Market Overview

The KSA Weapon Locating Radar market has experienced significant growth, with a market size of USD ~ million based on a recent historical assessment. This market is driven by increasing defense investments, security concerns, and the demand for advanced surveillance systems. Saudi Arabia’s ongoing military modernization initiatives and geopolitical tensions in the region have pushed the government to invest heavily in defense technologies, including radar systems. Additionally, the increasing use of unmanned systems and the advancement of radar technologies such as phased array and 3D radar are also fueling market growth.

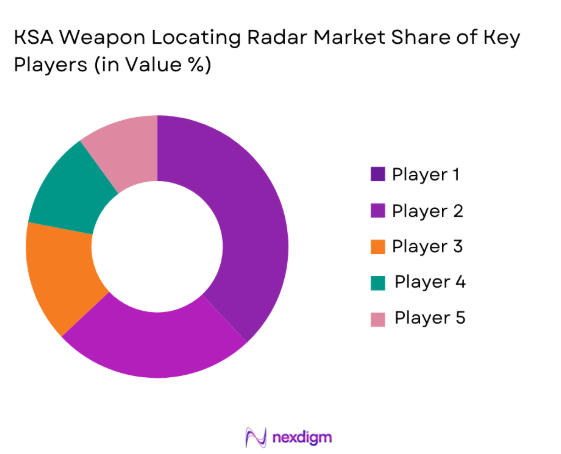

Dominant players in the KSA Weapon Locating Radar market are concentrated primarily in countries with advanced defense industries, including the United States, France, and Germany. These countries dominate due to their technological advancements, long-standing defense contracts, and strategic defense initiatives. Saudi Arabia has developed strong defense relationships with these nations, leading to a continuous flow of advanced radar technologies. Furthermore, regional security dynamics and collaborations with defense contractors have enhanced the Kingdom’s capability to maintain and upgrade its defense infrastructure, supporting the dominance of these regions in the market.

Market Segmentation

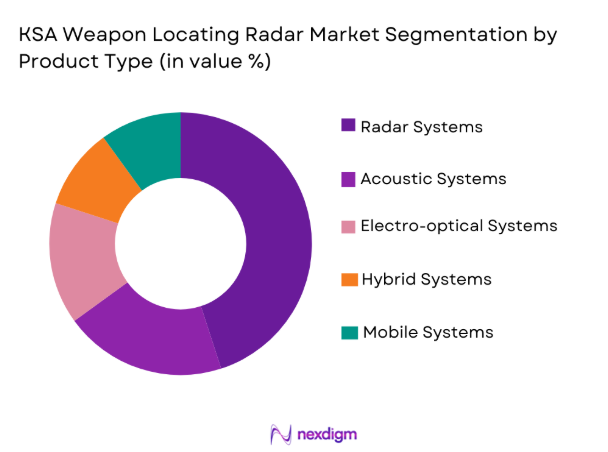

By Product Type

KSA Weapon Locating Radar market is segmented by product type into radar systems, acoustic systems, electro-optical systems, hybrid systems, and mobile systems. Recently, radar systems have a dominant market share due to their unparalleled accuracy in detecting and tracking weapon systems over large areas. The primary factors driving the dominance of radar systems include their ability to operate in all weather conditions, their integration with advanced signal processing algorithms, and their use in critical defense infrastructure. Furthermore, with continuous advancements in radar technology, such as phased array radar and 3D radar, the effectiveness and efficiency of these systems have significantly improved, further solidifying their dominance in the market.

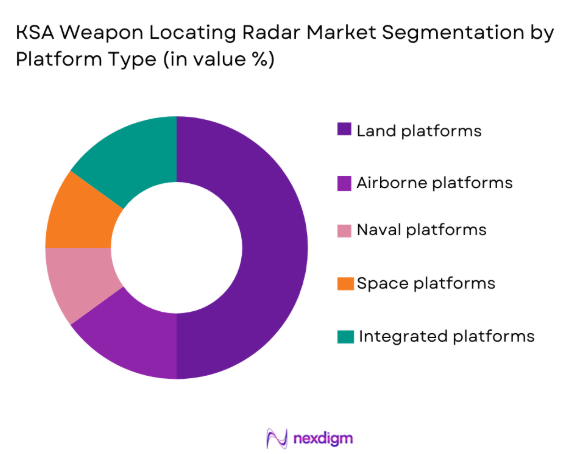

By Platform Type

KSA Weapon Locating Radar market is segmented by platform type into land platforms, naval platforms, airborne platforms, space platforms, and integrated platforms. Recently, land platforms have a dominant market share due to the significant use of radar systems in ground-based defense systems. Land platforms are critical for perimeter defense, border surveillance, and monitoring large-scale land operations, making them indispensable for Saudi Arabia’s defense forces. The growth in demand for advanced land-based radar systems, capable of high-resolution imaging and long-range detection, has been driven by increasing concerns over border security and the need for rapid deployment of defense technologies in volatile regions.

Competitive Landscape

The competitive landscape of the KSA Weapon Locating Radar market is characterized by a mix of established defense contractors and new entrants focused on innovative radar solutions. Consolidation is a key feature, with major players forming strategic partnerships and joint ventures to cater to the growing demand for advanced radar systems. Companies like Lockheed Martin, Thales Group, and BAE Systems dominate, leveraging their vast technological expertise and global reach. The market is also influenced by regional players who are heavily involved in defense procurements.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (USD Million) | Strategic Collaborations |

| Lockheed Martin | 1912 | USA | ~ | ~ | ~ | ~ | ~ |

| Thales Group | 2000 | France | ~ | ~ | ~ | ~ | ~ |

| BAE Systems | 1999 | UK | ~ | ~ | ~ | ~ | ~ |

| Raytheon Technologies | 1993 | USA | ~ | ~ | ~ | ~ | ~ |

| Rheinmetall AG | 1889 | Germany | ~ | ~ | ~ | ~ | ~ |

KSA Weapon Locating Radar Market Analysis

Growth Drivers

Increased Defense Expenditure:

Increased defense expenditure by Saudi Arabia has been a major growth driver for the KSA Weapon Locating Radar market. Over recent years, Saudi Arabia has allocated a significant portion of its national budget to defense, aiming to modernize its military and defense capabilities. This funding has led to advancements in radar technologies, specifically for detecting and locating weapon systems. The country’s security situation, coupled with rising threats from neighboring regions, has accelerated the demand for advanced weapon locating systems. Furthermore, the integration of cutting-edge radar technologies, such as phased array systems, has been critical in improving defense readiness. With an eye on both regional and global defense dynamics, the Kingdom continues to invest in improving its defense infrastructure. Additionally, high-profile defense partnerships with leading defense contractors have played a crucial role in supporting the growth of radar systems.

Technological Advancements in Radar Systems:

Technological advancements in radar systems have also been a crucial growth driver. Modern radar technologies, including 3D radar and synthetic aperture radar (SAR), provide enhanced detection capabilities, accuracy, and range, driving demand for such systems in defense applications. The evolution of radar technology has enabled the detection of objects from greater distances, which is essential for national defense and security. With the development of more sophisticated signal processing and AI-enhanced algorithms, radar systems have become more reliable and efficient. Saudi Arabia has embraced these advancements, integrating them into its defense strategies, which further fuels market growth. As defense contractors continue to innovate and improve radar performance, the KSA Weapon Locating Radar market stands to benefit from cutting-edge solutions that offer superior detection and tracking capabilities.

Market Challenges

High Capital Investment:

One of the main challenges for the KSA Weapon Locating Radar market is the high capital investment required to acquire and deploy advanced radar systems. The cost of purchasing, installing, and maintaining these systems is substantial, limiting the accessibility of such technologies to a few select countries or defense organizations. Saudi Arabia has allocated a significant portion of its defense budget to radar technologies, but the high upfront costs of procurement and integration remain a critical barrier. Additionally, complex systems require ongoing upgrades and maintenance, further increasing long-term costs. While defense expenditure is rising, the financial burden associated with these advanced systems continues to be a limiting factor for some organizations looking to enhance their radar capabilities. This cost barrier also affects the procurement strategies of smaller defense contractors and organizations in the region.

Integration and Interoperability Challenges:

Another challenge facing the KSA Weapon Locating Radar market is the complexity of integrating radar systems with existing defense infrastructure. Many of the new radar technologies require seamless integration with other systems, such as command and control, communications, and intelligence systems, which can be difficult. Compatibility issues and the challenge of ensuring interoperability across various defense platforms complicate the procurement process. These integration challenges delay the deployment of new radar systems and add additional layers of complexity to procurement strategies. Defense contractors often face technical hurdles when working to integrate new technologies with older legacy systems, making the transition to more advanced radar systems a time-consuming and expensive process.

Opportunities

Integration of AI and Machine Learning:

The integration of artificial intelligence (AI) and machine learning (ML) into radar systems represents a significant opportunity for growth in the KSA Weapon Locating Radar market. AI and ML have the potential to enhance the detection capabilities of radar systems by enabling them to automatically analyze vast amounts of data in real-time. With these technologies, radar systems can better detect and identify threats, improving operational efficiency and reducing human error. AI-driven radar systems can also enhance decision-making by providing predictive analytics and insights, which would help defense forces better respond to evolving threats. As Saudi Arabia continues to modernize its military, incorporating AI and ML into radar systems will enable it to stay at the forefront of technological innovation.

Growing Demand for Autonomous Defense Systems:

The increasing demand for autonomous defense systems presents another promising opportunity for the KSA Weapon Locating Radar market. As unmanned systems, drones, and autonomous vehicles become more prevalent in modern warfare, the demand for radar systems that can detect and locate these platforms is growing. Saudi Arabia’s defense forces have been incorporating autonomous systems into their strategies, creating new demand for radar technologies capable of detecting fast-moving, low-flying, and stealthy targets. The evolving nature of defense technology, with a shift towards automation and reduced human intervention, is driving the need for innovative radar solutions that can support these advanced systems. As the market for autonomous defense systems grows, radar technologies will become even more critical in detecting, tracking, and neutralizing potential threats.

Future Outlook

The KSA Weapon Locating Radar market is expected to grow significantly over the next five years, driven by technological advancements, increased defense expenditure, and the integration of artificial intelligence in radar systems. Saudi Arabia’s ongoing military modernization program, coupled with regional security concerns, will drive continued investments in radar technologies. Technological innovations, particularly in AI-enhanced radar systems and autonomous defense platforms, will further boost market growth. Additionally, the KSA government’s commitment to enhancing national security infrastructure and defense capabilities will provide long-term support to the market.

Major Players

- Lockheed Martin

- Thales Group

- BAE Systems

- Raytheon Technologies

- Rheinmetall AG

- Elbit Systems

- L3 Technologies

- Northrop Grumman

- Leonardo

- Harris Corporation

- Saab Group

- General Dynamics

- Indra Sistemas

- Rockwell Collins

- Boeing

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Defense contractors

- Military agencies

- Aerospace companies

- National security agencies

- Public sector defense divisions

- Technology developers in the defense sector

Research Methodology

Step 1: Identification of Key Variables

The key variables influencing the market include radar technology advancements, defense spending, and geopolitical dynamics.

Step 2: Market Analysis and Construction

The market was analyzed using primary and secondary research methods, including interviews with industry experts and analysis of government defense budgets.

Step 3: Hypothesis Validation and Expert Consultation

The preliminary research hypotheses were validated by consulting with experts from defense contractors and radar manufacturers to ensure accurate market data.

Step 4: Research Synthesis and Final Output

All collected data were synthesized to produce the final market report, which was reviewed by industry experts for accuracy and completeness.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Rising defense expenditure by the Saudi government

Increased adoption of advanced radar systems in defense applications

Ongoing military modernization programs in KSA

Geopolitical tensions and national security threats in the region

Technological advancements in radar and sensor systems - Market Challenges

High capital expenditure for radar system deployment

Interoperability and system integration complexities

Regulatory and compliance barriers for defense procurement

Cybersecurity vulnerabilities in defense technologies

Political and social resistance to military technology expansion - Market Opportunities

Integration of AI and machine learning in radar systems

Collaborations between defense contractors and tech firms

Emerging demand for autonomous systems and robotics in defense - Trends

Advancements in real-time weapon detection systems

Increased use of hybrid radar and sensor systems

Surge in demand for mobile and deployable radar systems

Incorporation of AI in radar signal processing

Growth in defense-related R&D investments - Government Regulations & Defense Policy

Export Control and Compliance Policies

Government funding and grants for advanced defense systems

Data protection and cybersecurity regulations for defense technologies - SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Radar Systems

Acoustic Systems

Electro-optical Systems

Hybrid Systems

Mobile Systems - By Platform Type (In Value%)

Land Platforms

Naval Platforms

Airborne Platforms

Space Platforms

Integrated Platforms - By Fitment Type (In Value%)

On-premise Solutions

Cloud-based Solutions

Hybrid Solutions

Modular Solutions

Integrated Solutions - By EndUser Segment (In Value%)

Military Forces

Defense Contractors

Government Agencies

Security Services

Private Sector / Technology Firms - By Procurement Channel (In Value%)

Direct Procurement

Government Tenders

Private Sector Procurement

Online Bidding Platforms

Third-party Distributors - By Material / Technology (in Value%)

Radar Technology

Acoustic Technology

Electro-optical Technology

Integrated Technology

Sensor Technology

- Market structure and competitive positioning

- Market share snapshot of major players

- CrossComparison Parameters (System Type, Platform Type, Procurement Channel, EndUser Segment, Fitment Type, Material/Technology, Installed Units, Average System Price, System Complexity Tier)

- SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Key Players

Lockheed Martin

Thales Group

BAE Systems

General Dynamics

Northrop Grumman

Raytheon Technologies

L3 Technologies

Leonardo

Harris Corporation

Saab Group

Rheinmetall AG

Elbit Systems

Hewlett Packard Enterprise

Boeing

Sikorsky Aircraft

- Military forces’ increasing demand for advanced radar systems

- Government agencies’ role in regulating and procuring defense systems

- Private sector companies’ involvement in defense technology innovations

- Security services’ need for effective weapon detection technologies

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035