Market Overview

As of 2024, the Kuwait logistics market is valued at USD ~ billion, with a growing CAGR of 6.2% from 2024 to 2030, reflecting the country’s strategic position as a trading hub in the Gulf region and its continued investment in infrastructure. The growth is significantly driven by the rise in e-commerce activities and governmental initiatives aimed at improving the logistics landscape, enhancing operational efficiency, and attracting foreign investments.

Kuwait’s logistics market is primarily dominated by the Capital Governorate, which houses major ports and logistics centres. This area enjoys the benefits of advanced infrastructure, a well-developed transportation network, and proximity to key trade routes. Additionally, cities like Ahmadi and Hawalli are crucial due to their industrial activities and increasing demand for logistics services in sectors such as retail and manufacturing.

Market Segmentation

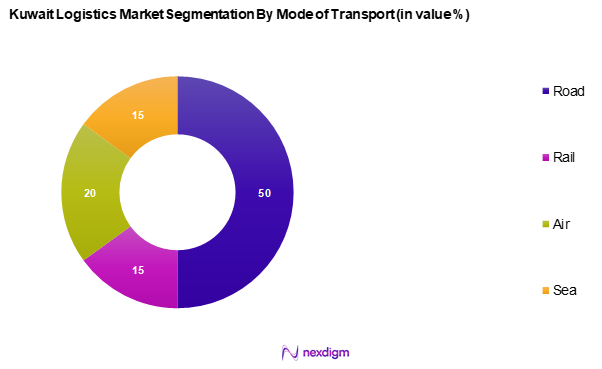

By Mode of Transport

The Kuwait logistics market is segmented into road, rail, air, and sea. Among these, the road transport segment holds a dominant share due to its flexibility, broad usage for last-mile delivery, and the extensive road network connecting various regions in Kuwait. Road logistics are favoured by businesses looking for efficient and timely transportation solutions for goods, which further enhances its market share.

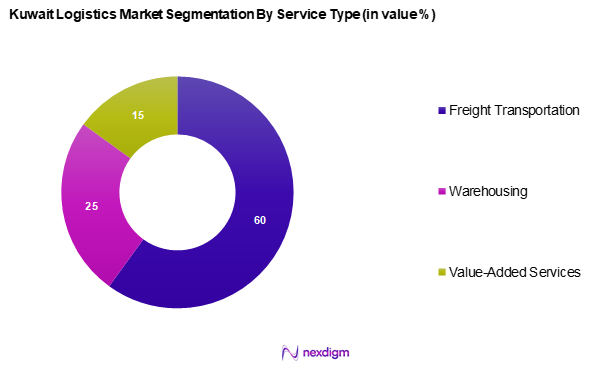

By Service Type

The Kuwait logistics market is segmented into freight transportation, warehousing, and value-added services. Freight transportation leads the market due to the growing demand for shipping goods efficiently across borders, reflecting Kuwait’s international trade dynamics. Key players have invested significantly in expanding freight capabilities, improving logistics networks and enhancing service reliability, thereby solidifying this segment’s dominance.

Competitive Landscape

The Kuwait logistics market is characterized by a small number of major players, including local and international companies. The market is dominated by firms such as Agility Logistics, DHL Supply Chain, and Aramex, which leverage their distribution networks and established reputations. This consolidation illustrates the significant impact these leading companies have on logistics operations within the country.

| Company Name | Establishment Year | Headquarters | Annual Revenue | Market Focus | Key Strengths |

| Agility Logistics | 1979 | Safat, Kuwait | – | – | – |

| DHL Supply Chain | 1969 | Bonn, Germany | – | – | – |

| Aramex | 1982 | Amman, Jordan | – | – | – |

| GWC | 2004 | Kuwait City | – | – | – |

| FedEx Logistics | 1973 | Memphis, USA | – | – | – |

Kuwait Logistics Market Analysis

Growth Drivers

Rising E-commerce Sector

The rapid growth of the e-commerce sector in Kuwait is a significant driver for the logistics market, as revenue generation reached USD 1.1 billion in 2022 according to the Kuwait Ministry of Commerce and Industry. The online retail market is anticipated to see a growth rate of approximately 14.2% annually in the coming years, propelled by increasing internet penetration, which stands at 99% as of 2023. Furthermore, the influx of international e-commerce platforms like Amazon and local players has led to higher demand for logistics services to facilitate prompt delivery and efficient supply chains, significantly impacting the overall logistics landscape in the country.

Government Initiatives

Significant investments in Kuwait’s transportation and infrastructure are contributing to improved connectivity across the country. Expansion projects at key transit hubs and enhancements to road networks are facilitating greater accessibility for both residents and visitors. These developments are fostering a favourable environment for the car rental market, as better infrastructure translates to increased vehicle usage and a higher demand for rental services.

Market Challenges

Regulatory Compliance Issues

The car rental and leasing market in Kuwait operates under stringent regulatory frameworks, requiring businesses to adhere to strict safety and operational guidelines. Compliance with registration requirements, insurance policies, and vehicle maintenance standards can be complex and resource-intensive. These regulatory challenges often lead to higher operational costs and can pose barriers for new market entrants, thereby influencing the overall growth and profitability of rental service providers.

Growing Competition

The car rental market in Kuwait is highly competitive, with numerous service providers vying for market share. A mix of established firms and smaller operators creates an environment where price competition is intense, often leading to reduced profit margins. In response, companies are focusing on service differentiation, such as enhanced customer experiences and value-added offerings, to maintain a competitive edge and attract a loyal customer base.

Opportunities

Investment in Technology

Current trends in technology present significant opportunities for the Kuwait logistics market. With approximately USD 654 million invested in technology innovations within the logistics sector in 2023, companies are increasingly adopting advanced technologies like artificial intelligence (AI) and the Internet of Things (IoT) to streamline operations and increase efficiency. The integration of technology into logistics is expected to improve tracking, reduce operational costs, and enhance customer service capabilities. This trend shows strong potential for the growth of intelligent logistics solutions in Kuwait, greatly enhancing market competitiveness.

Expansion of Intelligent Supply Chains

The demand for intelligent supply chains is another compelling opportunity within the logistics sector in Kuwait. As businesses strive to improve operational efficiency, leveraging technology for real-time tracking, predictive analytics, and automation is increasingly becoming necessary. The logistics sector is witnessing significant investments in smart warehousing solutions, with the government projected to allocate USD 250 million to improve logistics branding and streamline supply chain operations. This transformation towards smarter logistics not only improves service delivery but also aligns with global trends towards sustainability and efficiency in supply chain management.

Future Outlook

Over the next five years, the Kuwait logistics market is expected to experience significant growth, driven by rising e-commerce sales, government policy improvements fostering supply chain resilience, and increasing investments in technology. The current trajectory suggests a transition towards more digital and automated logistics solutions, which will play a crucial role in meeting the evolving demands of the market.

Major Players

- Agility Logistics

- KGL Logistics

- Alsalam Aircraft Company

- GWC

- Aramex

- DHL Supply Chain

- FedEx Logistics

- Tim Import & Export

- Saudi Logistics

- B2B Logistics

- BLI Logistics

- Mobility Logistics

- Al-Dhow Logistics

- Logistics & Transport Company

- MTC Logistics

Key Target Audience

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies (Kuwait Ministry of Commerce & Industry)

- Shipping and Freight Forwarding Companies

- E-commerce Businesses

- Retail Chains

- Manufacturers

- Distribution Network Providers

- Construction and Infrastructure Developers

Research Methodology

Step 1: Identification of Key Variables

In the initial phase, an ecosystem map of major stakeholders in the Kuwait logistics market is constructed. This involves extensive desk research utilizing multiple secondary databases for comprehensive information on industry factors influencing market dynamics.

Step 2: Market Analysis and Construction

This phase includes compiling historical data on market penetration and revenue generation in the Kuwait logistics market. It assesses the service quality and effectiveness of various logistics solutions to refine revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypothesis development follows, which is validated through consultations with industry experts via Computer-Assisted Telephone Interviews (CATIs). These experts represent a diverse cross-section of logistics companies, providing critical operational and financial insights. This feedback is invaluable for refining market data and ensuring the accuracy of reports concerning current trends and challenges in the logistics sector.

Step 4: Research Synthesis and Final Output

In the final phase, engagement with multiple logistics providers is conducted to gather comprehensive insights into service offerings, sales performance, and emerging consumer trends. This actionable data is cross-referenced with findings obtained from the bottom-up approach, ensuring a thorough analysis that reflects the current and anticipated future conditions of the Kuwait logistics market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Overview Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain & Value Chain Analysis

- Growth Drivers

Rising E-commerce Sector

Government Initiatives - Market Challenges

Infrastructure Limitations

Regulatory Hurdles - Opportunities

Investment in Technology

Expansion of Intelligent Supply Chains - Trends

Adoption of Automation

Rise in Sustainability Practices - Government Regulation

Investment Policies

Trade Agreements - SWOT Analysis

- Stake Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Mode of Transport, (In Value %)

Road

Rail

Air

Sea - By Service Type, (In Value %)

Freight Transportation

Warehousing

Value-Added Services - By Industry Vertical, (In Value %)

Retail

Manufacturing

Healthcare

Consumer Goods

Others - By Region, (In Value %)

Capital Governorate

Hawalli

Ahmadi

Al-Farwaniyah - By Technology Adoption, (In Value %)

Traditional Logistics

Digital Logistics - By Model, (In Value %)

1 PL

2 PL

3 PL

4 PL

- Market Share of Major Players on the Basis of Value/Volume, 2024

Market Share of Major Players by Mode of Transport Segment, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strength, Weakness, Revenues, Distribution Channels, Market Penetration, Innovations)

- SWOT Analysis of Major Players

- Pricing Analysis Basis SKUs for Major Players

- Detailed Profiles of Major Companies

Agility Logistics

KGL Logistics

Alsalam Aircraft Company

GWC

Aramex

DHL Supply Chain

FedEx Logistics

Tim Import & Export

Saudi Logistics

B2B Logistics

BLI Logistics

Mobility Logistics

Al-Dhow Logistics

Logistics & Transport Company

MTC Logistics

Others

- Market Demand and Utilization

- Purchasing Patterns and Budget Considerations

- Regulatory and Compliance Requirements

- Needs, Desires, and Pain Point Analysis

- Decision-Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030