Market Overview

As of 2024, the Kuwait cold chain market is valued at USD ~ million, with a growing CAGR of 4.6% from 2024 to 2030, reflecting a growing demand for efficient cold chain logistics as the country seeks to enhance food safety compliance and product preservation. The rising consumption of perishable goods along with stringent government regulations has been pivotal in driving this market.

Kuwait City is the dominant center for cold chain operations, primarily due to its strategic location as a trade hub and the concentration of logistics facilities. Additionally, the cities of Hawalli and Al Ahmadi play significant roles, bolstered by their proximity to major transport routes and population centers, creating a high demand for cold storage and transport solutions.

Market Segmentation

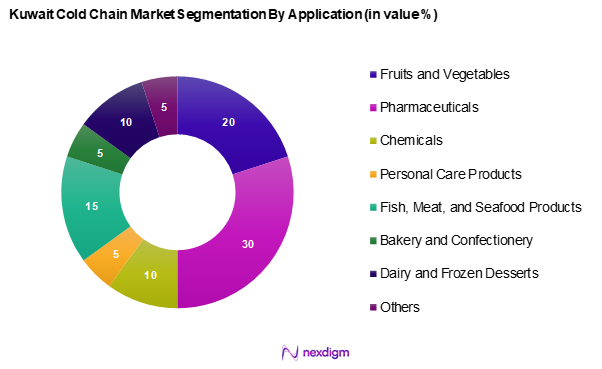

By Application

The Kuwait cold chain market segmentation into fruits and vegetables, pharmaceuticals, chemicals, personal care products, fish, meat, and seafood products, bakery and confectionery, dairy and frozen desserts, and others. Among these segments, the pharmaceuticals sector is projected to dominate in 2024 due to the increasing demand for temperature-sensitive medications and vaccines, especially considering the global pandemic’s impact on health care. The strict regulations regarding the transport and storage of pharmaceuticals have led to a surge in cold chain solutions, ensuring product integrity and compliance with safety standards.

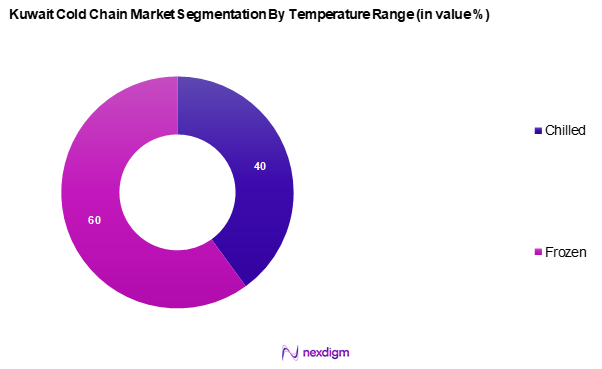

By Temperature Range

The Kuwait cold chain market segmentation into chilled and frozen categories. The frozen segment has a leading market share owing to the increasing consumer preference for frozen food options, which offer convenience and longer shelf life. The rise in frozen food outlets combined with the proliferation of e-commerce platforms for food delivery has significantly bolstered the demand for frozen cold chain logistics.

Competitive Landscape

The Kuwait cold chain market is characterized by a competitive landscape dominated by several key players, including local firms and established international companies. The key players focus on logistics efficiency and technological advancements to maintain their lead in the evolving market landscape.

| Company | Establishment Year | Headquarters | Revenue | Market Focus | Business Strategies | Market Share |

| Agility Logistics | 1979 | Kuwait City | – | – | – | – |

| Gulftainer | 1976 | Sharjah, UAE | – | – | – | – |

| Al Hariri Logistics | 2005 | Kuwait City | – | – | – | – |

| A.P. Moller – Maersk | 1904 | Copenhagen, Denmark | – | – | – | – |

| KGL Logistics | 2005 | Kuwait City | – | – | – | – |

Kuwait Cold Chain Market Analysis

Growth Drivers

Increasing Demand for Perishable Products

Kuwait has witnessed a growing demand for perishable products, driven by evolving consumer preferences for fresh produce, dairy, and meat. This shift reflects a broader trend in the region, where rising awareness about food quality and nutritional benefits is influencing purchasing decisions. Additionally, an expanding population is further fuelling the demand for fresh and frozen foods, necessitating efficient cold chain logistics to maintain product integrity and safety.

Government Regulations on Food Safety

Kuwait’s government has implemented stringent food safety regulations to protect public health, which has a direct impact on the cold chain market. The Ministry of Health has continuously enhanced monitoring protocols, mandating that perishable goods be maintained under specific temperature controls during storage and transportation. In 2023, Kuwait invested approximately USD 5 million in food safety programs, further emphasizing the importance of regulatory compliance in the food supply chain. These regulations not only enhance consumer confidence but also drive the need for robust cold chain solutions capable of meeting these standards.

Market Challenges

High Operational Costs

The cold chain sector in Kuwait faces substantial operational expenses, primarily due to the costs associated with maintaining refrigerated transport and storage facilities. Fuel prices, maintenance, and the need for specialized equipment add to the financial burden on businesses. Additionally, inflationary pressures contribute to rising expenditures, making cost efficiency and optimization crucial for industry players to sustain profitability.

Technology Adoption Barriers

Despite the evident benefits of advanced technologies such as IoT and automation, barriers to widespread adoption remain a significant challenge in the Kuwaiti cold chain market. Many local firms face difficulties in integrating these technologies due to high initial costs and a lack of skilled labour. In 2023, it was found that only 30% of cold chain operators had implemented any form of automated systems, limiting profitability and efficiency. This technological lag underscores the critical need for investments in training and development within the supply chain workforce to leverage growth opportunities fully.

Opportunities

Rising E-commerce in Food Delivery

The surge in e-commerce activities in Kuwait presents significant opportunities for the cold chain market, especially in food delivery services. The online grocery market was valued at approximately USD 67 million in 2022, reflecting a robust growth trajectory fueled by the pandemic-driven shift towards online shopping. With an expected doubling of online grocery shoppers by 2025, there is an increasing demand for efficient cold chain logistics to ensure the timely delivery of perishable goods, representing a critical growth area for service providers in the market.

Expansion of Retail Chains

The expansion of retail chains across Kuwait’s urban areas is creating new opportunities for cold chain logistics providers. Leading supermarkets such as Lulu Hypermarket and Carrefour have been increasing their cold storage facilities to meet escalating consumer demand for fresh and frozen products. In 2023, the total number of retail outlets grew by 12%, indicating ongoing urbanization and rising disposable incomes, which will necessitate advanced cold chain solutions to support the distribution of a diverse range of perishable products effectively. This trend highlights the immediate requirement for enhanced logistics capabilities within the cold chain sector.

Future Outlook

Over the next few years, the Kuwait cold chain market is poised for substantial growth, driven by increasing demand for perishable goods and heightened food safety regulations. The trend towards e-commerce, particularly in the grocery and food sectors, will necessitate robust cold chain solutions to ensure product quality throughout the supply chain. As companies invest in advanced technologies and infrastructure, the market is expected to evolve, reflecting both innovation and adaptation to consumer needs.

Major Players

- P. Moller – Maersk

- Agility Logistics

- Gulftainer

- Al Hariri Logistics

- Al Mufeed Cold Storage

- KGL Logistics

- Emirates Logistics

- Al-Qatami Group

- Fawaz Trading and Engineering

- Al Esa Cold Store

- Gulf Warehousing Company

- Warehousing General

- Cold Chain Logistics Middle East

- Al-Ahmed Cold Storage

- Nasser S. Al-Hajri Corporation

- Modern Cold Storage Co.

Key Target Audience

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies (Kuwait Food Safety Authority)

- Retailers

- Pharmaceutical Companies

- Food & Beverage Manufacturers

- Logistics and Supply Chain Providers

- E-commerce Platforms

- Cold Storage Infrastructure Developers

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Kuwait cold chain market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics and assess how they interact within the cold chain spectrum.

Step 2: Market Analysis and Construction

In this phase, we compile and analyse historical data pertaining to the Kuwait cold chain market. This includes assessing market penetration, the ratio of cold storage facilities to transport services, and the resultant revenue generation. An evaluation of service quality statistics alongside operational efficiencies will also be conducted to ensure the reliability and accuracy of revenue estimates presented in the market forecast.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and subsequently validated through Computer-Assisted Telephone Interviews (CATIs) with industry experts representing various companies in the cold chain logistics sector. These consultations provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating the projected market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple cold chain service providers to acquire detailed insights into product segments, operational performance, customer preferences, and other relevant factors. This interaction serves to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the Kuwait cold chain market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Overview Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain & Value Chain Analysis

- Growth Drivers

Increasing Demand for Perishable Products

Government Regulations on Food Safety - Market Challenges

High Operational Costs

Technology Adoption Barriers - Opportunities

Rising E-commerce in Food Delivery

Expansion of Retail Chains - Trends

Adoption of IoT and Automation

Shift towards Sustainable Practices - Government Regulation

Food Safety Standards

Import/Export Regulations - SWOT Analysis

- Stake Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Application, (In Value %)

Fruits and Vegetables

Pharmaceuticals

Chemicals

Personal Care Products

Fish, Meat, and Seafood Products

Bakery and Confectionery

Dairy and Frozen Desserts

Others - By Temperature Range, (In Value %)

Chilled

Frozen - By Distribution Channel, (In Value %)

Direct Sales

Retail

Warehouse & Logistics - By End User Industry, (In Value %)

Retailers

Wholesalers

Food Service Providers - By City, (In Value %)

Kuwait City

Hawalli

Al Ahmadi

Jahra

Others - By Technology, (In Value %)

Blast Freezing

Vapour Compression

Programmable Logic Controller (PLC)

Evaporating Cooling

Cryogenic Systems

Others

- Market Share of Major Players on the Basis of Value/Volume, 2024

Market Share of Major Players by Application Segment, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strengths, Weaknesses, Organizational Structure, Revenues, Distribution Channels, Delivery Capacity, Technology Adoption, and Customer Service)

- SWOT Analysis of Major Players

- Pricing Analysis Basis SKUs for Major Players

- Detailed Profiles of Major Companies

Agility Logistics

Gulftainer

Al Hariri Logistics

A.P. Moller – Maersk

KGL Logistics

Emirates Logistics

Al-Qatami Group

Fawaz Trading and Engineering

Al Esa Cold Store

Gulf Warehousing Company

Warehousing General

Cold Chain Logistics Middle East

Al-Ahmed Cold Storage

Nasser S. Al-Hajri Corporation

Modern Cold Storage Co.

Others

- Market Demand and Utilization

- Budget Allocations for Cold Storage Solutions

- Regulatory and Compliance Requirements

- Needs, Desires, and Pain Point Analysis

- Decision Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030