Market Overview

As of 2024, the KSA soft gelatin capsules market is valued at USD ~ million, with a growing CAGR of 3.4% from 2024 to 2030, highlighting a consistent increase driven by growing tourism and expatriate population in the country. The uplift in infrastructure development and government initiatives to promote tourism also significantly contribute to market expansion. As a result, the car rental and leasing sector has become a crucial service, meeting the transportation needs of both residents and visitors.

Kuwait City emerges as the dominant hub within this market, attributed to its status as the capital and major economic centre, where most businesses and tourism activities converge. Other prominent areas such as Hawalli and Ahmadi also play vital roles; their development has led to increased demand for rental services due to population growth and urbanization. The confluence of these factors reinforces the market’s robust presence in these regions.

Market Segmentation

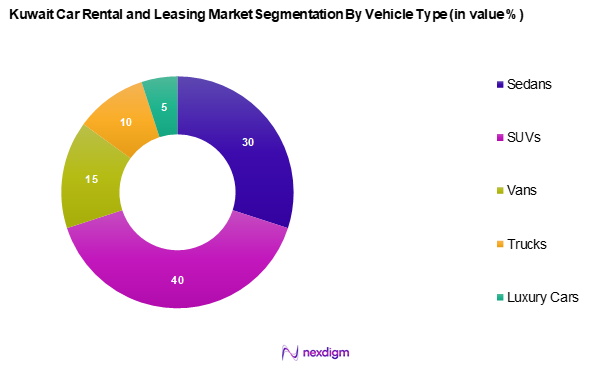

By Vehicle Type

The Kuwait car rental and leasing market is segmented into sedans, SUVs, vans, trucks, and luxury cars. The SUV segment currently dominates the market share because of rising consumer preference for spacious and versatile vehicles that are ideal for various terrains commonly found in Kuwait. The popularity of SUVs is bolstered by brand offerings from local and international providers, who cater to both the leisure and business segments effectively.

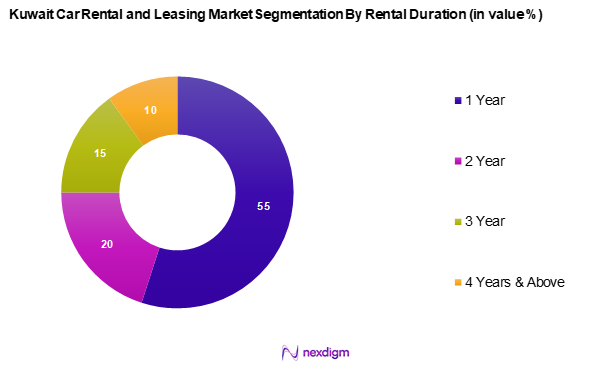

By Rental Duration

The Kuwait car rental and leasing market is segmented into 1-year, 2-year, 3-year, and 4 years & above. The 1-year rental duration leads the market due to the increasing preferences of individuals and corporations for short-term leases. This segment is particularly popular among expatriates and businesses seeking flexibility, allowing them to adapt quickly to changing needs without long-term commitments.

Competitive Landscape

The Kuwait car rental and leasing market is characterized by a competitive landscape dominated by several major players, including local firms and international brands. Established companies such as National Car Rental, Avis Kuwait, and Budget Rent a Car are key industry players, showcasing a significant influence over market dynamics.

| Company | Establishment Year | Headquarters | Fleet Size | Rental Locations | Revenue Streams | Customer Engagement Strategies |

| National Car Rental | 1947 | Kuwait City | – | – | – | – |

| Avis Kuwait | 1988 | Kuwait City | – | – | – | – |

| Budget Rent a Car | 1958 | New Jersey, U.S.A. | – | – | – | – |

| Sixt Rent a Car | 1912 | Bayern, Germany | – | – | – | – |

| Hertz Kuwait | 1918 | Kuwait City | – | – | – | – |

Kuwait Car Rental and Leasing Market Analysis

Growth Drivers

Increasing Tourism Activities

Kuwait’s tourism sector has been experiencing steady growth, supported by government initiatives aimed at enhancing the country’s appeal to international visitors. Investments in cultural, historical, and recreational attractions have led to a rise in tourist footfall. As a result, the demand for rental vehicles has increased, catering to travelers seeking flexible and convenient transportation options. This trend is expected to continue, with rental services playing a crucial role in addressing the mobility needs of the growing tourism sector.

Government Initiatives for Infrastructure Development

Significant investments in Kuwait’s transportation and infrastructure are contributing to improved connectivity across the country. Expansion projects at key transit hubs and enhancements to road networks are facilitating greater accessibility for both residents and visitors. These developments are fostering a favorable environment for the car rental market, as better infrastructure translates to increased vehicle usage and a higher demand for rental services.

Market Challenges

Regulatory Compliance Issues

The car rental and leasing market in Kuwait operates under stringent regulatory frameworks, requiring businesses to adhere to strict safety and operational guidelines. Compliance with registration requirements, insurance policies, and vehicle maintenance standards can be complex and resource-intensive. These regulatory challenges often lead to higher operational costs and can pose barriers for new market entrants, thereby influencing the overall growth and profitability of rental service providers.

Growing Competition

The car rental market in Kuwait is highly competitive, with numerous service providers vying for market share. A mix of established firms and smaller operators creates an environment where price competition is intense, often leading to reduced profit margins. In response, companies are focusing on service differentiation, such as enhanced customer experiences and value-added offerings, to maintain a competitive edge and attract a loyal customer base.

Opportunities

Rise of Digital Platforms for Rentals

The increasing adoption of digital platforms is transforming the car rental landscape in Kuwait. Online booking services and mobile applications are gaining popularity, providing customers with greater convenience and streamlined access to rental options. Companies that invest in user-friendly digital interfaces and seamless online experiences are well-positioned to capitalize on this trend, catering to the growing demand for tech-driven rental solutions.

Expansion of Fleet Management Services

Advancements in fleet management technologies are opening new avenues for growth within the rental market. The integration of telematics, real-time tracking, and data-driven maintenance solutions is enhancing operational efficiency for rental companies. These innovations allow businesses to optimize vehicle utilization, reduce downtime, and improve overall service quality. As a result, fleet management services are becoming an essential component of the car rental ecosystem, driving long-term sustainability and customer satisfaction.

Future Outlook

Over the next five years, the Kuwait car rental and leasing market is projected to witness significant growth, driven by an increase in tourism activities, continued government investment in infrastructure, and a growing reliance on flexible transportation solutions. This uptrend is expected to be coupled with an enhancement in digital booking platforms and a rise in eco-friendly vehicle options, aligning with global trends toward sustainability.

Major Players

- National Car Rental

- Avis Kuwait

- Budget Rent a Car

- Sixt Rent a Car

- Hertz Kuwait

- Al Mulla Group

- Al Rashed Group

- Al-Wazzan Group

- Safat Group

- Rapid Rent A Car

- First Rent A Car

- Car Rental Kuwait

- Al-Sharif Group

- Al-Ajmi Group

- GAC Motors

- Others

Key Target Audience

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies (Kuwait Ministry of Commerce and Industry, Ministry of Interior)

- Corporations/Businesses (Logistics, Oil and Gas Companies)

- Tourism Agencies

- Expatriate Agencies

- Event Management Companies

- Transportation and Fleet

- Management Services

- Real Estate and Property Management Firms

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing a comprehensive ecosystem map, encompassing all major stakeholders within the Kuwait car rental and leasing market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather detailed industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics, ensuring a thorough understanding of the landscape.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data pertaining to the Kuwait car rental and leasing market. This includes evaluating market penetration, the ratio of rental services to consumers, and resultant revenue generation. An assessment of service quality metrics will also be performed to ensure the reliability and accuracy of the revenue estimates, providing a solid foundation for market projections.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through Computer-Assisted Telephone Interviews (CATIs) with industry experts representing various companies in the market. These consultations will yield valuable insights into operational and financial aspects of the industry, which will be instrumental in refining and corroborating the gathered market data.

Step 4: Research Synthesis and Final Output

The final phase involves engaging with multiple car rental companies to acquire detailed insights regarding product segments, rental performance, consumer preferences, and other relevant factors. This interaction serves to verify and complement data derived from the bottom-up approach, ensuring a comprehensive, accurate, and validated analysis of the Kuwait car rental and leasing market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Market Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain & Value Chain Analysis

- Growth Drivers

Increasing Tourism Activities

Government Initiatives for Infrastructure Development - Market Challenges

Regulatory Compliance Issues

Growing Competition - Opportunities

Rise of Digital Platforms for Rentals

Expansion of Fleet Management Services - Trends

Shift Towards Eco-friendly Vehicles

Growth in Subscription Services - Government Regulations

Licensing Regulations

Safety Standards - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces Analysis

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Daily Rental Rate, 2019-2024

- By Vehicle Type, (In Value %)

Sedans

SUVs

Vans

Trucks

Luxury Cars - By Rental Duration, (In Value %)

1 Year

2 Year

3 Year

4 Years & Above - By End-user Type, (In Value %)

Individual Consumers

Corporate Clients

Oil and Gas

Government militaries & ministries

Construction

Logistics and Transportation

Others - By Geographic Region, (In Value %)

Kuwait City

Hawalli

Ahmadi

Farwaniya

Other Regions - By Fuel Type, (In Value %)

Gasoline

Diesel

Electric - By Market Structure, (In Value %)

Organized

Unorganized

- Market Share of Major Players On Basis of Value

Market Share by Vehicle Type Segment - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strength, Weakness, Revenue Streams, Number of Rental Locations, Fleet Size, Customer Engagement Strategies)

- SWOT Analysis of Major Players

- Pricing Analysis Basis SKUs for Major Players

- Detailed Profiles of Major Companies

National Car Rental

Avis Kuwait

Budget Rent a Car

Sixt Rent a Car

Hertz Kuwait

Al Mulla Group

Al Rashed Group

Al-Wazzan Group

Safat Group

Rapid Rent A Car

First Rent A Car

Car Rental Kuwait

Al-Sharif Group

Al-Ajmi Group

GAC Motors

Nissan Kuwait

KFH Auto

- Demographics and Preferences

- Purchasing Behavior and Budget Allocations

- Regulatory and Compliance Insights

- Customer Needs and Pain Points

- Decision-making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Daily Rental Rate, 2025-2030