Market Overview

The KSA X-band radar market is expected to reach USD ~ billion by the end of the year, driven by rising military investments, technological advancements, and increasing demand for advanced surveillance systems. The primary market drivers include the increasing defense budgets of the Kingdom, particularly in enhancing national security measures and monitoring capabilities. Additionally, the growing need for sophisticated radar systems in defense, meteorological, and civil applications contributes significantly to the market’s expansion. The rising geopolitical tensions and the demand for autonomous, real-time monitoring systems continue to push market growth.

In terms of market dominance, Saudi Arabia, particularly Riyadh and Jeddah, continues to lead the X-band radar market due to its high military expenditure and investment in advanced defense technologies. The Kingdom’s strategic location and defense initiatives make it a key player in the Middle East. The government’s ongoing investment in defense and infrastructure, as well as its collaborations with major international defense contractors, further solidifies the region’s leadership in the radar system market. Furthermore, the expanding defense contracts and modernization efforts continue to strengthen its dominance in the radar market.

Market Segmentation

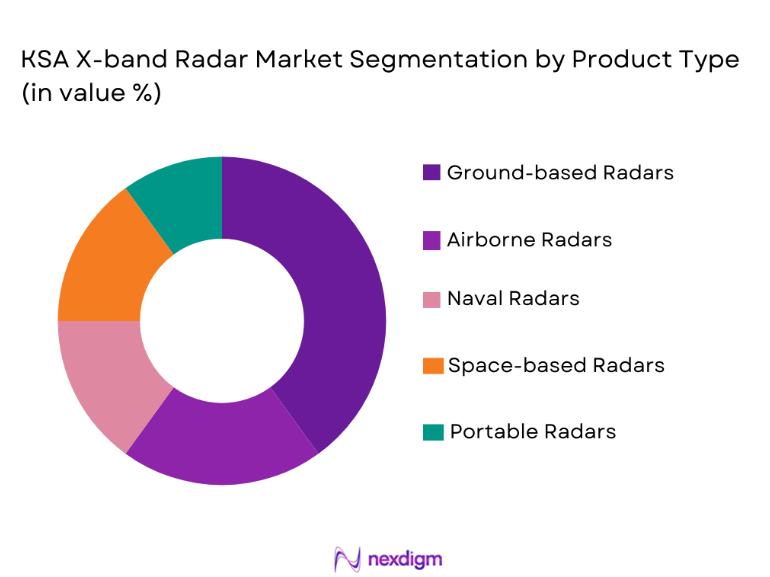

By Product Type

The KSA X-band radar market is segmented by product type into Ground-Based Radar, Airborne Radar, Naval Radar, and Space-Based Radar. Among these, the Ground-Based Radar segment holds the dominant market share, primarily due to its extensive use in defense applications, particularly for surveillance and reconnaissance purposes. The Kingdom’s significant investments in ground-based radar systems for military operations, border surveillance, and security operations make this segment the leader. These radars are critical for detecting objects and threats at long ranges, further increasing their demand. In addition, the growing demand for ground-based radar systems in security applications, such as civilian monitoring and traffic control, has also fueled this segment’s growth.

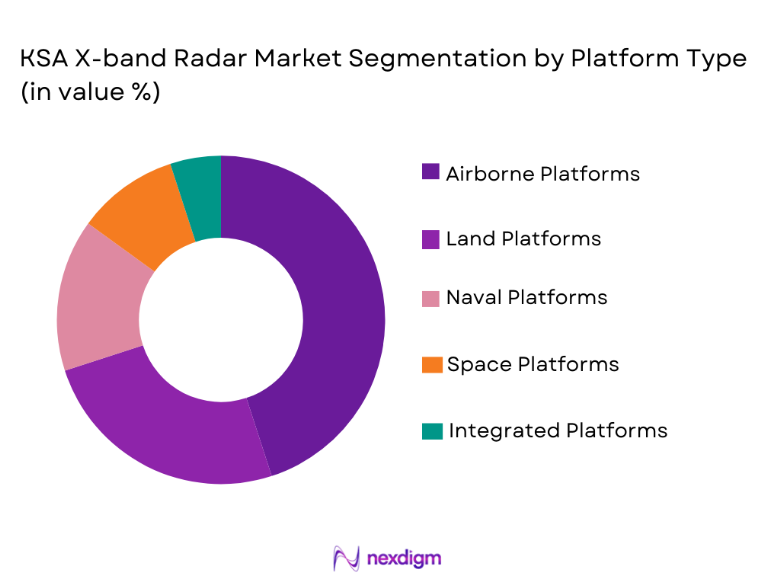

By Platform Type

The KSA X-band radar market is segmented by platform type into Land Platforms, Airborne Platforms, Naval Platforms, Space Platforms, and Integrated Platforms. The Land Platforms segment leads the market due to increasing demand for ground-based systems used in defense and national security. These platforms are being extensively used for surveillance and monitoring critical infrastructure, border security, and military activities. The Kingdom’s investment in land-based radar technologies for defense forces, especially along its borders and strategic locations, continues to fuel the growth of this segment. The increasing focus on modernizing military operations with advanced radar systems and integrating them into land platforms also boosts this segment’s prominence.

Competitive Landscape

The competitive landscape of the KSA X-band radar market is highly influenced by global defense companies. Consolidation within the radar manufacturing sector, along with partnerships between local and international firms, is driving technological advancements and market expansion. The Kingdom is home to numerous defense contractors and is increasingly focusing on upgrading its defense infrastructure, which makes it an attractive market for both domestic and foreign players. As international firms continue to collaborate with Saudi defense forces, competition remains robust, with key players like Raytheon, Thales, and Lockheed Martin maintaining strong positions in the market.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (USD) | Technology Partnerships |

| Raytheon Technologies | 1922 | Waltham, USA | ~ | ~ | ~ | ~ | ~ |

| Thales Group | 1893 | Paris, France | ~ | ~ | ~ | ~ | ~ |

| Lockheed Martin | 1912 | Bethesda, USA | ~ | ~ | ~ | ~ | ~ |

| BAE Systems | 1999 | London, UK | ~ | ~ | ~ | ~ | ~ |

| Northrop Grumman | 1939 | Falls Church, USA | ~ | ~ | ~ | ~ | ~ |

KSA X-band Radar Market Analysis

Growth Drivers

Defense Budget Expansion

Saudi Arabia’s substantial increase in defense spending has been a key growth driver for the X-band radar market. The government has been heavily investing in enhancing its national defense capabilities, including surveillance and reconnaissance systems. The Saudi government’s strategic initiatives to modernize military operations and bolster defense infrastructure further fuel demand for advanced radar systems. With an emphasis on national security, the Kingdom’s defense budget allocation towards radar systems and related technologies has skyrocketed in recent years. The push towards acquiring state-of-the-art technologies, such as X-band radar systems, has amplified the demand for these systems. Furthermore, the geopolitical situation in the Middle East, where border and coastal security is critical, has escalated the need for effective surveillance systems. As a result, the defense budget increase directly drives the X-band radar market growth, especially for land and naval-based systems.

Technological Advancements in Radar Systems

The rapid advancements in radar technology have significantly contributed to the growth of the KSA X-band radar market. With constant improvements in radar resolution, accuracy, and detection range, Saudi Arabia has increasingly adopted modern radar systems for its defense sector. Innovations like digital beamforming, AI integration, and real-time data processing have led to enhanced radar system capabilities, making them indispensable in military applications. The increasing demand for high-performance radar in complex environments, such as coastal regions, desert terrains, and urban areas, has driven the market for X-band radar systems. Additionally, the rise of new radar applications in civil and defense sectors has further contributed to the market’s growth. As Saudi Arabia continues to focus on high-tech defense systems, technological advancements in radar systems will remain a core driver of the X-band radar market.

Market Challenges

High Capital Investment

One of the primary challenges faced by the KSA X-band radar market is the high capital investment required for the deployment and maintenance of advanced radar systems. X-band radar systems, especially ground-based and space-based types, involve significant upfront costs, including hardware, installation, and operational costs. The complex nature of radar technology requires skilled personnel for both deployment and upkeep, further increasing the financial burden. Saudi Arabia’s growing defense budget is undoubtedly supporting the purchase of such systems; however, the large-scale installation and maintenance of these radar systems across the country require substantial financial resources. The need for constant upgrades to stay ahead of emerging technologies also adds to the financial burden. This high capital expenditure could potentially hinder market growth, especially for smaller defense players or those lacking significant funding.

Regulatory and Compliance Barriers

Regulatory and compliance issues present significant challenges for the KSA X-band radar market. The procurement of radar systems is subject to stringent national and international regulations, particularly regarding defense technology. Saudi Arabia must navigate complex export controls, compliance protocols, and certification requirements when acquiring foreign radar systems. This regulatory environment creates potential delays in procurement processes and could increase costs associated with market entry for international firms. Additionally, the integration of different radar systems into existing defense infrastructure must adhere to strict regulatory standards, further complicating the procurement process. As Saudi Arabia strengthens its defense capabilities, navigating these regulatory challenges will be crucial for accelerating the deployment of radar systems.

Opportunities

Partnerships with International Defense Firms

One of the most significant opportunities for the KSA X-band radar market lies in expanding collaborations with international defense companies. By partnering with global players, Saudi Arabia can acquire advanced radar technologies, integrate cutting-edge features, and bolster the capabilities of its defense sector. Partnerships can also help in fostering local expertise through knowledge transfer, enabling Saudi Arabia to strengthen its domestic defense industry. These collaborations not only offer access to superior technology but also allow for the customization of radar systems to meet local needs and environmental conditions. The growing interest of international defense firms in the Middle Eastern market presents a valuable opportunity for Saudi Arabia to modernize its defense radar systems.

Development of Space-Based Radar Systems

The development of space-based radar systems offers a significant opportunity in the KSA X-band radar market. Space-based radar technologies provide far-reaching surveillance and reconnaissance capabilities, making them crucial for monitoring vast areas, including remote and maritime zones. Saudi Arabia’s interest in strengthening its space program and enhancing satellite capabilities provides an ideal opportunity for deploying space-based radar systems. The Kingdom’s ambitious Vision 2030 initiative includes expanding its space and defense sectors, which could lead to significant investments in space-based radar technologies. These advancements could help Saudi Arabia improve its defense surveillance while diversifying its radar applications across various sectors.

Future Outlook

The KSA X-band radar market is expected to see significant growth over the next five years, driven by continued defense investments, technological advancements, and the growing need for advanced surveillance systems. The Kingdom’s strategic focus on bolstering national security, coupled with the increasing adoption of cutting-edge radar technologies, will foster long-term market expansion. Government initiatives to modernize military operations, particularly in air and maritime defense, will likely drive demand for sophisticated radar solutions. Furthermore, as Saudi Arabia continues to forge partnerships with leading defense companies, its radar systems will become more integrated and capable, supporting the Kingdom’s defense goals. Regulatory support and advancements in satellite and space-based radar technologies will further enhance the market’s prospects.

Major Players

- Lockheed Martin

- Raytheon Technologies

- Thales Group

- BAE Systems

- Northrop Grumman

- Leonardo

- Harris Corporation

- Saab Group

- Rheinmetall AG

- Elbit Systems

- Boeing

- General Dynamics

- L3 Technologies

- SAAB AB

- Rafael Advanced Defense Systems

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Defense contractors

- Aerospace and defense manufacturers

- Military forces

- Private sector technology firms

- Space agencies

- Homeland security agencies

Research Methodology

Step 1: Identification of Key Variables

This step involves identifying key variables that influence the KSA X-band radar market, including technological advancements, geopolitical factors, and defense spending trends.

Step 2: Market Analysis and Construction

Data is collected from both primary and secondary sources, followed by an analysis of market size, segmentation, and growth trends specific to KSA’s radar market.

Step 3: Hypothesis Validation and Expert Consultation

Experts in radar technology and defense sectors are consulted to validate hypotheses about market trends and challenges.

Step 4: Research Synthesis and Final Output

The findings from market analysis and expert consultations are synthesized to produce a comprehensive report, providing insights into the KSA X-band radar market. a

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increased Defense Spending in the Region

Technological Advancements in Radar Systems

Geopolitical Tensions Driving Demand for Defense Technologies

Demand for Improved Surveillance Capabilities

Advancements in Radar Signal Processing - Market Challenges

High Capital Investment Required for X-band Radar Systems

Technological Integration Challenges

Regulatory Barriers in Defense Procurement

Countermeasures Against Radar Systems

Shortage of Skilled Personnel for Radar System Development - Market Opportunities

Growth in Space-Based Radar Solutions

Partnerships with International Defense Contractors

Rising Demand for Radar Solutions in Homeland Security - Trends

Adoption of AI and Machine Learning in Radar Systems

Shift Towards Autonomous Radar Platforms

Increased Demand for Compact and Mobile Radar Solutions

Growing Role of X-band Radar in Space Exploration

Use of X-band Radar for Environmental and Meteorological Applications - Government Regulations & Defense Policy

Strict Defense Procurement Policies

Export Control Regulations

Defense Innovation Programs and Grants - SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Ground-Based X-Band Radar

Airborne X-Band Radar

Naval X-Band Radar

Space-Based X-Band Radar

Portable X-Band Radar - By Platform Type (In Value%)

Land Platforms

Naval Platforms

Airborne Platforms

Space Platforms

Integrated Platforms - By Fitment Type (In Value%)

On-premise Solutions

Cloud-based Solutions

Hybrid Solutions

Modular Solutions

Integrated Solutions - By EndUser Segment (In Value%)

Military Forces

Government Agencies

Defense Contractors

Security Services

Aerospace & Defense Manufacturers - By Procurement Channel (In Value%)

Direct Procurement

Government Tenders

Private Sector Procurement

Online Bidding Platforms

Third-party Distributors - By Material / Technology (in Value%)

Semiconductors

Antenna Technology

Signal Processing Technology

Radar Data Processing

Radar Integration Systems

- Market structure and competitive positioning

- Market share snapshot of major players

- CrossComparison Parameters (System Type, Platform Type, Procurement Channel, EndUser Segment, Fitment Type, Material / Technology)

- SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Key Players

Lockheed Martin

Thales Group

BAE Systems

Northrop Grumman

Raytheon Technologies

L3 Technologies

Leonardo

Harris Corporation

Saab Group

Rheinmetall AG

Elbit Systems

Boeing

General Dynamics

Harris Corporation

Rafael Advanced Defense Systems

- Military Forces’ Focus on Enhanced Detection Systems

- Government Agencies Seeking Advanced Surveillance Solutions

- Defense Contractors’ Demand for Advanced Radar Systems

- Aerospace Manufacturers Investing in Cutting-Edge Radar Technologies

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035