Market Overview

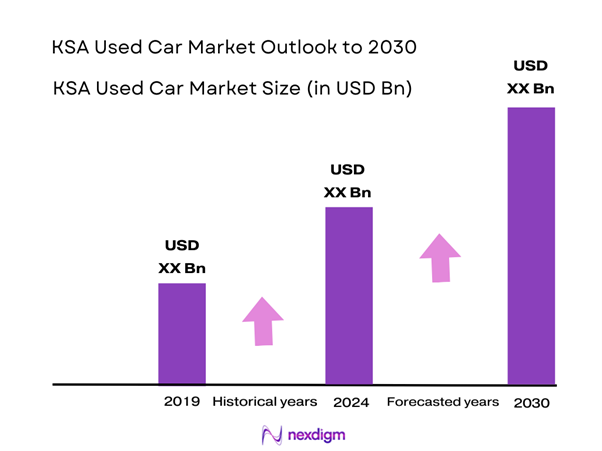

The KSA used car market is valued at approximately USD 9.60 Billion in 2024 with a Compound Annual Growth Rate (CAGR) of approximately 6.42% from 2024-2030, reflecting a robust growth trajectory driven by factors such as increasing disposable incomes and a rising middle class. The market has witnessed an influx of digital platforms catering to used car sales, expanding consumer access and facilitating transactions.

The dominant cities in the KSA used car market include Riyadh, Jeddah, and Dammam. Riyadh, being the capital and the largest city, benefits from a significant population and purchasing power, making it a central hub for vehicle transactions. Jeddah, with its strategic coastal location and thriving tourism sector, also supports a strong used car market, while Dammam serves as a critical industrial centre, further driving the demand for mobility solutions.

Market Segmentation

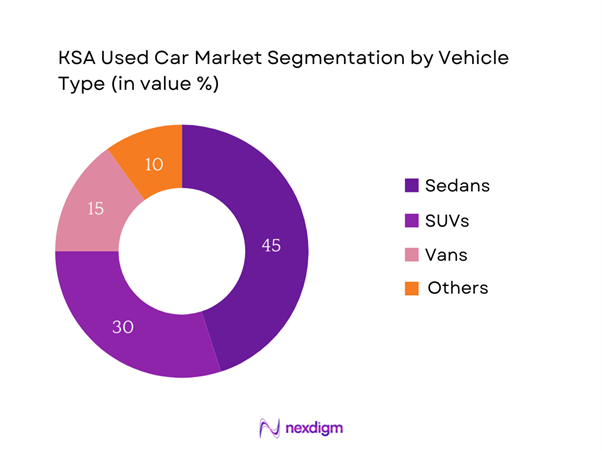

By Vehicle Type

The KSA used car market is segmented by vehicle type into sedans, SUVs, trucks, and vans. Among these segments, sedans dominate the market, primarily due to their affordability and fuel efficiency. As more consumers prioritize cost-effective transportation, sedans have gained traction as a favoured choice among first-time buyers. Additionally, brands manufacturing sedans have invested heavily in marketing and dealer networks, contributing to their strong presence in the market.

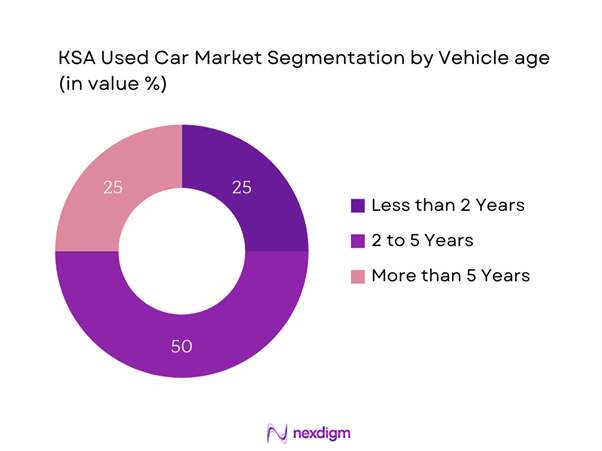

By Age of Vehicle

The market is further segmented by the age of the vehicle, including vehicles less than 2 years old, those between 2 to 5 years old, and those older than 5 years. The segment of vehicles aged 2 to 5 years is leading the market share due to their appeal as “like-new” vehicles. Consumers typically find these vehicles to provide a good balance between cost and reliability, representing a lower depreciation rate compared to newer or older cars. This segment has witnessed significant demand as buyers seek value without sacrificing quality.

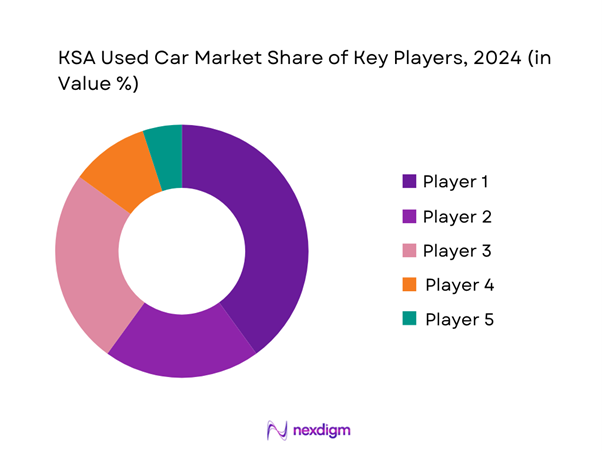

Competitive Landscape

The KSA used car market is dominated by a few major players, including Abdul Latif Jameel, Al-Futtaim Automotive, and local platforms such as CarSwitch and Haraj. This consolidation in the market highlights the influence of these key players, which benefit from established brand recognition and a sprawling distribution network. Their ability to adapt to consumer preferences and leverage technology for online transactions has solidified their competitive edge.

| Company | Establishment Year | Headquarters | Market Share | Number of Dealerships | Online Platform | Inventory Size | Customer Ratings | After-Sales Service |

| Abdul Latif Jameel | 1945 | Jeddah | – | – | – | – | – | – |

| Al-Futtaim Automotive | 1936 | Dubai | – | – | – | – | – | – |

| CarSwitch | 2016 | Riyadh | – | – | – | – | – | – |

| Haraj | 2015 | Jeddah | – | – | – | – | – | – |

| Syarah | 2018 | Riyadh | – | – | – | – | – | – |

KSA Used Car Market Analysis

Growth Drivers

Increasing Demand for Affordable Transportation

The increasing demand for affordable transportation is a driving factor in the KSA used car market. The Saudi Arabian population is projected to grow from approximately 35 million in 2022 to about 37.47 million by the end of 2025, contributing to rising transportation needs. Many citizens prefer used cars for their cost-effectiveness, primarily given the volatile new car market pricing. In 2024, approximately 50% of consumers reported considering used vehicles as an economical choice amidst economic pressures, reflecting a growing inclination toward cost-efficient transportation solutions.

Expanding E-commerce Platforms

The expansion of e-commerce platforms has transformed the used car buying experience in Saudi Arabia. The country’s digital economy is forecasted to reach USD 13 billion by end of 2025, according to MICT. With the proliferation of online platforms for vehicle sales, such as Haraj and Syarah, consumers have greater access to information and a broader marketplace to compare options. In 2023, an estimated 25% of used car transactions occurred online, showcasing the shift in consumer behavior towards digital purchasing methods, further stimulating market growth.

Market Challenges

Regulatory and Compliance Issues

Regulatory and compliance challenges pose significant hurdles to the KSA used car market. The Saudi Arabian government has imposed various regulations aimed at ensuring vehicle safety and environmental standards, which can add complexity and cost to the trading process. Currently, there are stringent requirements for vehicle inspections and emissions testing, as laid out by the Saudi Standards, Metrology and Quality Organization (SASO). The lack of uniformity in regulatory practices across different regions can lead to delays and increased operational challenges for businesses, thereby affecting market growth prospects.

Lack of Consumer Awareness

A notable challenge within the KSA used car market is the lack of consumer awareness regarding available options and benefits of used vehicles. Many prospective buyers may not fully understand the advantages of purchasing certified pre-owned cars or the risks associated with buying used vehicles from unverified sources. Educational initiatives and consumer awareness campaigns remain crucial in bridging this gap.

Opportunities

Digital Transformation in Sales Channels

The current digital transformation within sales channels presents a significant opportunity for the KSA used car market to flourish. The increase in internet penetration, projected to reach 99% by end of 2025, is driving more consumers to engage with online marketplaces for vehicle purchases. This shift toward digital platforms facilitates greater transparency, convenience, and accessibility for buyers. Additionally, the rise of fintech solutions, such as digital financing options, allows consumers to confidently navigate purchasing processes. The ongoing integration of technology into sales strategies positions used car dealers to capture a larger customer base effectively.

Expansion of Certified Pre-Owned Programs

The expansion of certified pre-owned (CPO) programs offers a promising opportunity for growth in the KSA used car market. CPO vehicles, which are inspected and come with warranties, provide consumers with added assurance regarding vehicle quality, which is paramount in a market where reliability is a key concern. In 2023, it was reported that CPO sales accounted for approximately 15% of total used car transactions, up from 10% in the previous year. This rise indicates a growing consumer preference for vehicles that come with guarantees, suggesting that further investment in CPO programs could lead to increased market share and heightened consumer confidence in used car purchases.

Future Outlook

Over the next five years, the KSA used car market is expected to experience significant growth, driven by continuous consumer demand for affordable vehicle options and the increasing presence of digital platforms transforming the purchasing experience. The integration of technology in the buying process, including the emergence of car subscription services and online marketplaces, is enhancing consumer convenience and trust. Furthermore, government initiatives aimed at boosting local mobility solutions are anticipated to further support market expansion. As citizens explore accessible vehicle options amid rising living costs, the trend towards purchasing used cars will likely continue to solidify its position within the broader automotive industry.

Major Players in the Market

- Abdul Latif Jameel

- Al-Futtaim Automotive

- CarSwitch

- Haraj

- Syarah

- AutoTrader KSA

- Xcite

- Motory

- Yelo Car Rental

- Aqarat

- CarBazaar

- Al-Jazirah Vehicles

- Bayut

- KSA Auto

- Al-Osais Group

Key Target Audience

- Automotive Dealerships

- Investment and Venture Capitalist Firms

- Government and Regulatory Bodies (Ministry of Commerce, Saudi Standards, Metrology and Quality Organization)

- Car Rental Agencies

- Fleets and Logistics Companies

- Online Marketplace Platforms

- Insurance Companies

- Auto Repair Shops

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the KSA used car market. This process utilizes extensive desk research and a combination of secondary and proprietary databases to gather detailed industry-level information. The primary objective here is to identify and define critical variables that affect market dynamics, including consumer preferences and competitive behavior.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data pertaining to the KSA used car market. This includes assessing market penetration rates, the ratio of marketplaces to service providers, and resulting revenue generation. Additionally, an evaluation of service quality statistics will be conducted to ensure the accuracy and reliability of revenue estimates and market insights.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and validated through consultations with industry experts representing a diverse range of companies. These discussions, conducted via computer-assisted telephone interviews (CATIs), will yield operational and financial insights directly from practitioners, helping refine and substantiate the collected market data.

Step 4: Research Synthesis and Final Output

The final phase involves engaging with multiple stakeholders within the used car segment to gain insights into product segments, sales performance, consumer preferences, and various other factors. This interaction seeks to validate and complement the statistics derived from the bottom-up approach, thus ensuring a comprehensive, accurate, and validated analysis of the KSA used car market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Overview Genisis

- Timeline of Major Players

- Business Cycle

- Supply Chain and Value Chain Analysis

- Growth Drivers

Rising Disposable Income

Increasing Demand for Affordable Transportation

Expanding E-commerce Platforms - Market Challenges

Regulatory and Compliance Issues

Lack of Consumer Awareness

Competition from New Cars - Opportunities

Digital Transformation in Sales Channels

Expansion of Certified Pre-Owned Programs - Trends

Increase in Online Sales Platforms

Rise of Car Subscription Services - Government Regulation

Vehicle Emission Standards

Import Tariffs

Consumer Protection Laws - SWOT Analysis

- Stake Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Vehicle Type (In Value %)

Sedans

– Compact Sedans

– Mid-size Sedans

– Full-size Sedans

SUVs

– Compact SUVs

– Mid-size SUVs

– Full-size SUVs

– Luxury SUVs

Vans

– Passenger Vans

– Mini Vans

– Commercial Vans

Others

– Pickup Trucks

– Coupes & Convertibles

– Hatchbacks

– Crossovers - By Age of Vehicle (In Value %)

Less than 2 Years

2 to 5 Years

More than 5 Years - By Sales Channel (In Value %)

Online Platforms

– Aggregator Marketplaces

– Certified Platform Sales

– Auction-Based Online Portals

Dealerships

– Authorized OEM-Backed Used Car Dealers

– Multi-brand Franchise Dealers

– Exhibition Showrooms

Auctions

– Insurance Recovery Auctions

– Bank Repo Auctions

– Commercial Vehicle Fleet Disposals

Others

– Corporate or Government Fleet Sales

– B2B Institutional Bulk Resale - By Region (In Value %)

Riyadh

Jeddah

Dammam

Khobar

Makkah

Others - By Fuel Type (In Value %)

Gasoline

Diesel

Electric - By Market Structure (In Value %)

Organized

– Certified dealers

– Digitally integrated players

– Warranty and finance availability

Unorganised

– Local dealerships

– C2C transactions

– Minimal documentation or guarantees

- Market Share of Major Authorized Dealers on the Basis of Value/Volume, 2024

- Business Landscape of Major Authorized Dealers (Business Model, Focus Area, Key Management, Vintage & Geographical Presence)

- Cross Comparison Parameters (Market Share, Revenue, Volume Sales, Inception Year, Number of Listings, Customer Service Rating, Average Selling Price (ASP), Inventory Turnover Ratio, Financing Options Offered)

- SWOT Analysis of Major Players

- Detailed Profiles of Major Companies

Abdul Latif Jameel

Al-Futtaim Automotive

Yelo Car Rental

Mawarid Group

Al-Jazirah Vehicles

KSA Auto

CarSwitch

Dubizzle KSA

Syarah

Al-Habtoor Group

Bayut

AutoTrader KSA

Motory

Haraj

Al-Osais Group

- Market Demand and Utilization

- Purchasing Power and Budget Allocations

- Regulatory and Compliance Requirements

- Needs, Desires, and Pain Point Analysis

- Decision Making Process

- By Value, 2024-2030

- By Volume, 2024-2030

- By Average Price, 2024-2030

- TAM/SAM/SOM Analysis

- Customer Cohort Analysis

- Marketing Initiatives

- White Space Opportunity Analysis