Market Overview

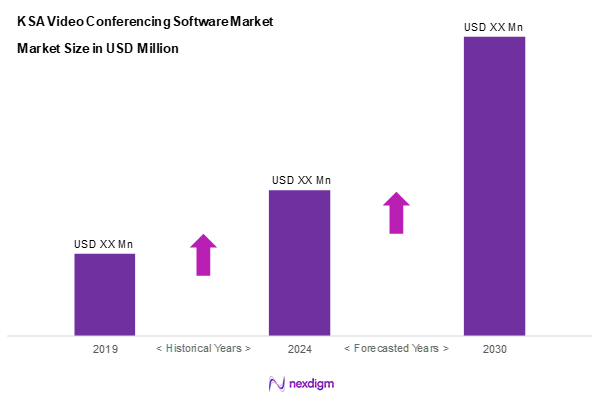

As of 2024, the KSA video conferencing software market is valued at USD 365.4 million, with a growing CAGR of 5.1% from 2024 to 2030. This expansion is largely driven by the increasing adoption of remote work solutions and enhanced digital communication platforms among various industries. As businesses and educational institutions shift towards more flexible and efficient operations, the demand for video conferencing solutions has surged, highlighting its critical role in modern organizational frameworks.

Riyadh, Jeddah, and Dammam are the dominant cities in this market, primarily due to their robust infrastructure and significant investment from both public and private sectors in technology. Riyadh, as the capital, offers numerous corporate and government offices that leverage video conferencing for operational efficiency. Jeddah and Dammam also contribute to the growth through their expanding corporate sectors and educational institutions, fostering a culture of digital engagement.

Market Segmentation

By Deployment Model

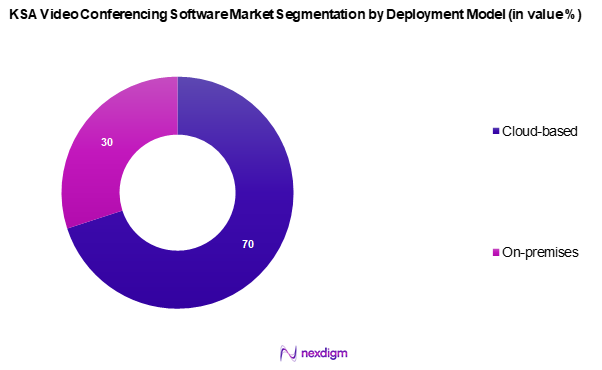

The KSA video conferencing software market is segmented into cloud-based and on-premises solutions. Among these, the cloud-based sub-segment is dominating the market share primarily due to its flexibility, cost-effectiveness, and ease of scalability. Businesses in KSA favour cloud solutions as they minimize the need for extensive IT infrastructure and provide seamless access to advanced features and regular updates. The rapid digital transformation in various sectors, including education and corporate, invigorates the adoption of cloud-based video conferencing tools.

By Enterprise Size

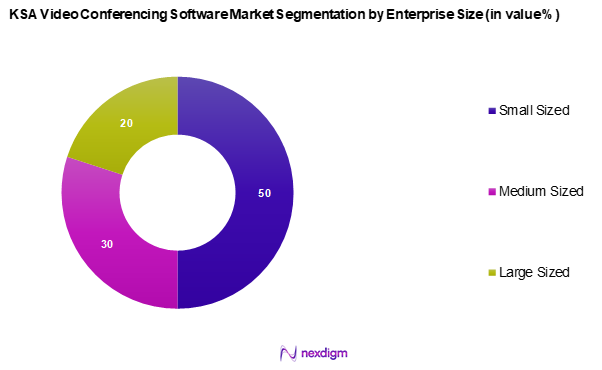

The KSA video conferencing software market is segmented into small-sized, medium-sized, and large-sized enterprises. The small-sized enterprise segment is currently leading the market due to the proliferation of start-ups and small businesses in KSA. These enterprises increasingly rely on video conferencing tools to facilitate communication and operations without incurring substantial costs. The competitive landscape and the need for efficient collaboration tools drive their preference for accessible and affordable video conferencing software solutions.

Competitive Landscape

The KSA video conferencing software market is dominated by several key players including global leaders and regional innovators. The consolidation among these companies highlights their significant influence as they compete for market share through innovative solutions and technological advancements. Major players such as Microsoft and Zoom have established a strong foothold in the region, offering tailored solutions that cater to the specific needs of enterprises in KSA.

| Company Name | Establishment Year | Headquarters | Key Product Offerings | Number of Users | Revenue

(USD Mn) |

| Microsoft Corporation | 1975 | Washington, USA | – | – | – |

| Zoom Video Communications | 2011 | California, USA | – | – | – |

| Cisco Systems Inc | 1984 | California, USA | – | – | – |

| Alphabet | 1998 | California, USA | – | – | – |

| BlueJeans by Verizon | 2009 | California, USA | – | – | – |

KSA Video Conferencing Software Market Analysis

Growth Drivers

Increasing Remote Work Adoption

The rise in remote work adoption is a significant factor driving the KSA video conferencing software market. The shift towards remote work arrangements, propelled by the impact of the COVID-19 pandemic, has transformed traditional work structures. This trend has prompted many organizations to implement flexible work policies, including hybrid models, making video conferencing tools essential for effective communication and collaboration. The ongoing digital transformation across various industries in KSA reflects a strong commitment to integrating technology into the workplace, ensuring that businesses can operate efficiently in increasingly flexible environments.

Advancement in Internet Infrastructure

The development of internet infrastructure in KSA is crucial to the growth of video conferencing software. The country has made significant strides in enhancing broadband access and has seen a widespread increase in internet connectivity. The expansion of fiber-optic networks has greatly improved overall connectivity, allowing more homes and businesses to benefit from reliable internet service. Additionally, the rollout of advanced network technologies not only meets the demand for seamless video communication but also lays the groundwork for greater adoption of high-quality video conferencing tools among various sectors, including corporate and educational institutions.

Market Challenges

Security Concerns

Security concerns present a considerable challenge in the KSA Video conferencing software market as organizations place a high emphasis on data protection amidst increasing cyber threats. With the rise in cyberattacks, businesses are under pressure to prioritize cybersecurity measures within their operations. The evolving threat landscape necessitates that organizations ensure data privacy through secure video conferencing solutions. This heightened focus on security may pose challenges to the rapid adoption of various platforms, as companies evaluate the robustness of their cybersecurity protocols in protecting sensitive information during online communications.

High Competition

The KSA video conferencing software market is marked by intense competition, with a multitude of players striving for market share. The influx of new entrants has escalated the challenges for established firms, as they work to maintain their competitive edge amid a diverse array of available solutions. As organizations seek innovative features and superior user experiences, providers must continually invest in marketing and technological advancements. This competitive environment necessitates differentiation, as companies strive to deliver exceptional services while managing the pressure of innovation and the constant evolution of consumer demands.

Opportunities

AI Integration for Enhanced Experience

The integration of artificial intelligence within video conferencing platforms opens up significant opportunities for market growth. Many enterprises in KSA are actively exploring AI technologies to improve operational efficiency and enhance user experiences. The adoption of AI-driven features, such as real-time translations and automated transcription services, is gaining traction. By automating routine tasks and enhancing user engagement, AI can streamline communication processes and increase overall productivity. As businesses look for innovative solutions, the incorporation of AI into video conferencing tools serves as a compelling value proposition, positioning companies for success in an increasingly tech-driven landscape.

Expansion of E-Learning and Corporate Training

The ongoing expansion of e-learning and corporate training initiatives presents a notable opportunity for the KSA video conferencing software market. As educational institutions and businesses increasingly recognize the value of remote learning and virtual training sessions, the demand for effective video conferencing tools is on the rise. With a growing emphasis on continuing education and professional development, organizations are seeking solutions that facilitate interactive and engaging virtual classrooms or training environments. This shift not only encourages the adoption of video conferencing platforms but also drives innovation in features that enhance user involvement and knowledge retention. The alignment of educational and corporate training goals with advanced video conferencing technologies positions the market for substantial growth, fostering a culture of lifelong learning across the region.

Future Outlook

Over the next five years, the KSA video conferencing software market is expected to show significant growth driven by continuous advancements in internet infrastructure, increasing focus on remote work solutions, and the integration of artificial intelligence into video conferencing platforms. As organizations in KSA increasingly adopt hybrid work models, the demand for video conferencing tools is anticipated to rise, leveraging improved user experiences and enhanced features.

Major Players

- Microsoft Corporation

- Zoom Video Communications

- Cisco Systems Inc.

- Alphabet

- BlueJeans by Verizon

- Adobe Inc.

- Avaya LLC

- Logitech International

- Huawei Technologies Co., Ltd

- Poly (Plantronics, Inc.)

- GoToMeeting

- StarLeaf

- Enghouse Video

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Corporations and enterprises

- Educational institutions

- Healthcare organizations

- Telecommunication companies

- Event organizers

- IT service providers

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the KSA video conferencing software market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data pertaining to the KSA video conferencing software market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics will be conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through Computer-Assisted Telephone Interviews (CATIs) with industry experts representing a diverse array of companies. These consultations will provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple video conferencing software manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction will serve to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the KSA video conferencing software market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Research Design, Understanding Market Potential Through Primary Research, Secondary Data Collection Techniques, Limitations and Future Directions)

- Definition and Scope

- Market volution

- Timeline of Major Developments

- Business Cycle Dynamics

- Supply Chain and Value Chain Analysis

- Growth Drivers

Increasing Remote Work Adoption

Advancement in Internet Infrastructure - Market Challenges

Security Concerns

High Competition - Opportunities

AI Integration for Enhanced Experience

Expansion of E-Learning and Corporate Training - Trends

Uptrend in Hybrid Event Platforms - Regulatory Framework

Data Protection Laws

Telecom Regulations - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Average Revenue Per User (ARPU), 2019-2024

- By Deployment Model (In Value %)

Cloud-based

On-premises - By Enterprise Size (In Value %)

Small Sized

Medium Sized

Large Sized - By End-User Industry (In Value %)

Healthcare

Education

IT & Telecom

Government

Corporate Enterprise

Others - By Application (In Value %)

Consumer

Enterprise - By Region (In Value %)

Riyadh

Jeddah

Dammam

Khobar

Others

- Market Share of Major Players on the Basis of Value/Volume, 2024

Market Share of Major Players by Type of Deployment Model Segment, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Product Differentiation, Customer Support Quality, Market Position, Revenue, Market Share, Strength, Weakness, and Others)

- SWOT Analysis of Major Players

- Pricing Strategies of Major Players

- Comprehensive Profiles of Leading Companies

Microsoft Corporation

Zoom Video Communications

Cisco Systems Inc

Alphabet

BlueJeans by Verizon

Adobe Inc

Avaya LLC

Logitech International

BlueJeans by Verizon

Huawei Technologies Co., Ltd

Poly (Plantronics, Inc.)

GoToMeeting

StarLeaf

Enghouse Video

- Market Demand Assessment

- Budget Allocation Analysis

- Compliance and Regulatory Needs

- User Experience Analysis

- Decision-Making Dynamics

- By Value Forecast, 2025-2030

- By Average Revenue Per User Forecast, 2025-2030