Market Overview

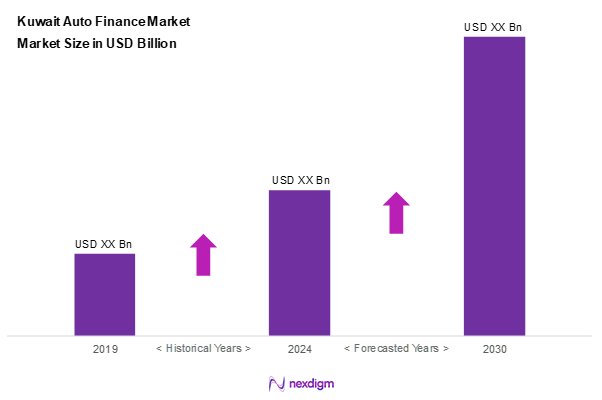

As of 2024, the Kuwait auto finance market is valued at USD ~ billion, with a growing CAGR of 6.4% from 2024 to 2030, driven predominantly by the rising demand for vehicle ownership among consumers seeking affordable financing options. This trend reflects an increase in disposable income and a burgeoning car culture in the region, leading to greater reliance on auto financing. The growth has been aided by an efficient banking system offering competitive interest rates and accessible loan products for various buyer profiles.

Kuwait City serves as the dominant market for auto finance, supported by its economic significance and concentration of banks and financial institutions. The city’s well-established infrastructure for both new and used vehicles contributes to its competitive edge in the market. Additionally, the coastal region’s access to international trade markets facilitates increased imports of vehicles, further boosting customer financing options and overall market activity.

Market Segmentation

By Loan Type

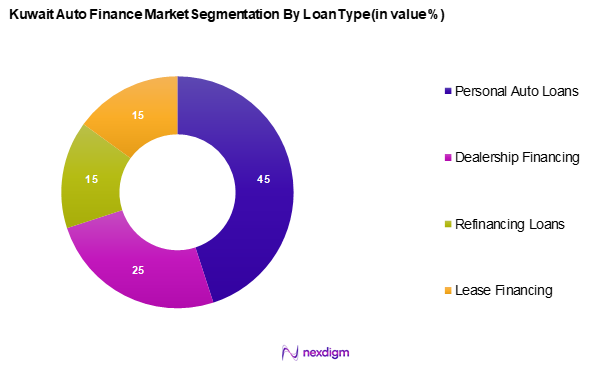

The Kuwait auto finance market is segmented into personal auto loans, dealership financing, refinancing loans, and lease financing. Among these, personal auto loans have claimed a significant market share owing to their broad appeal to individual consumers. The flexibility these loans offer, along with competitive interest rates, makes them appealing. Banks and financial institutions have tailored products that cater to various borrower segments, enhancing accessibility and maintaining a steady demand for personal auto loans.

By Borrower Profile

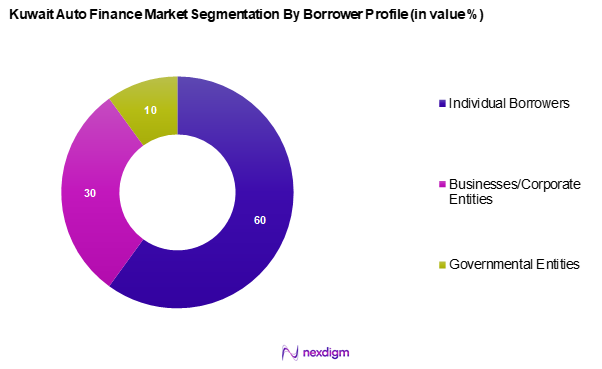

The Kuwait auto finance market is segmented into individual borrowers, businesses/corporate entities, and governmental entities. Individual borrowers dominate this segment primarily due to the increasing number of consumers entering the car market, supported by rising disposable incomes and favorable loan offerings. Personal purchase decisions and long-term financing options have led to significant growth in this sub-segment, making it crucial for lenders to develop tailored financial products to meet the borrowing needs.

Competitive Landscape

The Kuwait auto finance market is characterized by a handful of dominant players, including local banks and financial institutions. The competition is primarily fueled by the need for innovative loan products and customer service excellence. Major players in the market include institutions that have entrenched themselves through robust customer relationships and tailored financing arrangements.

| Major Players | Establishment Year | Headquarters | Loan Types Offered | Market Positioning | Customer Base | Online Services Offered |

| Gulf Bank | 1960 | Kuwait City | – | – | – | – |

| National Bank of Kuwait | 1952 | Kuwait City | – | – | – | – |

| Boubyan Bank | 2004 | Kuwait City | – | – | – | – |

| Kuwait Finance House | 1977 | Kuwait City | – | – | – | – |

| Warba Bank | 2010 | Kuwait City | – | – | – | – |

Kuwait Auto Finance Market Analysis

Growth Drivers

Increasing Vehicle Ownership

Kuwait has witnessed a steady rise in vehicle ownership, reflecting a growing preference for personal mobility. This trend is largely driven by an expanding middle class and rising disposable incomes. The accessibility of auto finance products has made vehicle ownership more feasible for many residents, further propelling market growth.

Competitive Interest Rates

The auto financing sector in Kuwait benefits from a favourable lending environment, with interest rates remaining attractive compared to regional counterparts. Financial institutions continue to offer competitive loan structures, encouraging consumers to finance vehicle purchases rather than relying solely on cash transactions. The availability of personal loans as a significant portion of total bank lending further facilitates vehicle financing, making it a preferred option for many buyers.

Market Challenges

Regulatory Compliance Issues

The auto finance market operates within a highly regulated framework designed to ensure consumer protection. However, frequent regulatory updates have increased compliance costs for lenders, leading financial institutions to adopt a more cautious approach when extending auto loans. This regulatory landscape presents barriers for new entrants and can slow market expansion in the short term.

Economic Instability

Economic conditions play a crucial role in shaping the auto finance market. Fluctuations in key economic indicators, particularly those linked to oil revenues, influence consumer confidence and spending patterns. Periods of economic uncertainty often lead to a more conservative approach from consumers, who may delay large financial commitments such as vehicle purchases, potentially impacting market growth.

Opportunities

Emergence of Digital Finance Solutions

The increasing adoption of digital financial services is reshaping the auto finance sector. With a tech-savvy population, financial institutions and fintech companies are investing in user-friendly digital platforms to streamline the loan application process. These advancements enhance accessibility, improve customer engagement, and cater to the demand for more efficient and flexible financing options, paving the way for substantial market expansion.

Increasing Demand for Flexible Financing Options

Consumer preferences are shifting toward more adaptable financing solutions, prompting banks and financial institutions to introduce customized loan structures. Features such as balloon payments and tiered interest rates enable buyers to tailor repayment plans according to their financial situations. This flexibility makes auto financing more attractive and accessible, driving higher participation in the market.

Future Outlook

The Kuwait auto finance market is poised for robust growth in the coming years, driven by supportive government policies, advancements in digital finance solutions, and an increase in consumer demand for vehicles. The industry is expected to expand as more financial institutions embrace technology to streamline the loan application process and enhance customer experience. Furthermore, the shift toward more sustainable car options may also contribute to the market’s evolution, as consumers become more discerning about vehicle choices.

Major Players

- Gulf Bank

- National Bank of Kuwait

- Boubyan Bank

- Kuwait Finance House

- Warba Bank

- Al Ahli Bank

- Commercial Bank of Kuwait

- Bank of Bahrain and Kuwait

- Burgan Bank

- Al-Jazeera Bank

- International Bank of Kuwait

- Al Baraka Banking Group

- Al Khaliji Bank

- Qatar National Bank

- Ahli United Bank

Key Target Audience

- Individual Borrowers

- Corporates and Businesses

- Government and Regulatory Bodies (e.g., Central Bank of Kuwait)

- Financial Analysts

- Investments and Venture Capitalist Firms

- Auto Dealership Associations

- Vehicle Manufacturers

- Insurance Companies

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves mapping out the ecosystem of stakeholders within the Kuwait auto finance market. Utilizing extensive desk research, we combine secondary sources and proprietary databases to gather detailed industry-level information. This phase aims to identify and define critical variables that impact market dynamics, ensuring a comprehensive understanding of the various factors influencing the auto finance landscape.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data related to the Kuwait auto finance market. This includes assessing market penetration rates, the ratio of financing options to vehicle purchases, and the resultant revenue generation. Detailed evaluations of service quality statistics will be conducted to ensure that revenue estimates are both reliable and accurate, informing subsequent analyses.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and validated through consultations with industry experts via Computer-Assisted Telephone Interviews (CATIs). These experts represent a diverse array of companies within the auto finance sector, providing valuable operational and financial insights that bolster the robustness of the market data. This step is crucial for refining the analysis and ensuring its relevance to current market conditions.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with various auto finance institutions to gather first-hand insights into their product offerings, sales performance, consumer preferences, and other significant factors. This interaction will enhance the veracity of statistical data obtained from both qualitative and quantitative research, ensuring a comprehensive, accurate, and validated analysis of the Kuwait auto finance market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Market Genesis

- Timeline of Major Players

- Industry Business Cycle

- Supply Chain & Value Chain Analysis

- Growth Drivers

Increasing Vehicle Ownership

Competitive Interest Rates - Market Challenges

Regulatory Compliance Issues

Economic Instability - Opportunities

Emergence of Digital Finance Solutions

Increasing Demand for Flexible Financing Options - Trends

Rise in Online Auto Loan Applications

Growth in Peer-to-Peer Lending Platforms - Government Regulation

Lending Regulations and Guidelines

Regulatory Compliance for Financial Institutions - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Interest Rates, 2019-2024

- By Loan Type, (In Value %)

Personal Auto Loans

Dealership Financing

Refinancing Loans

Lease Financing - By Borrower Profile, (In Value %)

Individual Borrowers

Businesses/Corporate Entities

Governmental Entities - By Vehicle Type, (In Value %)

New Vehicles

Used Vehicles - By Payment Schedule, (In Value %)

Monthly Payments

Bi-Weekly Payments

Annual Payments - By Region, (In Value %)

Kuwait City

Hawalli

Salmiya

Other Governorates

- Market Share of Major Players by Value/Volume, 2024

Market Share of Major Players by Type of Loan Segment, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strengths, Weaknesses, Organizational Structure, Revenue Metrics, Distribution Channels, Digital Presence, Customer Satisfaction Ratings)

- SWOT Analysis of Major Players

- Pricing Analysis Basis SKUs for Major Players

- Detailed Profiles of Major Companies

Gulf Bank

National Bank of Kuwait

Boubyan Bank

Al Ahli Bank

Kuwait Finance House

Warba Bank

Bank of Bahrain and Kuwait

Al Baraka Banking Group

Commercial Bank of Kuwait

Burgan Bank

KFH Auto

Al-Jazeera Bank

International Bank of Kuwait

Ahli United Bank

Qatar National Bank

Others

- Market Demand and Utilization

- Borrower Spending Behavior

- Regulatory and Compliance Requirements

- Needs, Desires, and Pain Point Analysis

- Decision-Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Interest Rates, 2025-2030