Market Overview

As of 2024, the KSA video streaming services market is valued at USD ~ billion, with a growing CAGR of 14.7% from 2024 to 2030, supported by a significant rise in internet penetration and mobile device usage. The growth trajectory is largely driven by increased demand for on-demand content, with consumers investing more in subscriptions for diverse viewing options. As a result the investments in local content production and partnerships with global streaming platforms increase in the region.

The major cities dominating the KSA video streaming services market include Riyadh, Jeddah, and Dammam. Riyadh showcases a combination of tech-savvy youth and urban infrastructure that promotes streaming. Jeddah’s diverse population and cultural ties further enhance content demand, while Dammam benefits from high disposable income levels, leading to increased subscriptions among residents. The cumulative effect of these dynamics secures the prominence of these cities in the market landscape.

Market Segmentation

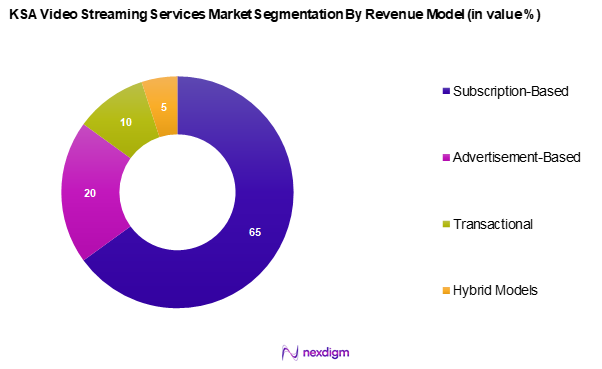

By Revenue Model

The KSA video streaming services market is segmented into Subscription-Based (SVoD), Advertisement-Based (AVoD), Transactional (TVoD), and Hybrid Models. Among these, Subscription-Based (SVoD) has a dominant market share, fueled by consumer preference for ad-free content and the appeal of exclusive original titles. Major platforms like Netflix and Shahid are attracting new subscribers, leveraging extensive libraries and localized content, which solidifies the SVoD segment’s leading status in 2024.

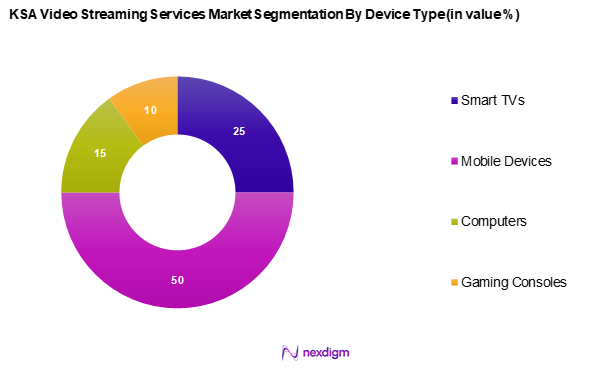

By Device Type

The KSA video streaming services market is segmented into Smart TVs, Mobile Devices, Computers, and Gaming Consoles. Mobile Devices represent the largest share due to the increasing adoption of smartphones and tablets, making it convenient for users to access content on-the-go. Enhanced mobile internet infrastructure and affordable data plans allow seamless streaming experiences, making platforms like YouTube and Shahid accessible, thus catering to the mobile-first audience in 2024.

Competitive Landscape

The KSA video streaming services market is characterized by the presence of several influential players, including both local and international brands. This consolidation indicates a competitive landscape where a few key companies hold significant market power, offering diverse content tailored to specific consumer preferences. The competition is constantly evolving, with local players leveraging cultural content while international services bring a broad library of popular titles.

| Company | Establishment Year | Headquarters | Subscription Price (USD) | Content Library Size | Unique Offerings | Market Share

(%) |

| Netflix | 1997 | California, USA | – | – | – | – |

| Shahid | 2010 | Dubai, UAE | – | – | – | – |

| Amazon Prime Video | 2006 | Washington, USA | – | – | – | – |

| Disney+ | 2019 | California, USA | – | – | – | – |

| OSN Streaming | 2009 | Dubai, UAE | – | – | – | – |

KSA Video Streaming Services Market Analysis

Growth Drivers

Increasing Internet Penetration

The expansion of internet connectivity in Saudi Arabia has played a crucial role in driving the growth of video streaming services. With wider broadband availability and enhanced mobile network infrastructure, more consumers have access to high-speed internet, making streaming platforms more accessible. The shift towards digital consumption is further fuelled by government initiatives promoting digital transformation. As internet penetration increases, the demand for online content continues to surge, encouraging both international and local streaming service providers to expand their offerings, improve service quality, and cater to a growing audience seeking high-quality streaming experiences.

Rising Demand for On-Demand Content

The growing preference for on-demand content is reshaping Saudi Arabia’s entertainment landscape. Consumers are increasingly shifting away from traditional television towards flexible, subscription-based streaming services that allow them to watch content at their convenience. The demand for diverse content, including international films, TV series, and regional productions, is rising as viewers seek more personalized entertainment experiences. Streaming platforms are capitalizing on this trend by offering extensive content libraries, exclusive releases, and customizable viewing options. This shift towards on-demand content consumption is driving investment in digital media and influencing the strategies of content providers.

Market Challenges

Content Licensing Issues

Obtaining content licenses remains a significant challenge for video streaming service providers in Saudi Arabia. Licensing agreements with international studios and regional content creators can be complex, requiring negotiations over distribution rights, exclusivity, and localization. Some providers face difficulties in securing premium content due to high licensing costs and regulatory restrictions. Additionally, certain content may require modifications to align with cultural and legal standards in the Kingdom. These challenges can limit the availability of diverse content, affecting user experience and restricting the competitive edge of streaming platforms that struggle with licensing hurdles.

Intense Competition

The Saudi video streaming market is highly competitive, with both global giants and regional players vying for consumer attention. Major international platforms have a strong presence, offering vast content libraries and advanced streaming technology. Meanwhile, local services are focusing on cultural relevance and regional content to differentiate themselves. This intense competition has led to aggressive pricing strategies, exclusive content deals, and continuous innovation in platform features. Smaller players may struggle to compete against well-funded global services, making market penetration challenging. The evolving competitive landscape demands strong branding, unique offerings, and strategic partnerships for sustained growth.

Opportunities

Expansion of Local Content

The increasing demand for culturally relevant entertainment presents a significant opportunity for streaming platforms in Saudi Arabia. Viewers are showing a growing preference for local films, TV shows, and documentaries that reflect regional traditions and societal themes. To cater to this demand, streaming services are investing in the production of original Arabic-language content and collaborating with regional filmmakers. Government support for the entertainment industry further encourages local content development, creating a favourable environment for home-grown productions. Platforms that prioritize local content expansion can enhance audience engagement, strengthen subscriber loyalty, and differentiate themselves in the competitive streaming market.

Collaboration and Partnerships

Strategic collaborations and partnerships are emerging as a key growth opportunity for video streaming platforms in Saudi Arabia. Streaming services are forming alliances with telecom operators, media houses, and entertainment studios to enhance content accessibility and user experience. Partnerships with telecom providers allow for bundled subscription plans, increasing market reach. Collaborations with production companies enable platforms to secure exclusive content, attracting more subscribers. Additionally, working with regional influencers and broadcasters helps in promoting platform visibility. These strategic alliances provide a competitive advantage by expanding distribution networks, reducing content acquisition costs, and enhancing brand positioning in the market.

Future Outlook

Over the next five years, the KSA video streaming services market is expected to experience considerable growth driven by the rising demand for localized content, an increase in digital consumption, and improving internet infrastructure. The expansion of mobile services and an increase in disposable incomes will further bolster revenues. Moreover, ongoing partnerships between local and global streaming services promise to deliver a more diverse range of content to consumers, shaping the market dynamics in the region.

Major Players

- Netflix

- Shahid (MBC Group)

- Amazon Prime Video

- Disney+

- Anghami

- Spotify

- OSN Streaming

- Apple TV+

- StarzPlay

- YouTube Premium

- MBC Group

- Jawwy TV

- OSN

- StarzPlay Arabia

- Viaplay

Key Target Audience

- Government Agencies (e.g., Saudi Communication and Information Technology Commission)

- Telecommunications Companies

- Advertising Agencies

- Content Creators and Media Producers

- Investments and Venture Capitalist Firms

- E-commerce Platforms

- Entertainment Industry Stakeholders

- Regulatory Bodies (e.g., Ministry of Media)

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the KSA video streaming services market. This step is supported by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, historical data pertaining to the KSA video streaming services market will be compiled and analysed. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics will be conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and validated through Computer-Assisted Telephone Interviews (CATI) with industry experts representing a diverse array of companies. These consultations will provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple streaming service providers to acquire detailed insights into product segments, subscriber statistics, consumer preferences, and other pertinent factors. This interaction will serve to verify and complement the statistics derived from the bottom-up approach, ensuring a comprehensive, accurate, and validated analysis of the KSA video streaming services market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Overview Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain and Value Chain Analysis

- Growth Drivers

Increasing Internet Penetration

Rising Demand for On-Demand Content - Market Challenges

Content Licensing Issues

Intense Competition - Opportunities

Expansion of Local Content - Trends

Shift Towards Original Content - Government Regulation

Content Regulations

Data Privacy Regulations - SWOT Analysis

- Stake Ecosystem

- Porter’s Five Forces

- By Revenue, 2019-2024

- By Number of Subscribers, 2019-2024

- By Average Revenue per User (ARPU), 2019-2024

- By Revenue Model, 2019-2024 (In Value %)

Subscription-Based (SVoD)

Advertisement-Based (AVoD)

Transactional (TVoD)

Hybrid Models - By Service Type, 2019-2024 (In Value %)

Video on Demand (VoD)

Live Streaming

Audio Streaming - By Device Type, 2019-2024 (In Value %)

Smart TVs

Mobile Devices

Computers

Gaming Consoles - By Geographic Region, 2019-2024 (In Value %)

Riyadh

Jeddah

Dammam

Khobar

Other Regions - By Demographics, 2019-2024 (In Value %)

Age Groups

Gender

Income Levels - By Content Type, 2019-2024 (In Value %)

Movies

TV Shows

Sports

Music

News

Others - By Streaming Type, 2019-2024 (In Value %)

Live/Linear Video Streaming

Non-Linear Video Streaming - By End User, 2019-2024 (In Value %)

Personal

Commercial

- Market Share of Major Players on the Basis of Value/Volume, 2024

Market Share of Major Players by Type of Service Segment, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Number of Subscribers, Revenue Growth Rate, Content Offerings, Unique Value Proposition, Distribution Channels)

- SWOT Analysis of Major Players

- Pricing Analysis Basis SKUs for Major Players

- Detailed Profiles of Major Companies

Netflix

Shahis (MBC Group)

Amazon Prime Video

Disney+

Anghami

Spotify

OSN Streaming

Apple TV+

StarzPlay

YouTube Premium

Shahid

Others

- Market Demand and Consumption Patterns

- Customer Preferences and Behavior

- Regulatory Compliance Needs

- Needs, Desires, and Pain Point Analysis

- Decision Making Process

- By Revenue, 2025-2030

- By Number of Subscribers, 2025-2030

- By Average Revenue per User (ARPU), 2025-2030