Market overview

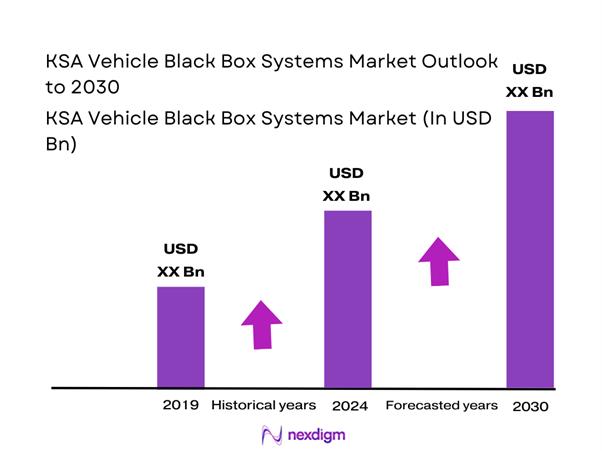

The KSA vehicle black box systems market is valued at USD ~ million, anchored in the rising deployment of embedded connectivity modules and telematics stacks across connected vehicles and fleets. This builds on a broader mobility digitization baseline where transportation technology spending reached USD ~ million in the prior year, expanding demand for always-on data capture, location intelligence, and in-vehicle event logging. As fleets scale, black box systems become foundational for compliance workflows, incident evidence, utilization tracking, and predictive maintenance.

Demand concentrates in Riyadh, Jeddah, and Dammam/Eastern Province because these corridors host the densest mix of enterprise fleets, logistics hubs, ride-hailing activity, and industrial transport. Riyadh’s central role in national administration and enterprise headquarters accelerates procurement cycles for compliance-grade IVMS. Jeddah’s trade and port-linked distribution intensifies long-haul and last-mile monitoring needs. The Eastern Province’s industrial and energy ecosystem sustains heavy-duty vehicle monitoring, safety logging, and auditability requirements across contractors and transport operators.

Market segmentation

By System Type / Data Capture Mode

In KSA, hardwired telematics/TCU “black box” units typically dominate deployments because they best match the country’s high-utilization commercial fleet reality—logistics, construction support fleets, utilities, and multi-shift operations—where operators need durable hardware, tamper resistance, and consistent data capture across long routes and harsh operating conditions. A fixed black box also enables CAN-bus capture (fuel behavior proxies, engine hours, idling, harsh braking) that is harder to standardize with plug-in devices across mixed vehicle makes. Enterprises prioritize audit-grade data trails for safety governance and operational accountability, making hardwired units the default in large tenders. As connected-vehicle penetration rises, embedded modules further reinforce this dominance by lowering friction for OEM-connected deployments and recurring platform subscriptions.

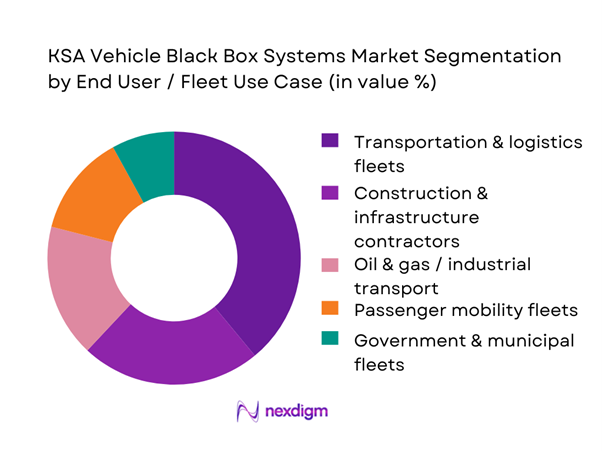

By End User / Fleet Use Case

Transportation & logistics fleets typically lead KSA black box demand because they convert telematics data into immediate, measurable operational control: route adherence, dwell-time reduction, utilization discipline, and incident evidence. Saudi logistics networks span dense urban delivery plus long-distance motorway routes, creating high exposure to driver behavior risk and high value from real-time visibility. Logistics operators also face tighter service-level expectations from enterprise customers, pushing adoption of proof-of-service telemetry, geo-fencing, and exception alerts. Where video telematics is added, it strengthens claims defensibility and driver coaching loops—particularly valuable in mixed subcontractor models. As Saudi mobility digitization expands and connected-car infrastructure grows, the logistics segment is structurally positioned to scale deployments faster than smaller owner-operator fleets due to centralized procurement and standardized fleet policies.

Competitive landscape

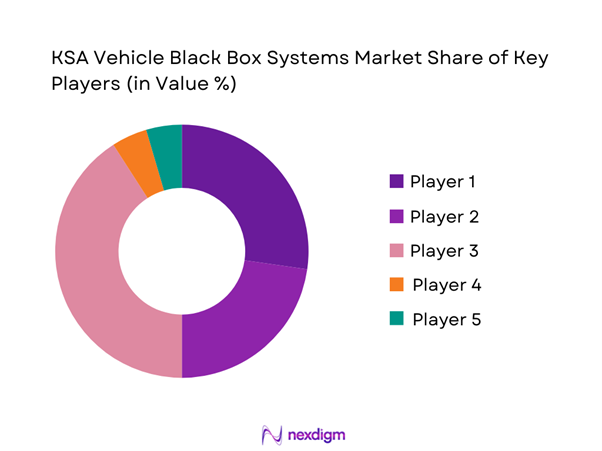

The KSA vehicle black box systems market is shaped by a mix of global telematics platforms (analytics, device management, integrations) and regional/system integrators that win contracts through local deployment capability, Arabic support, compliance packaging, and partnerships with telecom operators and fleet service networks. Competitive differentiation increasingly depends on video + telemetry fusion, AI event detection, API-first integrations, and enterprise-grade data governance, rather than basic tracking alone.

| Company | Est. Year | HQ | KSA go-to-market | Black box device model | Video telematics | Analytics depth | Integration (APIs/ERP/TMS) | Typical winning fleets |

| Geotab | 2000 | Canada | ~ | ~ | ~ | ~ | ~ | ~ |

| Verizon Connect | 2001 | USA | ~ | ~ | ~ | ~ | ~ | ~ |

| Samsara | 2015 | USA | ~ | ~ | ~ | ~ | ~ | ~ |

| Teletrac Navman | 1988 | USA/UK (brand heritage) | ~ | ~ | ~ | ~ | ~ | ~ |

| MiX Telematics | 1996 | South Africa | ~ | ~ | ~ | ~ | ~ | ~ |

KSA Vehicle Black Box Systems Market Analysis

Growth Drivers

TGA compliance driven adoption

The Transport General Authority (TGA) mandates OEM-level telematics and certified tracking devices for commercial fleets, requiring real-time logging of route accuracy, axle-load, and engine health variables that closely align with black box systems used for compliance monitoring. TGA regulation applies to logistics, public transport, and freight networks under land transport licensing frameworks, compelling operators to integrate digital data capture to maintain licensure and avoid sanctions. Saudi road freight transport was valued at USD ~ billion, reflecting scale in monitored logistics activity. This regulatory foundation accelerates installation of black box systems that fulfil both oversight and enforcement needs across fleet operations.

Fleet digitalization under Vision programs

Saudi Arabia’s Vision 2030 and related digital strategy have driven broad ICT uptake across transportation networks, enhancing demand for connected vehicle solutions like black box systems that support telemetry, safety analytics, and real-time visibility. Official national development policies position digital mobility as key to economic diversification, and national surveys show broad institutional adoption of ICT infrastructure across public and private sectors. The Kingdom’s GDP reached USD ~ billion in current US dollars, indicating macroeconomic capacity to invest in technology-driven fleet upgrades. These digital initiatives reinforce operational transparency, predictive maintenance, and performance optimization—core capabilities delivered by vehicle black box systems.

Challenges

Personal data protection compliance burden

Saudi Arabia’s Personal Data Protection Law (PDPL), effective from ~, imposes stringent controls on the collection, processing, and retention of personal and sensitive data—an area directly relevant for in-vehicle systems that capture driver behavior, camera footage, and location history. PDPL aligns with global best practices and necessitates structured data classification, explicit lawful bases, and secure handling of personal identifiers, increasing compliance overhead for operators deploying black box solutions. Regulators require organizations to demonstrate robust data governance measures, including data minimization, purpose limitation, and secure storage, to mitigate the risk of privacy breaches. These legal imperatives shape how black box data pipelines are architected and managed, demanding investment in secure data workflows that meet PDPL criteria.

Cybersecurity compliance and certification costs

Saudi cybersecurity expenditure reflects broad technology security priorities, with the national market valued at SAR ~ billion (USD ~ billion) at the end of ~ across both products and services, including network defenses, endpoint solutions, and data protection frameworks. Black box systems that connect to telematics platforms and cloud infrastructures must adhere to National Cybersecurity Authority (NCA) Essential Cybersecurity Controls (ECC) standards, requiring structured risk assessments, hardening controls, and continuous auditing. Certifications involve resource commitments for device security, secure telemetry channels, encryption at rest and in transit, and resilience against tampering—adding to implementation costs for operators. Aligning with ECC helps mitigate cyber threats but demands cross-disciplinary investment, especially for mixed fleet inventories.

Opportunities

AI video analytics and real-time risk scoring

Black box systems equipped with artificial intelligence analytics can process multi-camera feeds and telemetry streams to generate actionable safety insights, enabling automated detection of distracted driving, harsh events, and unsafe patterns. Macroeconomic digital infrastructure adoption under Vision ~ supports increased utilization of AI and IoT technologies, with national ICT frameworks driving investment in real-time data platforms. Leveraging AI models to score risk behavior in real time enhances insurer collaborations, strengthens safety programs, and fosters proactive interventions at operator scale. As fleet digital capabilities expand and computing costs decline, AI-augmented video telematics presents a clear avenue to extend black box value beyond compliance to continuous risk mitigation.

Fatigue and distraction monitoring systems

Integrating fatigue and distraction monitoring—such as eye closure detection, head pose analysis, and focus metrics—with black box telemetry creates a safety-first paradigm for fleet management. As traffic density and logistics volumes grow, multi-modal sensing can reduce incident rates and inform targeted coaching programs. Saudi Arabia’s GDP of USD ~ billion reflects the scale of mobility economic activity where safety investment is justified to protect human capital and assets. Fatigue monitoring data enhances regulatory reporting and operator risk profiles, feeding into insurer adjustments and compliance narratives. These systems, augmented by centralized analytics, strengthen operational performance and reduce absenteeism from crash-related disruptions.

Future outlook

Over the next few years, KSA’s vehicle black box systems demand is expected to expand as fleets digitize operations and compliance, and as connected-vehicle penetration increases. The market’s center of gravity will move from “tracking” to safety-grade, evidence-ready monitoring, where video, driver coaching, and automated incident workflows become standard. Saudi Arabia’s connected car revenue trajectory—from USD ~ million toward USD ~ million—signals a larger embedded connectivity foundation that black box solutions can ride on via OEM and aftermarket channels.

Major players

- Geotab Inc.

- Verizon Connect

- Fleet Complete

- Teletrac Navman

- Omnicomm

- Webfleet

- Gurtam

- MiX Telematics

- Samsara

- Fleetio

- Motive

- Inseego Corp.

- Ctrack

- Navman Wireless

Key target audience

- Fleet owners & transport operators

- Logistics and supply chain heads

- Construction and infrastructure fleet managers

- Oil & gas / industrial transport compliance teams

- Auto rental and mobility fleet operators

- Insurance companies & fleet risk underwriters

- Investments and venture capitalist firms

- Government and regulatory bodies

Research methodology

Step 1: Identification of Key Variables

We construct an ecosystem map covering OEM-connected modules, aftermarket black box devices, video telematics stacks, installers, telecom enablers, and platform providers. Desk research consolidates device types, compliance workflows, and procurement patterns to define variables such as installed base drivers, data-criticality, and integration intensity.

Step 2: Market Analysis and Construction

We compile historical demand indicators linked to connected-vehicle enablement, fleet digitization, and transportation technology spending. This phase structures the market into hardware + platform revenue streams and maps adoption by end-user clusters (logistics, industrial, mobility fleets) to build the bottom-up logic.

Step 3: Hypothesis Validation and Expert Consultation

We validate assumptions through CATIs with fleet operations heads, telematics installers, platform partners, and safety/compliance stakeholders. Inputs focus on device attach rates, subscription behaviors, camera penetration, replacement cycles, and tender requirements that shape real-world revenue realization.

Step 4: Research Synthesis and Final Output

We triangulate findings with operator interviews and vendor/distributor feedback to confirm segment logic, competitive positioning, and adoption barriers. The output is finalized after consistency checks across value chain layers—device supply, installation capacity, platform activation, and enterprise renewal behavior.

- Executive Summary

- Research Methodology (Market definitions and scope boundaries, assumptions, abbreviations, market sizing framework, triangulation logic, primary interview design including fleet operators, OEMs, insurers, regulators and system integrators, channel validation across fitment networks telecom operators and cloud providers, validation of device shipments versus active subscriptions, limitations and confidence grading)

- Definition and Scope

- Market Genesis and Evolution

- Ecosystem Snapshot

- Operating Model Landscape

- KSA Demand Centers

- Growth Drivers

TGA compliance driven adoption

Fleet digitalization under Vision programs

Insurance claims efficiency requirements

High risk corridor monitoring

Adoption of multi camera evidence systems - Challenges

Personal data protection compliance burden

Cybersecurity compliance and certification costs

Installation quality variability

Driver acceptance and monitoring resistance

Data hosting and localization constraints - Opportunities

AI video analytics and real time risk scoring

Fatigue and distraction monitoring systems

Overload and weight sensing integrations

API based insurer partnerships

OEM and aftermarket solution bundling - Trends

AI enabled dashcams

Real time driver risk scoring

Event triggered video policies

Multi sensor data fusion

Tamper detection and secure evidence chains - Regulatory & Policy Landscape

- SWOT Analysis

- Stakeholder & Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competitive Intensity & Ecosystem Mapping

- By Value, 2019–2024

- By Volume, 2019–2024

- By Active Subscriptions, 2019–2024

- By ARPU and ASP Benchmarks, 2019–2024

- By Replacement Cycle and Refresh Mix, 2019–2024

- By Fleet Type (in Value %)

Heavy trucks and trailers

Buses and coaches

Light commercial vehicles

Taxis limousines and ride hailing fleets

Passenger vehicles - By Application (in Value %)

Safety and driver behavior monitoring

Regulatory compliance and route monitoring

Incident evidence and insurance claims support

Cargo and asset condition monitoring

Overload axle load and weight monitoring - By Technology Architecture (in Value %)

Event data recorders

IVMS telematics control units

MDVR and multi camera video systems

AI dashcams and driver monitoring systems

Multi sensor gateway systems - By Connectivity Type (in Value %)

Cellular 4G and 5G

Dual SIM multi operator connectivity

Satellite and hybrid connectivity

Wi Fi offload and depot synchronization

Edge storage first versus cloud first architectures - By End-Use Industry (in Value %)

Logistics and freight transport

Public and regulated passenger transport

Oil and gas and industrial fleets

Government and municipal fleets

SMEs and owner operators - By Region (in Value %)

Central Region

Western Region

Eastern Region

Southern Region

Northern Region

- Competitive landscape snapshot

Market share mapping by active connected base - Cross Comparison Parameters (TGA compliance readiness, device tamper detection and evidence integrity, video architecture and channel capability, connectivity resilience and buffering, cybersecurity posture aligned to national standards, PDPL operationalization capability, local fitment and after sales footprint, integration breadth with fleet and insurer systems)

- Competitive strategy matrix

- SWOT analysis of major players

- Go to market and channel benchmarking

- Detailed Profiles of Major Companies

DSCO

Location Solutions

Perfect Vision KSA

FMS International

Speedotrack

TrackingME

Trkify

Teltonika

Queclink

Ruptela

Geotab

Verizon Connect

Samsara

Webfleet

MiX Telematics

- Buying center and stakeholder mapping

- Tendering and procurement patterns

- Decision criteria weighting

- Pain points and jobs to be done

- Adoption playbooks by fleet size

- By Value, 2025–2030

- By Volume, 2025–2030

- By Active Subscriptions, 2025–2030

- By ARPU and ASP Trajectory, 2025–2030

- By Replacement and Upgrade Mix, 2025–2030