Market Overview

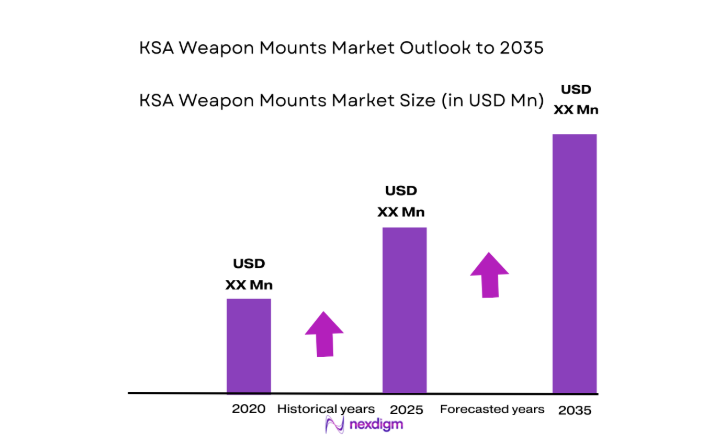

The KSA Weapon Mounts market is valued at approximately USD ~ million, driven by the growing defense budgets and increasing investments in military modernization by the government. Demand is primarily fueled by the rising geopolitical tensions in the Middle East, necessitating advanced weapon systems. The market’s growth is further supported by the need for technological advancements in defense systems, including remote weapon mounting and automation. These systems offer flexibility and enhanced security, making them essential for modernizing armed forces in the region.

Saudi Arabia remains a dominant player in the KSA Weapon Mounts market due to its substantial defense budget and its ongoing military modernization efforts. As one of the leading buyers of defense equipment in the region, the country invests heavily in advanced weapon systems to enhance its security capabilities. Additionally, the growing collaboration between local defense companies and international defense contractors further strengthens Saudi Arabia’s position. Its strategic location and defense priorities ensure its leading role in the market’s growth trajectory.

Market Segmentation

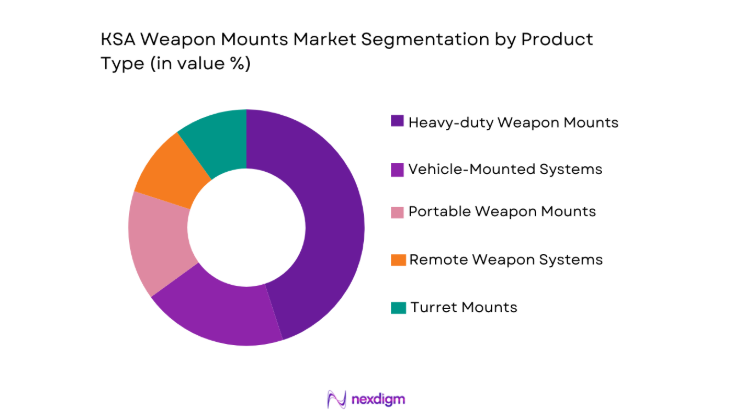

By Product Type

The KSA Weapon Mounts market is segmented by product type into heavy-duty weapon mounts, vehicle-mounted weapon systems, portable weapon mounts, remote weapon systems, and turret mounts. The heavy-duty weapon mounts sub-segment has a dominant market share due to their high durability and reliability in combat scenarios, especially for military forces operating in harsh environments. Heavy-duty mounts are preferred by the Saudi Arabian military and allied defense forces for their robust performance in demanding operations, as they support larger, more powerful weapons and ensure operational efficiency. The need for these mounts is also driven by the modernization of military fleets, which require advanced mounting solutions to support various weapon types in diverse terrains.

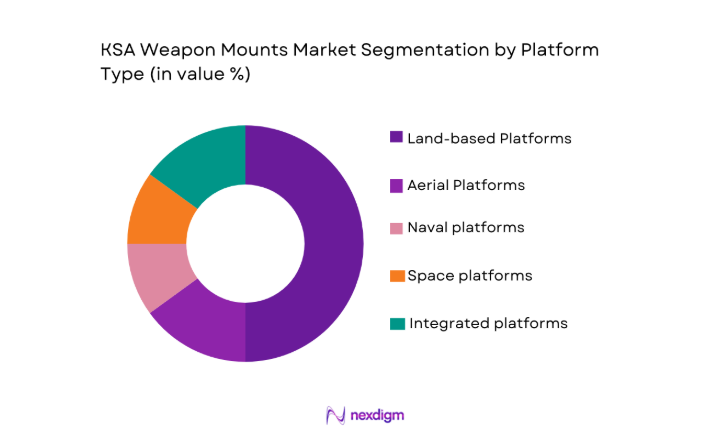

By Platform Type

The KSA Weapon Mounts market is segmented by platform type into land-based platforms, naval platforms, aerial platforms, space platforms, and integrated platforms. Among these, land-based platforms have a dominant market share due to the significant focus on strengthening ground defense capabilities. Saudi Arabia has prioritized enhancing its land-based military forces, and the integration of advanced weapon mounts into armored vehicles and tanks is a key part of this strategy. Additionally, the increasing procurement of ground-based systems driven by military modernization initiatives further strengthens the demand for these mounts. The reliability and versatility of land-based platforms make them a critical component of the Saudi Arabian military strategy.

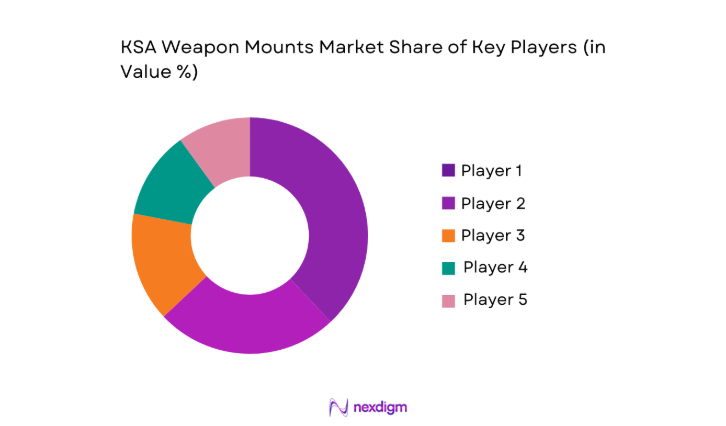

Competitive Landscape

The KSA Weapon Mounts market is highly competitive, with a mix of local and international players. The market has seen significant consolidation, with major global defense companies establishing joint ventures and collaborations with local players. These partnerships are essential for providing region-specific solutions and ensuring compliance with local defense standards. The influence of major players such as Lockheed Martin, BAE Systems, and Rheinmetall AG is substantial, with their advanced technologies dominating the market. The competitive landscape is further shaped by the growing need for advanced weapon systems and modernization efforts in the Kingdom.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Additional Parameter |

| Lockheed Martin | 1912 | USA | ~ | ~ | ~ | ~ | ~ |

| BAE Systems | 1999 | UK | ~ | ~ | ~ | ~ | ~ |

| Rheinmetall AG | 1889 | Germany | ~ | ~ | ~ | ~ | ~ |

| General Dynamics | 1952 | USA | ~ | ~ | ~ | ~ | ~ |

| Thales Group | 2000 | France | ~ | ~ | ~ | ~ | ~ |

KSA Weapon Mounts Market Analysis

Growth Drivers

Technological Advancements in Military Weapon Systems

Technological advancements in military weapon systems, such as improved automation and remote weapon control, are driving growth in the KSA Weapon Mounts market. These technologies offer enhanced precision, flexibility, and operational efficiency for the Saudi Arabian military. Modern weapon mounts are increasingly integrating features like AI and machine learning, enabling autonomous operations in complex environments. These innovations significantly reduce the need for human intervention in high-risk scenarios, boosting the demand for advanced weapon mounting systems. Saudi Arabia’s increasing defense budget is aligned with its need to adopt cutting-edge military technologies, including automated weapon systems, thus driving further demand for weapon mounts. The growing demand for advanced land-based and remote weapon systems is expected to fuel market growth over the next few years. Saudi Arabia’s commitment to military modernization through these technologies will continue to increase demand for next-generation weapon mounts.

Geopolitical Tensions in the Middle East

Geopolitical tensions in the Middle East are a key growth driver for the KSA Weapon Mounts market. The region has seen an increase in military confrontations and defense initiatives, prompting Saudi Arabia to bolster its defense capabilities. Rising regional instability has led the Kingdom to prioritize investments in advanced weapon systems to protect its borders and maintain its strategic position in the Middle East. Saudi Arabia’s growing concern over security threats from regional adversaries is catalyzing the procurement of more advanced weapon mounts. Additionally, the Kingdom’s alliances with global defense contractors and its strategic role in regional security are influencing the demand for state-of-the-art defense technologies. As Saudi Arabia looks to secure its borders and project power, it is investing heavily in its military infrastructure, including weapon mounts, to ensure its forces are equipped with the latest and most efficient technology.

Market Challenges

High Cost of Advanced Weapon Mounts

The high cost of advanced weapon mounts is a significant challenge for the KSA Weapon Mounts market. The complexity and integration of advanced technologies, such as remote control systems and automation, lead to a substantial increase in production and procurement costs. Saudi Arabia’s defense budget is large, but the high cost of these systems can still limit the pace of adoption, particularly for smaller units or niche applications. Additionally, maintenance and training costs associated with these systems further add to the overall expenditure. Despite these challenges, the Kingdom remains committed to its military modernization efforts, ensuring that the high costs of advanced weapon systems do not severely impact the overall procurement strategy. However, it remains a key challenge for the market, especially as the demand for high-tech weapon mounts continues to rise.

Technological Integration and Interoperability Issues

Technological integration and interoperability issues are another significant challenge faced by the KSA Weapon Mounts market. As weapon systems become more advanced, the challenge of ensuring seamless integration with existing platforms and technologies becomes more pronounced. Saudi Arabia’s defense forces operate a wide array of military platforms, which often include both legacy systems and modern, cutting-edge technologies. Ensuring that new weapon mounts can integrate with these diverse systems without significant re-engineering or operational disruption is a key challenge. Furthermore, interoperability with allied forces and multinational coalitions is vital for joint military operations. These integration and compatibility issues create delays in deployment and increase the overall complexity of procurement strategies, making it a major challenge for Saudi Arabia’s defense planners.

Opportunities

Expanding Demand for Autonomous Weapon Systems

The growing interest in autonomous systems presents a significant opportunity for the KSA Weapon Mounts market. As military forces look to reduce human intervention in high-risk scenarios, autonomous weapon systems are becoming increasingly popular. These systems offer improved efficiency, reduced risk to personnel, and enhanced combat capabilities. Saudi Arabia’s ongoing investment in military technologies, including robotics and autonomous systems, is driving the demand for weapon mounts that can integrate with these advanced platforms. The Saudi Arabian government’s focus on developing advanced autonomous defense solutions, including unmanned ground vehicles and drones, is expected to open new opportunities for weapon mount manufacturers. As Saudi Arabia continues to modernize its military forces with a focus on automation, the demand for specialized weapon mounts to support these systems will significantly increase.

Partnerships with Local and International Defense Contractors

Another promising opportunity for the KSA Weapon Mounts market lies in the growing collaboration between local and international defense contractors. Saudi Arabia has established numerous partnerships with leading global defense companies to enhance its military capabilities and localize production. These collaborations not only enable the transfer of advanced technologies but also create opportunities for local businesses to participate in the defense sector. As a result, Saudi Arabia is increasingly relying on joint ventures and partnerships to meet the rising demand for advanced weapon mounts. These partnerships are fostering innovation and ensuring the availability of cost-effective solutions while boosting the local economy. The growing focus on public-private collaborations will continue to drive the development of advanced weapon mounting systems, making this a key opportunity for market players.

Future Outlook

The future of the KSA Weapon Mounts market looks promising, driven by continued investment in military modernization and technological advancements. Over the next five years, the market is expected to grow at a steady pace, with increasing demand for autonomous and remote weapon systems. Advancements in artificial intelligence, machine learning, and automation will play a significant role in shaping the future of weapon mount technologies. Additionally, regulatory support and favorable government policies will further boost the adoption of advanced systems. The Saudi Arabian defense sector’s commitment to enhancing its military capabilities ensures that the demand for sophisticated weapon mounts will continue to rise, particularly for land-based and autonomous platforms.

Major Players

- Lockheed Martin

- BAE Systems

- Rheinmetall AG

- General Dynamics

- Thales Group

- Northrop Grumman

- Leonardo

- Saab Group

- Elbit Systems

- Raytheon Technologies

- L3 Technologies

- Honeywell International

- Harris Corporation

- Meggitt

- Textron Systems

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Military contractors

- Defense agencies

- Large-scale defense manufacturers

- Strategic defense alliances

- Defense technology developers

- Regional security agencies

Research Methodology

Step 1: Identification of Key Variables

Key market variables, including product types, platform types, and regional dynamics, are identified to ensure the research framework addresses all relevant factors influencing the KSA Weapon Mounts market.

Step 2: Market Analysis and Construction

Comprehensive analysis of historical data and current market conditions is conducted to construct the market landscape and identify growth trends, challenges, and opportunities within the KSA Weapon Mounts market.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are validated through consultations with industry experts, defense contractors, and technology developers to gain insights into evolving trends and ensure the research findings are accurate and relevant.

Step 4: Research Synthesis and Final Output

The final output synthesizes collected data and expert insights to generate an actionable market report, highlighting key trends, market opportunities, and competitive dynamics within the KSA Weapon Mounts sector.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Growth Drivers

Increased Defense Budgets and Military Modernization

Technological Advancements in Weapon Systems

Rising Geopolitical Tensions - Market Challenges

High Cost of Advanced Weapon Mounting Systems

Technological Integration and Interoperability Issues

Complexity in Manufacturing and Maintenance - Market Opportunities

Collaborations with Private Tech Firms for Advanced Mounts

Development of Modular and Customizable Mounting Systems

Expanding Markets in Emerging Economies - Trends

Integration of AI in Weapon Mount Systems

Surge in Remote and Autonomous Weaponry - Government Regulations & Defense Policy

- SWOT Analysis

- Porter’s Five Forces Analysis

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Heavy-duty Weapon Mounts

Vehicle-Mounted Weapon Systems

Portable Weapon Mounts - By Platform Type (In Value%)

Land-based Platforms

Naval Platforms

Aerial Platforms

Space Platforms

Integrated Platforms - By Fitment Type (In Value%)

On-Vehicle Fitments

Modular Mounts

Universal Mounting Systems - By End-user Segment (In Value%)

Military Forces

Defense Contractors

Law Enforcement Agencies - By Procurement Channel (In Value%)

Direct Procurement

Government Tenders

Private Sector Procurement

- Market share of major players

- Cross Comparison Parameters (System Type, Platform Type, Procurement Channel, End User Segment, Fitment Type, Material/Technology)

- SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Key Players

Rheinmetall AG

Lockheed Martin

General Dynamics

BAE Systems

Northrop Grumman

Raytheon Technologies

L3 Technologies

Leonardo

Harris Corporation

Saab Group

Elbit Systems

Thales Group

Meggitt

Sikorsky Aircraft

Textron Systems

- Military Forces’ Focus on Advanced Weapon Systems

- Private Security Firms Increasing Adoption of Remote Mounts

- Defense Contractors Prioritizing Modular Weapon Mounts

- Government Agencies Moving Toward Autonomous Systems

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035