Market Overview

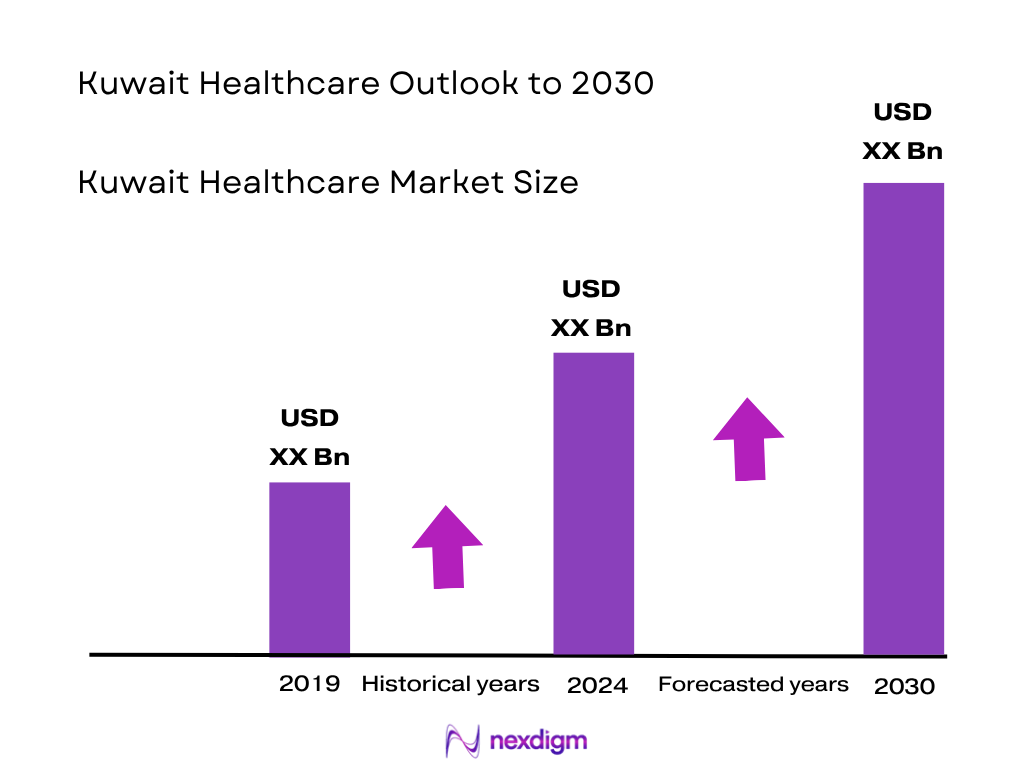

The Kuwait hospital services market is valued at USD 6,421.1 million, derived from horizon-style market data for the base year 2024. This value reflects revenues from inpatient, outpatient, and ancillary services. The market’s scale is propelled by significant government healthcare spending, infrastructure expansion under Vision 2035, rising chronic disease incidence, and an evolving private sector adopting new technologies.

The Kuwait healthcare market is led by major population and infrastructure hubs—Kuwait City, Hawally, and Farwaniya—where public hospitals, specialist clinics, and digital health initiatives are concentrated, supported by large government investments and high patient density. These areas benefit from proximity to flagship projects like Sheikh Jaber Al‑Ahmad Hospital and strong digital health rollouts.

Market Segmentation

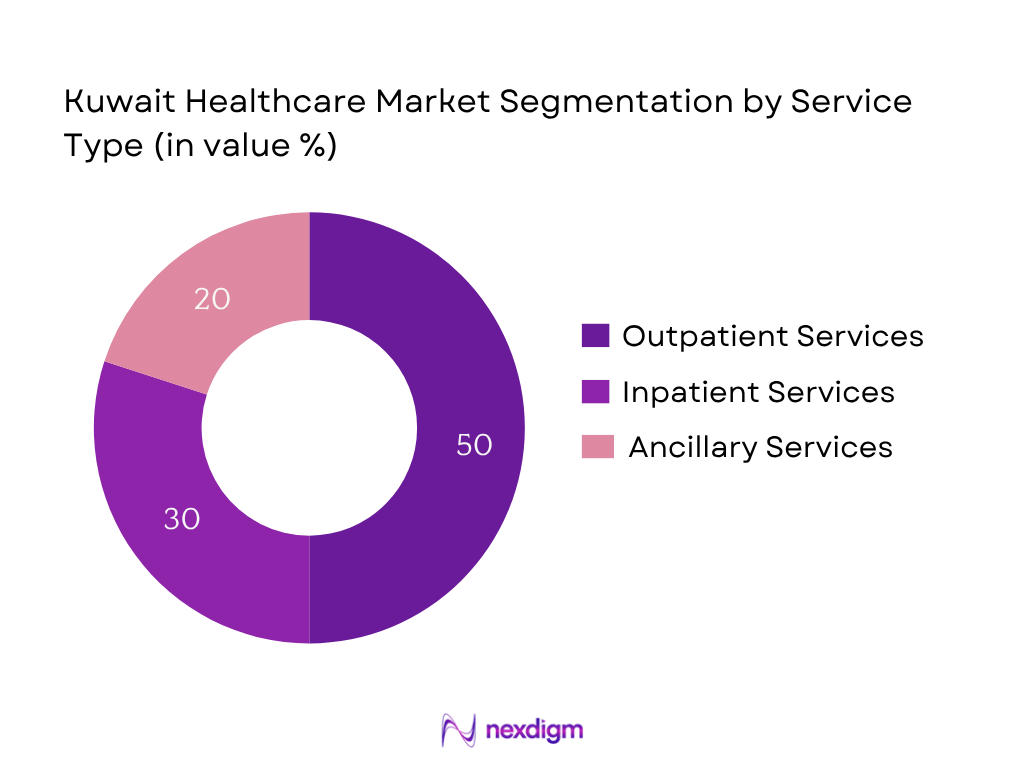

By Service Type

In Kuwait’s healthcare market, outpatient services dominate the market share. This dominance stems from high demand for routine consultations, diagnostic testing, and follow‑up visits, coupled with a systemic shift toward ambulatory care models to reduce hospital congestion. Outpatient facilities are more accessible, quicker, and preferred for minor procedures, fueling their market leadership.

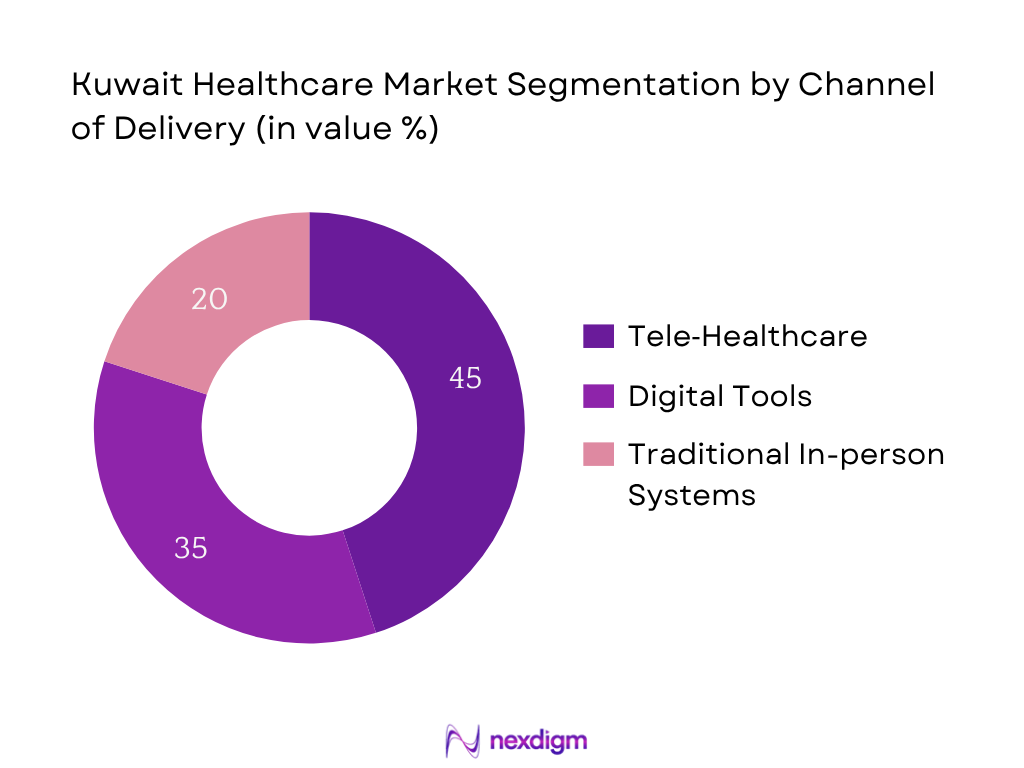

By Channel of Delivery

Tele‑healthcare leads. Its fast uptake was driven by pandemic acceleration, broader digital health strategy under Vision 2035, and government emphasis on digital transformation. Tele‑consultations offer convenience, reduce hospital visits, and bridge access gaps across governorates. They also align with Kuwait’s investments in integrated health records and platform-based care.

Competitive Landscape

The Kuwait healthcare market is shaped by a mix of major public institutions and prominent private hospitals, reflecting a competitive balance across infrastructure capability, services, and digital integration.

| Major Player | Year Established | Headquarters | Specialist Services | Insurance Tie‑Ups | Bed Capacity | Accreditation (e.g., JCI) | Digital Health Integration | Regional Expansion |

| Ministry of Health (public network) | — | Kuwait City | – | – | – | – | – | – |

| Sheikh Jaber Al‑Ahmad Hospital | 2020 | Kuwait City | – | – | – | – | – | – |

| Dar Al Shifa Hospital | 1970s | Kuwait City | – | – | – | – | – | – |

| Al Seef Hospital | — | Kuwait City | – | – | – | – | – | – |

| Royale Hayat Hospital | — | Kuwait City | – | – | – | – | – | – |

Kuwait Healthcare Market Analysis

Growth Drivers

Kuwait’s robust public health expenditure USD 2,292 per capita in 2023, significantly above the global median of USD 440—underscores sustained fiscal commitment to healthcare delivery systems, infrastructure expansion, and service capacity enhancement. Concurrently, the government’s health budget of USD 10 billion for 2024/2025, accounting for 11% of total government expenditure—with USD 608 million earmarked solely for infrastructure development including ten hospital projects—reinforces tangible expansion across the sector

Market Challenges

Kuwait’s oil‑driven GDP challenges pose systemic risks to health funding: oil‑sector real GDP contracted by 6.64% in 2024, following a 4.32% decline in 2023. Moreover, a widening fiscal deficit—estimated at 5.0% of GDP in 2024, up from 4.8% in 2023—restricts discretionary spending, potentially constraining healthcare expansion plans and capital availability for specialist recruitment and facility upgrades.

Opportunities

Kuwait’s non‑oil sector is on an uptick, supported by economic diversification, with non‑oil exports rising to 4.3% of GDP during the first nine months of 2024 (up from 3.6% year‑over‑year), reflecting broader economic dynamism. Additionally, the government maintains elevated reserve assets, with official reserves at USD 44.5 billion in 2024—only slightly lower than USD 47.5 billion in 2023—indicating sustained fiscal buffers to explore avenues such as home healthcare services, niche medical tourism initiatives, and digital healthcare startups backed by public reserves

Future Outlook

Over the forecast period, Kuwait’s healthcare market is expected to grow steadily, supported by government’s continuous investment in healthcare infrastructure, expansion of private facilities, and digital transformation. Strategic initiatives under Vision 2035, including the establishment of new hospitals, digital health programs, and stronger PPPs, will further reinforce service delivery, patient access, and quality of care.

Major Players

- Ministry of Health (Public Network)

- Sheikh Jaber Al‑Ahmad Hospital

- Mubarak Al‑Kabeer Hospital

- Dar Al Shifa Hospital

- Hadi Hospital

- Al Seef Hospital

- Royale Hayat Hospital

- Taiba Hospital

- New Mowasat Hospital

- Al Salam International Hospital

- Ibn Sina Hospital

- Kuwait Cancer Control Center

- Kuwait Specialized Eye Center

- Wara Hospital

Key Target Audience

- Healthcare Facility Investors and Venture Capitalist Firms

- Government and Regulatory Bodies (e.g., Ministry of Health, Kuwait Health Assurance Company – Daman)

- Hospital Infrastructure Developers

- Digital Health Solution Providers

- Medical Equipment Suppliers

- Insurance Providers

- Medical Tourism Promoters

- Long-Term Care and Rehabilitation Operators

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves mapping the Kuwaiti healthcare ecosystem—public/private hospitals, digital platforms, insurers—to identify drivers, capacity metrics, and infrastructure variables, based on desk research from government publications, horizon market data, and trade analysis.

Step 2: Market Analysis and Construction

This phase compiles and analyzes historical and current market data—hospital revenues, outpatient/inpatient splits, digital health adoption—from primary data archives and industry sources to establish market sizing.

Step 3: Hypothesis Validation and Expert Consultation

Developed market hypotheses around market growth and segmentation are validated through expert interviews—hospital administrators, policy advisors—using CATI or in-person methods to refine assumptions, especially around digital health and PPP impact.

Step 4: Research Synthesis and Final Output

This final phase synthesizes verified data and expert insights, cross‑checks with bottom‑up modeling of hospital capacities and financials, and integrates digital health and infrastructure projects to deliver a comprehensive, accurate market analysis.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Overview Genesis

- Timeline of Key Developments and Reforms in Kuwaiti Healthcare

- Public-Private Healthcare Ecosystem

- Supply Chain and Value Chain Mapping

- Patient Journey Mapping in Public vs Private Hospitals

- Insurance Penetration and Role of MoH, Daman & KFH

- Growth Drivers

Mandatory Expat Insurance

MoH Expansion Plans

Daman Rollout - Market Challenges

Specialist Shortages

Urban Overload

Public-Private Imbalance - Opportunities

Medical Tourism

Home Healthcare

Digital Health Startups - Trends

AI Diagnostics

Hospital Accreditation Surge

Remote Patient Monitoring - Government Regulation

Licensing via MoH

Insurance Cap Structure

PPP Rules - Stakeholder Ecosystem

- SWOT Analysis

- Porter’s Five Forces Analysis

- Investment and PPP Opportunity Assessment

- By Value, 2019-2024

- By Volume (Patient Visits, Bed Occupancy Rates, Surgeries, Prescriptions Dispensed), 2019-2024

- By Out-of-Pocket vs Government Healthcare Expenditure, 2019-2024

- By Healthcare Facility Type (In Value %)

Public Hospitals (e.g., Sabah Hospital, Mubarak Al-Kabeer)

Private Hospitals (e.g., Al Seef, Dar Al Shifa, Hadi Hospital)

Specialized Clinics (e.g., Dental, IVF, Orthopedic, Dermatology)

Diagnostic Labs & Imaging Centers

Daycare and Ambulatory Surgical Centers - By End User (In Value %)

Citizens under MoH Programs

Expatriates with Private Insurance

Self-Paying Patients

Corporate Insured Workforce

Government Referred Patients - By Healthcare Service Type (In Value %)

Preventive & Wellness Services

Curative and Acute Care Services

Rehabilitative & Long-Term Care

Diagnostic & Imaging Services

Mental Health & Psychiatric Services - By Insurance Provider (In Value %)

Ministry of Health

Kuwait Health Assurance Company (KHAC/Daman)

Gulf Insurance Group

Warba Insurance

Other Private Health Insurers - By Region (In Value %)

Capital (Kuwait City, Hawally, Farwaniya)

Ahmadi & Fahaheel

Jahra

Mubarak Al-Kabeer

Urban vs Rural Districts

- Market Share of Key Players (By Healthcare Facility Type & Revenue Contribution)

- Cross Comparison Parameters (Company Overview, Service Portfolio & Specialization, Patient Volume (Annual Visits), Insurance Tie-Ups, Number of Hospital Beds, Clinic & Branch Count, Accreditations (JCI, ISO, etc.), Digital Health Integration, Medical Staff Strength, Infrastructure Quality & Equipment, Expansion Roadmap)

- SWOT Analysis of Major Players

- Pricing Analysis – Consultation Fee, Procedure Costs, Insurance Packages

- Detailed Profiles of Major Companies

Dar Al Shifa Hospital

Hadi Hospital

Royale Hayat Hospital

Al Seef Hospital

Taiba Hospital

New Mowasat Hospital

Al Salam International Hospital

Ibn Sina Hospital

Kuwait Hospital

Kuwait Specialized Eye Center

Kuwait Cancer Control Center

Wara Hospital

Farwaniya Hospital

Sabah Hospital

Ministry of Health (Public Network)

- Health-Seeking Behaviour by Population Segment

- Average Medical Spend by Income Class

- Preference for Local vs International Facilities

- Patient Feedback Loop and Satisfaction Benchmarks

- Access Challenges by Region and Population

- By Value, 2025-2030

- By Volume (Patient Visits, Bed Occupancy Rates, Surgeries, Prescriptions Dispensed), 2025-2030

- By Out-of-Pocket vs Government health Expenditure, 2025-2030