Market Overview

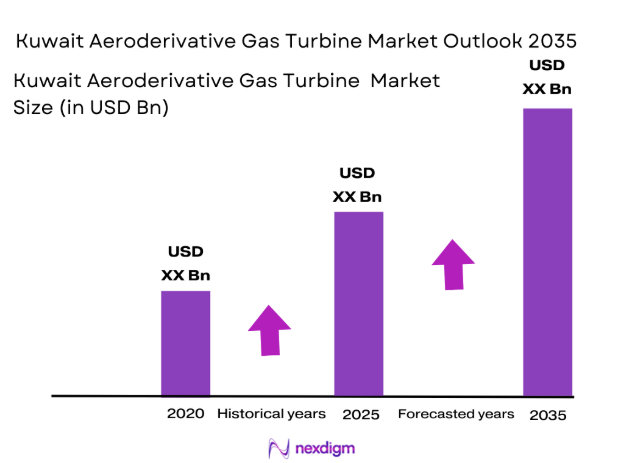

The Kuwait aeroderivative gas turbine market is expected to reach a valuation of USD ~ billion in 2025, driven by the country’s growing energy demand and expanding industrial base. The market is primarily fueled by the need for flexible, high-efficiency turbines that can complement Kuwait’s power grid, which includes both traditional and renewable energy sources. The continued growth of the oil and gas sector in Kuwait also plays a significant role in driving the demand for reliable and efficient power generation solutions. Kuwait’s energy consumption is expected to reach 18,000 GWh by 2024, with industrial and residential sectors being the primary consumers of electricity.

Kuwait City, as the capital and commercial hub, dominates the market due to its strategic location in the country’s power generation and industrial sectors. The city houses major industrial complexes, power plants, and government infrastructure. Additionally, Al Ahmadi is another key region for the oil and gas sector, home to several petrochemical plants and refineries that drive the demand for power generation equipment like aeroderivative gas turbines. These regions are essential for both industrial growth and electricity generation needs, making them the focal points of the aeroderivative gas turbine market.

Market Segmentation

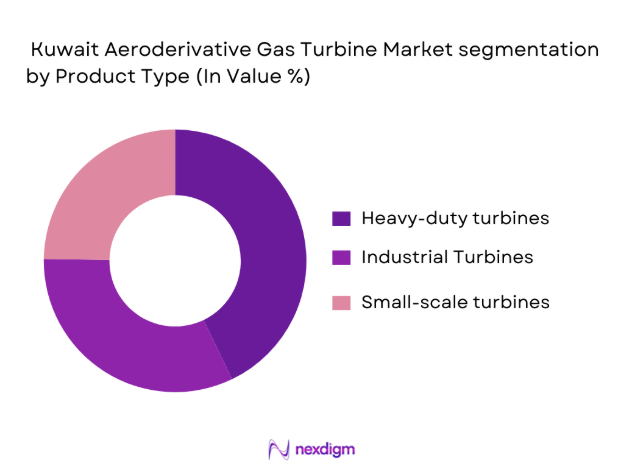

By Product Type

The Kuwait aeroderivative gas turbine market is segmented by product type into heavy-duty turbines, industrial gas turbines, and small-scale turbines. Among these, heavy-duty turbines dominate the market. These turbines are primarily used for large-scale power generation and are preferred due to their high efficiency and reliability, especially in Kuwait’s fluctuating energy demand. The heavy-duty turbines are critical for meeting base-load energy needs in power plants and industrial facilities. With a growing need for stable power generation to support the industrial sector and large-scale infrastructure projects, these turbines offer the most robust performance and capacity.

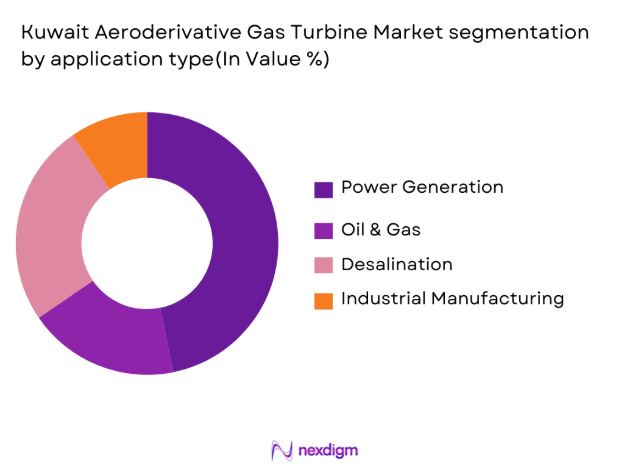

By Application

The application segment of the aeroderivative gas turbine market in Kuwait includes power generation, oil & gas, desalination plants, and industrial manufacturing. Power generation holds the largest market share within this segment. This is due to Kuwait’s reliance on gas turbines for its electricity production, particularly in power plants where turbines are used for both base-load and peaking power. As the demand for electricity continues to rise due to population growth and economic development, the application of aeroderivative turbines in power generation becomes more critical to ensuring consistent and efficient energy supply across the country.

Competitive Landscape

The Kuwait aeroderivative gas turbine market is dominated by both global leaders in the turbine manufacturing sector and local players who provide service and support. Companies such as General Electric (GE), Siemens Energy, and Mitsubishi Power have a strong presence due to their advanced technology and long-standing relationships with energy sector players in Kuwait. These companies offer high-performance turbines that meet the demands of Kuwait’s oil and gas sector as well as its growing renewable energy projects. Additionally, local players like Zamil Industrial provide important service support and maintenance, ensuring a reliable turbine operation in Kuwait’s challenging environments. The market is competitive, with major players focusing on technological innovation, efficiency, and fuel flexibility to meet the Kingdom’s evolving energy needs.

| Company | Establishment Year | Headquarters | Turbine Type | Market Focus | Key Differentiator |

| General Electric | 1892 | USA | ~ | ~ | ~ |

| Siemens Energy | 1847 | Germany | ~ | ~ | ~ |

| Mitsubishi Power | 1884 | Japan | ~ | ~ | ~ |

| Zamil Industrial | 1998 | Saudi Arabia | ~ | ~ | ~ |

| Doosan Heavy Industries | 1962 | South Korea | ~ | ~ | ~ |

Kuwait aeroderivative gas turbine Market Analysis

Growth Drivers

Increased Energy Demand

Kuwait’s growing energy demand is a major factor in driving the need for more power generation. In 2024, the country’s total electricity consumption is expected to reach 18,000 GWh, driven by population growth, urbanization, and expanding industrial activities. The demand for energy is expected to increase by 2-3% annually in line with economic

development, requiring more efficient, flexible, and reliable power generation technologies. The increasing industrialization, urban population, and rising energy consumption in sectors like residential, commercial, and manufacturing require advanced gas turbines for continuous and efficient power generation.

Kuwait Vision 2035 Initiatives

Kuwait’s Vision 2035 is a national development plan aimed at diversifying the economy and enhancing the energy sector’s efficiency. The government is investing heavily in modernizing its infrastructure, including its energy infrastructure, under the New Kuwait initiative. These efforts include expanding power generation capacity, integrating renewable energy, and modernizing power plants. The government’s emphasis on energy sustainability has led to the increasing adoption of aeroderivative gas turbines, as they are more adaptable to fluctuating energy needs and offer higher efficiency, lower emissions, and reduced operational costs.

Market Challenges

Dependence on Foreign Manufacturers

Kuwait’s aeroderivative gas turbine market relies heavily on foreign manufacturers for advanced turbines. While global players such as General Electric and Siemens dominate the market, this reliance on foreign technology presents risks, including delays in procurement, shipping challenges, and the need for foreign expertise. Moreover, geopolitical tensions in the Middle East and global supply chain disruptions could hinder access to critical turbine parts and services, potentially affecting power generation operations.

Regulatory Compliance and Tariffs

Kuwait’s regulatory framework for power generation is becoming stricter with a focus on emissions reduction and sustainable practices. This is increasingly influencing the adoption of gas turbines, as operators need to ensure that turbines meet evolving emission standards and environmental regulations. While this has pushed demand for cleaner and more efficient turbines, it has also created an additional layer of complexity for turbine operators to ensure compliance with regulations. Moreover, fluctuating import tariffs and regulatory barriers are affecting the ability to source parts at competitive prices. (Source: Kuwait Ministry of Electricity and Water)

Opportunities

Adoption of Hybrid Turbines for Renewable Integration

As Kuwait increases its investment in renewable energy, there is an increasing demand for hybrid turbines capable of operating seamlessly with renewable energy sources. Hybrid gas turbines can integrate wind and solar energy with traditional power generation, enabling a more stable and flexible energy grid. This integration is critical to managing the variable nature of renewable energy while ensuring a consistent power supply. The growing number of wind and solar projects in Kuwait presents an opportunity for turbines that can support these energy transitions, ensuring smooth integration into the grid.

Emerging Demand in Desalination Plants

Kuwait’s reliance on desalinated water for its domestic water supply has created a growing demand for reliable and efficient power generation systems to support desalination plants. Aeroderivative gas turbines are ideal for these applications due to their quick start-up capabilities and ability to operate under fluctuating load conditions. Given that 70% of Kuwait’s water supply comes from desalination, the need for robust power generation to support these facilities is expected to grow. As new desalination plants are constructed, this market presents a significant growth opportunity for aeroderivative gas turbines.

Future Outlook

The Kuwait aeroderivative gas turbine market is expected to experience steady growth in the coming years, driven by several key factors. The government’s commitment to energy diversification, including expanding renewable energy projects, will necessitate the integration of flexible and reliable gas turbine technology. As the country moves towards increasing its electricity generation capacity and modernizing its industrial infrastructure, the demand for high-efficiency, low-emission turbines will grow. Moreover, ongoing investments in desalination projects and the oil & gas sector will further boost market demand for advanced turbine solutions. The next decade will likely see continued technological advancements, particularly in hybrid gas turbines that can seamlessly integrate renewable energy sources.

Major Players in the KSA Aeroderivative Gas Turbine Market

- General Electric

- Siemens Energy

- Mitsubishi Power

- Rolls-Royce Holdings

- Ansaldo Energia

- Solar Turbines

- MAN Energy Solutions

- Baker Hughes

- Harbin Electric

- Doosan Heavy Industries

- Capstone Turbine Corporation

- OPRA Turbines

- Vericor Power Systems

- Capstone Green Energy

- Zamil Industrial

Key Target Audience

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies (Ministry of Electricity and Water, Kuwait Petroleum Corporation)

- Private Power Generation Companies

- Oil and Gas Operators

- Desalination Plant Operators

- Industrial Manufacturing Companies

- Energy Service Providers

- Engineering & Procurement Contractors

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves identifying critical market variables in the Kuwait aeroderivative gas turbine sector, including technological adoption, fuel efficiency trends, and regulatory frameworks. This research integrates both qualitative and quantitative data sources.

Step 2: Market Analysis and Construction

Data from historical trends in energy demand, industrial development, and government energy policies is compiled to construct the market forecast. This includes in-depth analysis of turbine installations, operational data, and financials of key market players.

Step 3: Hypothesis Validation and Expert Consultation

The market’s hypotheses are validated through consultations with industry experts and stakeholders in the energy and power generation sectors in Kuwait. These interviews provide valuable insights into market dynamics, competitive strategies, and technological adoption trends.

Step 4: Research Synthesis and Final Output

This phase synthesizes data from the previous steps to provide a comprehensive and actionable market report. Key data points are validated through direct engagement with turbine manufacturers and service providers, ensuring accuracy and reliability in the final output.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Overview Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain and Value Chain Analysis

- Growth Drivers

Increased Energy Demand

Kuwait Vision 2035 Initiatives

Oil & Gas Expansion

Technological Advancements in Turbine Efficiency - Market Challenges

- High Initial Capital Investment

Maintenance Complexity

Dependence on Foreign Manufacturers

Regulatory Compliance and Tariffs - Opportunities

Energy Diversification Projects

Local Manufacturing Development

Adoption of Hybrid Turbines for Renewable Integration

Emerging Demand in Desalination Plants - Trends

Shift Toward Hybrid Gas Turbines

Focus on Low Emission Technologies

Energy Efficiency Innovations - Government Regulation

Energy Efficiency Standards

Import Tariffs and Compliance Regulations - SWOT Analysis

- Porter’s Five Forces

- Competition Ecosystem

- By Value, 2020-2025

- By Volume, 2020-2025

- By Average Price, 2020-2025

- By Product Type (In Value %)

- Heavy-Duty Gas Turbines

Industrial Gas Turbines

Miniaturized Gas Turbines - By Application (In Value %)

- Power Generation

Oil & Gas

Desalination Plants

Industrial Manufacturing - By Fuel Type (In Value %)

Natural Gas

Diesel

Hybrid Fuels - By End User (In Value %)

Government and State-Owned Entities

Private Sector (Energy Companies)

Industrial & Commercial Users - By Region (In Value %)

Central Region

Southern Region

Northern Region

- Kuwait Aeroderivative Gas Turbine Market

- Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strength, Weakness, Organizational Structure, Revenues, Revenues by Turbine Type, Number of Touchpoints, Distribution Channels, Number of Dealers and Distributors, Margins, Production Plant, Capacity, Unique Value Offering, Service Networks)

- Detailed Profiles of Major Companies

General Electric

Siemens Energy

Mitsubishi Power

Solar Turbines

MAN Energy Solutions

Baker Hughes

Rolls-Royce Holdings

Ansaldo Energia

Kawasaki Heavy Industries

Harbin Electric

Doosan Heavy Industries

Capstone Turbine Corporation

OPRA Turbines

Vericor Power Systems

Capstone Green Energy

- National Power Utilities

- Oil & Gas Operators

- Desalination Facility Operators

- Industrial Manufacturing Plants

- Independent Power Producers

- By Value, 2026-2035

- By Volume, 2026-2035

- By Average Price, 2026-2035