Market Overview

The KSA VTOL UAV market is experiencing significant growth, driven by increasing demand for military surveillance and commercial applications. The market is valued at USD ~ billion based on recent historical assessments, with the demand for vertical take-off and landing (VTOL) UAVs fueled by advancements in drone technology, increasing military spending, and a rising preference for unmanned aerial systems (UAS) for logistics, surveillance, and environmental monitoring. The market is also supported by the growing adoption of VTOL UAVs in the civil sector, such as for inspections, agriculture, and law enforcement purposes.

Saudi Arabia is emerging as a dominant player in the KSA VTOL UAV market, largely due to its robust defense budget and strategic investments in advanced technology. The country’s position as a key player in the Middle East’s military infrastructure enables it to drive demand for UAVs in both defense and commercial sectors. Other contributing factors include the government’s efforts to enhance its national defense capabilities, investments in UAV technology for security purposes, and the growing use of UAVs in surveillance and agriculture within urban areas like Riyadh and Jeddah.

Market Segmentation

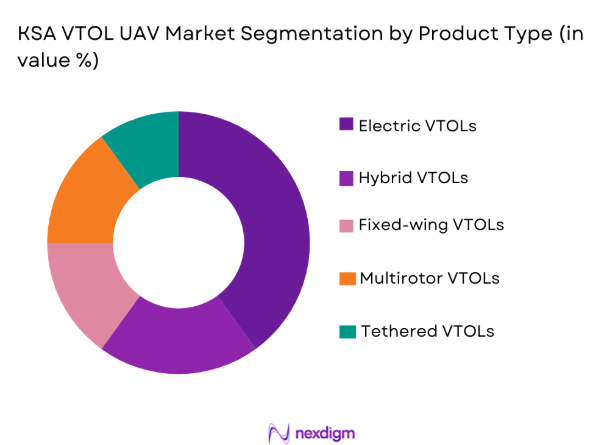

By Product Type:

KSA VTOL UAV market is segmented by product type into electric VTOLs, hybrid VTOLs, fixed-wing VTOLs, multirotor VTOLs, and tethered VTOLs. Recently, hybrid VTOLs have a dominant market share due to their versatility, offering a balance between efficiency, payload capacity, and range. Their ability to operate in different environments while providing longer flight durations makes them increasingly preferred in both military and civilian applications. Hybrid systems are suited for complex tasks, such as surveillance, reconnaissance, and commercial deliveries, making them highly attractive to defense contractors and logistics firms.

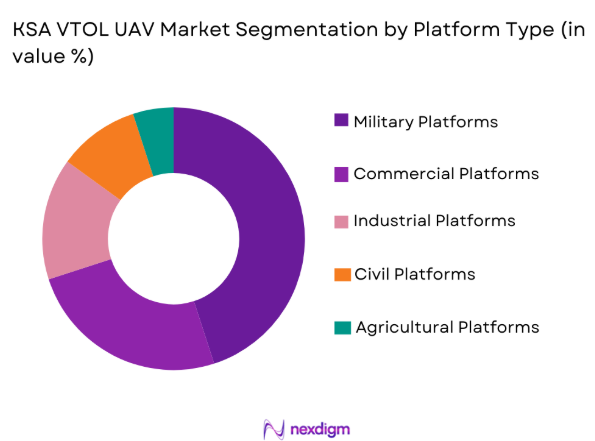

By Platform Type:

KSA VTOL UAV market is segmented by platform type into military, commercial, industrial, civil, and agricultural platforms. Recently, military platforms have a dominant market share due to the increasing demand for surveillance, reconnaissance, and tactical operations in defense settings. The Kingdom’s military focus on improving its border security, counterterrorism efforts, and surveillance capabilities has driven the adoption of VTOL UAVs within its armed forces. These platforms are highly suited for intelligence, surveillance, and reconnaissance (ISR) applications, making them essential for defense strategy.

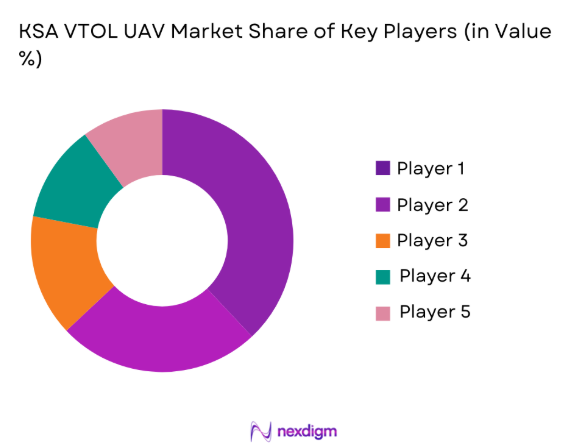

Competitive Landscape

The KSA VTOL UAV market is highly competitive, with several key players dominating the landscape. Leading companies have consolidated their positions through strategic partnerships, technological innovation, and government contracts. As the demand for military-grade drones and commercial UAVs continues to rise, these players are focusing on enhancing product performance and increasing manufacturing capacities. Key market players also leverage advancements in hybrid and electric propulsion systems to provide efficient and sustainable solutions.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (2024) | Additional Parameters |

| AeroVironment | 1971 | USA | ~ | ~ | ~ | ~ | ~ |

| Thales Group | 2000 | France | ~ | ~ | ~ | ~ | ~ |

| Boeing | 1916 | USA | ~ | ~ | ~ | ~ | ~ |

| Lockheed Martin | 1912 | USA | ~ | ~ | ~ | ~ | ~ |

| Northrop Grumman | 1939 | USA | ~ | ~ | ~ | ~ | ~ |

KSA VTOL UAV Market Analysis

Growth Drivers

Government Investments in National Security:

The Saudi Arabian government’s focus on enhancing national security is one of the major growth drivers for the VTOL UAV market. With increasing defense budgets, the demand for advanced surveillance and reconnaissance platforms like VTOL UAVs has surged. The government’s investment in technology and infrastructure to modernize defense capabilities has created an environment ripe for VTOL UAV adoption. Additionally, regional geopolitical tensions have made surveillance a key component of national security strategies. As the Kingdom focuses on improving its defense capabilities, VTOL UAVs are becoming essential tools for military operations. Furthermore, national security initiatives such as the Saudi Vision 2030 plan include investments in high-tech defense systems, which support the adoption of advanced UAV technologies. The high demand for VTOL UAVs among military forces is anticipated to fuel market growth.

Technological Advancements in UAV Propulsion Systems:

Advancements in electric and hybrid propulsion systems have been pivotal in driving the growth of the VTOL UAV market in Saudi Arabia. The increasing demand for more efficient and environmentally friendly UAVs has encouraged manufacturers to focus on developing advanced propulsion technologies. These innovations have led to significant improvements in flight times, payload capacities, and operational flexibility, which are highly valued in both commercial and military applications. The shift towards hybrid propulsion systems, which combine the benefits of both electric and traditional engines, is particularly notable. These systems allow VTOL UAVs to operate in more demanding environments, including remote areas, while reducing the environmental impact. The continuous development of efficient and sustainable propulsion systems has significantly enhanced the appeal of VTOL UAVs across multiple sectors, further driving the market growth in the Kingdom.

Market Challenges

High Production and Maintenance Costs:

One of the primary challenges faced by the KSA VTOL UAV market is the high production and maintenance costs associated with these advanced systems. The complexity of VTOL UAVs, especially those utilizing hybrid propulsion systems, leads to increased manufacturing costs. Additionally, the maintenance of these UAVs requires specialized parts and technical expertise, which further elevates the cost. This creates a barrier to adoption, particularly for small-scale operators and non-governmental organizations. While the defense sector can absorb these costs, civilian and commercial sectors may find it challenging to justify the expense, limiting the overall market potential. Furthermore, the need for continuous research and development to enhance UAV performance and reliability requires significant investment, adding to the financial burden on manufacturers and consumers alike. These high costs may hinder the broader adoption of VTOL UAVs, particularly in less economically developed regions within Saudi Arabia.

Regulatory and Certification Barriers:

Another significant challenge in the KSA VTOL UAV market is the regulatory and certification barriers that limit UAV deployment. The lack of a standardized regulatory framework for UAV operations, particularly for VTOL models, has led to delays in product certification and approvals. These regulations are crucial for ensuring the safety and reliability of UAV operations, especially in densely populated areas or sensitive regions. Furthermore, the regulatory process for integrating UAVs into national airspace systems remains cumbersome, with many operators facing lengthy approval timelines. In Saudi Arabia, the absence of clear guidelines for commercial UAV use is particularly problematic for businesses aiming to adopt UAVs for agriculture, logistics, or surveillance purposes. While the Saudi government has made strides in regulatory development, these challenges still pose obstacles for manufacturers, service providers, and operators looking to scale up operations.

Opportunities

Expansion in Commercial Applications:

One of the most significant opportunities in the KSA VTOL UAV market lies in the expansion of UAV applications beyond the military. The rise of UAVs in commercial sectors such as logistics, surveillance, and agriculture presents a vast potential market. For example, VTOL UAVs offer superior flexibility for inspecting infrastructure, monitoring crops, and delivering goods in urban and remote locations. These UAVs are particularly well-suited for last-mile delivery services, offering faster, more efficient solutions compared to traditional methods. The growing focus on smart city initiatives in Saudi Arabia further contributes to the demand for UAVs in urban planning and infrastructure management. With the government’s push for innovation in sectors like agriculture and logistics, VTOL UAVs have the opportunity to establish themselves as essential tools for commercial applications, driving market growth and diversification.

Partnerships with Private Tech Firms for Enhanced UAV Capabilities:

Another promising opportunity in the KSA VTOL UAV market is the potential for partnerships between UAV manufacturers and private technology firms. Collaborations with companies specializing in artificial intelligence, machine learning, and data analytics can enhance the operational capabilities of VTOL UAVs. These technologies can enable smarter flight planning, real-time decision-making, and automated operations, making UAVs more efficient and cost-effective. Furthermore, partnerships with tech firms can help address key challenges related to data processing, cybersecurity, and software integration, ultimately leading to more sophisticated UAV systems. By combining expertise from various sectors, manufacturers can develop more advanced VTOL UAV solutions tailored to the needs of the Saudi market. These collaborations have the potential to unlock new growth opportunities, making UAV technology more accessible and integrated into diverse industries across the Kingdom.

Future Outlook

The KSA VTOL UAV market is poised for continued growth in the coming years, with strong demand expected in both defense and commercial applications. Advancements in UAV technology, coupled with increasing government investment in national security and infrastructure, will drive further adoption. The regulatory landscape is also expected to evolve, with clearer frameworks for commercial UAV operations and streamlined certification processes. Technological innovations, particularly in propulsion systems and autonomy, will continue to enhance the operational capabilities of VTOL UAVs, making them more efficient and adaptable across various sectors.

Major Players

- AeroVironment

- Thales Group

- Boeing

- Lockheed Martin

- Northrop Grumman

- DJI Innovations

- EHang

- Skyfront

- L3Harris Technologies

- Textron

- Elbit Systems

- Saab Group

- Hensoldt

- Raytheon Technologies

- General Atomics

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Defense contractors

- Military and defense agencies

- Aerospace manufacturers

- UAV service providers

- Agricultural firms

- Infrastructure development companies

Research Methodology

Step 1: Identification of Key Variables

The first step involves identifying the key variables affecting the KSA VTOL UAV market, including technological advancements, regulatory frameworks, and demand drivers.

Step 2: Market Analysis and Construction

Market analysis is conducted by segmenting the market based on factors such as product type, platform type, and end-users. This helps to construct a clear picture of market dynamics.

Step 3: Hypothesis Validation and Expert Consultation

Consultation with industry experts and market participants validates the hypotheses derived from initial market research, ensuring that the findings are accurate and relevant.

Step 4: Research Synthesis and Final Output

The research is synthesized into a final report, which includes key insights, market forecasts, and actionable recommendations for stakeholders.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Rising demand for surveillance and reconnaissance capabilities

Advancements in battery and propulsion technology

Increasing government defense spending

Enhanced operational flexibility of VTOL UAVs

Growing interest in unmanned delivery systems - Market Challenges

High cost of VTOL UAVs

Technological challenges in autonomous flight

Regulatory and certification hurdles

Limited payload capacity of VTOL UAVs

Security and cyber threats to UAV systems - Market Opportunities

Integration of AI and machine learning in UAVs

Expansion of UAVs in agriculture and environmental monitoring

Increasing adoption in smart city and infrastructure applications - Trends

Rise of autonomous and AI-driven UAVs

Increased focus on lightweight and durable materials

Growing role of UAVs in supply chain management

Integration of UAVs with IoT and data analytics

Government-backed investments in UAV technology - Government Regulations & Defense Policy

UAV operational regulations for commercial applications

Military and defense UAV policy updates

Cybersecurity regulations for UAV technology - SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Electric VTOL UAVs

Hybrid VTOL UAVs

Fixed-wing VTOL UAVs

Multirotor VTOL UAVs

Tethered VTOL UAVs - By Platform Type (In Value%)

Military Platforms

Commercial Platforms

Civil Platforms

Industrial Platforms

Agricultural Platforms - By Fitment Type (In Value%)

Integrated Solutions

Modular Solutions

Custom Solutions

On-premise Solutions

Cloud-based Solutions - By EndUser Segment (In Value%)

Defense & Military

Agriculture & Environmental

Logistics & Transport

Public Safety & Surveillance

Energy & Utilities - By Procurement Channel (In Value%)

Direct Procurement

Government Tenders

Private Sector Procurement

Online Bidding Platforms

Third-party Distributors - By Material / Technology (in Value%)

Advanced Composites

Carbon Fiber

Lithium-ion Batteries

Hybrid Propulsion Systems

Lightweight Metals

- Market structure and competitive positioning

- Market share snapshot of major players

- CrossComparison Parameters (System Type, Platform Type, Procurement Channel, EndUser Segment, Fitment Type, Material / Technology, Growth Drivers, Market Challenges, Trends)

- SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Key Players

AeroVironment

Boeing

Lockheed Martin

Thales Group

Northrop Grumman

General Atomics

DJI Innovations

EHang

Skyfront

L3Harris Technologies

Textron

Elbit Systems

Saab Group

Hensoldt

Raytheon Technologies

- Growing defense sector demand for surveillance and reconnaissance UAVs

- Increased adoption of VTOL UAVs for infrastructure inspection

- Rising agricultural sector interest in UAV-based crop monitoring

- Public safety agencies adopting VTOL UAVs for emergency services

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035