Market Overview

The KSA Virtual Consultations market is valued at USD ~ billion, based on the most recent data. The market is driven by the surge in demand for remote healthcare solutions, accelerated by the post-COVID healthcare shift toward digital platforms. Increasing consumer preference for convenience, especially among younger, tech-savvy populations, is fueling the market’s growth. In addition, government initiatives under Vision 2030 have significantly contributed to boosting the telemedicine infrastructure, including regulations and financial support for healthcare digitization, fostering the market’s expansion.

Saudi Arabia’s key cities, including Riyadh, Jeddah, and Dammam, dominate the Virtual Consultations market due to their dense populations, high healthcare needs, and proximity to advanced technological infrastructures. Riyadh, as the capital, leads with the most telehealth services and digital consultations, supported by its robust healthcare system. Additionally, these urban centers benefit from government investment in smart healthcare solutions, coupled with the adoption of cutting-edge technologies like AI and IoT. Rural regions are catching up as well, thanks to government initiatives focusing on expanding digital health access to underserved areas.

Market Segmentation

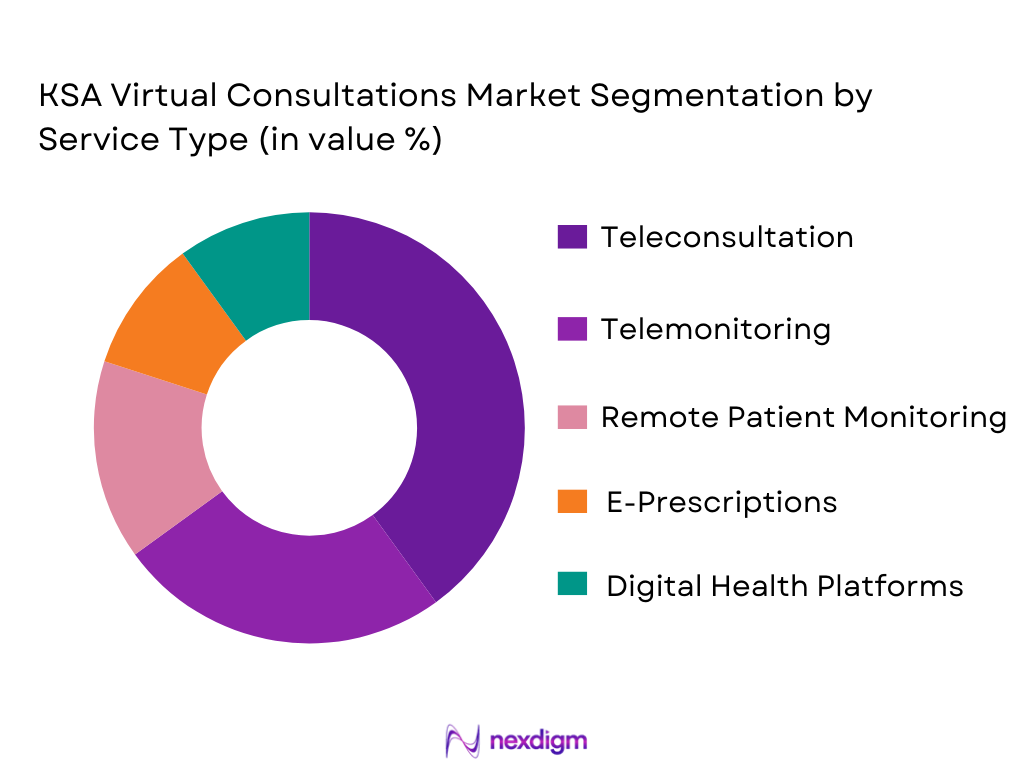

By Service Type

The KSA Virtual Consultations market is segmented by service type into teleconsultation, telemonitoring, remote patient monitoring, e-prescriptions, and digital health platforms. Among these, teleconsultation holds a dominant market share, owing to its broad appeal among patients seeking medical advice without leaving their homes. This segment is also driven by the demand for general consultations, specialist access, and convenience, making teleconsultation a preferred choice. Patients find teleconsultations particularly beneficial for routine checkups and mental health consultations, further cementing its dominance in the market.

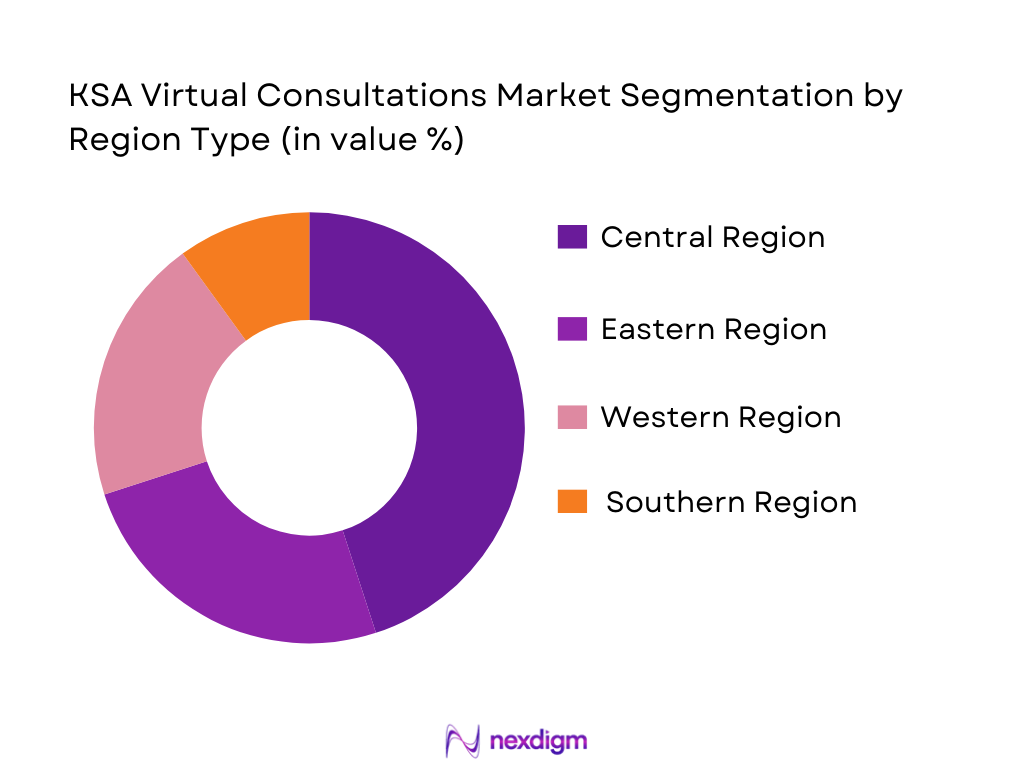

By Region

The KSA Virtual Consultations market is regionally segmented into Central, Eastern, Western, and Southern regions. The Central region, which includes Riyadh, holds the dominant share of the market due to its status as the nation’s political, economic, and healthcare hub. It has a higher concentration of healthcare facilities that have implemented telemedicine services, along with a higher rate of adoption among tech-savvy individuals. Additionally, government-led healthcare initiatives in Riyadh and surrounding areas further drive the growth of virtual consultations.

Competitive Landscape

The market is dominated by large players who are innovating in digital health platforms, creating partnerships with healthcare providers, and improving the reach of virtual consultations. The growing demand for telemedicine and virtual healthcare is making it increasingly crucial for companies to develop robust, scalable platforms that are secure, easy to use, and integrate seamlessly with existing healthcare systems. Established players are taking advantage of government support and partnerships with hospitals, while newer entrants focus on developing specialized virtual care solutions for niche patient groups.

| Company Name | Establishment Year | Headquarters | Technology Used | Revenue | End-User Focus | Key Partnerships |

| Teladoc Health | 2002 | USA | ~ | ~ | ~ | ~ |

| Amwell | 2006 | USA | ~ | ~ | ~ | ~ |

| Saudi Telemedicine | 2015 | Saudi Arabia | ~ | ~ | ~ | ~ |

| InTouch Health | 2002 | USA | ~ | ~ | ~ | ~ |

| Al-Dawaa Pharmacies | 1993 | Saudi Arabia | ~

|

~ | ~ | ~ |

KSA Virtual Consultations Market Analysis

Growth Drivers

Urbanization

Urbanization continues to drive the growth of the KSA Virtual Consultations market, as cities like Riyadh and Jeddah have seen rapid population growth. In 2025, over ~% of Saudi Arabia’s population lived in urban areas, a trend expected to continue. This urbanization fosters the adoption of telemedicine services, as the demand for healthcare in these high-density areas rises. Furthermore, urban residents are more likely to adopt digital health solutions due to greater access to technology and infrastructure, such as high-speed internet.

Industrialization

Industrialization in Saudi Arabia, particularly under the Vision 2030 initiative, is contributing to increased demand for virtual consultations, especially within the working population. Saudi Arabia’s industrial workforce is growing, with significant investments in sectors like manufacturing and energy. The expansion of these industries demands scalable health solutions for employees. Virtual consultations offer an efficient, cost-effective way to monitor and manage worker health remotely, particularly for routine checkups and mental health services. This is critical as industrialization brings more workers into urban centers, further propelling telemedicine usage.

Restraints

High Initial Cost

Despite the advantages, the high initial costs of setting up telemedicine platforms remain a significant barrier. The cost of digital infrastructure, including telemedicine systems, EHR integration, and cybersecurity measures, can be substantial. In 2025, healthcare providers in Saudi Arabia faced costs upwards of USD ~ million for implementing a comprehensive telemedicine infrastructure. While the long-term cost savings are clear, these upfront costs may deter smaller healthcare providers from investing in virtual consultation systems, limiting the market’s growth in certain regions.

Technical Challenges

Technical challenges, including inadequate internet connectivity in rural areas, can hinder the expansion of virtual consultations. In 2025, the Saudi Communications and Information Technology Commission (CITC) reported that approximately ~% of rural Saudi residents had limited access to high-speed internet, which is essential for seamless telemedicine services. This lack of connectivity creates disparities in healthcare access, as patients in rural areas face difficulties accessing virtual healthcare services. Improvements in broadband infrastructure are needed to ensure broader adoption of telemedicine services across the country.

Opportunities

Technological Advancements

Technological advancements, particularly in AI and IoT, are enhancing the capabilities of virtual consultations in Saudi Arabia. In 2025, the Ministry of Health reported increasing adoption of AI-powered diagnostic tools and remote monitoring devices, enabling more accurate consultations. The use of IoT-enabled devices, such as wearable health trackers, provides real-time data, allowing healthcare providers to offer more personalized care during virtual consultations. These innovations are improving the quality of remote healthcare, making telemedicine an even more viable solution for a larger portion of the population.

International Collaborations

Saudi Arabia is actively seeking international collaborations to enhance its telemedicine capabilities. In 2025, the Ministry of Health signed agreements with leading global telemedicine firms to expand the range of services available to Saudi patients, including mental health consultations and specialized care. These collaborations provide Saudi citizens with access to international expertise, enhancing the country’s telehealth offerings and expanding the reach of virtual consultations. These partnerships are expected to play a key role in advancing the market, bringing more innovative solutions to the country.

Future Outlook

Over the next five years, the KSA Virtual Consultations market is expected to continue its rapid expansion. Government support for telemedicine, coupled with technological advancements, will lead to widespread adoption across both urban and rural areas. Healthcare providers will increasingly integrate telehealth into their operations to reduce costs and improve patient outcomes. The push for digital healthcare is expected to align with Vision 2030, which emphasizes the modernization of healthcare in Saudi Arabia. The growing demand for remote healthcare services due to convenience, cost-effectiveness, and expanding internet connectivity will provide further momentum to this sector’s growth.

Major Players in the KSA Virtual Consultations Market

- Teladoc Health

- Amwell

- Saudi Telemedicine

- InTouch Health

- Al-Dawaa Pharmacies

- LivHealth

- CareX Medical

- Medtronic

- Dr. Sulaiman Al-Habib Medical Group

- NeoMed

- IDoctor

- HealthZoom

- Riyadh Medical Services

- Saudi German Hospitals Group

- MedeAnalytics

Key Target Audience

- Healthcare Providers (Hospitals, Clinics, Telemedicine Platforms)

- Insurance Providers (Private and Government)

- Government Agencies (Saudi Ministry of Health, Saudi Food and Drug Authority)

- Investments and Venture Capitalist Firms

- Technology Providers (AI and IoT Firms)

- Pharmaceutical Companies

- Medical Device Manufacturers

- Corporate Health Programs and Wellness Initiatives

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the KSA Virtual Consultations market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, historical data pertaining to the market size, growth rate, and adoption trends are gathered. A granular analysis is conducted to segment the market by service type, end-user, technology, and region. This will include assessing market penetration, the ratio of healthcare providers to virtual consultation services, and the resultant revenue generation.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through telephone and online interviews with industry experts representing telemedicine providers, healthcare providers, and government bodies. These consultations provide valuable operational and financial insights directly from practitioners in the field, which will be instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves synthesizing the data from various sources and collaborating with stakeholders in the healthcare industry to verify the statistics. Direct engagement with companies will help refine product segments, sales performance, consumer preferences, and other pertinent factors. This step ensures a comprehensive, accurate, and validated analysis of the KSA Virtual Consultations market.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach)

- Definition and Scope (Virtual Consultations, Telemedicine)

- Overview Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain and Value Chain Analysis (Healthcare Providers, Telehealth Platforms, End-users)

- Growth Drivers

Government Support for Digital Health

Increasing Healthcare Costs and Demand for Accessible Services

Growing Prevalence of Chronic Diseases - Market Challenges

Regulatory and Compliance Barriers

Data Security and Privacy Concerns

Lack of Digital Literacy in Rural Areas

High Initial Setup Costs - Opportunities

Demand for Integrated Healthcare Systems

Surge in Digital Health Startups

Rising Demand for Preventative Care and Wellness Solutions - Trends

Integration of AI for Personalized Care

Expansion of Telehealth into Mental Health Care

Rise of Hybrid Health Services Models - Government Regulation

Health Ministry Initiatives and Telehealth Regulations

Data Protection and Compliance Laws

Licensure for Cross-Border Teleconsultations - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces Analysis

- Competition Ecosystem

- By Value, 2019-2025

- By Volume, 2019-2025

- By Average Price of Platforms/Services, 2019-2025

- By Service Type (In Value %)

Teleconsultation

Telemonitoring

Remote Patient Monitoring

E-Prescriptions

Digital Health Platforms

- By End-User (In Value %)

Individual Patients

Healthcare Providers (Hospitals, Clinics)

Government Healthcare Agencies

Insurance Providers

Corporate/Employee Healthcare Programs

- By Technology (In Value %)

Artificial Intelligence

IoT in Telemedicine

Cloud Computing

Blockchain in Telemedicine

Virtual Reality

- By Region (In Value %)

Central Region

Eastern Region

Western Region

Southern Region

- Market Share of Major Players on the Basis of Value/Volume

Market Share of Major Players by Service Type

Market Share of Major Players by Region

Market Share of Major Players by End-User - Cross Comparison Parameters (Company Overview, Business Strategies ,Recent Developments, Strengths and Weaknesses ,Organizational Structure ,Revenues ,Revenues by Service Type, Number of Touchpoints Distribution Channels ,Margins, Production Capacity, Unique Value Offering)

- SWOT Analysis of Major Players

- Pricing Analysis of Major Players

- Detailed Profiles of Major Companies

Teladoc Health

Amwell

Mediclinic Group

HealthZoom

Dr. Sulaiman Al-Habib Medical Group

Medtronic

InTouch Health

Saudi Telemedicine

iDoctor

LivHealth

Al-Dawaa Pharmacies

CareX Medical

Al-Rajhi Telemedicine

Khaled Medical Group

NeoMed

- Market Demand and Utilization

- Purchasing Power and Budget Allocations

- Regulatory and Compliance Requirements

- Needs, Desires, and Pain Point Analysis

- Decision-Making Process

- Future Market Size by Value, 2026-2030

- Future Market Size by Volume, 2026-2030

- Average Frame Cost Outlook, 2026-2030