Market Overview

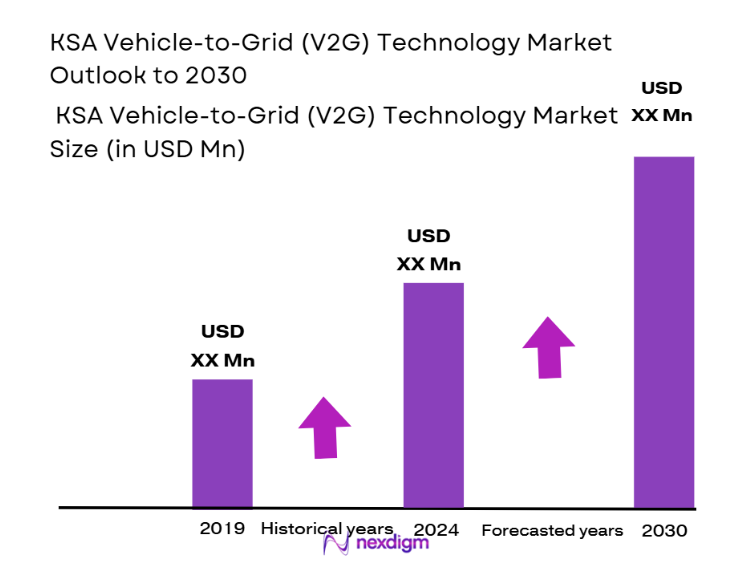

The Vehicle-to-Grid (V2G) technology market in Saudi Arabia is a rapidly growing sector, driven by the increasing adoption of electric vehicles (EVs) and the country’s aggressive push towards renewable energy integration under Vision 2030. The market is valued at approximately USD ~ million in 2024, reflecting the steady growth in both EV fleet expansion and V2G infrastructure development. This growth is largely influenced by government policies incentivizing EV adoption, the demand for sustainable energy solutions, and the increasing need for grid stability solutions to accommodate the rise in renewable energy production.

Saudi Arabia’s major cities, such as Riyadh, Jeddah, and Dhahran, are at the forefront of driving the V2G market. Riyadh, as the capital, leads in terms of government policy implementation, with various projects supporting the expansion of EV charging infrastructure and V2G systems. Jeddah, a key commercial hub, is a critical player in integrating renewable energy and advanced grid technologies. Dhahran, home to oil and energy giants like Aramco, plays a significant role in V2G research and innovation, aligning with the nation’s goal to diversify its energy mix and reduce carbon emissions.

Market Segmentation

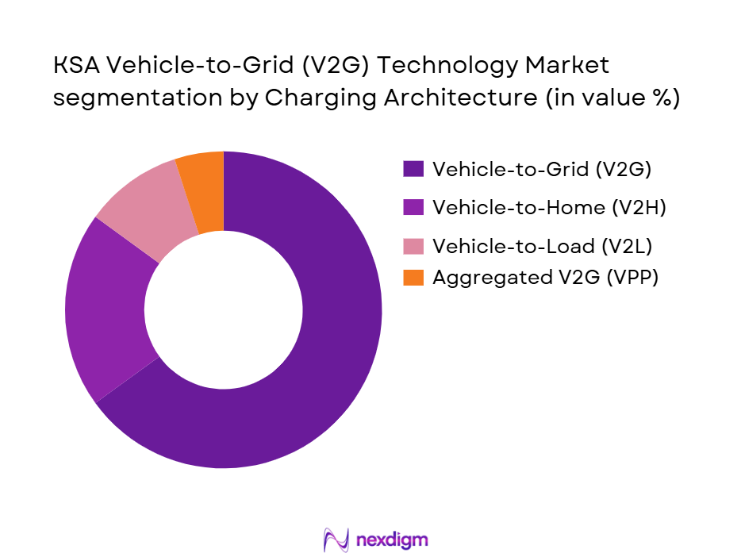

By Charging Architecture

The KSA V2G market is segmented into various charging architectures, with Vehicle-to-Grid (V2G) technology showing a dominant market share. V2G systems, where EVs not only draw power from the grid but also return energy to it, are at the forefront due to their ability to provide grid balancing services. This architecture supports various grid services, including frequency regulation and peak demand shaving, which are critical in maintaining grid stability amid fluctuating renewable energy inputs.

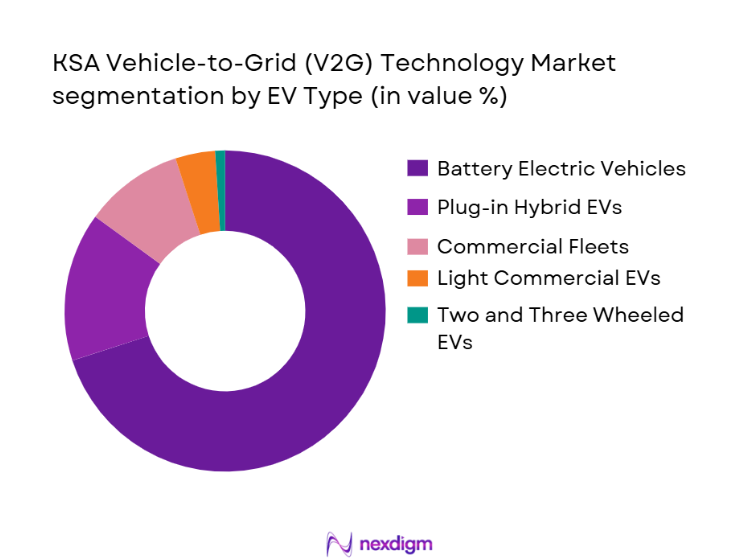

By EV Type

The V2G market in Saudi Arabia is also segmented based on the type of electric vehicles. Battery Electric Vehicles (BEVs) dominate this segment due to their higher adoption rates compared to Plug-in Hybrid Electric Vehicles (PHEVs) and other types of EVs. The government’s policies favoring zero-emission vehicles have led to increased BEV sales, which in turn drives the demand for V2G infrastructure.

Competitive Landscape

The KSA V2G market is witnessing intense competition, with global players vying for dominance. Key companies driving innovation include Nuvve Holding Corp, Enel X, and ABB, which provide cutting-edge V2G solutions that facilitate grid balancing and support renewable energy integration. These companies are collaborating with local utilities and government agencies to deploy large-scale V2G systems that contribute to a more sustainable energy grid.

The competitive landscape is highly fragmented, with both local and international players focusing on innovation and standardization to gain a competitive edge. The partnerships between energy providers, vehicle manufacturers, and technology companies are key to the successful deployment and scalability of V2G technology in the region.

| Company | Establishment Year | Headquarters | Technology Focus | V2G Infrastructure | Grid Service Support | Partnerships | Product Offering |

| Nuvve Holding Corp | 2010 | San Diego, USA | ~ | ~ | ~ | ~ | ~ |

| Enel X | 2017 | Rome, Italy | ~ | ~ | ~ | ~ | ~ |

| ABB | 1883 | Zurich, Switzerland | ~ | ~ | ~ | ~ | ~ |

| Siemens Smart Infrastructure | 1847 | Munich, Germany | ~ | ~ | ~ | ~ | ~ |

| Wallbox | 2015 | Barcelona, Spain | ~ | ~ | ~ | ~ | ~ |

KSA Vehicle-to-Grid (V2G) Technology Market Analysis

Growth Drivers

Government Policies and Vision 2030

Saudi Arabia’s Vision 2030 and its commitment to renewable energy sources significantly drive the adoption of Vehicle-to-Grid (V2G) technology. The government’s push towards reducing dependence on fossil fuels and increasing the share of renewable energy in the national grid has created a favorable environment for V2G solutions that can support grid stability and contribute to energy storage.

Increase in Electric Vehicle (EV) Adoption

The rapid growth of electric vehicle sales in Saudi Arabia, fueled by government incentives and shifting consumer preferences towards more sustainable modes of transport, has led to a surge in demand for V2G infrastructure. This growth is expected to continue as EV manufacturers expand their offerings, and charging infrastructure becomes more widespread.

Market Challenges

High Initial Investment for V2G Infrastructure

The cost of implementing V2G infrastructure, including bidirectional chargers and smart grid systems, remains a significant challenge. High capital expenditure for both utilities and consumers can delay widespread adoption of V2G technology, especially in an emerging market like Saudi Arabia.

Regulatory Uncertainty and Standardization

The lack of clear and standardized regulations around V2G technology poses a challenge for the market. This includes issues around grid access, compensation for grid services provided by EVs, and the compatibility of different EV models with V2G infrastructure. Regulatory uncertainty can hinder investments and slow down market growth.

Opportunities

Integration with Renewable Energy Sources

Saudi Arabia’s strong focus on integrating renewable energy sources like solar and wind power into the national grid presents an opportunity for V2G systems to play a crucial role. V2G technology can help stabilize the grid by providing energy storage solutions, making it easier to balance renewable energy generation with demand.

Emerging Business Models for Grid Services

The increasing complexity of grid management, especially with the rise in EVs, opens up opportunities for new business models. V2G systems can be monetized through services such as frequency regulation, peak demand shaving, and energy arbitrage. Energy aggregators and utilities can tap into these opportunities, creating new revenue streams for V2G operators.

Future Outlook

The KSA Vehicle-to-Grid (V2G) market is poised for significant growth in the coming years, driven by strong government policies and a commitment to sustainable energy solutions. Over the next 5 years, the market is expected to experience a substantial increase in both the adoption of electric vehicles and the deployment of V2G infrastructure, aligning with Saudi Arabia’s vision to reduce its carbon footprint and boost the use of renewable energy. Technological advancements in charging infrastructure and energy management platforms will further propel market growth, offering opportunities for businesses and consumers to participate in grid services.

Major Players

- Nuvve Holding Corp

- Enel X

- ABB

- Siemens Smart Infrastructure

- Wallbox

- Schneider Electric

- Engie

- Cargill

- ChargePoint

- EVBox

- Delta Electronics

- KeBA

- Powershare Networks

- AESC

- LG Chem

Key Target Audience

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies (Ministry of Energy, Saudi Electricity Company)

- Energy and Utility Providers (Saudi Electric Company, ACWA Power)

- Automobile Manufacturers (Electric Vehicle OEMs)

- Grid Service Providers (National Grid Authorities, Regional Utility Companies)

- EV Charging Station Providers (Retail Networks, Franchise Operators)

- Battery Manufacturers (for EVs and V2G Systems)

- Energy Aggregators (Virtual Power Plants, Distributed Energy Resource Managers)

Research Methodology

Step 1: Identification of Key Variables

The research begins with the identification of all relevant market variables influencing the V2G market in Saudi Arabia. These include the adoption rate of electric vehicles, government policies, and the demand for grid services like frequency regulation and peak demand shaving. Secondary research, including government reports and market surveys, helps us capture these parameters.

Step 2: Market Analysis and Construction

We then construct a comprehensive market model by analyzing historical data and market trends for both the vehicle and energy sectors. This phase involves assessing the evolution of EV adoption in KSA and the regulatory landscape that supports V2G technology, as well as the role of renewable energy in grid management.

Step 3: Hypothesis Validation and Expert Consultation

We validate our market assumptions through consultations with industry experts, including stakeholders in government, utility companies, and technology providers. These discussions help refine our understanding of market dynamics and ensure that our projections align with the current and future state of the market.

Step 4: Research Synthesis and Final Output

The final phase involves synthesizing all collected data and expert insights. This process includes verifying the accuracy of data through direct engagements with key players in the V2G market. The final output is a comprehensive and accurate report, providing stakeholders with detailed insights into the market’s growth trajectory, competitive landscape, and future outlook.

- Executive Summary

- Research Methodology (Market Definitions & Technical Scoping; Geographic & Regulatory Boundaries; Bidirectional Charging Standardization; Battery Degradation & Economics Adjustment; Load Curve & Revenue Modeling; Smart Grid Integration Metrics; Primary Research Frame; Market Forecasting Model Assumptions; Limitations)

- Market Definition and Technology Scope

- Genesis & Market Evolution in Saudi Arabia

- KSA Electrification & Renewable Interdependency Context

- KSA Electricity Grid Topology & Smart Grid Readiness

- Value Chain & Ecosystem Mapping

- Maturity Curve & Adoption Readiness Levels

- Drivers

EV Adoption Momentum & Localization Goals under Vision 2030

Renewable Energy Integration Demand & Storage Arbitrage

Smart Grid Deployment Targets & Digitalization - Constraints

High Capital Upfront for Bidirectional Chargers

EV OEM Compatibility Gaps & Standardization Barriers

Grid Tariff & Regulatory Ambiguity

Battery Warranty & Lifecycle Reduction Challenges - Regulatory & Policy Landscape

Energy Market Regulations

EV Charging Policy & Incentives

Saudi Standards for Bidirectional Charging

Utility Tariffs & V2G Compensation Mechanisms

Cybersecurity & Data Governance Norms

- Market Value (SAR) – V2G Hardware 2019-2025

- Market Value – Software & Energy Management Platforms 2019-2025

- Installed Bidirectional Charging Capacity 2019-2025

- EV Penetration as Proxy Demand 2019-2025

- Grid Services Revenue Pools 2019-2025

- By Charging Architecture (In Value%)

VehicletoHome

VehicletoGrid

VehicletoLoad

Aggregated V2G - By EV Type (In Value%)

BatteryElectric Vehicles

Plugin Hybrid EVs

Commercial Fleets

Light Commercial EVs

Two& ThreeWheel EVs - By Component (In Value%)

Hardware

Smart Meters

Power Electronics & Inverters

Energy Management Software

Cybersecurity/Communication Protocols - By Grid Service (In Value%)

Frequency Regulation

Demand Response

Peak Demand Offset

Ancillary Services

Energy Arbitrage - By Ownership/Deployment Model (In Value%)

UtilityOwned Infrastructure

AggregatorManaged V2G

Independent EV Owner Participation

Fleet Operator Programs

- CrossComparison Parameters (Bidirectional Charger Deployment Footprint, Grid Services Revenue per Installed Unit, Software Capability Index, EV OEM V2G Compatibility Coverage, Standardization & Interoperability Compliance Score, Charging Infrastructure Uptime & Reliability Metrics, Strategic Partnerships with Utilities/DSOs, Battery Warranty & Degradation Compensation Terms)

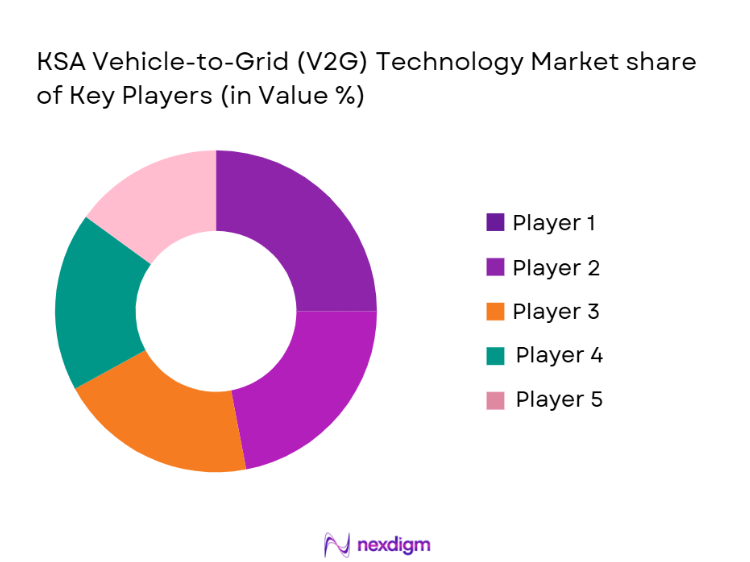

- Market Share by Revenue & Deployment Scale

- SWOT Analysis of Key Market Players

- Key Players:

Nuvve Holding Corp

Enel X

Octopus Energy / Octopus Electric Vehicles

ENGIE

ABB

Siemens Smart Infrastructure

Schneider Electric

Delta Electronics

Wallbox

ChargePoint

EVBox

KEBA

Powershare Networks

Utility Partners

Local Consortium

- Market Demand and Utilization

- Purchasing Power and Budget Allocations

- Regulatory and Compliance Requirements

- Needs, Desires, and Pain Point Analysis

- Decision-Making Process

- Market Forecast 2026-2030

- Scenario Forecasting 2026-2030

- Impact of Local EV Manufacturing & Localization Policies 2026-2030