Market Overview

The KSA UAV Propulsion Systems market current size stands at around USD ~ million, supported by expanding unmanned fleets, rising defense allocations, and accelerated indigenous manufacturing initiatives. Demand levels are reflected through approximately ~ active propulsion units deployed across operational UAV platforms, with growing integration of hybrid and fuel-based engines. Procurement volumes increased steadily as surveillance and tactical missions intensified, while propulsion efficiency and endurance capabilities remained critical evaluation parameters for procurement authorities and system integrators across military and security programs.

The market is primarily concentrated around Riyadh, Jeddah, and the Eastern Province due to defense infrastructure density and aerospace manufacturing clusters. Government-backed industrial zones, military research centers, and defense OEM facilities create strong demand concentration. The ecosystem benefits from centralized procurement, increasing localization mandates, and aligned defense strategies. Growing collaboration between domestic manufacturers and international technology partners continues to strengthen propulsion development, testing, and lifecycle support capabilities across the Kingdom.

Market Segmentation

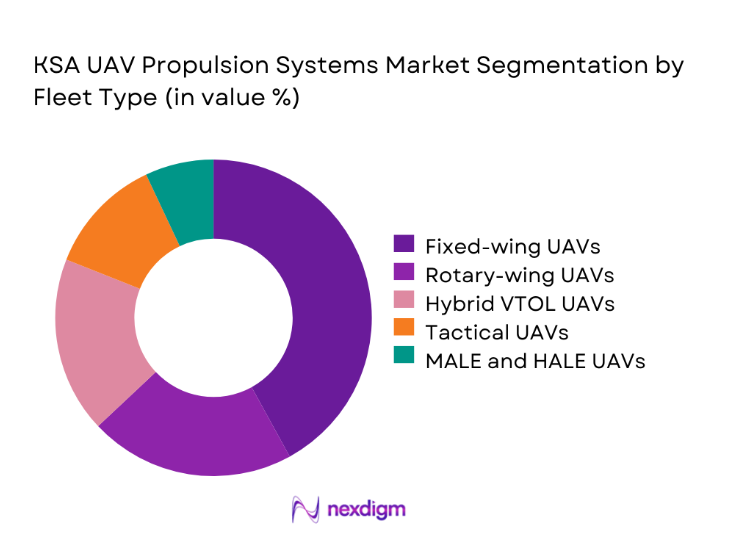

By Fleet Type

Fixed-wing UAVs dominate propulsion demand due to their extended endurance requirements and suitability for long-range surveillance missions. Rotary-wing and hybrid VTOL platforms are gaining momentum, driven by border patrol and urban monitoring applications requiring vertical takeoff capability. Tactical UAVs represent a significant share due to increasing deployment frequency, while MALE and HALE platforms contribute steadily through defense modernization programs. The growing diversification of UAV missions continues to expand propulsion system requirements across multiple fleet categories.

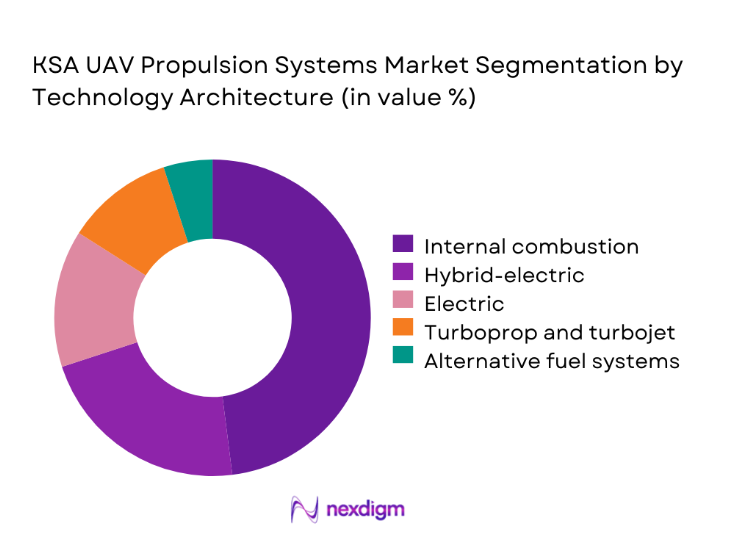

By Technology Architecture

Internal combustion propulsion systems continue to dominate due to operational reliability and established supply chains. Hybrid-electric propulsion is gaining traction as endurance optimization and fuel efficiency become strategic priorities. Fully electric propulsion remains limited to short-range platforms, while turboprop and jet-based systems serve high-performance defense UAVs. Emerging hydrogen-based concepts are under evaluation, supported by sustainability initiatives and future-oriented defense research programs.

Competitive Landscape

The competitive environment is characterized by a mix of domestic defense manufacturers and international propulsion technology providers. Market participants compete on performance efficiency, system reliability, localization depth, and integration compatibility with UAV platforms. Long-term defense contracts, technology transfer agreements, and after-sales support capabilities play a critical role in shaping competitive positioning within the Kingdom’s regulated aerospace ecosystem.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Saudi Arabian Military Industries | 2017 | Saudi Arabia | ~ | ~ | ~ | ~ | ~ | ~ |

| Honeywell Aerospace | 1935 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| Safran Group | 1924 | France | ~ | ~ | ~ | ~ | ~ | ~ |

| Rolls-Royce | 1906 | United Kingdom | ~ | ~ | ~ | ~ | ~ | ~ |

| UAV Engines Ltd | 1970 | United Kingdom | ~ | ~ | ~ | ~ | ~ | ~ |

KSA UAV Propulsion Systems Market Analysis

Growth Drivers

Rising defense modernization and localization initiatives

Defense modernization programs are accelerating UAV propulsion demand through structured localization strategies and increased domestic manufacturing participation across platforms. National security priorities have elevated investments in indigenous aerospace capabilities, encouraging procurement of advanced propulsion technologies. Local production mandates stimulate partnerships between international suppliers and domestic manufacturers. Increased defense budgeting allocation supports long-term propulsion system upgrades and fleet expansion. Technology transfer frameworks enhance in-country engineering expertise and production scalability. Government-backed industrial zones facilitate component manufacturing and assembly operations. Military modernization programs emphasize endurance and reliability improvements. These initiatives collectively reinforce consistent propulsion demand growth. Localization policies reduce dependency on imports over time. Strategic defense alignment sustains long-term propulsion system development activity.

Increased deployment of UAVs for border surveillance

Border surveillance expansion significantly drives propulsion system demand across fixed-wing and hybrid UAV platforms. Increasing territorial monitoring requirements amplify UAV fleet utilization rates. Extended flight endurance remains critical for persistent border operations. Surveillance missions require propulsion systems capable of operating under extreme climatic conditions. Increased deployment frequency accelerates replacement and maintenance cycles. Operational reliability has become a primary procurement criterion for defense agencies. Propulsion systems supporting longer loitering capabilities are prioritized. Border security missions require stable power output under variable payload conditions. Continuous monitoring initiatives sustain recurring propulsion demand. National security objectives reinforce long-term UAV deployment strategies.

Challenges

Dependence on imported propulsion technologies

Reliance on imported propulsion components creates supply chain vulnerabilities for domestic UAV programs. International sourcing exposes procurement timelines to geopolitical and regulatory disruptions. Limited domestic manufacturing capability constrains rapid system customization. Import dependency affects maintenance turnaround times and spare availability. Technology transfer limitations slow local innovation cycles. Currency fluctuations introduce procurement cost uncertainties. Certification dependencies restrict rapid system upgrades. Domestic suppliers face barriers entering high-precision propulsion manufacturing. Localization efforts require significant technical skill development. Supply chain resilience remains a persistent industry concern.

High development and certification costs

Propulsion system development requires extensive testing, validation, and regulatory certification processes. High engineering costs limit rapid prototyping and innovation cycles. Certification requirements increase time-to-market for new propulsion designs. Specialized testing infrastructure demands significant capital investment. Compliance with military-grade performance standards raises development complexity. Limited testing facilities increase reliance on overseas validation centers. Cost-intensive qualification processes restrict participation of smaller manufacturers. Extended development timelines affect deployment schedules. Budget constraints influence technology adoption speed. Financial barriers challenge rapid propulsion innovation across platforms.

Opportunities

Localization under Vision 2030 programs

Vision 2030 initiatives create significant opportunities for domestic propulsion manufacturing expansion. Localization mandates encourage technology transfer and industrial capability development. Government incentives support investment in aerospace manufacturing infrastructure. Increased local content requirements strengthen domestic supplier participation. Defense offset programs facilitate knowledge transfer from global OEMs. Workforce development initiatives enhance technical skill availability. Public-private partnerships accelerate propulsion system innovation. Localization reduces long-term procurement dependency risks. Industrial clustering supports cost-efficient production ecosystems. National strategies align defense procurement with economic diversification objectives.

Development of hybrid and electric propulsion systems

Hybrid and electric propulsion development presents opportunities for efficiency improvements and reduced operational footprints. Demand for extended endurance drives adoption of hybrid architectures. Electric propulsion supports quieter operations for surveillance missions. Advances in energy storage technologies enhance feasibility of electric UAVs. Hybrid systems offer optimized fuel consumption profiles. Environmental sustainability goals support alternative propulsion research. Lightweight materials improve propulsion efficiency and performance. Research funding supports experimental propulsion programs. Emerging technologies attract defense innovation investments. Future platforms increasingly integrate hybrid propulsion solutions.

Future Outlook

The KSA UAV Propulsion Systems market is expected to witness sustained growth driven by defense modernization and localization strategies. Increasing focus on endurance, efficiency, and indigenous production will shape future propulsion development. Technological advancements and regulatory support are likely to accelerate adoption of hybrid systems. Long-term defense planning will continue to strengthen domestic manufacturing capabilities.

Major Players

- Saudi Arabian Military Industries

- Honeywell Aerospace

- Safran Group

- Rolls-Royce

- Pratt & Whitney

- MTU Aero Engines

- UAV Engines Ltd

- H3X Technologies

- MagniX

- PBS Group

- Austro Engine

- L3Harris Technologies

- EDGE Group

- RTX Corporation

- Leonardo

Key Target Audience

- Defense ministries and armed forces

- Border security and surveillance agencies

- Aerospace and UAV manufacturers

- Propulsion system integrators

- Government procurement authorities

- Defense research organizations

- Investments and venture capital firms

- Saudi Arabian General Authority for Military Industries

Research Methodology

Step 1: Identification of Key Variables

Market boundaries, propulsion categories, and application scope were defined based on defense usage patterns and platform classifications. Key operational parameters influencing propulsion demand were identified through industry consultations.

Step 2: Market Analysis and Construction

Data was structured using platform-level deployment analysis, propulsion type adoption trends, and integration depth across UAV categories. Demand patterns were mapped using defense procurement and fleet expansion indicators.

Step 3: Hypothesis Validation and Expert Consultation

Findings were validated through interactions with industry professionals, defense engineers, and procurement specialists. Assumptions were refined based on technical feasibility and operational constraints.

Step 4: Research Synthesis and Final Output

Insights were consolidated through triangulation of qualitative and quantitative inputs. Final outputs were structured to reflect market dynamics, technology evolution, and strategic relevance.

- Executive Summary

- Research Methodology (Market Definitions and UAV propulsion system boundary setting, propulsion technology and platform segmentation framework, bottom-up and top-down market sizing using fleet and program data, revenue attribution across propulsion subsystems and lifecycle stages, primary validation with defense OEMs and UAV integrators in KSA, triangulation using procurement data and flight hour utilization, assumptions on localization and defense spending impacts)

- Definition and Scope

- Market evolution

- Usage and mission profiles

- Ecosystem structure

- Supply chain and localization dynamics

- Regulatory and defense procurement environment

- Growth Drivers

Rising defense modernization and localization initiatives

Increased deployment of UAVs for border surveillance

Government focus on indigenous aerospace manufacturing

Growing adoption of long-endurance UAV platforms

Integration of advanced propulsion for endurance optimization

Rising investment in unmanned combat capabilities - Challenges

Dependence on imported propulsion technologies

High development and certification costs

Thermal management and fuel efficiency limitations

Regulatory constraints on testing and deployment

Limited domestic supplier ecosystem

Maintenance and lifecycle cost complexity - Opportunities

Localization under Vision 2030 programs

Development of hybrid and electric propulsion systems

Export potential to regional defense markets

Public-private partnerships in UAV manufacturing

Integration of AI-driven propulsion management

Retrofit and upgrade opportunities for existing fleets - Trends

Shift toward hybrid-electric propulsion

Increased endurance and payload optimization

Localization of propulsion component manufacturing

Use of advanced materials and lightweight alloys

Adoption of predictive maintenance systems

Integration of propulsion with autonomous flight control - Government Regulations

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Value, 2020–2025

- By Volume, 2020–2025

- By Installed Base, 2020–2025

- By Average Selling Price, 2020–2025

- By Fleet Type (in Value %)

Fixed-wing UAVs

Rotary-wing UAVs

Hybrid VTOL UAVs

Tactical UAVs

MALE and HALE UAVs - By Application (in Value %)

ISR and surveillance

Combat and strike missions

Border security and patrol

Logistics and cargo delivery

Training and simulation - By Technology Architecture (in Value %)

Internal combustion engines

Turboprop and turbojet engines

Hybrid-electric propulsion

Fully electric propulsion

Hydrogen and alternative fuel propulsion - By End-Use Industry (in Value %)

Defense and military

Homeland security

Oil and gas monitoring

Critical infrastructure inspection

Research and testing institutions - By Connectivity Type (in Value %)

Line-of-sight controlled systems

Satellite communication enabled systems

Autonomous and semi-autonomous systems - By Region (in Value %)

Central Saudi Arabia

Western Saudi Arabia

Eastern Province

Southern Region

Northern Region

- Market structure and competitive positioning

- Market share snapshot of major players

- Cross Comparison Parameters (propulsion power output, fuel efficiency, system weight, endurance support, localization level, integration capability, lifecycle cost, after-sales support)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Detailed Profiles of Major Companies

Saudi Arabian Military Industries (SAMI)

Advanced Electronics Company (AEC)

Honeywell Aerospace

Safran Group

Rolls-Royce

Pratt & Whitney

MTU Aero Engines

UAV Engines Ltd

H3X Technologies

MagniX

PBS Group

Austro Engine

Rotax Aircraft Engines

EDGE Group

L3Harris Technologies

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- Post-purchase service expectations

- By Value, 2026–2035

- By Volume, 2026–2035

- By Installed Base, 2026–2035

- By Average Selling Price, 2026–2035