Market Overview

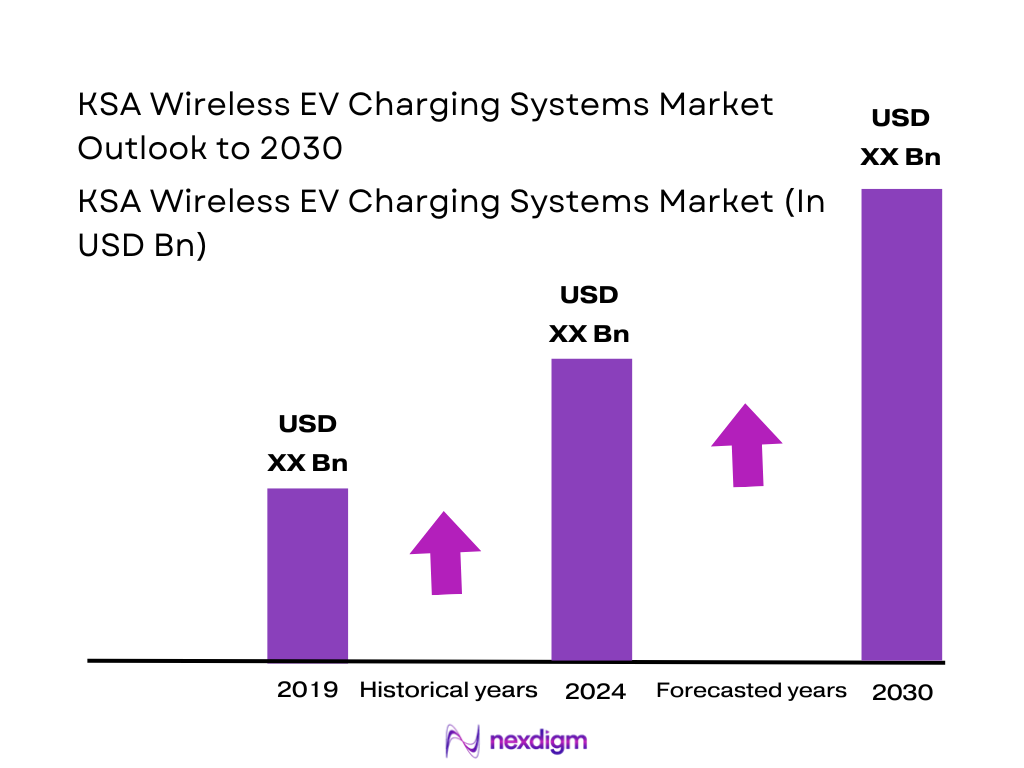

The KSA wireless EV charging systems market sits at the intersection of Saudi Arabia’s broader wireless charging and EV transitions. The Kingdom’s overall wireless charging market generated USD ~ million in revenue at the latest reported baseline and is forecast to reach USD ~ million, driven by fast growth in automotive and consumer applications. Globally, dedicated wireless EV charging solutions have expanded from around USD ~ million to over USD ~ million within one recent year, underlining rapid technology uptake. This expansion is underpinned by Saudi Vision 2030, rising EV imports, and strong policy support for green mobility.

Within the KSA wireless EV charging systems market, Riyadh is emerging as the anchor city, supported by the Vision 2030 commitment that 30% of vehicles in the capital will be electric, backed by over USD ~ billion in EV manufacturing and infrastructure investments. The EV charging landscape remains nascent, with roughly a few hundred public charging points nationwide and concentrated infrastructure build-out in Riyadh, Jeddah and Dammam. High-profile giga-projects such as NEOM and the Red Sea developments, which embed smart-city and autonomous mobility concepts, are expected to become early adopters of dynamic wireless charging corridors and bus depots, giving these regions outsized influence on future deployment patterns.

Market Segmentation

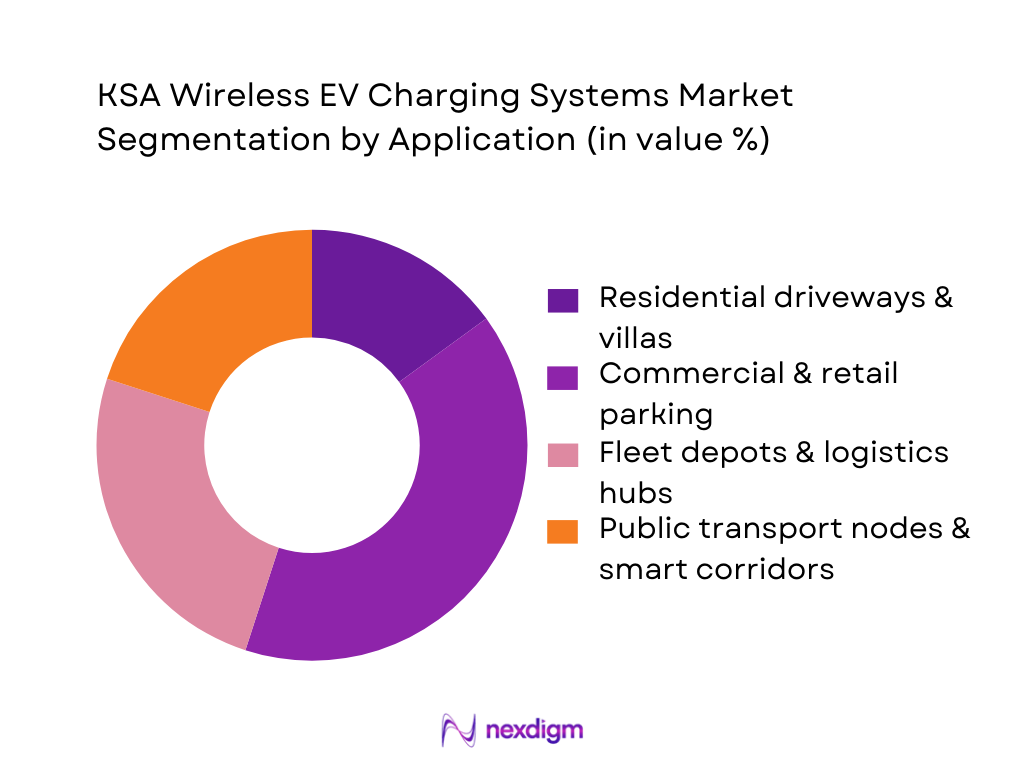

By Application

The KSA Wireless EV Charging Systems Market is segmented into residential driveways & villas, commercial & retail parking, fleet depots & logistics hubs, and public transport nodes & smart corridors. Commercial & retail parking currently holds a dominant market share because public charging in malls, hotels and destinations is already a central pillar of Saudi EV infrastructure, valued at about USD ~ billion when wired and wireless technologies are combined. These high-footfall locations are where early EV adopters expect reliable, convenient charging, making them ideal testbeds for wireless pads integrated into parking bays. Charge-point operators like Electromin are rolling out networks at over 100 locations across the Kingdom, prioritizing destination sites with strong commercial returns and visibility, which naturally aligns with wireless pilots and premium user experiences.

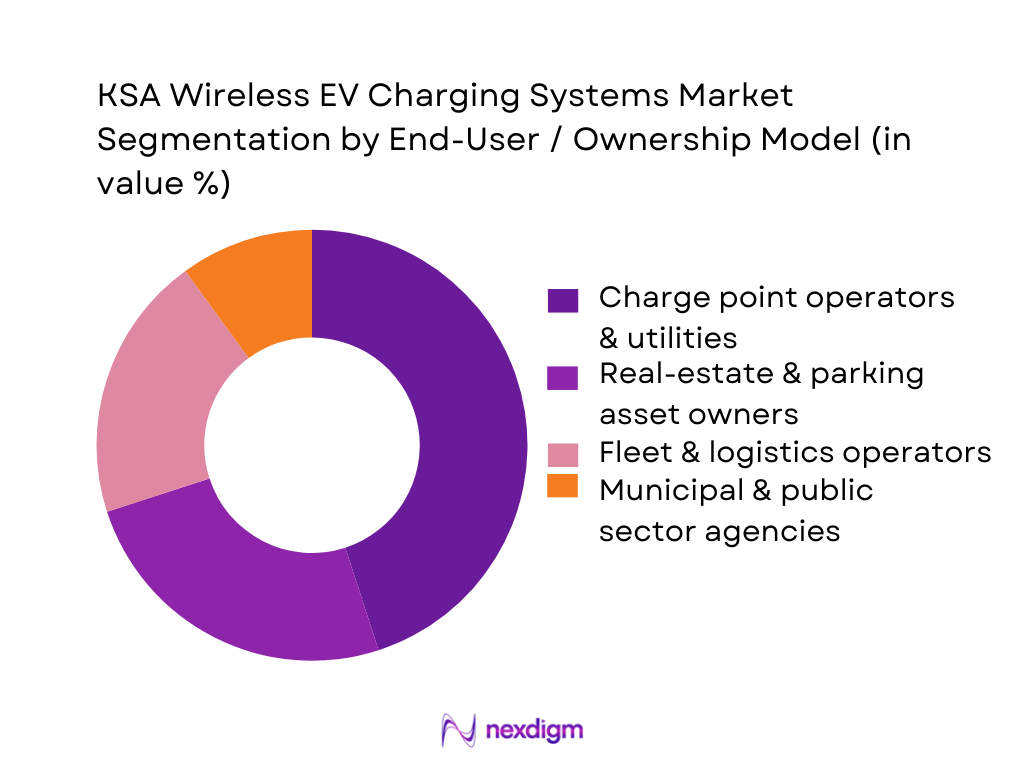

By End-User / Ownership Model

The KSA Wireless EV Charging Systems Market is segmented into charge point operators (CPOs) & utilities, real-estate & parking asset owners, fleet & logistics operators, and municipal & public sector agencies. CPOs and utilities currently dominate because they already manage the largest share of public and semi-public charging assets in Saudi Arabia. Electromin, for instance, is building and operating what it describes as the Kingdom’s largest EV charging network, with a dedicated charge-point management system that optimizes uptime and energy flows across dozens of locations. These players are best positioned to absorb the higher upfront capex of wireless pads, interface with the national grid operator and EVIQ, and structure long-term service contracts with real-estate owners and fleets, making them the natural early owners of wireless EV charging infrastructure.

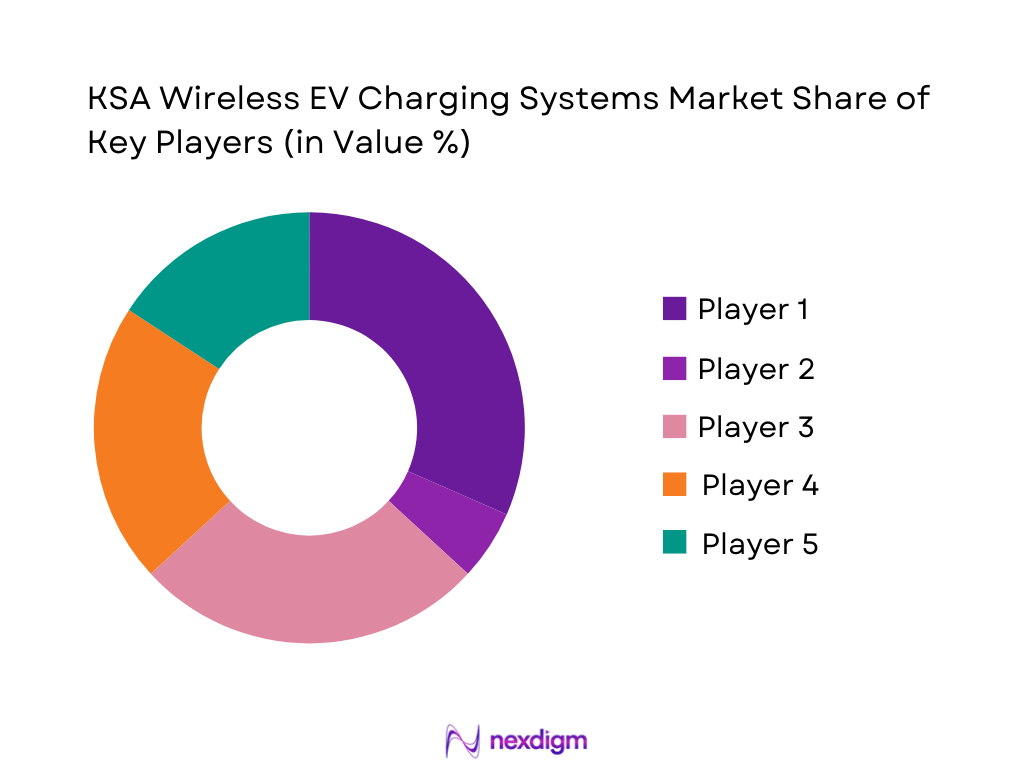

Competitive Landscape

The KSA Wireless EV Charging Systems Market is shaped by a mix of global technology licensors and emerging local infrastructure operators. Global specialists such as WiTricity, Electreon, InductEV (formerly Momentum Dynamics) and HEVO are pushing magnetic-resonance, inductive and dynamic in-road charging technologies, while regional CPOs like Electromin and utility-backed platforms work on deployment, integration and grid optimization. The competitive landscape remains fragmented at the pilot stage, but consolidation is expected as OEMs like Toyota, Hyundai and Chinese EV brands align with preferred technology partners for factory-fitted wireless charging options in vehicles destined for Saudi Arabia.

| Company | Establishment Year | Headquarters (City, Country) | Core Wireless EV Charging Offering | Dominant Technology | Primary Vehicle Focus (Global) | KSA / GCC Activity Status* | Role in Value Chain in KSA* |

| WiTricity | 2007 | Watertown, Massachusetts, USA | ~ | ~ | ~ | ~ | ~ |

| Electreon | 2013 | Beit Yanai, Israel | ~ | ~ | ~ | ~ | ~ |

| InductEV (formerly Momentum Dynamics) | 2009 | King of Prussia, Pennsylvania, USA | ~ | ~ | ~ | ~ | ~ |

| HEVO | 2011 | Brooklyn, New York, USA | ~ | ~ | ~ | ~ | ~ |

| Electromin | ~2010s | Khobar / Riyadh, Saudi Arabia | ~ | ~ | ~ | ~ | ~ |

KSA Wireless EV Charging Systems Market Analysis

Growth Drivers

Vision-Led EV Adoption Targets

Saudi Arabia’s Vision 2030 and transport strategies create a structural demand base for wireless EV charging. The Kingdom’s GDP reached about USD ~ billion, with GDP per capita at USD ~, reflecting strong fiscal capacity to support large-scale mobility transitions. A national population of ~ million people underpins long-term vehicle demand, with ~ million registered and roadworthy vehicles on the road. Riyadh’s goal for at least 30% of its vehicle fleet to be electric, combined with an EV infrastructure company launched to roll out fast charging at more than 1,000 locations, sets a clear policy direction that wireless depot, kerbside and premium parking charging can align with.

Saudi Green Initiative Emissions Reduction

The Saudi Green Initiative and updated Nationally Determined Contribution (NDC) frame wireless EV charging as a tool for transport decarbonization. Energy-related CO₂ emissions were ~ million tons, making the Kingdom a top global emitter. Transport is a major source: recent assessments show transport emissions around ~ tons of CO₂ per person, with transport responsible for roughly one-fifth of national emissions and 100% of transport energy supplied by fossil fuels. At the same time, the power sector’s carbon intensity is approximately ~ gCO₂ per kWh. Saudi Arabia’s NDC and SGI commit to reducing, avoiding, and removing ~ million tons of CO₂-equivalent annually, backed by a green-economy investment envelope of more than SAR ~ billion. These climate and energy targets push policymakers and fleet operators toward zero-tailpipe-emission technologies and grid-integrated charging architectures, making high-efficiency wireless depots and taxi ranks strategically attractive.

Challenges

High Upfront System CAPEX

Wireless EV charging deployments in the Kingdom compete for capital with a very large pipeline of national projects. Saudi Arabia’s GDP stood at roughly USD ~ billion, while non-oil activities grew strongly, and the government continues to finance Vision 2030 megaprojects amid projected fiscal deficits of around USD ~ billion. At the same time, more than SAR ~ billion has been earmarked for green-economy initiatives, including grid upgrades, renewables and land-restoration projects. These macro figures show that although liquidity is available, capital is being pulled into many sectors simultaneously, raising hurdle rates for new technologies. Wireless EV charging systems, with specialized pads, embedded civil works and control electronics, therefore face a financing challenge: they must demonstrate lifecycle value in terms of reduced fleet downtime, higher asset utilization and avoided connector maintenance to compete for a share of national infrastructure budgets.

Technology Standardization Risk

Saudi Arabia’s EV charging rollout is starting from a small installed base, so early choices on standards and architectures carry outsized long-term consequences. Projections suggest the Kingdom will need ~ charging points to support anticipated EV uptake, while today’s ecosystem is still in its infancy, with a growing but limited number of public and semi-public chargers across Riyadh, Jeddah, NEOM and the Eastern Corridor. Most existing chargers are conventional plug-in AC units, and a state-backed national network is being designed around fast-charging standards and interoperability regulations. Committing prematurely to any one wireless protocol, pad geometry or grid-side communication standard could lock in costly retrofits later. For wireless charging vendors, this environment demands active participation in Saudi standards forums and alignment with global norms on safety, electromagnetic exposure and foreign-object detection so they can scale with, not against, the national ecosystem design.

Opportunities

Fleet-as-a-Service Models

Fleet-as-a-Service (FaaS) models for taxis, corporate shuttles and logistics operators are a natural fit for wireless EV charging in Saudi Arabia. The Kingdom’s population of ~ million includes a notably young demographic, with more than 70% of citizens under 35, driving demand for app-based mobility and e-commerce. Non-oil exports reached SAR ~ billion in a single month, signaling intensifying trade flows and last-mile delivery volumes. At the same time, passenger mobility in Riyadh is dominated by private vehicles, at roughly 87.8% of trips, highlighting both high vehicle-kilometers traveled and an addressable pool of vehicles that can be professionally managed in fleets. Wireless pads embedded in depots, mall parking, business districts and airport holding areas enable “invisible charging” during scheduled stops, which is particularly attractive under FaaS contracts where uptime guarantees and predictable total-cost-of-ownership matter more than vehicle list price. This supports scalable business cases in which charging hardware is financed against long-term service revenues rather than one-off equipment sales.

Concession Structures with Municipalities

Municipal and corridor-level concessions offer a second major opportunity for wireless EV charging in KSA. Saudi Arabia is investing heavily in sustainable urban infrastructure, with SGI bundling more than 60 green initiatives and over SAR ~ billion of planned investment, while Vision 2030 mega-projects such as NEOM, the Red Sea developments and other new urban districts are designed around low-emission mobility from the outset. A dedicated EV-infrastructure company, jointly backed by the sovereign wealth fund and the national utility, has been established to build fast-charging networks at over 1,000 locations, demonstrating the state’s willingness to rely on structured, long-term infrastructure vehicles. For city authorities and economic zones, bundling wireless EV charging into broader parking, curb-management or smart-district concessions allows capex to be amortized over multi-year availability-payment contracts, aligned with urban-planning goals and air-quality targets. This creates room for large-scale, interoperable wireless deployments across taxi ranks, BRT stops and logistics hubs, anchored by public-sector creditworthiness but operated by specialized private consortia.

Future Outlook

Over the next six years, the KSA Wireless EV Charging Systems Market is expected to transition from pilot-stage deployments to early commercialization, closely tracking Saudi Arabia’s wider EV adoption push. The country aims to produce up to ~ EVs annually by 2030 through Public Investment Fund-backed platforms such as Lucid and Ceer, creating a sizable domestic parc that will benefit from premium, cable-free charging solutions. Regulatory initiatives, including the Saudi Green Initiative and National Transport and Logistics Strategy, embed electrification and smart infrastructure into long-term planning, making wireless charging a natural fit for autonomous on-demand mobility, electric buses and high-end passenger EVs.

Major Players

- WiTricity Corporation

- Electreon Wireless Ltd.

- InductEV

- HEVO Inc.

- Qualcomm Incorporated

- Continental AG

- Robert Bosch GmbH

- Toyota Motor Corporation

- Hyundai Motor Company

- ABB Ltd.

- Siemens AG

- Electromin

- Lucid Group

- Ceer Motors

Key Target Audience

- EV OEMs and platform developers

- Charge point operators (CPOs) and utilities

- Real-estate developers and parking-asset owners

- Fleet and logistics operators

- Public transport authorities and government transport agencies

- Government and regulatory bodies

- Investments and venture capitalist firms

- Smart-city and giga-project developers and master planners

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders in the KSA Wireless EV Charging Systems Market—technology licensors, EV OEMs, CPOs, utilities, regulators, fleet operators and real-estate owners. This step is supported by extensive desk research using secondary and proprietary databases to gather infrastructure, EV-parc and policy data. The objective is to identify critical variables such as installed pad capacity, EV stock, charging sessions, tariff structures and deployment models.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data for Saudi Arabia’s EV ecosystem and wireless charging adoption. This includes EV sales, charging-point counts, usage intensity in malls and hotels, and technology adoption curves for inductive and resonant charging. We then construct a bottom-up revenue model based on installed and planned pilot projects, average system cost (pads, power electronics, civil works) and service revenues per active wireless-enabled bay. Cross-checks with top-down benchmarks from the Saudi wireless charging databook ensure alignment.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses on segment sizes, growth rates and adoption inflection points are validated through interviews with a mix of industry experts—CPOs, global wireless technology vendors, local utilities, EV OEMs and giga-project mobility planners. Structured computer-assisted interviews are used to obtain views on commercial readiness, cost trajectories, preferred business models and regulatory bottlenecks. These insights are triangulated with published policy documents to refine volume and revenue estimates and to stress-test timing assumptions for dynamic wireless corridors and fleet depots.

Step 4: Research Synthesis and Final Output

The final phase integrates bottom-up modelling with expert feedback to generate a robust view of the KSA Wireless EV Charging Systems Market. Scenario analysis is applied to assess sensitivity to EV adoption rates, capital-cost deflation and policy incentives. Where public sources do not provide explicit KSA-specific values, Nexdigm derives internal estimates bounded by externally reported total wireless-charging and EV-market figures. These outputs are then translated into segment-wise forecasts, competitive benchmarking, and strategic recommendations tailored for investors, OEMs, CPOs and policy-makers.

- Executive Summary

- Research Methodology (Market definition for wireless EV charging pads, lanes and power electronics, demand modeling using EV parc and fleet duty cycles, bottom-up sizing by installed pads and kW, top-down triangulation with KSA EV charging infra spend, adoption curves for fleets and real estate, primary interviews with CPOs, utilities and fleet operators, scenario building for static vs dynamic wireless lanes, study limitations and sensitivity checks to tariff and capex assumptions)

- Definition, Scope and System Boundaries

- Technology Genesis and Global to KSA Adoption Pathways

- Positioning within KSA EV Charging and Smart Mobility Portfolio

- Business and Investment Cycle for Wireless EV Charging Projects

- Supply Chain and Value Chain Mapping for KSA Deployments

- Growth Drivers

Vision-led EV adoption targets

Saudi Green Initiative emissions reduction

Charging-infrastructure gap

Fleet electrification of taxis

Buses and logistics - Challenges

High upfront system capex

Technology standardization risk

Thermal derating in desert conditions

Interoperability with existing DC fast charging

grid capacity constraints at hubs, long approval cycles - Opportunities

Fleet-as-a-service models

Concession structures with municipalities

Dynamic bus-lane pilots

Premium real-estate differentiation via wireless bays

Airport and metro hub integration - Trends

Move from pilot to scaled corridors

Integration with autonomous valet parking

Wireless-ready OEM platforms

Software-defined charging orchestration

Bundling with renewable PPAs - Government Regulation and Standards

- Technology Roadmap and Cost Curves

- SWOT Analysis

- Porter’s Five Forces

- By Value, 2019-2024

- Installed Base by Number of Pads, Segments and Equipped Vehicles, 2019-2024

- Average Realization per Installed kW and per Charging Point, 2019-2024

- Mix of New Installations vs Retrofit and Upgrade Projects, 2019-2024

- By Charging Application (in Value %)

Residential Off-Street Parking

Commercial and Retail Parking Assets

Corporate and Industrial Campuses

Public Transport Nodes and Metro Hubs

Fleet Depots, Logistics Yards and Truck Stops - By Technology Architecture (in Value %)

Static Parking Bay Charging

Semi-Dynamic Queuing and Taxi-Rank Charging

Dynamic Lane-Embedded Roadway Segments

Inductive Pad Systems

Resonant and Hybrid Wireless Architectures - By Power Level and Operating (in Value %)

Low Power up to Light-Duty Charging

Medium Power for Destination and Workplace

High Power for Bus and Truck Depots

Ultra-High Power for Dynamic Lane Segments - By Vehicle Type (in Value %)

Private Passenger Cars

Taxis and Ride-Hailing Fleets

City Buses and BRT Systems

Medium and Heavy Commercial Vehicles

Service, Municipal and Utility Fleets - By End-User and Ownership Model (in Value %)

Utilities and Distribution Companies

Charge Point Operators and eMSPs

Government and Municipal Bodies

Real-Estate Developers and Parking Asset Funds

Logistics, Bus and Fleet Operators - By Region (in Value %)

Riyadh and Surrounding Growth Corridor

Western Region and Pilgrimage Corridors

Eastern Region Industrial and Logistics Cluster

Northern Economic and Mining Zones

Southern and Emerging Urban Nodes

- Market Share of Major Players by Installed Pads, kW and Equipped Vehicles

- Cross Comparison Parameters (Wireless transfer efficiency at KSA ground clearance and wheelbase profiles, maximum static and dynamic charging power per system, compliance with SAE J2954 and relevant IEC and SASO standards, integration readiness with national charging backbone and utility SCADA, thermal derating and reliability at desert ambient conditions, capex and opex per installed kW and per bay, primary use-case focus by application and vehicle segment, localization of hardware, software and service capability within KSA)

- Competition Ecosystem

- Strategic and Go-to-Market Moves

- SWOT Analysis of Major Players in KSA Context

- Indicative Pricing and Commercial Models Benchmarking

- Detailed Profiles of Major Companies

WiTricity Corporation

Electreon Wireless Ltd.

InductEV Inc.

HEVO Inc.

Plugless Power Inc.

ENRX Group

Powermat Technologies Ltd.

IPT Technology GmbH

Qualcomm Technologies, Inc.

Siemens AG

ABB Ltd.

Schneider Electric SE

ChargePoint Holdings, Inc.

Electromin

- Passenger Vehicle Owners

- Taxis, Ride-Hailing and Chauffeur Fleets

- Public Transport Operators

- Logistics, E-Commerce and Industrial Fleets

- Real-Estate and Parking Asset Owners

- By Value, 2025-2030

- Installed Base by Number of Pads, Segments and Equipped Vehicles, 2025-2030

- Average Realization per Installed kW and per Charging Point, 2025-2030

- Mix of New Installations vs Retrofit and Upgrade Projects, 2025-2030