Market Overview

The KSA Vehicle Occupant Detection Systems market is valued at USD ~ million with an indicated CAGR of ~ on the same source page; that source reports the figure as the KSA “Vehicle Occupancy Detection System” market. For demand context, Saudi Arabia recorded ~ total motor vehicle sales in the latest year, up from ~ in the prior year, which expands the new-vehicle base where ODS/OCS features are bundled into airbag/seat/ADAS electronics.

Dominant demand centers are Riyadh, Makkah, and the Eastern Province, because these regions concentrate new registrations, large employer fleets, higher trim-mix purchases, and dealer/OEM service networks that accelerate adoption of safety features integrated into seats, airbags, and body controllers. The national parc is also expanding—Saudi official road-transport statistics report over ~ registered vehicles in use, and more than ~ newly registered vehicles in the latest year—supporting a larger addressable installed base for service, calibration, and retrofit-related sensing modules.

Market Segmentation

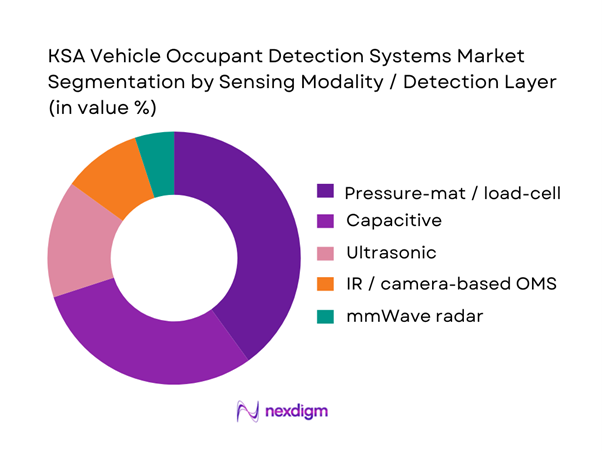

By Sensing Modality / Detection Layer

Pressure-mat/load-cell seat sensing is typically the dominant architecture in KSA fitment for occupant classification/airbag suppression use cases because it is deeply embedded in the seat supply chain and validated across harsh operating conditions (high cabin heat, dust, long idle hours). It also aligns with how many OEMs package safety electronics: seat-integrated sensing tied to airbag ECUs, restraint controllers, and seatbelt reminders, which reduces integration friction at dealerships and service centers. In KSA, where the new-vehicle base continues to expand (motor vehicle sales rising to ~ units in the latest year), OEMs and Tier-1s prioritize proven sensing stacks that minimize warranty exposure and calibration complexity while meeting safety feature expectations on popular SUV and sedan trims.

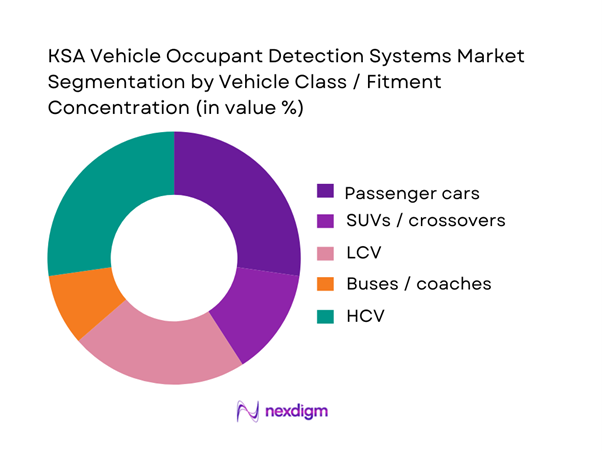

By Vehicle Class / Fitment Concentration

SUVs/crossovers tend to dominate occupant detection system value in KSA because the market’s purchase mix is skewed toward higher-trim, feature-rich SUVs that bundle multiple in-cabin electronics: advanced restraint controllers, multi-airbag configurations, and seat modules (powered seats, seatbelt reminders, occupant classification). These trims pull through more sensing content per vehicle—seat-integrated mats/load cells, seatbelt buckle sensing, and increasingly sensor-fusion hooks into body control/ADAS ECUs. Demand is reinforced by the country’s large and growing registered-vehicle base (over ~ vehicles in use) and strong annual new registrations (over ~ newly registered vehicles), which concentrates premium-feature adoption in major metros where dealer networks can support diagnostics and calibration.

Competitive Landscape

The KSA Vehicle Occupant Detection Systems market is effectively an OEM/Tier-1 dominated space: occupant detection is rarely bought as a standalone commodity; it is bundled into seats + restraints (airbags/ECU) + in-cabin sensing stacks, with revenue captured through global supply contracts and localized distribution/service partners. KSA demand is therefore shaped by which Tier-1 seat/restraint and electronics suppliers are nominated by OEMs active in the Kingdom, and by the depth of authorized service capabilities in Riyadh, Jeddah, Dammam/Khobar.

| Company | Est. Year | HQ | Core ODS/OCS Offering Focus | Primary Sensing Stack | OEM/Tier-1 Role | Typical Integration Point | Diagnostics & Calibration Support | Local Presence Lever (KSA) |

| Continental | 1871 | Germany | ~ | ~ | ~ | ~ | ~ | ~ |

| Bosch | 1886 | Germany | ~ | ~ | ~ | ~ | ~ | ~ |

| ZF | 1915 | Germany | ~ | ~ | ~ | ~ | ~ | ~ |

| Denso | 1949 | Japan | ~ | ~ | ~ | ~ | ~ | ~ |

| Aptiv | 1994 | Ireland/USA | ~ | ~ | ~ | ~ | ~ | ~ |

KSA Vehicle Occupant Detection Systems Market Analysis

Growth Drivers

New Vehicle Safety Feature Penetration

Saudi Arabia’s vehicle parc is expanding fast enough to “pull through” more occupant-detection content per vehicle (seat-belt reminder logic, passenger classification for airbag suppression, and cabin sensing add-ons). Administrative road-transport data shows registered and roadworthy vehicles rose from ~ to ~ units across the latest two readings, while newly issued driving licenses increased from ~ to ~ in the same period—two direct indicators that new vehicle inflow and first-time drivers are rising simultaneously. For suppliers, higher annual inflow means more opportunities to spec occupant-detection architectures (seat weight mats, pressure sensors, seat-track position sensors, buckle/pretensioner signal fusion, or short-range radar) at the OEM/Tier-1 sourcing stage rather than only aftermarket. The macro backdrop supports continued consumer mobility demand: Saudi Arabia’s GDP is USD ~ and population is ~, which sustains high passenger-vehicle utilization and replacement cycles, especially in large metro regions where licensing issuance is concentrated.

Rising SUV and Multi-Row Vehicle Sales

Occupant detection becomes more “mission critical” as the fleet shifts toward SUVs and multi-row vehicles, because these platforms increase the number of seating positions, child-seat use cases, and the need for robust passenger classification (front passenger airbag enable/disable, rear-seat occupancy checks, and alert logic). Saudi road-transport indicators show ~ registered roadworthy vehicles and over ~ first-time driving licenses—two signals that household vehicle access and driver base are broadening, which typically correlates with higher demand for family-oriented body styles (SUVs/7-seaters) in large urban corridors. In multi-row cabins, OEMs tend to add more sensing nodes (seat-occupied status per row, belt status per seat, seat-track/seatback angle signals, and—on higher trims—cabin radar/camera overlays) to meet safety expectations and reduce airbag deployment risk. The macro environment also enables sustained new-vehicle financing and purchase capacity: GDP per capita is USD ~ and inflation is ~ (consumer prices), supporting affordability in the mass and mid-premium segments where SUVs dominate showroom mix.

Challenges

Sensor Drift Under Heat and Humidity

Saudi operating conditions stress occupant detection hardware because long-duration heat soak and thermal cycling can shift sensor baselines (seat weight mats, pressure sensors, and certain capacitive/strain-based elements), increasing false positives/negatives unless compensation and validation are robust. This is commercially important because the installed base is large—~ registered roadworthy vehicles—and new inflow is strong, meaning any systemic drift issue scales quickly across the parc. Climate risk signals for the region include recurring extreme heat episodes exceeding ~, which accelerates polymer aging, adhesive creep, connector fretting, and EMC noise susceptibility—factors that can degrade occupant classification stability over time. Road-safety outcomes increase the stakes: with ~ serious accidents and ~ fatalities recorded in the latest road-transport statistics, regulators, OEMs, and insurers are less tolerant of safety-sensor degradation that could impair restraint systems. The macro environment supports higher utilization (and therefore higher thermal exposure hours): Saudi Arabia’s population is ~ and GDP USD ~, sustaining high vehicle-kilometers in major urban corridors. For suppliers, this drives the need for KSA-specific validation plans: hot-soak cycles, cabin temperature mapping, long-term drift modeling, and diagnostic thresholds that remain stable across trim variants and seat foam suppliers.

Calibration and Diagnostic Capability Gaps

Occupant detection systems are only as reliable as their calibration and service ecosystem. As the market shifts toward multi-sensor fusion (seat occupancy + buckle + seat position + radar/camera overlays), workshop capability becomes a constraint: incorrect seat replacement, poor harness handling, or missing calibration routines can cause persistent DTCs, airbag warning lamps, or misclassification of occupants. The scale of the challenge is tied to fleet growth indicators: ~ first-time licenses and ~ registered vehicles imply growing service demand and a larger population of technicians required to support modern safety electronics. Road-safety pressure is substantial—~ injuries and ~ serious accidents—so OEMs and regulators will increasingly expect consistent diagnostic standards, not “best effort” repairs. This matters most in mid-market vehicles where owners may seek non-dealer repairs, raising the odds of calibration shortcuts. From a systems perspective, suppliers must design for serviceability: self-diagnostics, clear fault isolation (seat mat vs buckle vs ECU vs harness), and stable recalibration procedures that can be executed with standardized tooling. Macro stability supports broader aftersales investment: GDP per capita USD ~ and inflation ~ help sustain dealership and authorized-service expansion, but capability still lags feature complexity without targeted training.

Opportunities

Child Presence Detection Upgrades

A large and growing vehicle parc creates a meaningful retrofit and upgrade runway for child presence detection (rear-seat occupancy alerts, door-open reminders, and cabin presence logic tied to vehicle locking and HVAC states). Saudi road-transport data indicates ~ registered roadworthy vehicles and ~ first-time licenses, pointing to a high “family mobility” footprint and sustained vehicle usage across households. Public enforcement framing also supports the opportunity: authorities explicitly categorize “non-using safety seats meant for children” as a traffic violation, which elevates child safety into a compliance conversation and supports OEM messaging around occupant detection as part of a broader child-safety stack. Insurance ecosystem growth is another tailwind: gross written premiums rose from SAR ~ to SAR ~, enabling more structured safety-linked underwriting and partnerships that can accelerate adoption of cabin-alert features. Critically, current road outcomes are severe enough to keep attention high—~ fatalities and ~ injuries—so stakeholders (OEMs, fleets, insurers, regulators) have a strong rationale to promote solutions that reduce preventable harm without relying on future forecasts. For vendors, the near-term opportunity is to package robust, heat-tolerant sensing modules with clear diagnostics and low false-alarm rates, suitable for KSA thermal conditions and multi-row cabins.

In-Cabin Radar and Camera Fusion

Fusion of short-range radar and in-cabin cameras can move occupant detection beyond seat-based sensing to “whole-cabin awareness” (rear-seat occupancy, occupant posture, seat-belt usage verification, and potentially driver monitoring integration). Saudi Arabia’s scale supports these deployments: ~ registered vehicles and ~ serious accidents define a market where safety technology can deliver measurable operational value in risk reduction and claims avoidance. The climate context reinforces the case for radar-assisted sensing—extreme heat episodes above ~ are harsh on purely mechanical/pressure-based sensors, so radar can provide redundancy and reduce dependence on seat-foam drift alone. Digitization readiness also supports connected feature rollouts: internet usage is ~ (latest value), enabling app-linked alerts and OTA feature refinement where OEM platforms support it. From an ecosystem standpoint, growing insurance sector capacity (premiums rising to SAR ~) can enable partnerships that push advanced cabin safety packages into fleets and high-utilization users first, then into retail trims. The opportunity is “current-stats-backed” because the installed base and road-safety burden are already large; suppliers that can demonstrate low false positives in hot cabins, robust night performance, and strong privacy-by-design will be best positioned for rapid program wins in the Kingdom.

Future Outlook

Over the next planning cycle, KSA occupant detection demand is expected to rise as OEMs increase standard safety packaging, add higher-content seat and restraint electronics on popular trims, and expand in-cabin sensing beyond “seat occupied” into occupant classification, child presence detection, and driver/occupant monitoring adjacencies. Globally, driver and occupant monitoring is expanding quickly (one widely cited industry estimate values the broader driver & occupant monitoring market at USD ~ and projects growth), and that momentum typically pulls KSA adoption via imported models and Tier-1 platform rollouts.

Major Players

- Continental

- Bosch

- ZF

- Denso

- Aptiv

- Autoliv

- Valeo

- Forvia

- Lear Corporation

- Hyundai Mobis

- Magna International

- Joyson Safety Systems

- NXP Semiconductors

- Infineon Technologies

Key Target Audience

- OEM regional offices and national distributors

- Tier-1 seat system suppliers

- Tier-1 restraint & airbag ECU suppliers

- Automotive electronics importers & authorized parts distributors

- Fleet operators and corporate mobility buyers

- Insurance companies and motor underwriters

- Investments and venture capitalist firms

- Government and regulatory bodies

Research Methodology

Step 1: Identification of Key Variables

We construct the KSA occupant detection ecosystem map across OEMs, Tier-1s, distributors, and service networks. We compile variables such as vehicle parc growth, new registrations, trim-mix, seat electronics content, and calibration/service constraints using validated secondary sources and industry databases.

Step 2: Market Analysis and Construction

We analyze the demand stack by mapping: (a) new-vehicle sales volumes, (b) feature penetration of occupant sensing in top-selling segments, and (c) Tier-1 nomination pathways that determine which systems flow into KSA imports and locally serviced fleets.

Step 3: Hypothesis Validation and Expert Consultation

We validate fitment and pricing logic through CATIs with dealer service heads, Tier-1 channel partners, and seat/restraint electronics installers to confirm calibration loads, failure modes, warranty policies, and sourcing lead-times.

Step 4: Research Synthesis and Final Output

We synthesize findings using triangulation: aligning top-down (vehicle parc and sales) with bottom-up (BOM-level electronics content and Tier-1 shipment logic), and reconciling differences through expert review and model-level feature audits.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Abbreviations, Scope Boundary for Occupant Classification Detection and Child Presence, Market Sizing Approach Using Vehicle Parc and Bottom-Up Unit Shipments, Price Build-Up Method Including Sensor ECU Integration and Validation, Primary Research with OEMs Tier-1s Dealers Fleets Workshops, Secondary Research Using Regulatory and OEM Sources, Data Triangulation and Validation Logic, Bias Controls and Outlier Treatment, Limitations and Future Conclusions)

- Definition and Scope

- Market Genesis and Adoption Path in KSA

- KSA Passenger Safety Technology Context

- Business Cycle and Replacement and Refresh Dynamics

- Vehicle Safety and Compliance Landscape Touchpoints

- Growth Drivers

New Vehicle Safety Feature Penetration

Rising SUV and Multi-Row Vehicle Sales

Fleet Safety Compliance Requirements

Integration with ADAS and In-Cabin Monitoring

Child Safety Awareness and Insurance Influence - Challenges

Sensor Drift Under Heat and Humidity

Calibration and Diagnostic Capability Gaps

Counterfeit and Grey Market Components

Validation and Integration Cost Burden

Mid-Segment Vehicle Price Sensitivity - Opportunities

Child Presence Detection Upgrades

In-Cabin Radar and Camera Fusion

Dealer Service Attach and Upgrade Programs

Fleet Retrofit Safety Solutions

Localization and Regional Assembly Pathways - Trends

Cabin Monitoring System Adoption

Radar-Based Micro-Motion Detection

AI-Based Occupancy Classification

OTA-Enabled Algorithm Updates

Privacy-by-Design Cabin Sensing - Regulatory & Policy Landscape

- SWOT Analysis

- Stakeholder & Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competitive Intensity & Ecosystem Mapping

- By Value, 2019–2024

- By Units, 2019–2024

- By Average System ASP, 2019–2024

- By Technology Architecture (in Value %)

Pressure and Weight Mat Sensing

Capacitive and Field Sensing

In-Cabin Camera Based Monitoring

In-Cabin Radar Based Detection

Sensor Fusion Systems - By Application (in Value %)

Occupant Classification for Airbag Suppression

Seatbelt Reminder and Buckle Status Trigger

Child Presence Detection and Rear Seat Alert

Occupant Position and Out-of-Position Detection

Multi-Row Occupancy Detection - By Fleet Type (in Value %)

Passenger Cars

SUVs and CUVs

Light Commercial Vehicles

Buses and Coaches

Specialty and Off-Road Vehicles - By End-Use Industry (in Value %)

OEM Factory Fitment

Port or Distributor Installation

Aftermarket Retrofit

Software and Algorithm Upgrade Driven Systems

Replacement Parts and Service Components - By Region (in Value %)

Central Region

Western Region

Eastern Region

Northern Region

Southern Region

- Market Share Snapshot by Value and Units

- Cross Comparison Parameters (Sensor Modality Breadth, OCS Algorithm Robustness and Misclassification Rate, Child Presence Detection Capability, Heat and Drift Stability, Integration Footprint with Vehicle ECUs and Networks, Validation and Compliance Toolchain Strength, Failure Rate and Warranty Exposure, KSA Serviceability and Diagnostics Support)

- SWOT of Major Players

- Pricing and BOM Benchmarking

- Detailed Profiles of Major Companies

Robert Bosch GmbH

Continental AG

ZF Friedrichshafen AG

Autoliv Inc.

Aptiv PLC

Valeo SA

DENSO Corporation

Hyundai Mobis

Joyson Safety Systems

Magna International

Forvia

Lear Corporation

TE Connectivity

NXP Semiconductors

- Demand and Utilization Patterns

- Procurement and Budget Logic

- Compliance and Liability Considerations

- Needs and Pain Point Assessment

- Decision-Making Workflow

- By Value, 2025–2030

- By Units, 2025–2030

- By Average System ASP, 2025–2030