Market Overview

The KSA UAV Payload and Subsystems market current size stands at around USD ~ million with steady activity observed across 2024 and 2025 procurement cycles. Demand has remained consistent due to fleet modernization, border surveillance requirements, and increasing integration of ISR payloads across unmanned platforms. Procurement volumes in 2024 showed measurable growth, while 2025 reflected further acceleration supported by domestic manufacturing initiatives. Spending remained concentrated around EO/IR, communication, and mission control subsystems, driven by defense modernization programs and platform upgrades.

The market is geographically concentrated around Riyadh, Eastern Province, and Western industrial clusters due to defense infrastructure density. These regions benefit from proximity to military bases, system integrators, and aerospace manufacturing zones. Strong policy backing, localization mandates, and maturing supplier ecosystems have strengthened deployment capacity. The ecosystem also benefits from defense-driven innovation hubs, test ranges, and increasing collaboration between government entities and technology developers.

Market Segmentation

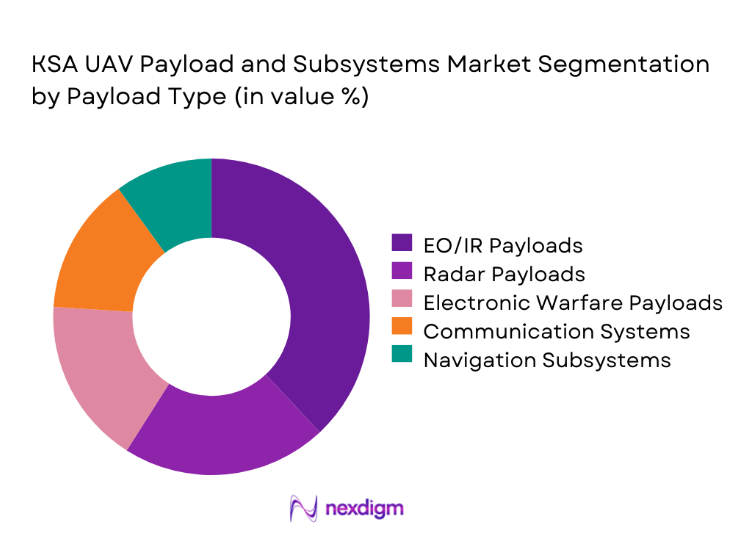

By Payload Type

Electro-optical and infrared payloads dominate due to widespread ISR deployment and surveillance requirements. Radar and electronic warfare payloads follow due to strategic defense needs. Communication relay and navigation subsystems show consistent adoption driven by long-endurance UAV missions. Payload modularity and mission adaptability increasingly influence purchasing decisions. Demand concentration remains higher for multi-sensor payloads supporting real-time intelligence operations.

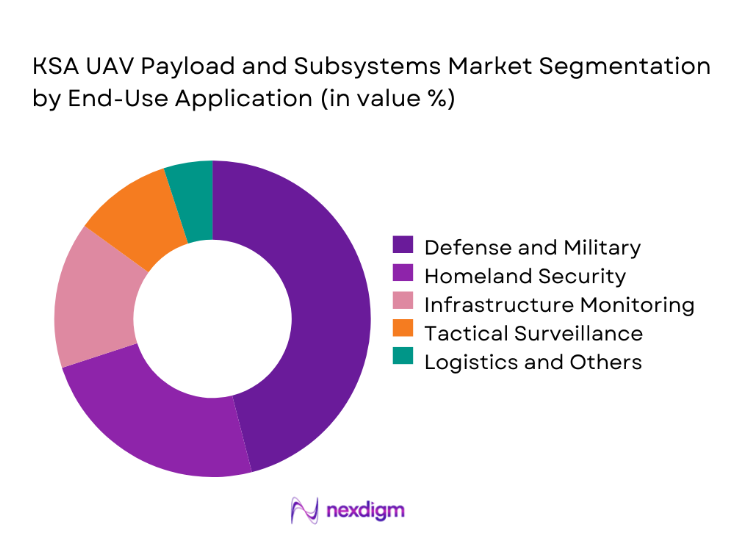

By End-Use Application

Defense and homeland security applications dominate payload demand due to persistent border surveillance and ISR missions. Critical infrastructure monitoring follows as energy and transport operators increase UAV adoption. Tactical reconnaissance and intelligence gathering continue to drive subsystem upgrades. Emergency response and logistics applications remain smaller but show steady adoption due to regulatory support and operational efficiency gains.

Competitive Landscape

The competitive landscape is moderately consolidated with strong presence of domestic defense integrators and international subsystem suppliers. Companies compete on technology depth, system compatibility, localization capability, and regulatory compliance. Partnerships and joint ventures remain common strategies to address localization and capability transfer requirements.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Saudi Arabian Military Industries | 2017 | Riyadh | ~ | ~ | ~ | ~ | ~ | ~ |

| Advanced Electronics Company | 1988 | Riyadh | ~ | ~ | ~ | ~ | ~ | ~ |

| Alsalam Aerospace Industries | 1988 | Riyadh | ~ | ~ | ~ | ~ | ~ | ~ |

| Intra Defense Technologies | 2004 | Riyadh | ~ | ~ | ~ | ~ | ~ | ~ |

| L3Harris Technologies | 1895 | Melbourne | ~ | ~ | ~ | ~ | ~ | ~ |

KSA UAV Payload and Subsystems Market Analysis

Growth Drivers

Rising defense modernization and localization initiatives

Defense modernization programs continue driving investments into UAV payloads supporting national security and operational readiness priorities. Localization strategies have encouraged domestic production of mission systems and subsystem integration capabilities. Defense budgets allocated during 2024 supported technology upgrades and payload standardization initiatives. Indigenous manufacturing incentives strengthened local supplier participation across payload categories. Government-backed industrial programs accelerated knowledge transfer and manufacturing depth. Increased emphasis on sovereign capability reduced reliance on foreign payload imports. Modernization goals also encouraged adoption of advanced sensing technologies across platforms. Defense planning cycles emphasized lifecycle extension and subsystem upgrades. Strategic alignment with Vision programs supported payload innovation initiatives. These combined factors sustained consistent market expansion momentum.

Increased ISR demand for border and critical infrastructure security

Heightened border monitoring requirements significantly increased deployment of ISR-equipped UAV platforms. Infrastructure protection programs expanded surveillance coverage across energy and transportation assets. Security agencies prioritized real-time intelligence collection through advanced payload integration. UAV deployments increased across coastal and remote border regions. Persistent surveillance needs drove demand for high-end electro-optical systems. Integration of multi-sensor payloads enhanced situational awareness capabilities. Rising security concerns reinforced UAV mission frequency across regions. Cross-agency collaboration further expanded ISR utilization. Operational readiness mandates sustained continuous payload upgrades. These trends reinforced steady growth across ISR-related subsystems.

Challenges

High dependence on imported high-end payload technologies

Advanced payload components remain heavily reliant on foreign suppliers and external manufacturing sources. Import dependencies expose procurement cycles to geopolitical and regulatory risks. Limited domestic production capability restricts rapid customization and scaling. Supply chain disruptions impact delivery schedules and system integration timelines. Technology access constraints affect long-term capability development. Localization targets remain challenging for complex sensor technologies. Dependence on imports increases lifecycle support costs. Export control regulations complicate acquisition processes. Limited domestic alternatives slow substitution efforts. These factors collectively constrain market self-sufficiency.

Technology transfer and IP restrictions

Technology transfer limitations restrict access to advanced payload designs and proprietary architectures. Intellectual property restrictions hinder domestic innovation and reverse engineering capabilities. Licensing agreements often limit customization flexibility for local integrators. Compliance requirements slow development timelines for indigenous solutions. Security regulations restrict sharing of sensitive design information. Limited exposure to core technologies affects local R&D progress. Collaboration frameworks remain tightly controlled by foreign suppliers. IP protection frameworks increase negotiation complexity. These challenges delay capability maturation within domestic ecosystems. Overall technology absorption remains gradual.

Opportunities

Localization of payload manufacturing under Vision 2030

Localization initiatives encourage domestic production of UAV payload components and subsystems. Government incentives support establishment of advanced manufacturing facilities. Local assembly reduces lead times and supply chain dependency risks. Knowledge transfer programs enhance engineering and integration capabilities. Partnerships with international firms accelerate technical skill development. Domestic manufacturing improves lifecycle management efficiency. Localization strengthens national security objectives through controlled production. Increased local content requirements stimulate supplier ecosystem growth. Workforce development initiatives support sustainable industry expansion. These factors collectively enhance long-term market potential.

Development of AI-enabled sensor fusion systems

AI integration enables enhanced data processing and real-time decision-making capabilities. Sensor fusion technologies improve target identification and situational awareness accuracy. Increased computing capability supports autonomous mission execution. AI-driven payloads reduce operator workload and response time. Defense agencies prioritize intelligent systems for future operations. Advancements in onboard processing enable faster analytics deployment. AI applications improve multi-sensor coordination efficiency. Demand for intelligent payloads continues rising across platforms. Research investments accelerate algorithm development. These advancements create significant growth avenues.

Future Outlook

The market is expected to witness steady advancement driven by localization policies, technology integration, and sustained defense investments. Increasing adoption of intelligent payloads and modular systems will shape future procurement patterns. Collaboration between domestic and international players will strengthen ecosystem maturity. Long-term growth will be supported by strategic defense programs and evolving operational requirements.

Major Players

- Saudi Arabian Military Industries

- Advanced Electronics Company

- Alsalam Aerospace Industries

- Intra Defense Technologies

- TAQNIA Defense

- L3Harris Technologies

- Thales Group

- Leonardo

- Elbit Systems

- HENSOLDT

- ASELSAN

- Raytheon Technologies

- Northrop Grumman

- Safran Electronics & Defense

- Teledyne FLIR

Key Target Audience

- Defense ministries and armed forces

- Homeland security agencies

- Border security authorities

- UAV manufacturers and integrators

- Defense procurement agencies

- Investments and venture capital firms

- Government and regulatory bodies including GAMI and MOD

- Aerospace system integrators

Research Methodology

Step 1: Identification of Key Variables

The research identifies payload categories, subsystem classifications, and application areas relevant to UAV deployments. Key demand drivers and procurement patterns are mapped. Regulatory and operational factors influencing adoption are assessed.

Step 2: Market Analysis and Construction

Market structure is developed using segmentation by application, payload type, and end user. Demand trends and deployment patterns are evaluated. Data consistency is maintained across all analytical layers.

Step 3: Hypothesis Validation and Expert Consultation

Industry experts, system integrators, and defense stakeholders validate assumptions. Feedback is used to refine growth drivers and challenge assessments. Market dynamics are cross-verified through multiple inputs.

Step 4: Research Synthesis and Final Output

All findings are consolidated into a structured analytical framework. Insights are validated for consistency and relevance. Final outputs align with industry realities and strategic developments.

- Executive Summary

- Research Methodology (Market Definitions and scope for UAV payloads and subsystems in KSA defense and commercial fleets, segmentation framework based on payload type and mission role, bottom-up market sizing using platform-level payload integration data, revenue attribution across domestic and imported subsystems, primary validation through OEMs system integrators and defense stakeholders, triangulation using procurement contracts and fleet modernization plans, assumptions linked to localization policies and defense spending cycles)

- Definition and Scope

- Market evolution

- Usage and mission integration landscape

- Ecosystem and value chain structure

- Supply chain and localization dynamics

- Regulatory and defense procurement environment

- Growth Drivers

Rising defense modernization and localization initiatives

Increased ISR demand for border and critical infrastructure security

Expansion of indigenous UAV manufacturing programs

Growing adoption of ISR-enabled tactical UAVs

Rising defense budget allocation for unmanned systems - Challenges

High dependence on imported high-end payload technologies

Technology transfer and IP restrictions

Integration complexity across multi-platform fleets

Cybersecurity and data integrity concerns

Long procurement and certification cycles - Opportunities

Localization of payload manufacturing under Vision 2030

Development of AI-enabled sensor fusion systems

Growth of homeland security and civil surveillance use cases

Strategic partnerships with global payload OEMs

Expansion of SATCOM-enabled long-endurance UAVs - Trends

Shift toward modular and plug-and-play payloads

Increased adoption of EO/IR and multi-sensor payloads

Integration of AI-based analytics at payload level

Rising demand for indigenous EW payloads

Miniaturization and weight optimization of subsystems - Government Regulations

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Value, 2020–2025

- By Volume, 2020–2025

- By Installed Base, 2020–2025

- By Average Selling Price, 2020–2025

- By Fleet Type (in Value %)

MALE UAVs

HALE UAVs

Tactical UAVs

Mini and Micro UAVs

VTOL and Hybrid UAVs - By Application (in Value %)

ISR and surveillance

Border security and patrol

Target acquisition and tracking

Electronic warfare and SIGINT

Cargo and logistics support - By Technology Architecture (in Value %)

Electro-optical and infrared payloads

Radar and SAR payloads

Electronic warfare systems

Communication relay systems

Navigation and flight control subsystems - By End-Use Industry (in Value %)

Defense and military

Homeland security

Border control agencies

Energy and critical infrastructure

Commercial and industrial operators - By Connectivity Type (in Value %)

Line-of-sight communication

Beyond line-of-sight SATCOM

Hybrid communication architecture - By Region (in Value %)

Central Saudi Arabia

Western Region

Eastern Province

Southern Region

Northern Region

- Market structure and competitive positioning

- Market share snapshot of major players

- Cross Comparison Parameters (product portfolio breadth, localization capability, platform compatibility, technology maturity, pricing strategy, contract footprint, aftersales support, partnerships and alliances)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Detailed Profiles of Major Companies

Saudi Arabian Military Industries (SAMI)

Advanced Electronics Company

Alsalam Aerospace Industries

Intra Defense Technologies

TAQNIA Defense and Security

L3Harris Technologies

Teledyne FLIR

Thales Group

Leonardo S.p.A.

HENSOLDT

Elbit Systems

ASELSAN

Northrop Grumman

Safran Electronics & Defense

Raytheon Technologies

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- Post-purchase service expectations

- By Value, 2026–2035

- By Volume, 2026–2035

- By Installed Base, 2026–2035

- By Average Selling Price, 2026–2035