Market Overview

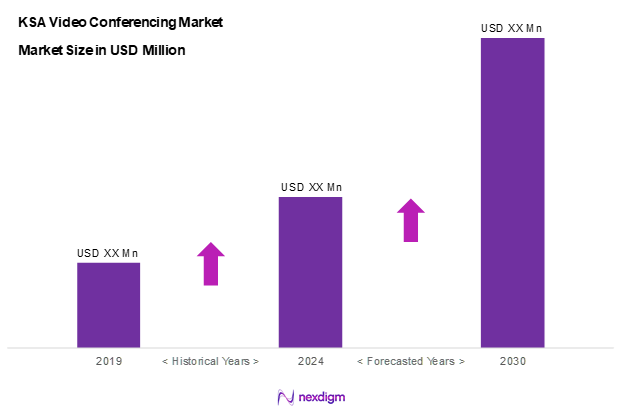

The KSA video conferencing market is valued at approximately USD 346.1 million in 2024 with a growing CAGR of 24.0% during the forecast period of 2024 to 2030, representing robust growth momentum sustained by the rise in remote work and digital transformation initiatives within enterprises. Increasing adoption of cloud-based solutions and the need for effective corporate communication tools drive the market’s expansion, backed by significant investments in digital infrastructure. With a growing emphasis on virtual collaboration, this market is expected to be at the forefront of technological advancements.

Cities like Riyadh and Jeddah dominate the KSA video conferencing market due to their status as the largest economic hubs in the kingdom. Riyadh houses numerous corporate headquarters and government agencies, while Jeddah serves as a critical port and economic centre. The combination of high urbanization and the concentration of business activities in these cities enhances the demand for video conferencing solutions, setting the stage for continued market growth.

Market Segmentation

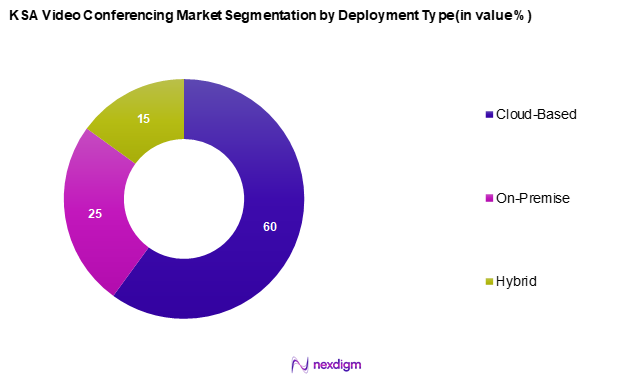

By Deployment Type

The KSA video conferencing market is segmented by deployment type into on-premise, cloud-based, and hybrid solutions. Cloud-Based solutions are expected to dominate the market share due to their scalability, ease of integration, and cost-effectiveness. The rise of remote work has prompted organizations to transition to cloud-based solutions, allowing for flexible access to video conferencing services and facilitating collaboration across different locations.

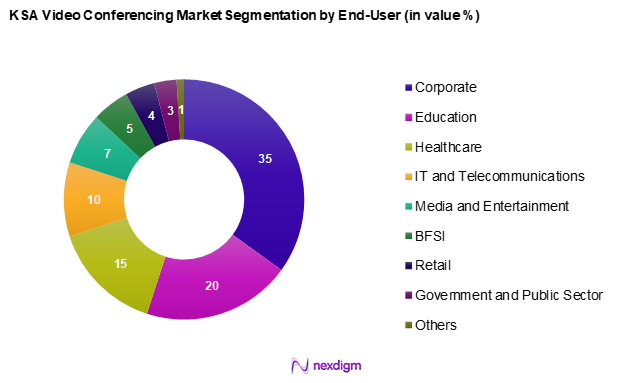

By End-User

The KSA video conferencing market is further segmented into corporate, education, healthcare, IT and telecommunications, media and entertainment, BFSI, retail, Government and public sector, and others. The Corporate segment holds the dominant share because businesses increasingly rely on virtual meetings for communication and collaboration. This growth is driven by the need for effective team management, especially in remote and hybrid working models, and the recognition that video conferencing solutions significantly enhance productivity and reduce travel costs.

Competitive Landscape

The KSA video conferencing market is characterized by competition among major players that offer comprehensive solutions tailored to various segments. The market is dominated by a few key players, including global companies such as Cisco and Microsoft, which have established strong footholds in the industry. This consolidation underscores the market’s competitive dynamics and the strategic importance of innovative technology.

| Company Name | Establishment Year | Headquarters | Market Focus | Product Range | Revenue (USD Mn) | Security Features |

| Cisco | 1984 | San Jose, USA | – | – | – | – |

| Microsoft | 1975 | Redmond, USA | – | – | – | – |

| Zoom | 2011 | San Jose, USA | – | – | – | – |

| RingCentral | 1999 | Belmont, USA | – | – | – | – |

| Enghouse Video | 1984 | Ontario, Canada | – | – | – | – |

KSA Video Conferencing Market Analysis

Growth Drivers

Rise of Remote Work

The rise of remote work in Saudi Arabia has significantly influenced the demand for video conferencing solutions. As of 2023, approximately 31% of employees in KSA reported working remotely at least part of the time, according to the Saudi Ministry of Human Resources and Social Development, which is projected to increase as companies recognize the benefits of flexible work arrangements. This shift has necessitated robust communication tools to maintain productivity and collaboration among teams scattered geographically, thereby fuelling the need for reliable video conferencing services. The Kingdom’s Vision 2030 initiative further encourages work-life balance, solidifying the trend towards remote work.

Digital Transformation

Saudi Arabia has made significant strides in digital transformation, committing over USD 2.5 billion in investments towards technology and innovation as part of its Vision 2030 strategy, which aims to transition the economy away from oil dependency. In 2023, the Kingdom reported that 60% of Small And Medium Enterprises (SMEs) have embarked on digital transformation initiatives, enabling greater efficiency and connectivity. This prioritization of digitization has generated heightened demand for video conferencing solutions that support virtual business operations, enhancing communication efficiency across all sectors.

Market Challenges

Security Concerns

Security concerns surrounding data privacy and confidentiality remain a significant challenge in the KSA video conferencing market. According to a 2023 report by the National Cybersecurity Authority of Saudi Arabia, there were over 10,000 cyber incidents reported in the Kingdom by mid-2023, highlighting the need for robust security measures. As organizations increasingly adopt video conferencing tools, ensuring secure communication channels is essential to protect sensitive information from unauthorized access, thereby creating a barrier to widespread video conferencing adoption.

Technical Compatibility Issues

Technical compatibility poses challenges for organizations looking to implement video conferencing solutions. In a survey conducted in 2023, 42% of IT managers in KSA reported difficulties in integrating new video conferencing systems with existing IT infrastructure. Issues such as varying platform capabilities, legacy systems, and device compatibility hinder seamless communication experiences. As organizations attempt to deploy these systems, the lack of technical harmonization can prevent efficient usage, slowing adoption rates within organizations that require reliable and effective communication tools.

Opportunities

Integration with AI and Machine Learning

The ongoing integration of Artificial Intelligence (AI) and machine learning within video conferencing platforms represents a significant opportunity for the market. As of 2023, about 33% of KSA organizations are exploring AI functionalities, such as real-time language translation and automated transcription services. These enhancements not only improve user experience but also make meetings more productive and accessible for diverse teams. With the growth of AI capabilities, video conferencing providers can differentiate their offerings and capture a larger market share in the evolving communications landscape.

Expansion of Internet Connectivity

The expansion of internet connectivity across Saudi Arabia, driven by government initiatives, presents a major growth opportunity for the video conferencing market. The Saudi government has committed to enhancing internet infrastructure, with plans to invest USD 1.0 billion in expanding broadband access to underserved areas by 2025. As a result, the Kingdom’s internet penetration rate is expected to reach 97% in urban areas, significantly increasing access to online resources and communication tools. This expansion is likely to drive the adoption of video conferencing solutions, as businesses and individuals gain improved connectivity, enabling smoother virtual communication and collaboration.

Future Outlook

Over the next five years, the KSA video conferencing market is anticipated to experience substantial growth propelled by ongoing government support for digital transformation, advancements in video conferencing technologies, and a steady increase in demand for remote communication solutions. As businesses embrace hybrid work models, the reliance on robust, reliable video communication platforms is expected to surge, positioning the market for significant expansion.

Major Players

- Cisco Systems, Inc.

- Zoom Communications, Inc.

- Microsoft

- Alphabet

- Verizon

- Enghouse Video

- LogMeIn, Inc.

- Pexip AS

- RingCentral, Inc.

- Adobe

- net, Inc.

- GoTo

- Creative Solutions Co. Ltd.

Key Target Audience

- Corporates and Enterprises

- Education Institutions

- Healthcare Providers

- IT and Telecommunications Companies

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies (e.g., Ministry of Communications and Information Technology)

- Non-Governmental Organizations (NGOs)

- Business Service Providers

Research Methodology

Step 1: Identification of Key Variables.

This phase involves mapping the ecosystem of stakeholders within the KSA video conferencing market. We will conduct extensive desk research utilizing secondary and proprietary databases to collate comprehensive industry-level information. The primary goal is to identify and define critical variables influencing market dynamics, ensuring a solid foundation for further analysis.

Step 2: Market Analysis and Construction.

In this phase, we will gather and analyse historical data related to the KSA video conferencing market. This includes scrutinizing market penetration rates, the ratio of service providers to users, and corresponding revenue generation. Additionally, an evaluation of service quality metrics will be conducted to ensure that we have reliable revenue estimates, which will provide context to the current market landscape.

Step 3: Hypothesis Validation and Expert Consultation.

Our market hypotheses will be developed and validated through interactions with industry experts using Computer-Assisted Telephone Interviews (CATIs). These consultations will cover a wide range of representatives from notable companies within the sector, providing operational and financial insights that are crucial in refining and verifying the market data.

Step 4: Research Synthesis and Final Output.

The final phase includes direct engagement with manufacturers and key service providers to obtain detailed insights regarding product segments, sales performance, consumer preferences, and other relevant factors. The insights garnered during this interaction will complement the statistics obtained from the bottom-up approach, thereby enabling a comprehensive, accurate, and validated analysis of the KSA video conferencing market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Overview Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain and Value Chain Analysis

- Growth Drivers

Rise of Remote Work

Digital Transformation - Market Challenges

Security Concerns

Technical Compatibility Issues - Opportunities

Integration with AI and Machine Learning

Expansion of Internet Connectivity - Trends

Hybrid Work Environments

Increased Use of Virtual Reality (VR)

Mobile-First Video Conferencing Solutions - Government Regulation

Cybersecurity Guidelines

Data Protection Law

Encouragement of Technology Adoption - SWOT Analysis

- Stake Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Average Price, 2019-2024

- By Deployment Type

On-Premise

– Enterprise-Owned Server-Based Systems

– Secure Environments for Regulated Industries

– Customizable IT Infrastructure

Cloud-Based

– Public Cloud Solutions (Zoom, Microsoft Teams, Google Meet)

– Private Cloud Platforms

– SaaS-Based Video Conferencing Tools

Hybrid

– Integrated On-Prem and Cloud Systems

– Hybrid Cloud Solutions for Multisite Connectivity

– Scalable, Flexible Infrastructure - By Component

Hardware

– Video Conferencing Cameras

– Microphones & Audio Systems

– Displays & Monitors

– Codecs and Control Systems

Solutions

– Unified Communication Platforms

– Collaboration Suites with Screen Sharing

– Meeting Room Management Software

Services

– Integration & Deployment Services

– Managed Services & IT Support

– Training and Consulting Services - By Applications

Video Conferencing

– One-on-One Meetings

– Group Video Calls

– Cross-Border Business Collaboration

Webcasting and Live Streaming

– Virtual Events and Webinars

– Live Corporate Announcements

– Broadcast for Town Halls & Conferences

Video Content Management and Collaboration

– Cloud Video Libraries

– Searchable Archives

– Collaborative Workspaces with Playback

Video-Based Training and Learning

– Employee Training Modules

– Virtual Classrooms and LMS Integration

– Skill Development Platforms

Others

– Remote Recruitment & Interviewing

– Telelegal and Courtroom Streaming

– Religious and Cultural Broadcasts - By End-User

Corporate

– MNCs & Enterprises

– SMEs and Startups

Education

– K-12 Schools

– Colleges and Universities

– Online Tutoring Platforms

Healthcare

– Telemedicine Consultations

– Virtual Medical Conferences

– Training for Healthcare Workers

IT and Telecommunications

– Remote IT Support and Coordination

– Project Management and Development Teams

Media and Entertainment

– Virtual Production and Editing

– Press Briefings and Talent Interviews

BFSI (Banking, Financial Services, and Insurance)

– Remote Client Advisory

– Internal Compliance and Training Meetings

Retail

– Supply Chain Coordination

– Store Manager Training and Briefings

Government and Public Sector

– E-Governance Communication

– Public Service Announcements

– Internal Coordination Across Ministries - By Region

Riyadh

Jeddah

Dammam

Medina

Mecca

Eastern Province (Khobar, Al Hasa)

NEOM & Special Economic Zones

- Market Share of Major Players on the Basis of Value, 2024

Market Share of Major Players by Development Segment, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strength, Weakness, Organizational Structure, Revenues, Revenues by Business Segment, and others)

- SWOT Analysis of Major Players

- Pricing Analysis Basis SKUs for Major Players

- Detailed Profiles of Major Companies

Cisco Systems, Inc.

Zoom Communications, Inc

Microsoft

Alphabet

Verizon

Enghouse Video

LogMeIn, Inc.

Pexip AS

RingCentral, Inc.

Adobe

GoTo

Creative Solutions Co. Ltd.

- Market Demand and Utilization

- Purchasing Power and Budget Allocations

- Regulatory and Compliance Requirements

- Needs, Desires, and Pain Point Analysis

- Decision Making Process

- By Value, 2025-2030

- By Average Price, 2025-2030