense agencies strengthen market positioning. Technology differentiation is driven by simulator realism, integration capability, and lifecycle support offerings.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| CAE Inc. | 1947 | Canada | ~ | ~ | ~ | ~ | ~ | ~ |

| L3Harris Technologies | 2019 | USA | ~ | ~ | ~ | ~ | ~ | ~ |

| Thales Group | 1893 | France | ~ | ~ | ~ | ~ | ~ | ~ |

| Leonardo S.p.A. | 1948 | Italy | ~ | ~ | ~ | ~ | ~ | ~ |

| Elbit Systems | 1966 | Israel | ~ | ~ | ~ | ~ | ~ | ~ |

KSA UAV Flight Training and Simulation Market Analysis

Growth Drivers

Rising UAV procurement by Saudi defense forces

Rising defense procurement programs continue accelerating demand for structured UAV pilot training across military and security organizations nationwide. Fleet expansion during 2024 and 2025 increased simulator utilization requirements for safe mission readiness across multiple operational units. Defense acquisition strategies emphasize synthetic environments to reduce live flight risks and operational expenses while improving mission rehearsal effectiveness. Training throughput requirements expanded as UAV fleet diversity increased across surveillance and tactical missions supporting operational readiness goals. Government-backed modernization initiatives encouraged structured simulation adoption within air force training commands nationwide to standardize pilot competency benchmarks. Procurement alignment with long term capability planning strengthened simulator demand across operational bases supporting force readiness objectives nationally. Operational tempo increases required scalable training solutions capable of supporting concurrent trainee cohorts across multiple mission profiles simultaneously. Simulator-based training improved availability of aircraft assets for frontline mission deployment while reducing maintenance scheduling conflicts significantly overall. Training command budgets increasingly allocated resources toward immersive simulation infrastructure enhancements supporting long-term operational readiness objectives nationwide planning. Overall procurement momentum continues reinforcing sustained demand for advanced UAV training ecosystems across defense organizations nationally today consistently.

Increasing emphasis on indigenous operator training

National workforce development strategies increasingly emphasize localized UAV operator training to enhance operational independence and skills sustainability. Domestic training initiatives expanded during 2024 and 2025 to reduce reliance on foreign instruction frameworks. Localized curricula enable alignment with regional mission requirements and operational doctrines effectively. Indigenous training programs support faster deployment readiness through culturally and operationally aligned instruction models. Simulation-based learning accelerates skill acquisition while maintaining compliance with national aviation regulations. Training localization reduces logistical complexity associated with overseas certification pathways. Government incentives encouraged domestic training infrastructure investments supporting long-term workforce development goals. Increased availability of local instructors strengthened training continuity and knowledge retention across defense units. Simulation centers enabled standardized assessment methodologies across multiple training cohorts consistently. Emphasis on national capability building continues reinforcing demand for localized UAV training ecosystems.

Challenges

High capital cost of advanced simulators

High acquisition costs of advanced simulators present significant barriers to rapid deployment across training facilities. Budget allocation constraints limit the pace of simulator upgrades despite growing operational requirements. Advanced hardware integration demands substantial upfront investment in computing and visualization systems. Maintenance and calibration expenses further elevate total ownership costs for training operators. Smaller training units face difficulties justifying capital expenditure without long-term utilization certainty. Budget prioritization often favors platform acquisition over training infrastructure development. Financial planning complexities delay modernization cycles within training commands. High initial investment reduces flexibility for technology experimentation or phased implementation strategies. Cost pressures increase reliance on shared or centralized simulation facilities nationwide. These financial constraints collectively moderate the speed of market expansion.

Limited local manufacturing of training systems

Limited domestic manufacturing capability restricts rapid customization of UAV training solutions for local requirements. Dependence on imported simulation hardware increases lead times for system deployment. Localization challenges affect integration with indigenous command and control platforms. Technology transfer limitations constrain domestic value creation and skill development. Supply chain dependencies introduce vulnerability to external regulatory or geopolitical disruptions. Local assembly capabilities remain insufficient for large-scale deployment programs. Integration complexity increases when adapting foreign systems to national standards. Technical support reliance on external providers affects operational continuity and responsiveness. Localization gaps hinder scalability of training infrastructure expansion efforts. These factors collectively slow the pace of self-sustained market growth.

Opportunities

Localization of UAV training infrastructure

Localization initiatives create opportunities for establishing dedicated UAV training centers within national defense ecosystems. Domestic infrastructure development enhances operational sovereignty and reduces reliance on foreign training facilities. Investment in local simulation capabilities supports long-term workforce sustainability objectives. Training centers aligned with national standards improve consistency across operational units. Localization enables faster customization of curricula for mission-specific requirements. Domestic facilities reduce training downtime associated with overseas deployments. Collaboration with local technology providers fosters knowledge transfer and capability development. Localized ecosystems encourage innovation tailored to regional operational challenges. Government support accelerates establishment of compliant training infrastructure nationwide. These developments position localization as a critical long-term growth catalyst.

Growth of simulation-as-a-service models

Simulation-as-a-service models offer flexible access to advanced training capabilities without heavy capital investment. Subscription-based platforms enable scalable training aligned with fluctuating operational demand. Cloud-enabled simulation reduces infrastructure maintenance responsibilities for operators. Service-based delivery supports rapid technology upgrades and feature enhancements. Centralized management improves training standardization across distributed user groups. Usage-based models enhance cost predictability for defense training budgets. Remote access capabilities expand training reach across geographically dispersed units. Data-driven insights improve training effectiveness and performance monitoring. Service models enable faster adoption of emerging simulation technologies. These advantages drive increasing acceptance of service-oriented training solutions.

Future Outlook

The market is expected to maintain steady growth supported by continued defense modernization and UAV fleet expansion initiatives. Increased emphasis on localized training and digital simulation will shape future investment patterns. Integration of advanced analytics and immersive technologies will further enhance training effectiveness. Policy alignment and long-term defense planning will remain critical to sustained market development.

Major Players

- CAE Inc.

- L3Harris Technologies

- Thales Group

- Leonardo S.p.A.

- Elbit Systems

- Boeing Defense

- Lockheed Martin

- BAE Systems

- Raytheon Technologies

- Saab AB

- Rheinmetall Defence

- Indra Sistemas

- General Atomics

- Turkish Aerospace Industries

- Kratos Defense

Key Target Audience

- Ministry of Defense of Saudi Arabia

- Saudi Arabian Military Industries

- General Authority of Civil Aviation

- Border Guard and Internal Security Forces

- Defense procurement agencies

- UAV fleet operators

- Training and simulation service providers

- Investments and venture capital firms

Research Methodology

Step 1: Identification of Key Variables

Market scope was defined through analysis of UAV deployment trends, training requirements, and simulator classifications relevant to national defense usage. Key performance indicators were identified based on operational, technological, and regulatory factors.

Step 2: Market Analysis and Construction

Data was structured using segmentation frameworks aligned with application, technology, and end-user demand. Market dynamics were assessed using qualitative and quantitative indicators relevant to training infrastructure development.

Step 3: Hypothesis Validation and Expert Consultation

Industry insights were validated through expert interactions, operational benchmarks, and defense training workflow analysis. Assumptions were refined based on consistency checks and practical feasibility.

Step 4: Research Synthesis and Final Output

Findings were consolidated through triangulation of qualitative insights and quantitative indicators. Final outputs were structured to ensure consistency, clarity, and strategic relevance.

- Executive Summary

- Research Methodology (Market Definitions and UAV training scope mapping, Platform and simulator taxonomy development, Bottom-up market sizing using KSA defense and civil UAV programs, Revenue attribution across training hardware software and services)

- Definition and scope

- Market evolution

- Operational and training use cases

- Ecosystem structure

- Training delivery and simulator supply chain

- Regulatory and defense accreditation environment

- Growth Drivers

Rising UAV procurement by Saudi defense forces

Increasing emphasis on indigenous operator training

Growth of ISR and border surveillance missions

Saudi Vision 2030 defense localization initiatives

Expansion of civil and commercial UAV operations - Challenges

High capital cost of advanced simulators

Limited local manufacturing of training systems

Integration complexity with classified UAV platforms

Dependence on foreign OEMs and technology transfer

Regulatory restrictions on simulation data - Opportunities

Localization of UAV training infrastructure

Growth of simulation-as-a-service models

Integration of AI-based training analytics

Expansion of joint military training programs

Development of civil drone pilot certification programs - Trends

Adoption of immersive VR and AR training

Shift toward networked and cloud-based simulation

Increasing use of digital twins for UAV training

Integration of mission rehearsal with C2 systems

Focus on lifecycle training and sustainment solutions - Government Regulations

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Value, 2020–2025

- By Volume, 2020–2025

- By Installed Base, 2020–2025

- By Average Selling Price, 2020–2025

- By Fleet Type (in Value %)

Fixed-wing UAVs

Rotary-wing UAVs

Hybrid VTOL UAVs

MALE and HALE UAVs

Tactical and mini UAVs - By Application (in Value %)

Military operator training

ISR mission rehearsal

Border and homeland security training

Commercial UAV pilot training

Maintenance and mission planning simulation - By Technology Architecture (in Value %)

Full flight simulators

Part-task trainers

Desktop simulation systems

Virtual reality based simulators

Live virtual constructive training systems - By End-Use Industry (in Value %)

Defense and armed forces

Internal security and border control

Oil and gas surveillance operators

Infrastructure and utility operators

Academic and training institutes - By Connectivity Type (in Value %)

Standalone simulators

Networked training systems

Cloud-enabled simulation platforms

Integrated command-and-control training systems - By Region (in Value %)

Central Saudi Arabia

Western Saudi Arabia

Eastern Province

Northern Saudi Arabia

Southern Saudi Arabia

- Market structure and competitive positioning

- Market share snapshot of major players

- Cross Comparison Parameters (Product portfolio depth, Simulator realism level, Localization capability, Military certification compliance, Pricing model, After-sales support, Technology integration capability, Regional presence)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Detailed Profiles of Major Companies

L3Harris Technologies

Thales Group

Boeing Defense

Lockheed Martin

Elbit Systems

Leonardo S.p.A.

BAE Systems

Raytheon Technologies

Saab AB

Kratos Defense & Security Solutions

General Atomics Aeronautical Systems

Turkish Aerospace Industries

Rheinmetall Defence

Indra Sistemas

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- Post-purchase service expectations

- By Value, 2026–2035

- By Volume, 2026–2035

- By Installed Base, 2026–2035

- By Average Selling Price, 2026–2035