Market Overview

The KSA Vehicle-to-Everything (V2X) communication market is valued at USD ~ million in 2025 and is expected to grow rapidly as the demand for smart transportation systems increases across the country. This growth is fueled by the government’s efforts to promote autonomous vehicles, improve road safety, and transition to smart cities. The market is largely driven by technological advancements in cellular communication and the rollout of 5G networks, which provide the necessary infrastructure for V2X solutions. Additionally, the government’s Vision 2030 initiative, focused on digital infrastructure and sustainability, contributes significantly to this market’s growth trajectory.

The cities that dominate the V2X communication market in Saudi Arabia are Riyadh, Jeddah, and Dammam. Riyadh, being the capital, is the epicenter of governmental initiatives and infrastructure investments, which drive the adoption of V2X technologies. Jeddah, as a major commercial and tourist hub, is an essential player in the deployment of smart mobility solutions. Dammam, located in the Eastern Province, benefits from its proximity to major industrial zones and ports, making it a focal point for both public transportation and commercial fleets looking to integrate V2X communication systems.

Market Segmentation

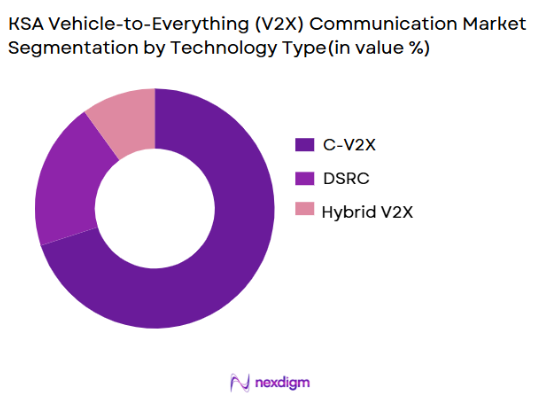

By Technology Type

The KSA V2X communication market is primarily segmented into C-V2X, DSRC, and hybrid V2X technologies. Among these, Cellular Vehicle-to-Everything (C-V2X) technology currently dominates the market due to its scalability and the broader deployment of 5G networks, which offer faster and more reliable data transmission essential for real-time vehicle-to-vehicle (V2V) and vehicle-to-infrastructure (V2I) communication. C-V2X’s growing adoption is further supported by telecom partnerships and governmental support for its integration into the country’s smart city initiatives.

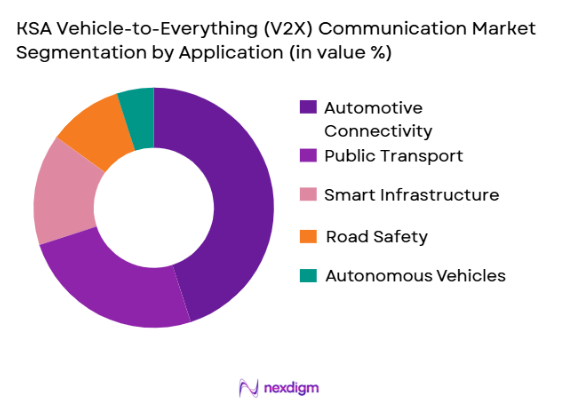

By Application

The V2X communication market in KSA is also segmented by its application into automotive connectivity, public transport, smart infrastructure, road safety, and autonomous vehicle operations. The automotive connectivity segment holds the largest market share, primarily driven by the integration of V2X communication in modern passenger vehicles. As automotive manufacturers continue to integrate V2X technology to enable real-time communication between vehicles and road infrastructure, this segment’s dominance is expected to persist. V2X-enabled vehicles improve safety by preventing accidents and reducing traffic congestion, making them highly attractive to consumers and fleets.

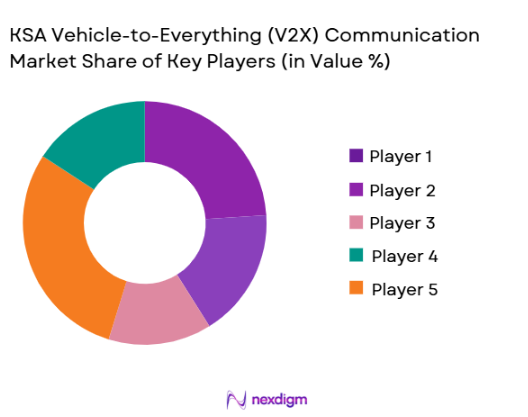

Competitive Landscape

The KSA V2X communication market is dominated by a combination of global technology giants and local players, reflecting the increasing demand for advanced communication technologies in the automotive and infrastructure sectors. Leading companies in this market include Qualcomm, Huawei, NXP Semiconductors, Cohda Wireless, and Ericsson. These players are focusing on strategic partnerships with both local government agencies and private enterprises to expand their presence in the market.

| Company | Establishment Year | Headquarters | Technology Focus | Strategic Alliances | Market Presence | R&D Investment |

| Qualcomm | 1985 | San Diego, USA | ~ | ~ | ~ | ~ |

| Huawei | 1987 | Shenzhen, China | ~ | ~ | ~ | ~ |

| NXP Semiconductors | 2006 | Eindhoven, Netherlands | ~ | ~ | ~ | ~ |

| Cohda Wireless | 2007 | Adelaide, Australia | ~ | ~ | ~ | ~ |

| Ericsson | 1876 | Stockholm, Sweden | ~ | ~ | ~ | ~ |

KSA Vehicle-to-Everything (V2X) Communication Market Analysis

Growth Drivers

Urbanization

The Kingdom of Saudi Arabia (KSA) is experiencing rapid urbanization, with the urban population expected to rise from ~% in 2022 to around ~% by 2025. This rapid urban growth drives the need for smart mobility solutions, including V2X communication systems, to enhance traffic management, reduce congestion, and ensure safety. The adoption of connected infrastructure in urban areas plays a vital role in V2X growth, with Riyadh and Jeddah leading smart city initiatives. The growing urban population creates a greater need for solutions that improve transport systems and reduce pollution, aligning with Vision 2030’s goals for sustainable cities.

Industrialization

KSA’s industrial sector continues to expand, with non-oil industries contributing to ~% of GDP in 2022. This growth, particularly in logistics, manufacturing, and construction, significantly influences the demand for V2X communication systems. As industries expand, commercial fleets, supply chains, and public transportation systems require advanced communication technologies to enhance operational efficiency and safety. KSA’s strategic focus on logistics infrastructure development, including the Red Sea ports, enhances the demand for V2X technology to manage commercial vehicle communication effectively. These developments are key growth drivers in the V2X sector.

Restraints

High Initial Costs

The initial costs of V2X communication systems remain a significant barrier to widespread adoption, especially for smaller fleets and municipal transportation authorities. The cost of integrating V2X systems into existing vehicle fleets and infrastructure can be substantial. As of 2024, the high setup costs for V2X infrastructure—ranging from sensor installation to integration of communication protocols—pose challenges for both public and private sectors in KSA. These upfront costs hinder the market’s speed of adoption despite the clear long-term benefits of V2X technology.

Technical Challenges

The integration of V2X communication systems with existing infrastructure poses significant technical challenges. These challenges include ensuring system interoperability, standardizing communication protocols across different vehicle manufacturers, and overcoming the complexity of multi-vehicle communication in real-time. As of 2024, there is a lack of a unified framework that fully integrates different technologies, such as C-V2X and DSRC, within the Saudi transport system. This lack of standardization has led to delays in implementing fully functional V2X systems.

Opportunities

Technological Advancements

Technological advancements, particularly in 5G network deployment and the evolution of autonomous vehicles, present significant growth opportunities for the V2X market in KSA. With the nationwide rollout of 5G expected to be completed by 2025, this high-speed network will significantly enhance V2X communication capabilities. Moreover, the rising adoption of electric vehicles, supported by government incentives, further increases the potential for V2X integration to enable smoother and safer vehicle-to-infrastructure communication. These technological advancements are laying the foundation for future growth.

International Collaborations

KSA’s collaboration with international tech companies such as Qualcomm, Ericsson, and Huawei to develop 5G and V2X ecosystems creates significant opportunities for the market. These partnerships foster the transfer of knowledge, best practices, and cutting-edge technologies into the local market, accelerating the development of the V2X communication infrastructure. In addition, KSA’s hosting of international tech summits and partnerships in the automotive sector reinforces its position as a leader in smart mobility in the Middle East.

Future Outlook

The KSA V2X communication market is poised for substantial growth over the next few years. This growth is expected to be driven by the ongoing investments in smart city projects, the rise of autonomous vehicles, and the rapid expansion of 5G infrastructure. Additionally, the Saudi government’s push for digital transformation and sustainability under Vision 2030 will further accelerate the adoption of V2X technologies across public transportation and private fleets. As these systems continue to mature, we anticipate the KSA V2X communication market to reach new heights in terms of both technological advancements and market penetration.

Major Players

- Qualcomm

- Huawei

- NXP Semiconductors

- Cohda Wireless

- Ericsson

- Intel Corporation

- Autotalks

- Dell Technologies

- General Motors

- Ford Motor Company

- Aptiv

- Continental AG

- Bosch

- ZTE Corporation

- Nokia Networks

Key Target Audience

- Automotive Manufacturers

- Telecom Operators (STC, Zain, Mobily)

- Transportation Authorities (Saudi Ministry of Transport, Riyadh Metro Authority)

- Infrastructure Developers and Contractors

- Government and Regulatory Bodies (Saudi Communications and Information Technology Commission, Saudi Standards, Metrology and Quality Organization)

- Investment and Venture Capitalist Firms

- Public Transport Operators

- Fleet Management Companies

Research Methodology

Step 1: Identification of Key Variables

In this phase, we begin by constructing an ecosystem map of the key stakeholders in the KSA V2X communication market. Extensive desk research is conducted using secondary sources like industry reports, public databases, and government publications to identify and define the variables that impact the market dynamics.

Step 2: Market Analysis and Construction

We compile and analyze historical data to assess market penetration, adoption rates of V2X technologies, and corresponding revenue generation. In addition, we examine the alignment of telecom infrastructure with the deployment of V2X systems to ensure accurate market sizing.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses generated from secondary research are validated through expert consultations. We conduct interviews with key players in the automotive, telecom, and infrastructure sectors to gain insights into the operational and financial aspects of the market.

Step 4: Research Synthesis and Final Output

The final phase involves synthesizing data collected from both primary and secondary sources, leading to a comprehensive and validated analysis. This process includes direct engagement with manufacturers and infrastructure providers to verify the accuracy and completeness of the market data.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, KSA-Specific Terminologies, Abbreviations, Market Sizing Logic, Bottom-Up & Top-Down Validation, Triangulation Framework, Primary Interviews Across OEMs, Telecom Providers, Infrastructure Developers, and Government Agencies, Demand-Side & Supply-Side Weightage, Data Reliability Index, Limitations & Forward-Looking Assumptions)

- Definition and Scope

- Market Genesis and Evolution Pathway

- Key Technological Milestones in V2X Communication in KSA

- V2X Industry Timeline

- V2X Business Cycle

- V2X Supply Chain & Value Chain Analysis

- Key Growth Drivers

Expansion of Smart Cities and Infrastructure

Government Regulations and Support for Smart Mobility Initiatives

Adoption of Autonomous Vehicles

5G Network Deployment for V2X

- Market Opportunities

Emerging Demand for Connected Vehicle Solutions

Deployment of V2X in Commercial Fleets and Public Transport

Expansion of Hydrogen-Fueled and Electric Vehicles with V2X Integration

- Key Trends

Advancements in Fuel Cell and Electric Vehicle Integration with V2X

Rising Investment in V2X Infrastructure

Trend Toward Sustainable and Clean Transportation

- Regulatory & Policy Landscape

Government Regulations for V2X in KSA

Telecom and Automotive Industry Policies

Infrastructure Development Guidelines

- SWOT Analysis

Strengths

Weaknesses

Opportunities

Threats

- By Value, 2019-2025

- By Volume, 2019-2025

- By Average Selling Price, 2019-2025

- By Technology Type (In Value %)

Cellular Vehicle-to-Everything (C-V2X)

Dedicated Short Range Communication (DSRC)

Hybrid V2X Solutions - By Application (In Value %)

Automotive & Vehicle Connectivity

Smart Infrastructure (Smart Traffic, Smart Cities)

Public Transport & Fleet Management

Road Safety and Accident Prevention

Autonomous Vehicle Operations - By Region (In Value %)

Central Region

Eastern Region

Western Region

Southern Region - By Deployment Type (In Value %)

Vehicle-based V2X Communication

Infrastructure-based V2X Communication - By Consumer Segment (In Value %)

Early Adopters

Mass Market (Private & Fleet Users)

- Market Share Analysis

- Cross Comparison Parameters(Product Portfolio Breadth, Technology Efficiency and Interoperability, Regulatory Approvals and Compliance, Pricing and Cost Alignment, Local Distribution Network and Touchpoints, Manufacturing & Localization Capabilities, R&D Investment and Technological Advancements, Strategic Partnerships & Collaborations)

- SWOT Analysis of Key Players

Strengths

Weaknesses

Opportunities

Threats

- Pricing Analysis

Pricing for C-V2X and DSRC Technologies

Comparative Pricing Across Market Segments (Private, Fleet, Public Infrastructure)

- Detailed Company Profiles

Qualcomm

Intel Corporation

NXP Semiconductors

Cohda Wireless

Sierra Wireless

Ericsson

Huawei Technologies

Autotalks

Dell Technologies

General Motors

Ford Motor Company

Aptiv

Continental AG

BoschZTE Corporation

- Demand Pattern & Utilization Metrics

- Procurement Models & Purchasing Cycles

- Regulatory and Certification Expectations

- Needs, Desires & Pain-Point Mapping

- Decision-Making Framework (Private vs. Fleet Consumers)

Cost vs. Sustainability Prioritization

By Value, 2026-2030

By Volume, 2026-2030

By Average Selling Price, 2026-2030