Market Overview

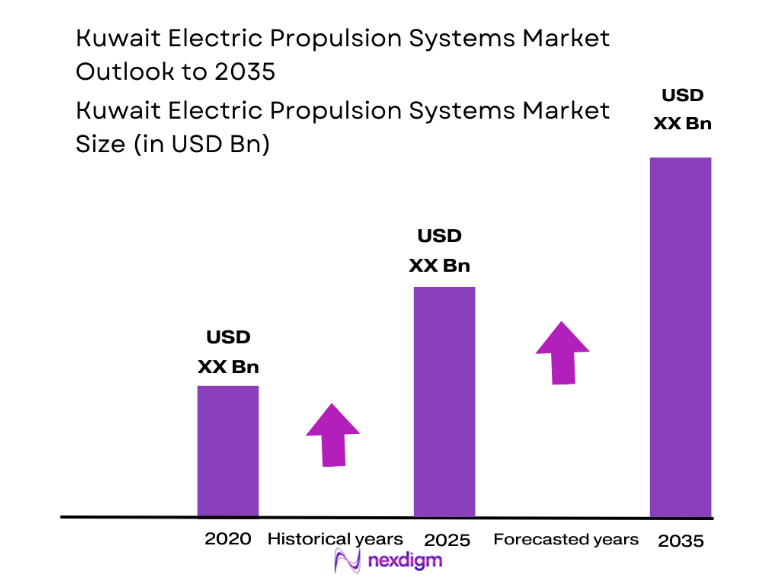

The Kuwait Electric Propulsion Systems market is estimated to be valued at USD ~ billion based on a recent historical assessment. The market is primarily driven by advancements in aerospace technologies, increasing demand for sustainable propulsion systems, and government initiatives focused on reducing carbon emissions in the aerospace sector. Growing investments in electric propulsion technologies are further fostering the expansion of the market, as more industries adopt energy-efficient systems for space exploration, satellite technologies, and unmanned vehicles.

The Kuwait market is dominated by cities such as Kuwait City, which has a robust infrastructure for aerospace and defense technologies. The presence of key governmental agencies and research institutions focused on green technology and aerospace innovation contributes significantly to the dominance. Kuwait’s strategic location in the Middle East and its growing commitment to sustainable practices make it a regional leader in electric propulsion systems development.

Market Segmentation

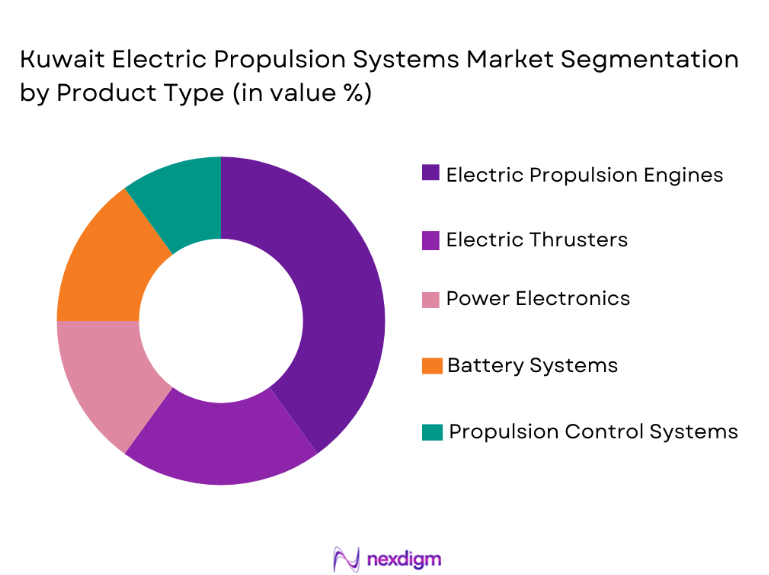

By Product Type

The Kuwait Electric Propulsion Systems market is segmented by product type into electric propulsion engines, electric thrusters, power electronics, battery systems, and propulsion control systems. Among these, electric propulsion engines are the dominant segment due to the rising demand for high-efficiency, environmentally friendly propulsion in both commercial and defense sectors. The increasing adoption of electric propulsion in satellite systems and unmanned aerial vehicles (UAVs) is driving growth in this segment, as electric engines offer long-term cost savings and reduce environmental impact, making them a preferred choice for both governmental and commercial applications.

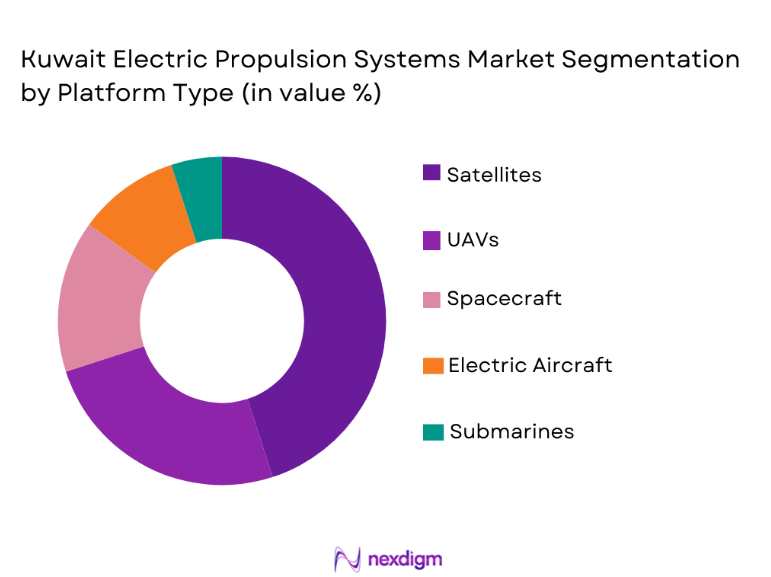

By Platform Type

The market is segmented by platform type into spacecraft, satellites, unmanned aerial vehicles (UAVs), submarines, and electric aircraft. Recently, satellites have emerged as the dominant platform in Kuwait’s market due to the growing demand for space exploration and telecommunications. Electric propulsion systems are increasingly used in satellites for more energy-efficient and reliable operations. With the advancement in satellite technology and the reduction in the cost of electric propulsion systems, the segment is seeing a shift towards more widespread use in both government and commercial satellite applications.

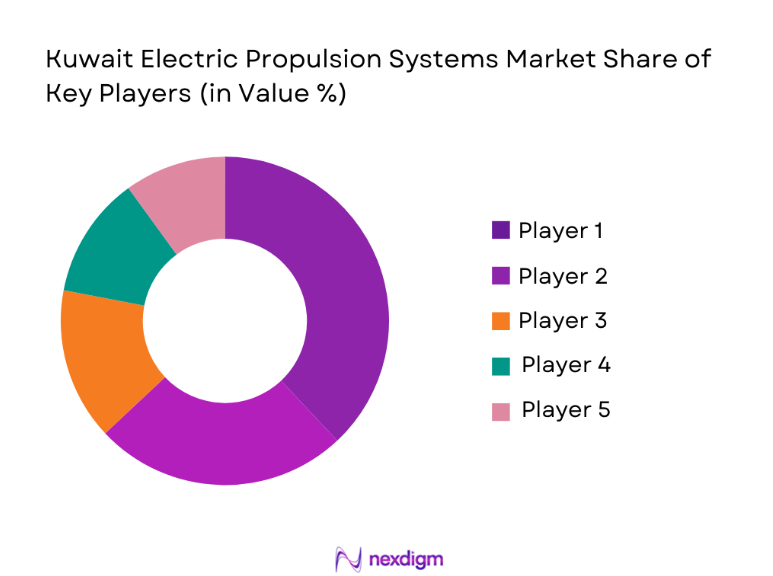

Competitive Landscape

The competitive landscape of the Kuwait Electric Propulsion Systems market is marked by high levels of consolidation with major aerospace players investing heavily in electric propulsion technologies. These companies are focused on both defense and commercial sectors, creating a competitive environment in which both established companies and emerging startups are racing to develop more efficient propulsion systems. Key players in the market continue to enhance their technological capabilities, driving further innovations and setting the stage for future growth.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Additional Market-Specific Parameter |

| Lockheed Martin | 1912 | Bethesda, MD | ~

|

~

|

~

|

~

|

~

|

| Northrop Grumman | 1939 | Falls Church, VA | ~ | ~

|

~

|

~

|

~

|

| Thales Group | 2000 | Paris, France | ~ | ~

|

~

|

~

|

~

|

| Aerojet Rocketdyne | 1915 | Sacramento, CA | ~ | ~

|

~

|

~

|

~

|

| Airbus | 1970 | Toulouse, France | ~ | ~

|

~

|

~

|

~

|

Kuwait Electric Propulsion Systems Market Analysis

Growth Drivers

Increased Demand for Sustainable Technologies

The growing emphasis on environmental sustainability is a key driver for the Kuwait Electric Propulsion Systems market. As countries and industries move toward reducing carbon emissions, electric propulsion technologies are increasingly seen as a viable solution for achieving greener aerospace operations. The aerospace and defense sectors are under rising pressure to minimize their environmental footprint, and electric propulsion systems provide an efficient alternative to traditional combustion engines. These systems not only reduce emissions but also improve fuel efficiency, making them an attractive choice for long-term energy savings. As governments, especially in the Middle East, implement stricter environmental regulations and encourage the adoption of green technologies, the demand for electric propulsion systems is expected to increase. This shift aligns with the region’s commitment to sustainable development, providing a significant market opportunity for electric propulsion system manufacturers to expand their offerings.

Government Investments in Space and Aerospace Innovation

The government of Kuwait has been investing heavily in space and aerospace technologies, particularly in green and sustainable solutions. These investments are spurred by a national commitment to diversifying the economy and advancing the country’s aerospace capabilities. Kuwait’s focus on reducing its reliance on fossil fuels aligns with the global trend toward more sustainable energy solutions in the aerospace industry. Government-backed research and development initiatives for electric propulsion technologies, along with partnerships with aerospace companies, have accelerated innovation in the market. These investments foster the growth of electric propulsion systems by providing funding for technological advancements, testing, and commercial adoption. As a result, there has been an increased focus on developing more cost-effective and energy-efficient propulsion solutions, which will contribute to the long-term growth of the market.

Market Challenges

High Initial Capital Investment

A significant challenge for the Kuwait Electric Propulsion Systems market is the high initial capital required for the development, testing, and implementation of electric propulsion technologies. The upfront cost of designing, producing, and integrating electric propulsion systems is substantial, which can limit the market’s growth potential, especially for small and medium-sized companies. Furthermore, the research and development phase for electric propulsion systems requires extensive investment in technology, facilities, and personnel. The aerospace and defense industries, which typically operate on large-scale projects, face difficulties in justifying such high costs, especially given the uncertain returns on investment. Although electric propulsion systems offer long-term savings and environmental benefits, the financial burden of initial investment remains a key barrier to widespread adoption. Overcoming this challenge will require continued technological advancements to reduce the production and integration costs of electric propulsion systems, along with increasing support from both public and private sectors.

Technological Integration and Compatibility

The integration of electric propulsion systems with existing aerospace platforms presents another challenge for the Kuwait Electric Propulsion Systems market. Many current aerospace systems were designed to operate with traditional propulsion technologies, meaning retrofitting them with electric propulsion systems is complex and costly. The lack of standardization and compatibility between new electric propulsion technologies and legacy systems complicates the integration process. Additionally, testing and certification for electric propulsion systems are often lengthy and costly due to regulatory hurdles and the need for rigorous safety checks. This integration challenge is particularly significant in the defense and aerospace sectors, where existing platforms and infrastructure require substantial modifications. The market will need to address these compatibility issues through the development of modular and scalable electric propulsion solutions that can easily be integrated with existing platforms.

Opportunities

Advancements in Hybrid Electric Propulsion Systems

One of the most promising opportunities in the Kuwait Electric Propulsion Systems market is the development of hybrid electric propulsion systems. These systems combine traditional and electric propulsion technologies, offering a versatile solution that can balance performance with environmental benefits. Hybrid systems are particularly beneficial for aerospace applications, such as unmanned aerial vehicles (UAVs) and commercial aircraft, where a mix of power sources can ensure both efficiency and range. The increasing adoption of hybrid electric propulsion in various aerospace applications offers a cost-effective way to reduce fuel consumption and emissions while maintaining high performance. Hybrid propulsion technologies are also more flexible, as they can leverage existing infrastructure while integrating new electric propulsion components. This presents a significant opportunity for companies to create hybrid propulsion solutions that cater to both the defense and commercial sectors, boosting the overall growth of the electric propulsion market.

Emerging Applications in Autonomous UAVs

The demand for autonomous UAVs presents another key opportunity for the Kuwait Electric Propulsion Systems market. As the use of UAVs expands in sectors such as agriculture, logistics, surveillance, and defense, there is an increasing need for electric propulsion systems that offer efficiency and reliability. Electric propulsion is ideal for UAVs due to its low operating costs, quieter operation, and environmentally friendly attributes. With autonomous UAVs becoming more popular for both commercial and defense applications, the electric propulsion systems market has the opportunity to supply power-efficient solutions that meet the demands of these platforms. Regulatory changes favoring the increased use of UAVs and advancements in automation technologies will further drive the demand for electric propulsion systems in this area. As a result, the electric propulsion systems market can capitalize on the expanding UAV market to deliver high-performance and sustainable propulsion solutions.

Future Outlook

The Kuwait Electric Propulsion Systems market is expected to see significant growth over the next five years, driven by technological advancements, increasing demand for environmentally friendly systems, and supportive government policies. Key growth trends will include the development of more efficient propulsion systems, innovations in battery technology, and the rising demand for green solutions in aerospace and defense. Technological developments in hybrid propulsion systems and autonomous UAVs will further drive market expansion, with regulatory support pushing for more sustainable solutions in aerospace applications. As the market matures, electric propulsion technologies will become increasingly integrated into various aerospace platforms, offering substantial long-term benefits.

Major Players

- Lockheed Martin

- Northrop Grumman

- Thales Group

- Aerojet Rocketdyne

- Airbus

- Boeing

- Rolls-Royce

- Safran

- L3 Technologies

- Leonardo

- Blue Origin

- Rocket Lab

- SpaceX

- Virgin Galactic

- Sierra Nevada Corporation

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Aerospace manufacturers

- Defense contractors

- Space agencies

- Private sector / commercial aerospace

- Research institutions

- UAV technology companies

Research Methodology

Step 1: Identification of Key Variables

The first step involves identifying the key variables that will influence the market, such as technological advancements, regulatory changes, and demand patterns.

Step 2: Market Analysis and Construction

Market analysis is conducted to understand the current market size, growth potential, and future forecasts based on collected data, with a focus on key drivers and challenges.

Step 3: Hypothesis Validation and Expert Consultation

We validate hypotheses through consultations with industry experts, including manufacturers, technology developers, and government representatives, to ensure the accuracy of findings.

Step 4: Research Synthesis and Final Output

The final output is synthesized into a comprehensive market report, combining all insights to offer a clear outlook and strategic recommendations for stakeholders.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing Demand for Sustainable Propulsion Systems

Government Investments in Aerospace Innovations

Technological Advancements in Electric Propulsion - Market Challenges

High Initial Investment Costs

Lack of Infrastructure for Electric Propulsion Testing

Integration Complexities with Existing Systems - Market Opportunities

Development of Lightweight Electric Propulsion Systems

Growth in Space Exploration Programs

Increasing Adoption of Electric Propulsion in Commercial Aircraft - Trends

Advancements in Hybrid Electric Propulsion

Increased Focus on Green Aerospace Technologies

Integration of Artificial Intelligence in Electric Propulsion Systems - Government Regulations

Environmental Regulations and Emissions Standards

Aerospace Safety and Certification Regulations

International Space Law and Collaboration Policies

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Electric Propulsion Engines

Electric Thrusters

Power Electronics

Battery Systems

Propulsion Control Systems - By Platform Type (In Value%)

Spacecraft

Satellites

Unmanned Aerial Vehicles (UAVs)

Submarines

Electric Aircraft - By Fitment Type (In Value%)

OEM Solutions

Retrofit Solutions

Aftermarket Solutions

Integrated Solutions

Modular Systems - By EndUser Segment (In Value%)

Space Agencies

Aerospace Manufacturers

Defense Contractors

Private Sector / Commercial Aerospace

Research Institutions - By Procurement Channel (In Value%)

Direct Procurement

Government Tenders

Private Sector Procurement

Online Procurement Platforms

Third-party Distributors

- Market Share Analysis

- CrossComparison Parameters (System Type, Platform Type, Procurement Channel, EndUser Segment, Fitment Type)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Porter’s Five Forces

- Key Players

Lockheed Martin

Northrop Grumman

Thales Group

Aerojet Rocketdyne

Airbus

Boeing

Rolls-Royce

Safran

L3 Technologies

Leonardo

Blue Origin

Rocket Lab

SpaceX

Virgin Galactic

Sierra Nevada Corporation

- Demand for Sustainable Solutions from Space Agencies

- Adoption of Electric Propulsion by Commercial Aerospace Manufacturers

- Emerging Focus of Defense Contractors on Green Technology

- Growth in UAVs and Satellite Applications for Electric Propulsion Systems

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035