Market Overview

The KSA Weapons and Ammunition Market is projected to see robust growth, with the market size being estimated at approximately USD ~ billion. This growth is driven by increased government defense spending, strategic military initiatives, and rising geopolitical tensions in the region. The continued expansion of Saudi Arabia’s military infrastructure, bolstered by partnerships with global defense contractors, supports this upward trajectory. Furthermore, advanced technological integration in weapons systems and ammunition is expected to drive innovation and demand.

The Kingdom of Saudi Arabia is a key player in the Middle East, dominating the weapons and ammunition market due to its substantial military investments and strategic defense alliances. The major urban centers, particularly Riyadh and Jeddah, serve as critical hubs for defense procurement and research. The country’s geopolitical position, particularly its focus on regional stability and security, alongside the Vision 2030 initiative, positions KSA as a leader in defense spending and innovation.

Market Segmentation

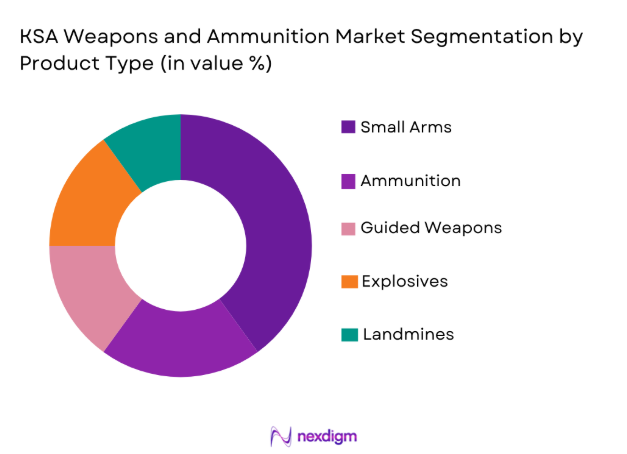

By Product Type:

The KSA Weapons and Ammunition Market is segmented by product type into small arms, ammunition, guided weapons, explosives, and landmines. Recently, small arms have maintained a dominant market share due to the consistent demand from military and law enforcement sectors. Factors such as ongoing modernization of armed forces, increasing territorial security concerns, and the frequent use of small arms in regional conflicts have made this sub-segment the largest contributor to market growth. The evolution of small arms technology, alongside extensive procurement programs by the Saudi military, continues to strengthen the sub-segment’s leading position.

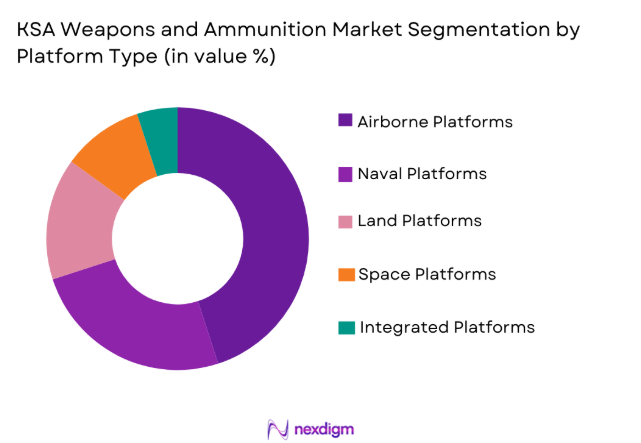

By Platform Type:

The KSA Weapons and Ammunition Market is segmented by platform type into land platforms, airborne platforms, naval platforms, space platforms, and integrated platforms. Airborne platforms currently dominate the market, driven by the increasing integration of advanced military aircraft and drones in defense strategies. The rise in air combat capabilities, along with the strategic importance of air superiority in the region, has bolstered demand for airborne weapons and ammunition. Moreover, KSA’s defense investments in air platforms such as fighter jets and UAVs further emphasize the leading role of airborne platforms in the market.

Competitive Landscape

The KSA Weapons and Ammunition Market is highly competitive, characterized by a blend of local and international players. Major global defense contractors, as well as regional players, dominate the landscape, with several having long-term government contracts in the Kingdom. There has been notable consolidation within the industry as companies seek to form strategic partnerships with the Saudi government and military. Additionally, companies with advanced technological offerings, such as precision-guided munitions and smart ammunition, have gained significant market share.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Key Market Parameter |

| Lockheed Martin | 1912 | USA | ~ | ~ | ~ | ~ | ~ |

| BAE Systems | 1999 | UK | ~ | ~ | ~ | ~ | ~ |

| Raytheon Technologies | 1922 | USA | ~ | ~ | ~ | ~ | ~ |

| Northrop Grumman | 1939 | USA | ~ | ~ | ~ | ~ | ~ |

| Thales Group | 2000 | France | ~ | ~ | ~ | ~ | ~ |

KSA Weapons and Ammunition Market Analysis

Growth Drivers

Increasing Government Military Investment:

The Kingdom of Saudi Arabia has significantly increased its defense budget, with a focus on modernizing its armed forces. This investment covers a wide range of military technologies, including weapons systems, ammunition, and advanced platforms. This shift is partially in response to regional security threats, emphasizing the need for a robust, state-of-the-art defense capability. Furthermore, the Saudi government’s Vision 2030 initiative aims to reduce reliance on foreign defense contractors, pushing local manufacturers to expand. The Kingdom is also investing heavily in defense research and development (R&D), further fueling demand for innovative weaponry and ammunition. The combination of substantial financial backing, an active procurement program, and the desire to build a more self-reliant defense infrastructure has directly contributed to the market’s growth. This trend is likely to continue as Saudi Arabia focuses on defense diversification and modernization efforts.

Regional Geopolitical Tensions:

Geopolitical instability in the Middle East has significantly boosted demand for advanced weapons and ammunition in KSA. The ongoing conflicts and tensions with neighboring countries and non-state actors have intensified the Kingdom’s security needs, pushing it to invest heavily in defense capabilities. Saudi Arabia’s central role in the region’s military alliances, such as its participation in the Yemen conflict, has led to an increased demand for precision weapons, artillery, and ammunition. The government’s strategic shift towards adopting cutting-edge defense technologies, including drones and missile defense systems, underscores the nation’s desire for military superiority. Saudi Arabia is also leveraging these tensions to build a formidable military presence, necessitating a continuous supply of high-quality, technologically advanced weapons and ammunition. The consistent rise in defense expenditures, driven by these geopolitical pressures, ensures the steady growth of the market.

Market Challenges

Regulatory and Compliance Barriers:

The KSA Weapons and Ammunition Market faces significant regulatory challenges, particularly in the context of international trade and arms export controls. Saudi Arabia must navigate strict regulations set by various global defense organizations and foreign governments when procuring weapons and ammunition. Compliance with international arms treaties and agreements, such as the Arms Trade Treaty (ATT), complicates the purchasing and exporting process. Furthermore, domestic regulations governing the local production of weapons and ammunition require strict adherence to safety and security standards, which may restrict certain types of weapons technology from being deployed. These regulatory challenges result in delays in procurement cycles and potential supply chain disruptions. The complexities of regulatory compliance, alongside the changing landscape of international defense agreements, pose ongoing challenges to the smooth operation of the weapons market in the Kingdom.

High Capital Expenditure:

The weapons and ammunition market in Saudi Arabia is heavily influenced by the high capital expenditure required for modernizing military systems. Acquiring advanced weapons platforms, such as fighter jets, guided missiles, and naval systems, entails substantial financial commitments, which often lead to budget constraints. Additionally, developing domestic manufacturing capabilities and establishing R&D facilities for weapons production requires long-term investment, which may delay short-term market returns. These high capital costs may force the government to prioritize certain sectors of defense over others, potentially slowing the growth of certain sub-segments of the weapons and ammunition market. The financial burden of continually upgrading defense infrastructure, coupled with the rising cost of raw materials for ammunition and weapons systems, could strain the market’s overall expansion. This challenge underscores the need for strategic financial planning and international partnerships to alleviate budgetary pressures.

Opportunities

Expansion of Autonomous Weapons Systems:

One of the most promising opportunities in the KSA Weapons and Ammunition Market is the increasing interest in autonomous weapons systems, such as drones and automated artillery. These systems offer enhanced precision, reduced human error, and the ability to operate in high-risk environments with minimal casualties. Saudi Arabia’s growing focus on technological innovation and its desire to enhance military capabilities align with this trend, as autonomous weapons systems are seen as the future of modern warfare. With advancements in AI, robotics, and sensor technologies, the development and deployment of autonomous systems are expected to be a key area of growth. This opportunity is supported by the Kingdom’s Vision 2030 strategy, which promotes technological modernization and self-reliance in defense. As demand for these advanced systems increases, local and international defense firms are likely to invest heavily in developing and deploying autonomous weapons in Saudi Arabia.

Rising Demand for Precision-Guided Munitions:

Another key opportunity in the KSA Weapons and Ammunition Market lies in the growing demand for precision-guided munitions (PGMs). These advanced weapons systems, which include guided missiles and bombs, offer superior accuracy and are less likely to cause collateral damage compared to traditional weapons. With the Kingdom’s strategic military goals of maintaining air and land superiority, the demand for PGMs is expected to surge. Saudi Arabia’s military operations, particularly in the context of regional security concerns, require precise and effective weaponry, driving the need for PGMs. Additionally, advancements in GPS and laser guidance technologies are making PGMs more affordable and accessible, further propelling their adoption. As a result, the market for PGMs is likely to expand significantly, creating new opportunities for both local manufacturers and international suppliers.

Future Outlook

Over the next five years, the KSA Weapons and Ammunition Market is expected to grow at a steady pace, driven by ongoing military modernization and advancements in defense technologies. Increased investment in advanced weaponry, including autonomous systems and precision-guided munitions, will dominate the landscape. Saudi Arabia’s commitment to expanding its defense infrastructure under Vision 2030, alongside regional geopolitical concerns, will continue to fuel demand for cutting-edge weapons systems. Additionally, regulatory support and strategic partnerships with global defense firms will enable the Kingdom to strengthen its position as a leader in the defense industry. Technological advancements in weapons systems, coupled with an evolving geopolitical landscape, will shape the future growth of the market.

Major Players

- Lockheed Martin

- BAE Systems

- Raytheon Technologies

- Northrop Grumman

- Thales Group

- General Dynamics

- L3 Technologies

- Elbit Systems

- Leonardo

- Saab Group

- Rheinmetall AG

- Harris Corporation

- Kongsberg Gruppen

- Rheinmetall Defence

- Leonardo DRS

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Defense contractors

- Military forces

- Aerospace and defense technology companies

- Security services

- Private sector / Technology firms

- Defense procurement agencies

Research Methodology

Step 1: Identification of Key Variables

The first step involves identifying the essential variables influencing the weapons and ammunition market in Saudi Arabia, such as government spending, geopolitical tensions, and technological advancements.

Step 2: Market Analysis and Construction

This step entails analyzing market data to understand the current market structure, demand trends, and regional influences, allowing for the construction of a detailed market model.

Step 3: Hypothesis Validation and Expert Consultation

We validate our hypotheses by consulting with industry experts, government officials, and military representatives to ensure the accuracy of the data collected.

Step 4: Research Synthesis and Final Output

The final step involves synthesizing all collected data into a cohesive market report that highlights key trends, opportunities, challenges, and growth projections for the KSA weapons and ammunition market.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increased Government Investment in National Security

Technological Advancements in Military Systems

Rising Geopolitical Tensions

Ongoing Military Modernization Programs

Demand for Enhanced Defense Capabilities - Market Challenges

High Capital Expenditure in Defense Projects

Regulatory and Compliance Barriers

Technological Integration and Interoperability Issues

Export Restrictions and Trade Barriers

Political and Social Resistance to Military Expansion - Market Opportunities

Integration of Commercial Technologies into Defense Systems

Advancements in Smart Ammunition Technologies

Expansion in Military UAV Systems - Trends

Increased Automation in Weapons Systems

Rise in Demand for Precision-guided Ammunition

Adoption of Cybersecurity Measures in Ammunition Systems

Shift Towards Smart Military Technologies

Investment in Advanced Combat Systems - Government Regulations & Defense Policy

Export Control and Compliance Policies

Government Funding and Grants for Defense Technologies

Regulations Regarding the Use of Autonomous Weapons - SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Small Arms

Ammunition

Guided Weapons

Explosives

Landmines - By Platform Type (In Value%)

Land Platforms

Airborne Platforms

Naval Platforms

Space Platforms

Integrated Platforms - By Fitment Type (In Value%)

On-premise Solutions

Cloud-based Solutions

Hybrid Solutions

Modular Solutions

Integrated Solutions - By EndUser Segment (In Value%)

Military Forces

Defense Contractors

Government Agencies

Security Services

Private Sector / Technology Firms - By Procurement Channel (In Value%)

Direct Procurement

Government Tenders

Private Sector Procurement

Online Bidding Platforms

Third-party Distributors - By Material / Technology (In Value%)

Steel

Composite Materials

Smart Materials

Advanced Ceramics

Polymer-based Materials

- Market structure and competitive positioning

- Market share snapshot of major players

- CrossComparison Parameters (System Type, Platform Type, Procurement Channel, EndUser Segment, Fitment Type)

- SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Key Players

Riyadh Military Industries

Al-Fahd Industries

Saudi Advanced Industries

Lockheed Martin

Northrop Grumman

General Dynamics

BAE Systems

Raytheon Technologies

Saab Group

Thales Group

Elbit Systems

Leonardo

Kongsberg Gruppen

Harris Corporation

L3 Technologies

Military Forces’ Increasing Demand for Advanced Weaponry

Government Agencies’ Role in Regulating and Procuring Ammunition

Defense Contractors’ Shift Towards Innovation and Integration

Private Sector’s Growing Interest in Defense-related Technologies

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035