Market Overview

The market size for KSA Weapons Carriage and Release Systems is expected to reach USD ~ billion, driven by the growing demand for advanced defense technologies. Government investments and geopolitical tensions have led to an increased focus on improving military capabilities in the Kingdom. This growth is further fueled by the increasing defense budgets aimed at modernizing the military infrastructure, alongside advancements in the design and deployment of weapons carriage and release systems.

Saudi Arabia’s dominance in this market is largely due to its significant defense spending, supported by a strategic location and partnerships with global defense contractors. The Kingdom is central to the Middle East’s defense sector, benefiting from both domestic military modernization initiatives and foreign defense investments. Additionally, major defense infrastructure projects, coupled with its strategic defense alliances, bolster Saudi Arabia’s position as a key player in the weapons carriage and release systems market.

Market Segmentation

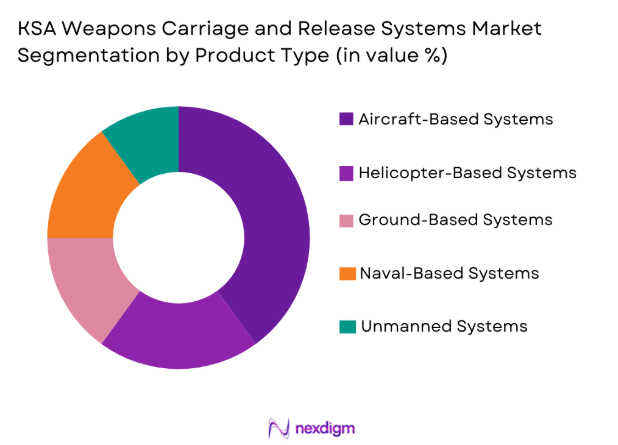

By Product Type:

KSA Weapons Carriage and Release Systems market is segmented by product type into aircraft-based systems, helicopter-based systems, ground-based systems, naval-based systems, and unmanned systems. Recently, aircraft-based systems have a dominant market share due to factors such as high demand from the Royal Saudi Air Force, ongoing aircraft modernization programs, and strategic defense priorities. Additionally, these systems offer versatile solutions for various military applications, enhancing their appeal for use in a range of combat scenarios, further driving their market presence.

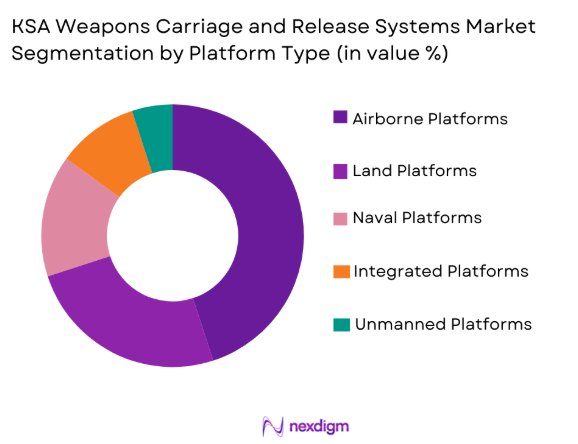

By Platform Type:

KSA Weapons Carriage and Release Systems market is segmented by platform type into land platforms, airborne platforms, naval platforms, integrated platforms, and unmanned platforms. Recently, airborne platforms have a dominant market share due to increasing air defense system investments, the expansion of military aerospace capabilities, and high demand from defense sectors focusing on aerial combat operations. These platforms benefit from Saudi Arabia’s need to enhance air superiority in the region and their ability to integrate with various aerial defense systems.

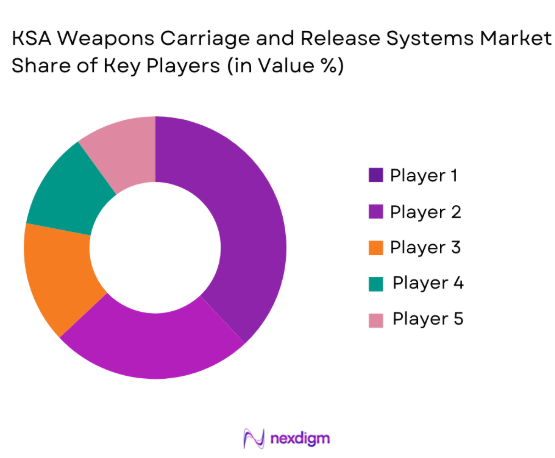

Competitive Landscape

The competitive landscape of KSA Weapons Carriage and Release Systems is defined by key players, including global defense giants that influence market dynamics through technological advancements, strategic partnerships, and defense procurements. Major players in this market continue to innovate, driving growth through enhanced product offerings while focusing on consolidating their market position.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (USD) | R&D Investment |

| Lockheed Martin | 1912 | USA | ~ | ~ | ~ | ~ | ~ |

| Boeing | 1916 | USA | ~ | ~ | ~ | ~ | ~ |

| Raytheon Technologies | 1993 | USA | ~ | ~ | ~ | ~ | ~ |

| BAE Systems | 1999 | UK | ~ | ~ | ~ | ~ | ~ |

| Northrop Grumman | 1939 | USA | ~ | ~ | ~ | ~ | ~ |

KSA Weapons Carriage and Release Systems Market Analysis

Growth Drivers

Government Investments in Defense Technologies:

Government investments in defense technologies have been a crucial driver for the growth of the KSA Weapons Carriage and Release Systems market. As Saudi Arabia strives to modernize its military infrastructure, significant capital is allocated to upgrading defense technologies. These investments have led to the development and integration of advanced systems, such as state-of-the-art weapons carriage and release platforms. Additionally, government spending aligns with the Kingdom’s long-term strategic defense goals, which include securing airspace and enhancing operational flexibility. The government is not only investing in defense procurements but also fostering collaborations with top-tier global defense contractors to ensure the systems meet international standards and bolster national security. This significant financial backing plays a pivotal role in ensuring continuous growth within the defense technology sector, particularly in the weapons carriage and release systems domain.

Technological Advancements in Air Defense Systems:

The continuous technological advancements in air defense systems are another major driver for the market’s expansion. Saudi Arabia has been focusing on improving its air defense capabilities, with new systems designed to increase operational effectiveness and integrate seamlessly with modern fighter jets and unmanned systems. The integration of cutting-edge technologies such as AI, automation, and advanced radar systems is transforming weapons carriage and release systems into more sophisticated, adaptable platforms. These advancements allow for enhanced accuracy, response times, and overall mission success rates. As defense agencies demand better protection against evolving threats, the weapons carriage and release systems market in Saudi Arabia benefits significantly from these ongoing innovations. The country’s commitment to technological superiority ensures that the demand for more efficient, reliable, and integrated solutions will remain strong in the coming years.

Market Challenges

High Costs of Defense System Integration:

One of the key challenges for the KSA Weapons Carriage and Release Systems market is the high cost of defense system integration. The complexity of integrating new technologies into existing defense infrastructure poses both financial and operational challenges. Many defense systems, including weapons carriage and release platforms, require substantial upgrades and modifications to operate at peak efficiency. The costs associated with such upgrades can be significant, often involving long timelines and high-risk factors. These costs can restrict the pace at which the Kingdom can modernize its military forces, slowing down the adoption of the latest technologies. Additionally, the financial burden of acquiring advanced systems can be amplified by ongoing geopolitical tensions in the region, leading to increased scrutiny and cost concerns. To address this challenge, the government is looking at strategic partnerships and joint ventures with international defense players to help offset some of the financial pressure.

Security Concerns and Cyber Threats:

Another major challenge facing the weapons carriage and release systems market in Saudi Arabia is the rising threat of cybersecurity breaches. As defense technologies become increasingly connected, the risk of cyberattacks targeting critical military systems grows. These attacks can compromise the functionality of weapons systems, potentially rendering them ineffective or unreliable during critical missions. The complexity of modern defense platforms, coupled with the increasing integration of communication networks, has introduced new vulnerabilities that adversaries can exploit. To mitigate these risks, the Kingdom is heavily investing in cybersecurity measures, but the evolving nature of cyber threats continues to challenge military preparedness. Addressing these security concerns is vital for maintaining operational effectiveness and ensuring that weapons carriage and release systems are protected against potential attacks that could jeopardize national security.

Opportunities

Expansion of Autonomous Systems:

The expansion of autonomous systems in the KSA Weapons Carriage and Release Systems market presents a significant growth opportunity. As military technology advances, there is a growing trend toward the development and deployment of unmanned and autonomous platforms. These systems offer numerous advantages, including enhanced operational flexibility, reduced human intervention, and the ability to execute complex missions in high-risk environments. The adoption of autonomous systems in Saudi Arabia’s defense strategy is aligned with global trends toward unmanned aerial and ground systems. This growing demand for autonomous solutions presents an opportunity for companies in the weapons carriage and release systems market to innovate and provide more effective, cost-efficient platforms. The Kingdom’s commitment to advancing its autonomous defense capabilities ensures that this segment will experience substantial growth in the coming years.

Strategic Partnerships with Global Defense Contractors:

Strategic partnerships with global defense contractors are a key opportunity for growth in the KSA Weapons Carriage and Release Systems market. By partnering with established international companies, Saudi Arabia can gain access to cutting-edge technologies and benefit from expertise in advanced system design and integration. These collaborations help reduce the risks and costs associated with in-house development, while also accelerating the deployment of new systems. With ongoing investments in military modernization, Saudi Arabia is well-positioned to forge new partnerships, particularly with companies offering innovative weapons systems and platform integration solutions. The expansion of such strategic partnerships allows for the development of highly sophisticated systems that meet the Kingdom’s specific defense needs, while also strengthening its position as a leader in the Middle East’s defense sector.

Future Outlook

The KSA Weapons Carriage and Release Systems market is poised for steady growth over the next five years. Key drivers such as government investment, technological advancements, and strategic partnerships will continue to fuel expansion. With increasing geopolitical tensions and rising defense budgets, the demand for advanced military technologies, including weapons carriage and release systems, is expected to grow. Technological developments, particularly in autonomous systems and AI integration, will shape future market trends. Additionally, regulatory support for defense innovation will provide a solid foundation for continued market evolution.

Major Players

- Lockheed Martin

- Boeing

- Raytheon Technologies

- BAE Systems

- Northrop Grumman

- Thales Group

- Leonardo

- L3 Technologies

- Saab Group

- Rheinmetall AG

- Elbit Systems

- Harris Corporation

- Kongsberg Gruppen

- Textron Systems

- General Dynamics

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Military contractors

- Aerospace manufacturers

- Defense agencies

- Security technology firms

- National defense organizations

- Foreign defense investment firms

Research Methodology

Step 1: Identification of Key Variables

The first step involves identifying key variables such as product types, platform types, and end-user requirements. Market trends, regulatory landscapes, and technological advancements are also analyzed.

Step 2: Market Analysis and Construction

In this step, data is collected from primary and secondary sources to build a comprehensive understanding of the market structure, trends, and size. This data is then used to construct the market model.

Step 3: Hypothesis Validation and Expert Consultation

Experts from the defense sector are consulted to validate initial hypotheses, providing real-time insights and feedback that refine market forecasts.

Step 4: Research Synthesis and Final Output

All collected data and insights are synthesized into a cohesive market report, ensuring that the final output provides a clear picture of market trends, challenges, and opportunities.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Government Investments in Defense Technologies

Technological Advancements in Weapons Release Systems

Rising Military Expenditures

Increase in Geopolitical Tensions

Demand for Precision Strike Capabilities - Market Challenges

High R&D Costs

Complexity of System Integration

Geopolitical Instability in the Region

Technological Security Concerns

Regulatory and Compliance Issues - Market Opportunities

Expansion in Autonomous Systems

Partnerships with Aerospace Manufacturers

Development of Multi-Platform Solutions - Trends

Increasing Demand for Smart Weapon Systems

Rise of Integrated Defense Solutions

Advancements in Cybersecurity for Weapon Systems

Integration of AI in Weapons Carriage Systems

Surge in Demand for Hybrid Fitment Technologies - Government Regulations & Defense Policy

Export Control Regulations

Compliance with International Defense Standards

Government Defense Procurement Policies - SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Aircraft-Based Systems

Helicopter-Based Systems

Ground-Based Systems

Naval-Based Systems

Unmanned Systems - By Platform Type (In Value%)

Land Platforms

Airborne Platforms

Naval Platforms

Integrated Platforms

Unmanned Platforms - By Fitment Type (In Value%)

On-premise Solutions

Cloud-based Solutions

Hybrid Solutions

Modular Solutions

Integrated Solutions - By EndUser Segment (In Value%)

Military Forces

Defense Contractors

Government Agencies

Security Services

Private Sector / Technology Firms - By Procurement Channel (In Value%)

Direct Procurement

Government Tenders

Private Sector Procurement

Online Bidding Platforms

Third-party Distributors - By Material / Technology (In Value%)

Advanced Composites

Alloy Materials

Polymer-Based Materials

Electronic Control Systems

Aerospace-Grade Technologies

- Market structure and competitive positioning

- Market share snapshot of major players

- CrossComparison Parameters (System Type, Platform Type, Procurement Channel, EndUser Segment, Fitment Type, Material, Technology, R&D Investment, Regulatory Compliance, Innovation)

- SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Key Players

Lockheed Martin

Boeing

General Dynamics

Northrop Grumman

Raytheon Technologies

Thales Group

BAE Systems

L3 Technologies

Leonardo

Saab Group

Rheinmetall AG

Elbit Systems

Harris Corporation

Kongsberg Gruppen

Textron Systems

- Military Forces’ Focus on Modernization

- Government Agencies’ Procurement of Defense Systems

- Defense Contractors’ Shift Towards Innovative Solutions

- Private Sector’s Role in Research and Development

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035