Market Overview

The KSA wheel covers market sits within the broader automotive aftermarket and passenger car accessories ecosystem. In this ecosystem, the Saudi Arabia automotive aftermarket is valued at USD ~ billion and is projected to reach USD ~ billion, implying a ~ CAGR over the forecast period—supporting sustained demand for exterior appearance parts such as wheel covers (hubcaps/wheel trims). Demand is reinforced by rising vehicle usage: passenger-car sales increased from ~ units to ~ units on the latest annual readings.

Riyadh, Jeddah, and Dammam/Khobar dominate demand due to the highest vehicle density, premiumization, and the strongest concentration of dealer networks, organized accessory retailers, and e-commerce fulfilment capacity. Additionally, the national vehicle base continues expanding—registered and roadworthy vehicles increased from ~ million to ~ million on the latest reported year-on-year count—supporting routine replacement and aesthetic upgrades (including wheel cover refresh cycles) across private fleets, ride-hailing, and corporate vehicles.

Market Segmentation

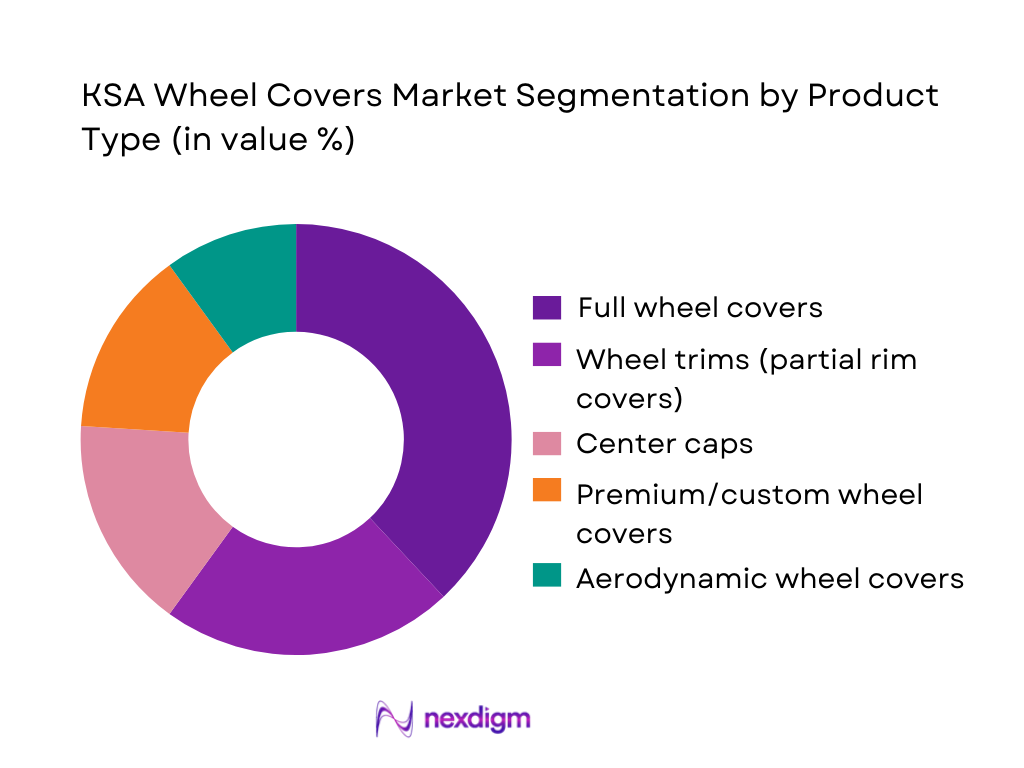

By Product Type

KSA wheel covers market is segmented by product type into full wheel covers (full-size hubcaps), wheel trims (partial rim covers), center caps, aerodynamic wheel covers (efficiency-focused), and premium/custom wheel covers (design-led finishes). Recently, full wheel covers dominate due to their strong value proposition for mass-market passenger cars: they deliver a “new wheel look” without the cost of alloy wheel replacement, are widely available in popular diameters, and are routinely bundled by accessory shops during purchase or ownership milestones (new-to-owner, resale preparation, inspection renewal, cosmetic refresh).

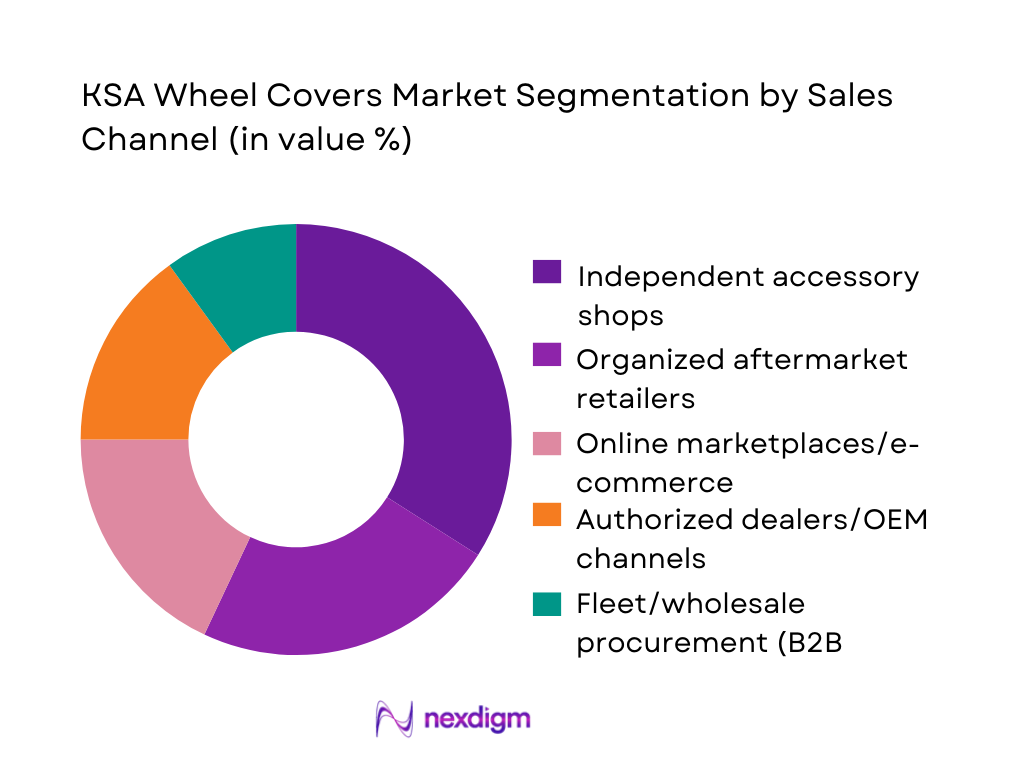

By Sales Channel

KSA wheel covers market is segmented by sales channel into authorized dealers or OEM channels, organized aftermarket retailers, independent accessory shops (unorganized retail), online marketplaces or e-commerce, and fleet or wholesale procurement (B2B). Recently, independent accessory shops dominate as they are the most accessible channel for quick cosmetic upgrades and replacement purchases, typically stocking multiple price tiers and designs. Their dominance is reinforced by high walk-in traffic in major urban corridors, bundled installation services, and the ability to match fitment immediately—especially for high-frequency replacement use cases in ride-hailing and corporate fleets.

Competitive Landscape

The KSA wheel covers market is moderately fragmented, with demand split between dealer-supplied OEM-style wheel covers and a larger, style-driven aftermarket supplied through accessory retailers and independent shops. Competition is shaped by fitment breadth (rim sizes), finish durability in high-heat conditions, design variety, availability across major cities, and price positioning across economy-to-premium tiers.

| Company | Establishment Year | Headquarters | Primary Go-to-Market in KSA | Core Wheel-Cover Offering | Material & Finish Range | Fitment Coverage (Key Rim Sizes) | Key Strength | Typical Buyer Segment |

| Pilot Automotive | 2000 | USA | ~ | ~ | ~ | ~ | ~ | ~ |

| Sparco | 1977 | Italy | ~ | ~ | ~ | ~ | ~ | ~ |

| Momo | 1964 | Italy | ~ | ~ | ~ | ~ | ~ | ~ |

| Genuine OEM Accessory Programs (Toyota/Nissan/Hyundai dealer networks) | Varies | Japan/Korea | ~ | ~ | ~ | ~ | ~ | ~ |

| Petromin (Accessories distribution/retail ecosystem) | 1968 | Saudi Arabia | ~ | ~ | ~ | ~ | ~ | ~ |

KSA Wheel Covers Market Analysis

Growth Drivers

Vehicle Parc Growth

Saudi Arabia’s expanding in-use vehicle base directly increases the addressable replacement and styling demand for wheel covers across passenger cars, SUVs, light commercial vehicles, and fleet vehicles. Official road transport statistics show registered and roadworthy vehicles increased from ~ million to ~ million, while newly registered vehicles rose from ~ to ~. This matters for wheel covers because every incremental vehicle adds four exposed wheel positions that require aesthetic upkeep in a dust- and heat-heavy operating environment, and because first registration growth also expands the near-term installed base for accessory fitment (OEM dealer add-ons and aftermarket). The same statistical release also shows ~ first-time driving licenses issued, reinforcing continued vehicle usage intensity and higher wear exposure on wheel-facing components. On the macro side, the World Bank reports Saudi Arabia’s economy at USD ~ trillion GDP and USD ~ GDP per capita, supporting sustained discretionary and fleet maintenance spend in automotive ownership cycles without relying on pricing claims.

Aftermarket Customization Trends

Aftermarket personalization in Saudi Arabia is structurally supported by a large, growing, and highly urban consumer base plus a heavy-duty mobility ecosystem (private cars, ride-hailing, delivery, and corporate fleets) where visual upkeep is part of vehicle value signaling. Population estimates indicate the Kingdom reached ~ people, including ~ Saudi citizens and ~ non-Saudi residents, up from ~ citizens and ~ non-Saudis—a scale that supports dense urban vehicle ecosystems where appearance upgrades (including wheel covers or hubcaps) are frequent low-friction modifications compared with mechanical upgrades. Road transport statistics reinforce the usage environment: ~ traffic accident injuries and ~ fatalities were recorded alongside ~ serious traffic accidents, pointing to sustained repair-and-replacement flows in external vehicle components and accessories. While wheel covers are not safety parts, they are commonly replaced after curb impacts, minor collisions, and tire service events. In parallel, high passenger movement linked to religious and domestic travel increases car turnover and rental usage; official Hajj statistics show ~ total pilgrims, which sustains seasonal mobility surges in Makkah and Madinah corridors where rental and fleet presentation standards are typically stricter.

Challenges

Price Sensitivity

Wheel covers often sit in a highly competitive, substitutable accessory category (multiple materials, designs, and quality tiers), making consumers and fleets sensitive to value-for-money—especially when broader household budgets must accommodate a large, growing population and high mobility intensity. Official population estimates show the Kingdom at ~ people, split between ~ Saudi citizens and ~ non-Saudi residents. In many automotive aftermarket categories, non-Saudi residents and price-conscious drivers can disproportionately influence demand for entry-tier products because vehicle ownership and usage can be utilitarian (commuting, delivery, shared-use). On the mobility side, the Kingdom recorded ~ million registered and roadworthy vehicles and ~ newly registered vehicles, indicating a broad base of owners who must allocate ongoing spend across fuel, maintenance, insurance, and periodic repairs; discretionary accessory purchases (like wheel covers) therefore face tight selection behavior where buyers may defer replacement, buy lower-tier alternatives, or reuse worn covers longer.

Low Product Differentiation

A core market friction is the limited perceived differentiation across mass-market wheel covers (similar aesthetics, overlapping size-fit ranges, and minimal functional claims), which makes brand building difficult and increases churn between sellers. Saudi Arabia’s vehicle base is large enough that many importers, distributors, and retailers can enter with look-alike SKUs, especially when fitment is standardized across common rim diameters. The effect is amplified by the Kingdom’s continued new-vehicle inflow that expands the addressable fitment pool and attracts more accessory suppliers chasing “universal fit” volumes. At the same time, sustained traffic incidents (~ serious accidents) create high replacement demand that can be captured by whichever seller is cheapest and most available at the point of repair—especially in workshop-led purchases where the buyer prioritizes quick completion. The macro environment supports broad commercial activity, but that scale can intensify competition rather than protect margins when product narratives are weak. Practically, low differentiation increases reliance on channel strength (mechanic or retailer recommendation, availability, quick delivery) over technical superiority, and it encourages copycat designs that further blur distinctions.

Opportunities

Electric Vehicle Adoption

EV adoption creates an opportunity for wheel covers because EV customers and OEMs often prioritize aero efficiency styling, lower drag design cues, and clean visual differentiation—conditions that can increase demand for aerodynamic wheel covers and premium design variants. While the EV base is still emerging, current market signals show accelerating ecosystem focus: reporting notes Saudi Arabia sold ~ electric vehicles and recorded ~ charging stations nationwide—small numbers, but significant because they indicate a transition from “pilot” to “buildout,” with policymakers and investors pushing scale-up. The same reporting references large, strategic investment ambition around EVs, which typically pulls in new model launches and higher consumer visibility—both supportive of accessory categories that differentiate vehicle appearance. In parallel, macroeconomic capacity remains supportive (World Bank: USD ~ GDP per capita), which can sustain demand for higher-spec aesthetic components as EVs are typically purchased by urban consumers early in the adoption curve. For wheel covers, the near-term opportunity is to align product portfolios with EV-specific needs: aero-style covers for efficiency-minded owners, premium finishes that resist heat or UV, and fitment for newer wheel sizes and designs.

Aerodynamic Wheel Covers

Aerodynamic wheel covers represent a forward-looking growth pocket because Saudi Arabia’s mobility profile includes long-distance intercity travel and high-speed highway usage where efficiency-oriented design features can matter to fleets and performance-focused consumers—especially as OEMs and regulators emphasize efficiency. Reporting highlights infrastructure gaps such as the absence of chargers on a ~ kilometre highway between Riyadh and Mecca, underscoring the importance of maximizing vehicle efficiency and range planning for EV and hybrid users in long corridor travel—an environment where aerodynamic wheel-cover designs become more relevant as part of an overall efficiency package (alongside tires and driving behavior). Additionally, official road transport data shows heavy cross-border logistics and movement: road freight imports through land ports increased to ~ million tons, reflecting sustained highway freight activity where fleet operators continuously evaluate efficiency improvements (even when not quantified here through fuel-cost claims). With ~ million vehicles in operation, even a modest shift toward “function-led aesthetics” can create meaningful volume for aerodynamic covers that combine styling with practical performance cues (reduced turbulence, lower brake-dust accumulation patterns, easier cleaning).

Future Outlook

Over the next five years, the KSA wheel covers market is expected to grow in line with the expanding automotive aftermarket, supported by rising vehicle density, higher accessory attachment rates, and increasing consumer preference for cost-effective visual upgrades. As organized retail and e-commerce continue to professionalize assortment and fitment guidance, replacement cycles should shorten, particularly for high-usage vehicles. The broader Saudi Arabia automotive aftermarket is projected to expand from USD ~ billion to USD ~ billion, implying a ~ CAGR, which is supportive for wheel covers as a recurring-purchase exterior accessory category.

Major Players

- Petromin

- Abdul Latif Jameel

- Toyota OEM Accessories

- Hyundai OEM Accessories

- Nissan OEM Accessories

- Aljomaih Automotive

- Sparco

- Momo

- Pilot Automotive

- Richbrook

- Gorilla Automotive Products

- OxGord

- AutoDrive

- 3M

Key Target Audience

- Vehicle OEMs and authorized distributor networks

- Aftermarket parts and accessories distributors

- Organized auto accessory retail chains

- Independent accessory shop owners and buying groups

- Fleet operators and fleet procurement teams

- Ride-hailing and mobility operators’ procurement teams

- Investments and venture capitalist firms

- Government and regulatory bodies

Research Methodology

Step 1: Identification of Key Variables

We begin by mapping the KSA wheel covers ecosystem across OEM accessory pathways, aftermarket distribution, independent accessory clusters, and e-commerce. Desk research is supported by structured collection of fitment standards, rim-size prevalence, product-material benchmarks, and the role of climate durability. The objective is to define the variables that most influence sell-through and pricing.

Step 2: Market Analysis and Construction

We compile the demand stack using vehicle base indicators (vehicle stock and annual sales), replacement or upgrade triggers, and channel-level throughput (dealer vs. aftermarket vs. online). We then build a bottom-up view of category throughput by rim size bands, price tiers, and product formats (full covers, trims, caps) to structure the total opportunity.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses on dominant channels, fastest-moving SKUs, and price elasticity are validated via CATIs with accessory distributors, retail buyers, and high-volume independent shops in major cities. These discussions provide direct insights on monthly sell-through, return rates, fitment pain points, and seasonality, which are used to refine assumptions.

Step 4: Research Synthesis and Final Output

Findings are triangulated by cross-checking distributor insights with retailer assortment audits and online price or availability checks. We synthesize the validated results into segmentation, competitive positioning, and outlook scenarios, ensuring internal consistency between demand drivers, channel economics, and product-level performance.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Abbreviations, Scope of Wheel Covers and Hubcaps, Market Sizing Logic, Bottom-Up and Top-Down Validation, Primary Interviews with OEMs, Dealers and Importers, Secondary Research Sources, Data Triangulation, Limitations and Assumptions)

- Definition and Scope

- Evolution of Wheel Covers in Passenger and Commercial Vehicles

- Role of Wheel Covers in Vehicle Aesthetics, Aerodynamics, and Protection

- Industry Lifecycle and Replacement Cycle Analysis

- Automotive Aftermarket Ecosystem in KSA

- Growth Drivers

Vehicle Parc Growth

Aftermarket Customization Trends

Cost-Effective Aesthetic Enhancements

High Replacement Rates - Challenges

Price Sensitivity

Low Product Differentiation

Counterfeit Imports

Climate-Induced Material Degradation - Opportunities

Electric Vehicle Adoption

Aerodynamic Wheel Covers

Private Label Retail Brands

Online Customization Platforms - Trends

Shift Toward Aero Covers

Premium Styling Kits

Lightweight Materials

E-Commerce Penetration - Regulatory & Policy Landscape

- SWOT Analysis

- Stakeholder & Ecosystem Analysis

- Porter’s Five Forces Analysis

- By Value, 2019–2024

- By Volume, 2019–2024

- By Average Selling Price, 2019–2024

- OEM Fitment vs Aftermarket Replacement Contribution, 2019–2024

- By Product Type (in Value %)

Full Wheel Covers

Hubcaps

Aero Wheel Covers

Decorative Wheel Covers

Heavy-Duty Wheel Covers - By Material Type (in Value %)

ABS Plastic

Polypropylene

Aluminum

Stainless Steel

Composite Materials - By Vehicle Type (in Value %)

Passenger Cars

SUVs and Crossovers

Light Commercial Vehicles

Heavy Commercial Vehicles

Electric Vehicles - By Sales Channel (in Value %)

OEM Fitment

Authorized Dealerships

Independent Auto Parts Retailers

Online Automotive Platforms

Workshops and Garages - By Rim Size Compatibility (in Value %)

Small Rim Sizes

Mid-Segment Rim Sizes

Premium and Large Rim Sizes - By Region (in Value %)

Central Region

Western Region

Eastern Region

Southern Region

Northern Region

- Market Share of Major Players

- Cross Comparison Parameters (Product Portfolio Breadth, Material Innovation Capability, OEM Tie-Ups, Aftermarket Reach, Pricing Positioning, Distribution Footprint in KSA, Brand Recognition, Customization and Design Capability)

- SWOT Analysis of Major Players

- Pricing Analysis by Rim Size and Vehicle Segment

- Detailed Profiles of Major Companies

Toyota Genuine Parts

Hyundai Mobis

Nissan Genuine Accessories

Ford Motorcraft

General Motors Accessories

Bosch Automotive Aftermarket

Aljomaih Automotive Accessories

Abdul Latif Jameel Auto Parts

Arabian Auto Agency Accessories

Maxion Wheels

Momo Automotive

Sparco Accessories

Pilot Automotive

Car Mate Manufacturing

- OEM Procurement Behavior

- Aftermarket Consumer Buying Preferences

- Replacement Frequency and Usage Patterns

- Price Sensitivity and Brand Loyalty

- Decision-Making Criteria Across Vehicle Categories

- By Value, 2025–2030

- By Volume, 2025–2030

- By Average Price, 2025–2030