Market Overview

The KSA UAV Navigation Systems market current size stands at around USD ~ million, supported by expanding defense modernization programs and growing unmanned aerial deployments across multiple sectors. In 2024 and 2025, fleet expansion accelerated with increased adoption of advanced navigation architectures, inertial systems, and GNSS integration across surveillance, logistics, and industrial applications. Strong government-backed localization policies and defense procurement programs supported sustained deployment volumes. Technology upgrades focused on accuracy, redundancy, and mission reliability. System integration and localization initiatives strengthened domestic capabilities while improving operational resilience.

Saudi Arabia’s UAV navigation ecosystem is concentrated around defense hubs, border surveillance zones, and industrial corridors with strong aviation infrastructure. Major activity clusters exist around central and eastern regions due to defense installations and oil and gas operations. Demand is reinforced by airspace modernization initiatives and controlled UAV integration frameworks. The ecosystem benefits from government-backed manufacturing incentives, rising private sector participation, and increasing adoption of autonomous platforms. Regulatory clarity and infrastructure investments continue shaping deployment density and system sophistication nationwide.

Market Segmentation

By Application

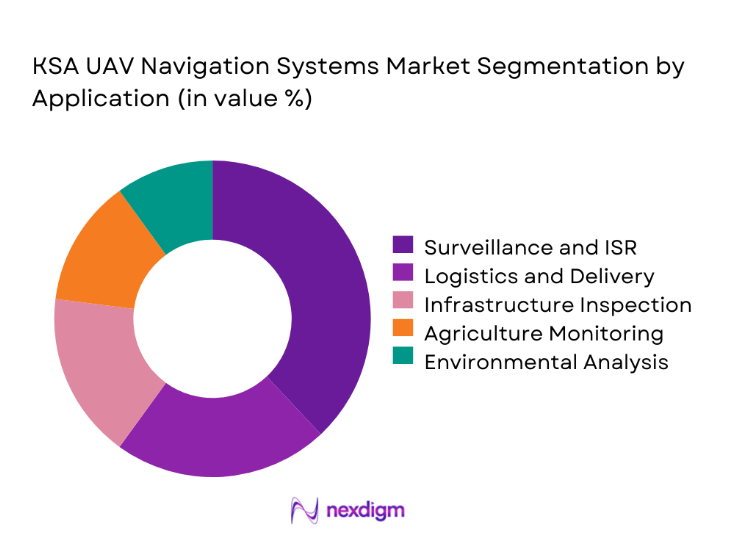

The surveillance and intelligence segment dominates the KSA UAV navigation systems market due to strong defense and border monitoring requirements. Persistent aerial monitoring, ISR missions, and perimeter security operations account for the highest navigation system utilization. Logistics and infrastructure inspection follow closely, supported by industrial expansion and remote asset monitoring needs. Agricultural and environmental applications are emerging steadily, driven by water management and land mapping requirements. Increasing adoption of BVLOS operations further strengthens navigation accuracy requirements. Continuous upgrades in navigation reliability support sustained segment dominance.

By Technology Architecture

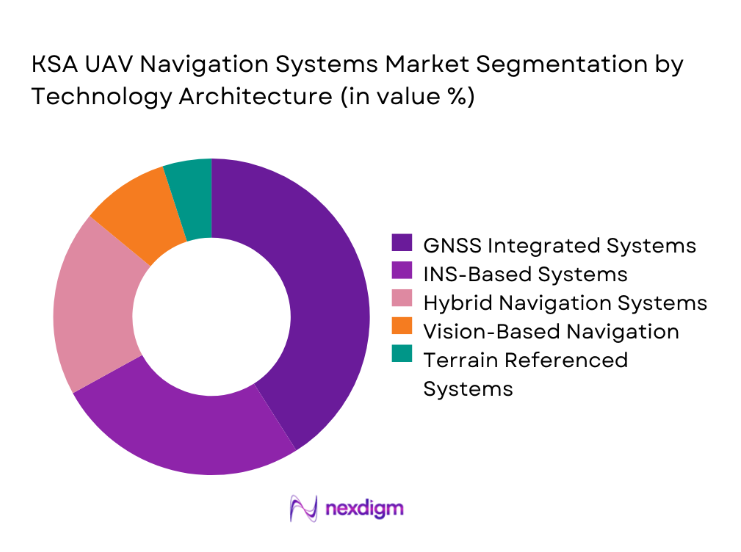

GNSS-integrated navigation systems hold the largest share due to their reliability and compatibility with military and commercial UAV platforms. INS-based systems remain critical for mission continuity in signal-denied environments. Hybrid navigation architectures combining vision, inertial, and satellite inputs are gaining strong adoption. Terrain-referenced navigation adoption is increasing for low-altitude and long-endurance missions. Advanced sensor fusion technologies are increasingly favored for enhanced positional accuracy and redundancy.

Competitive Landscape

The KSA UAV navigation systems market is moderately consolidated with a mix of international aerospace leaders and regional defense technology providers. Competitive positioning is driven by system reliability, compliance readiness, integration capability, and long-term service support. Strategic partnerships, localization commitments, and technology transfer agreements play a critical role in vendor selection and contract awards.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Lockheed Martin | 1912 | USA | ~ | ~ | ~ | ~ | ~ | ~ |

| Northrop Grumman | 1939 | USA | ~ | ~ | ~ | ~ | ~ | ~ |

| Thales Group | 1893 | France | ~ | ~ | ~ | ~ | ~ | ~ |

| Honeywell Aerospace | 1906 | USA | ~ | ~ | ~ | ~ | ~ | ~ |

| Leonardo | 1948 | Italy | ~ | ~ | ~ | ~ | ~ | ~ |

KSA UAV Navigation Systems Market Analysis

Growth Drivers

Rising defense modernization programs

Defense modernization initiatives continue to drive procurement of advanced UAV navigation systems across military branches. Increased budget allocation toward aerial surveillance platforms supported higher adoption of integrated navigation technologies. In 2024 and 2025, defense programs prioritized precision navigation and mission reliability enhancements. Localization strategies further encouraged procurement of compliant navigation subsystems. Advanced ISR missions demanded greater navigation accuracy and redundancy. Modernization plans emphasized system interoperability across platforms. Indigenous manufacturing initiatives strengthened supply continuity. Enhanced border security requirements sustained demand growth. Integration with command networks expanded system complexity. Continuous upgrades maintained consistent procurement momentum.

Expansion of UAV usage in border surveillance

Border security operations increasingly rely on UAV platforms for continuous monitoring and reconnaissance missions. Navigation systems play a critical role in ensuring accurate path tracking and mission endurance. In 2024 and 2025, UAV deployments increased across sensitive border regions. Autonomous navigation improved response efficiency and reduced operational risk. Multi-sensor navigation enhanced situational awareness for patrol missions. Government agencies expanded UAV fleet utilization across desert and maritime borders. High endurance missions increased demand for navigation reliability. Terrain-adaptive navigation supported low-altitude surveillance. Secure navigation systems improved operational confidence. This expansion significantly strengthened navigation system demand.

Challenges

Regulatory restrictions on UAV operations

Strict regulatory frameworks continue to limit UAV operational flexibility across controlled airspaces. Approval requirements slow deployment timelines for navigation-intensive platforms. Airspace integration challenges restrict beyond-visual-line-of-sight missions. Certification processes increase compliance complexity for system vendors. Regulatory uncertainty impacts long-term investment planning. Flight authorization procedures vary across operational zones. Data security regulations affect navigation system architecture design. Limited harmonization delays technology adoption cycles. Operational approvals require extensive documentation. These constraints collectively slow market expansion.

High cost of advanced navigation systems

Advanced navigation systems require sophisticated sensors and integration capabilities. High development and certification costs increase procurement barriers for operators. Smaller UAV operators face budget limitations when adopting premium navigation technologies. Maintenance and calibration expenses further elevate ownership costs. Import dependencies increase overall system expenditure. Advanced components require specialized technical support. Cost sensitivity affects adoption across commercial applications. Budget prioritization limits large-scale deployment. Long procurement cycles slow replacement rates. These factors constrain overall market penetration.

Opportunities

Localization of navigation system production

Localization initiatives offer strong opportunities for domestic manufacturing of UAV navigation components. Government incentives support technology transfer and facility development. Local production reduces dependency on imports and supply risks. Domestic manufacturing improves customization for regional requirements. Localized assembly enhances regulatory compliance efficiency. Workforce development strengthens long-term capability building. Public-private partnerships accelerate ecosystem maturity. Reduced lead times improve procurement efficiency. Cost optimization becomes achievable through localized sourcing. This opportunity supports sustained market growth.

Integration with AI-based navigation algorithms

AI integration enhances navigation accuracy through adaptive decision-making capabilities. Machine learning enables improved obstacle avoidance and route optimization. AI-based navigation supports autonomous mission execution. Data-driven algorithms improve navigation reliability under complex conditions. Real-time analytics enhance situational awareness for operators. AI integration reduces human intervention requirements. Advanced algorithms support swarm UAV coordination. Predictive navigation improves mission success rates. Technology convergence drives system differentiation. This integration creates strong long-term growth potential.

Future Outlook

The KSA UAV navigation systems market is expected to witness steady expansion driven by defense modernization, autonomous system adoption, and regulatory maturation. Increasing localization, technology partnerships, and AI integration will shape future deployments. Demand will remain strong across surveillance, logistics, and infrastructure monitoring applications. Continued investments in airspace management and navigation security will further enhance market stability and growth potential.

Major Players

- Lockheed Martin

- Northrop Grumman

- Thales Group

- Honeywell Aerospace

- Leonardo

- BAE Systems

- Safran Electronics & Defense

- Collins Aerospace

- L3Harris Technologies

- RTX Corporation

- Saab AB

- Elbit Systems

- General Atomics

- Aselsan

- Baykar Technologies

Key Target Audience

- Defense procurement authorities

- Saudi Ministry of Defense

- General Authority of Civil Aviation

- Border security agencies

- UAV manufacturers and integrators

- Oil and gas infrastructure operators

- Logistics and surveillance service providers

- Investments and venture capital firms

Research Methodology

Step 1: Identification of Key Variables

Key variables were identified through analysis of UAV deployment patterns, navigation technologies, and regulatory frameworks. Market boundaries were defined based on application relevance and system functionality.

Step 2: Market Analysis and Construction

Market structure was developed using deployment trends, technology adoption rates, and procurement behavior across defense and commercial sectors. Segmentation was refined based on operational usage.

Step 3: Hypothesis Validation and Expert Consultation

Findings were validated through expert consultations with aviation professionals and defense technology specialists. Assumptions were refined based on real-world operational feedback.

Step 4: Research Synthesis and Final Output

Validated data points were synthesized to form coherent insights. Analytical consistency was maintained through triangulation and cross-verification methods.

- Executive Summary

- Research Methodology (Market Definitions and UAV navigation system scope alignment, Platform and navigation technology taxonomy mapping, Bottom-up market sizing using fleet and procurement data, Revenue attribution by navigation subsystem and integration level, Primary interviews with UAV OEMs and defense aviation authorities, Data triangulation using flight permits and import-export records, Assumptions based on KSA defense and civil aviation programs)

- Definition and scope

- Market evolution

- Usage and mission profiles

- Ecosystem structure

- Supply chain and integration framework

- Regulatory and certification environment

- Growth Drivers

Rising defense modernization programs

Expansion of UAV usage in border surveillance

Government-backed localization initiatives

Growing demand for autonomous navigation

Increasing adoption of BVLOS operations - Challenges

Regulatory restrictions on UAV operations

High cost of advanced navigation systems

Dependence on foreign GNSS infrastructure

Cybersecurity and signal interference risks

Limited local manufacturing ecosystem - Opportunities

Localization of navigation system production

Integration with AI-based navigation algorithms

Growth of commercial UAV applications

Development of anti-jamming navigation solutions

Public-private partnerships in UAV programs - Trends

Shift toward multi-sensor navigation fusion

Increasing adoption of AI-enabled navigation

Integration with national geospatial platforms

Demand for encrypted navigation systems

Rising use of autonomous swarm UAVs - Government Regulations

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Value, 2020–2025

- By Volume, 2020–2025

- By Installed Base, 2020–2025

- By Average Selling Price, 2020–2025

- By Fleet Type (in Value %)

Fixed-wing UAVs

Rotary-wing UAVs

Hybrid VTOL UAVs

Tactical UAVs

MALE and HALE UAVs - By Application (in Value %)

ISR and surveillance

Mapping and geospatial analysis

Border and coastal monitoring

Logistics and cargo delivery

Agriculture and environmental monitoring - By Technology Architecture (in Value %)

GNSS-based navigation

INS-based navigation

GNSS-INS integrated systems

Vision-based navigation

Terrain-referenced navigation - By End-Use Industry (in Value %)

Defense and homeland security

Oil and gas

Construction and infrastructure

Agriculture

Logistics and transportation - By Connectivity Type (in Value %)

Line-of-sight navigation systems

Beyond visual line-of-sight systems

Satellite-assisted navigation

Hybrid communication-based navigation - By Region (in Value %)

Central Saudi Arabia

Western Saudi Arabia

Eastern Saudi Arabia

Southern Saudi Arabia

Northern Saudi Arabia

- Market structure and competitive positioning

- Market share snapshot of major players

- Cross Comparison Parameters (product portfolio depth, navigation accuracy, system integration capability, compliance with KSA regulations, pricing strategy, after-sales support, local partnership presence, technology maturity)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Detailed Profiles of Major Companies

Lockheed Martin

Northrop Grumman

Thales Group

Honeywell Aerospace

Collins Aerospace

BAE Systems

Safran Electronics & Defense

Elbit Systems

Leonardo

L3Harris Technologies

RTX Corporation

Saab AB

Baykar Technologies

Aselsan

General Atomics Aeronautical Systems

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- Post-purchase service expectations

- By Value, 2026–2035

- By Volume, 2026–2035

- By Installed Base, 2026–2035

- By Average Selling Price, 2026–2035