Market Overview

The Kuwait BNPL market is valued at USD 184.0 million, according to regional analysis for the GCC encompassing Kuwait in 2024. This reflects a substantial volume of transactions facilitated by BNPL solutions, supported by burgeoning e‑commerce activity and growing digital payment infrastructure. Comparing with 2023—when regional BNPL uptake was notably accelerated post‑pandemic—the market’s momentum is grounded in digitization and fintech adoption that continue to fuel its scale in monetary terms.

Within the GCC, countries like Kuwait, alongside UAE and Saudi Arabia, dominate BNPL adoption due to high smartphone penetration, robust e‑commerce ecosystems, and favorable regulatory frameworks. In particular, Kuwait’s affluent consumer base, advanced digital infrastructure, and openness to financial innovation make it a natural leader in BNPL uptake. These factors position it as a prominent hub, despite lacking explicit share figures, because these systemic enablers drive leverage of BNPL solutions more than any raw percentages.

Market Segmentation

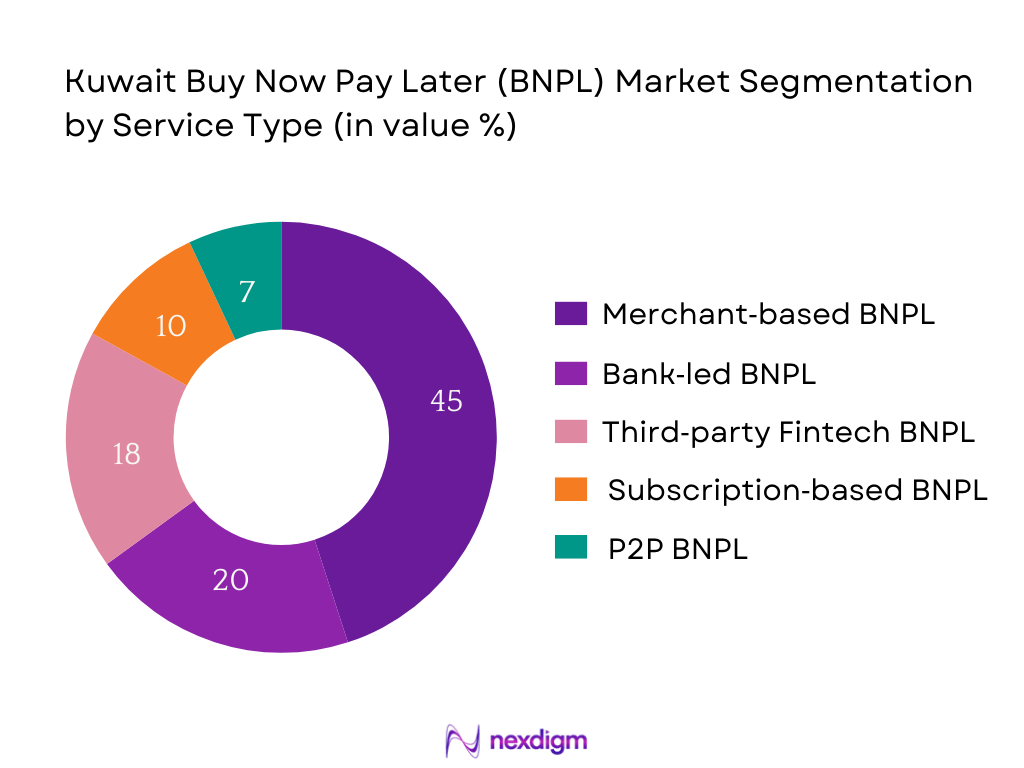

By Service Type

Merchant‑based BNPL is dominating the market, as most consumers in Kuwait use BNPL at the point-of-sale or during online checkouts, where retailers embed BNPL as a checkout option. This prevalence is driven by strong partnerships between merchants and BNPL providers, promoting seamless user experience, rewarding incentives, and incremental average order values. Kuwaiti retailers in fashion, electronics, and lifestyle sectors actively onboard BNPL with attractive terms, making merchant-based BNPL the most widely used sub‑segment.

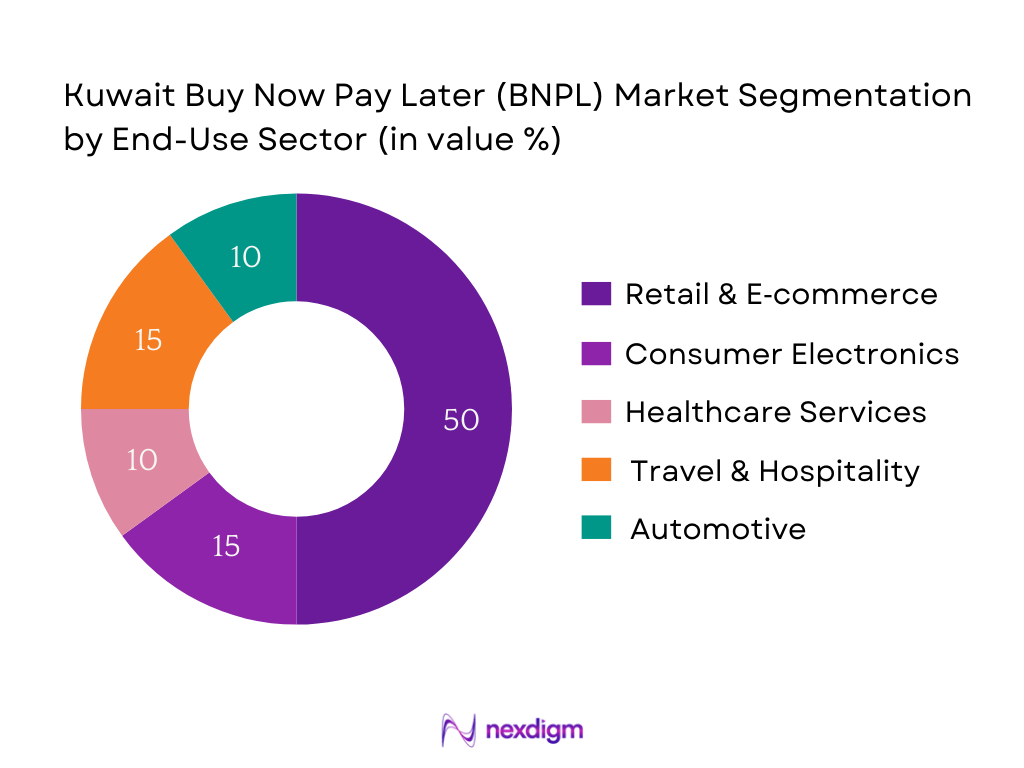

By End‑Use Industry

Retail & E‑commerce dominates the BNPL market in Kuwait, reflecting high consumer engagement online and offline. Kuwaiti shoppers frequently use BNPL when purchasing apparel, accessories, and daily necessities, thanks to attractive installment options and absence of interest. Retailers actively promote BNPL as a value-add, while e-commerce platforms integrate it as a seamless payment method. The combination of strong retail sector presence and consumer enthusiasm propels this sub‑segment to the forefront.

Competitive Landscape

The Kuwait BNPL competitive landscape is characterized by a blend of pioneering fintech brands and regional banking entities, each striving to capture consumer and merchant interest. Global BNPL providers like Tamara, Tabby, and Postpay are active along with regional firms such as Spotii and Zoodpay, while local banks and retailers are increasingly launching their own BNPL pilots. This mix underscores the market’s dynamic, with both agile fintechs and established institutions competing for dominance via service integration and innovative offerings.

| Company Name | Establishment Year | Headquarters | Merchant Network Coverage | CBK Sandbox Status | Underwriting Model (e.g., AI-risk) | Fee Structure Differentiators | Default Rate (Indicative) | Tech Integration (API/SDK) |

| Tamara | – | Saudi Arabia | – | – | – | – | – | – |

| Tabby | – | UAE | – | – | – | – | – | – |

| Postpay | – | UAE | – | – | – | – | – | – |

| Spotii | – | UAE | – | – | – | – | – | – |

| Zoodpay | – | UAE | – | – | – | – | – | – |

Kuwait BNPL Market Analysis

Key Growth Drivers

Rising E‑Commerce and Mobile Wallet Transactions

Kuwait’s digital spending landscape indicates strong tailwinds for BNPL. On 1 December 2024, mobile e‑commerce transactions averaged USD 380.443, up from previous days. Meanwhile, coupon- and rebate-driven e‑commerce transactions reached USD 68.298 on the same date, reflecting active engagement in digital shopping. Additionally, card transactions totaled KD 47.12 billion (~USD 155 billion) in 2024, with electronic payments reaching KD 18.8 billion. Kuwait’s GDP stands at USD 160.23 billion in 2024, with 100 percent of the population using the Internet—all indicating a digitally connected consumer base that increasingly prefers flexible, digital payment methods like BNPL.

Central Bank Sandbox Enabling BNPL Innovation

Kuwaiti economic fundamentals support fintech innovation like BNPL. GDP growth is expected to rebound by 2.8 percent in 2024, driven by expansionary fiscal policies and infrastructure projects. Inflation moderated to 2.44 percent by October 2024, reflecting stable monetary conditions. In parallel, consumer spending rose to a record KD 47.81 billion (~USD 156 billion) in 2024, with KD 18.92 billion (~USD 61 billion) in POS transactions—up 8.02 percent year-over-year. These macroeconomic indicators—recovering growth, controlled inflation, and high digital/purchase activity—create fertile conditions for BNPL innovation. The Central Bank of Kuwait’s sandbox framework encourages pilot BNPL offerings in this environment, facilitating experimentation with regulatory oversight.

Key Market Challenges

Absence of Centralized Credit Scoring

Despite conducive economic conditions, Kuwait lacks a unified credit scoring infrastructure essential for BNPL risk assessment. While data on consumer digital engagement are robust, there is no publicly available centralized credit bureau metric. Economically, GDP per capita is USD 32,290 in 2024, signifying considerable purchasing power, but without shared credit profiles, BNPL providers cannot reliably tailor underwriting models. Unemployment remains low—2.1 percent of the labor force in 2024—yet youth unemployment (e.g., among women aged 15–24) remains elevated at 28.7 percent. Without centralized scoring, assessing young and unbanked users becomes challenging. This data gap constraints providers’ ability to manage credit risk effectively and scale BNPL services across diverse customer segments.

High Default Risk in Unbanked/Young Populations

Youth and unbanked populations in Kuwait present elevated credit risk absent institutional safeguards. As mentioned, youth unemployment among women aged 15–24 stands at 28.7 percent. Despite overall low unemployment and high GDP per capita (USD 32,290), many younger or informal-income groups lack formal bank accounts and credit history. Without centralized scoring and limited financial inclusion, BNPL exposure to default risk is concentrated in these cohorts. Although electronic payment uptake is high and POS spends are robust (KD 18.92 billion), vulnerable demographics may strain repayment capacities. Thus, providers must deploy alternate data or preemptive risk modeling to mitigate potential defaults.

Emerging Opportunities

BNPL Penetration in Healthcare and Education Sectors

Healthcare and education expenditure in Kuwait exhibit sizable e‑commerce value, indicating growing potential for BNPL integration. On 1 December 2024, e‑commerce average order value for Education transactions stood at USD 6.124, while Healthcare related purchases averaged USD 128.098. Meanwhile, overall internet penetration at 100 percent ensures digital access across households. Given consumer willingness to engage in online spending for essential services, BNPL can fill cash flow gaps in sectors like tuition payments and health services. Providers can thus tap into recurring, high-value segments—supported by stable macroeconomic environment (GDP USD 160.23 billion, inflation 2.9 percent)—to launch customized plans for healthcare and education expenditures.

SME‑Focused BNPL Product Launches

Small and medium enterprises (SMEs) in Kuwait are increasingly reliant on digital payments and require flexible financing options. With electronic payments rising to KD 18.8 billion and POS volumes surging to KD 18.92 billion in 2024, SMEs participating in digital commerce stand to benefit from embedded BNPL solutions. Kuwait’s strong fiscal position—underpinned by USD 160.23 billion GDP and improving growth outlook (GDP growth ~2.8 percent)—provides a stable environment for SME lending innovation. BNPL providers can partner with SMB merchants to finance inventory purchases or offer consumer-facing installments at checkout. With internet usage universal (100 percent), these offerings can be widely adopted and scale quickly, unlocking e‑commerce growth via SMEs.

Future Outlook

Over the forecast horizon, the Kuwait BNPL market is expected to accelerate, propelled by digital commerce maturation, fintech‑bank collaborations, and regulatory developments. Increased affordability tools, embedded BNPL in retail and service ecosystems, and tailored underwriting will drive both adoption and trust.

Major Players

- Tamara

- Tabby

- Postpay

- Cashew Payments

- Spotii

- Payby

- Zoodpay

- Aramex Smart

- Rise

- (Pilot) Bank-led BNPL (e.g., CBK Sandbox Bank)

Key Target Audience

- Investment and Venture Capitalist Firms

- Government and Regulatory Bodies (e.g., Central Bank of Kuwait)

- Large Retailers & E‑commerce Platforms

- Banks interested in BNPL product launches

- Fintech Payment Gateway Providers

- Telecom Operators exploring embedded BNPL

- Merchant Acquirers & POS Service Providers

- BNPL Solution Vendors & Technology Integrators

Research Methodology

Step 1: Identification of Key Variables

The process begins with mapping the Kuwait BNPL ecosystem—identifying stakeholders like fintech BNPL platforms, banks, merchants, and regulators. This mapping is informed by extensive desk research using secondary sources and proprietary databases to define critical variables influencing adoption, market structure, and transaction volumes.

Step 2: Market Analysis and Construction

Here, we compile quantitative data on historical BNPL revenues and transaction volumes in Kuwait. We analyze service-type, end-use industry distribution, and build revenue estimates using both top-down and bottom-up approaches, cross-validated against e‑commerce and payment statistics.

Step 3: Hypothesis Validation and Expert Consultation

We formulate hypotheses regarding growth drivers, consumer behavior, and provider strategies. These are validated via interviews—conducted virtually or onsite—with industry stakeholders, including BNPL providers, merchant partners, and regulatory representatives, to gain operational and strategic perspectives.

Step 4: Research Synthesis and Final Output

Finally, we engage directly with major BNPL platforms and participating financial institutions in Kuwait to obtain data on product features, user metrics, default rates, and growth expectations. This validates and complements earlier data, ensuring a robust and accurate market analysis.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Regulatory Sandbox Review, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Market Genesis and Evolution

- Timeline of Major BNPL Providers

- BNPL Business Cycle (Merchant – BNPL Platform – Payment Gateway – Consumer Flow)

- Value Chain and Ecosystem Structure

- Key Growth Drivers

Rising E-Commerce and Mobile Wallet Transactions

Central Bank Sandbox Enabling BNPL Innovation - Key Market Challenges

Absence of Centralized Credit Scoring

High Default Risk in Unbanked/Young Populations - Emerging Opportunities

BNPL Penetration in Healthcare and Education Sectors

SME-Focused BNPL Product Launches - Trends

Embedded BNPL at Merchant Checkout

Loyalty and Rewards Bundling with BNPL - Regulatory Framework

Central Bank of Kuwait Sandbox Program

Licensing Guidelines and Fintech Oversight - SWOT Analysis

- Stakeholder Ecosystem (Fintech, Regulator, Consumer, Merchant, Bank)

- Porter’s Five Forces Analysis

- Competition Ecosystem (Value-Chain Positioning of Players)

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Transaction Size, 2019-2024

- By End-Use Industry (In Value %)

Retail & E-Commerce

Consumer Electronics

Travel & Hospitality

Automotive

Healthcare - By Payment Channel (In Value %)

Online Checkout

POS (Point of Sale) - By Demographic Group (In Value %)

Gen Z

Millennials

Gen X

High-Income Professionals

Female Shoppers - By Provider Type (In Value %)

Fintech Startups

Bank-led BNPL

Retailer-Integrated BNPL - By BNPL Model (In Value %)

Pay-in-4 Installments

Deferred Payment

Interest-Free Monthly Plan

Revolving Credit

- Market Share of Major Players on the Basis of Value/Volume

Market Share by BNPL Model

Market Share by Industry Served - Cross Comparison Parameters (BNPL Product Portfolio, Merchant Partnership Network, AI-Based Credit Risk Capabilities, Licensing and Regulatory Status, Late Fee and Interest Policies, Integration Technology (API-based, SDK), Default Rates and Collection Efficiency, Geographic Presence and Expansion Plans)

- SWOT Analysis of Major Players

- Pricing Analysis Across Key BNPL Models (Installment Fee, Merchant Discount Rate, Penalties)

- Detailed Profiles of Major Companies

Tamara

Tabby

Cashew Payments

Spotii

Postpay

Rise BNPL

Payby

Zoodpay

Aramex Smart

Al Ahli Bank BNPL

Kuwait Finance House BNPL Initiative

Commercial Bank of Kuwait Digital PayLater

Local Retailer BNPL Program A

Local Retailer BNPL Program B

Peer-to-Peer BNPL Platform (Pilot-Stage)

- Consumer Demographic Profile

- Usage Frequency and Average Spend

- Pain Points and Satisfaction Metrics

- Risk Tolerance and Default Behavior

- Buyer Journey and Purchase Intent Signals

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Transaction Size, 2025-2030