Market Overview

The Kuwait Medical Devices market is valued at approximately USD 0.7 billion, based on a five‑year historical analysis, with growth driven by substantial government investment in healthcare infrastructure, rising prevalence of chronic diseases, and expansion of private healthcare facilities. The robust adoption of advanced diagnostic and monitoring equipment reflects the sustained demand from both public and private sectors.

Major demand stems from Kuwait City’s capital region, where government-led healthcare megaprojects and large-scale tertiary and specialty hospitals are concentrated. Additionally, Al Jahra and Hawalli regions exhibit strong uptake due to flourishing private clinics and labs. The concentration of advanced infrastructure and strategic healthcare development positions these cities as dominant hubs.

Market Segmentation

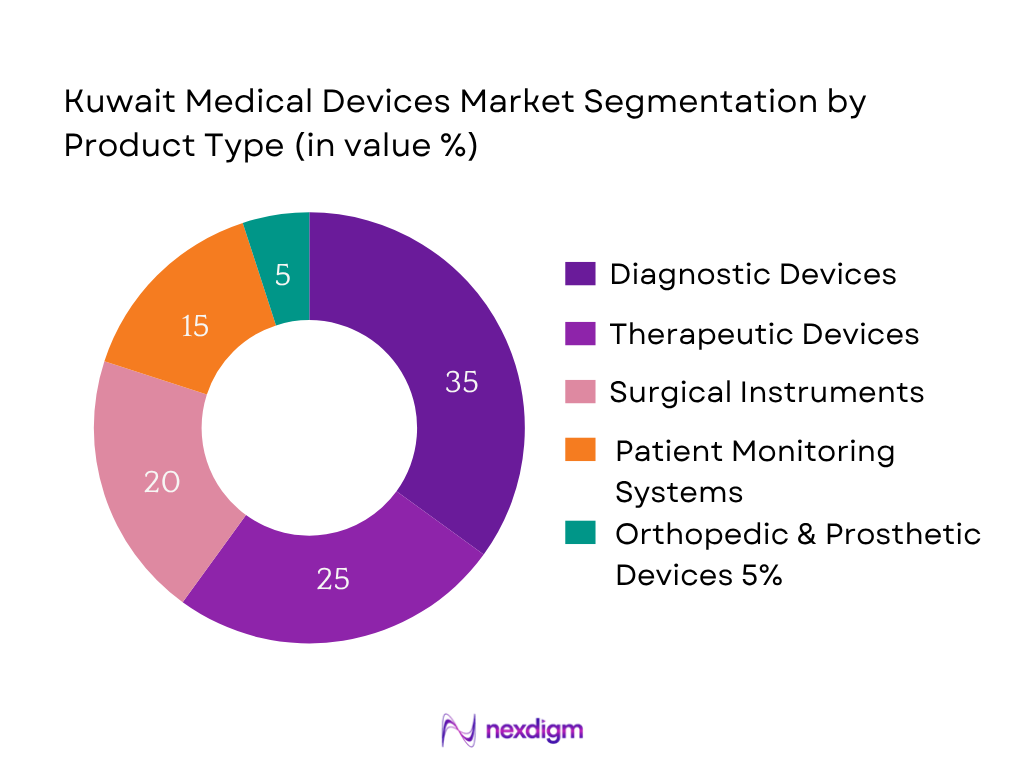

By Product Type

Currently, Diagnostic Devices dominate the market due to growing emphasis on early disease detection and expanded utilization of imaging systems—MRI, CT scans, and ultrasound—in both public and private hospitals. These devices are integral to clinical workflows, highly reimbursed, and supported by healthcare modernization initiatives, which drives their commanding market share.

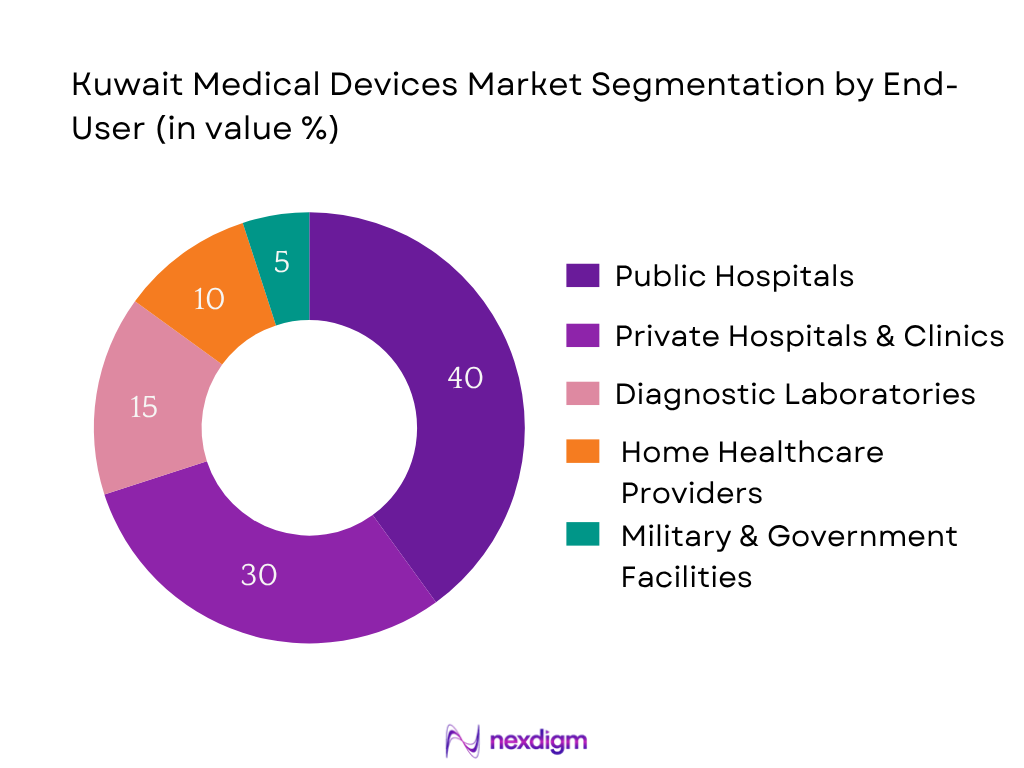

By End User

Public Hospitals command the largest segment due to Kuwait’s considerable public healthcare infrastructure, significant capital deployment under Kuwait Vision 2035, and comprehensive procurement programs. Their purchasing scale and strategic plans to expand and upgrade equipment make this segment dominant.

Competitive Landscape

The Kuwait Medical Devices market features a mix of global and well-established local players, intensifying competition through product innovation and strategic partnerships.

| Company | Establishment Year | Headquarters | Product Registrations | Local Distribution Network | Tender Participation | Service & Training Capability | Regulatory Know-how |

| Siemens Healthineers | 1847 | Germany | – | – | – | – | – |

| GE Healthcare | 1892 | USA | – | – | – | – | – |

| Philips Healthcare | 1891 | Netherlands | – | – | – | – | – |

| Medtronic | 1949 | Ireland (USA ops) | – | – | – | – | – |

| Stryker | 1941 | USA | – | – | – | – | – |

Kuwait Medical Devices Market Analysis

Growth Drivers

The market benefits substantially from robust public healthcare expenditure: Kuwait’s current health expenditure is at 4.27% of GDP (2022), underpinning consistent funding for medical infrastructure and procurement of technologies. Additionally, Kuwait maintains 2.4 hospital beds per 1,000 population (2023), indicating ongoing expansion of hospital capacity and associated demand for diagnostic and therapeutic equipment. Financing is further strengthened by government development initiatives: under the nation’s long-term economic plan, over USD 4.42 billion has been earmarked for replacing or expanding nine hospitals, driving procurement of advanced devices. Together, these macroeconomic indicators—public funding levels, physical capacity expansion, and targeted infrastructure spending—directly boost medical device uptake, making government-backed healthcare investment a primary growth driver.

Market Challenges

Import dependency poses a bottleneck: Kuwait’s imports of medicinal and pharmaceutical products stood at USD 638.8 million (2023), reflecting high reliance on foreign-sourced devices and potential supply chain risks. Coupled with total national imports valued at USD 37.49 billion (2023), this underscores a large volume of vulnerable medical-tech import requirements. Additionally, low domestic R&D capacity—at just 0.10% of GDP in 2023—limits local innovation and prolongs regulatory timelines for approvals and device development. This combination of high external reliance and limited R&D capability presents significant challenges: regulatory authorities face complex approval processes for imports, risk disruptions in supply, and lack local production to complement procurement, dampening agility in addressing urgent healthcare equipment needs.

Market Opportunities

There is significant potential in facilitating foreign direct investment for local manufacturing: although Kuwait’s R&D spending is only 0.10% of GDP (2023), this low baseline suggests room for scaling industrial capability in medical devices through targeted FDI. Meanwhile, the sheer volume of imports—USD 1.224 billion in medicaments (2023) and USD 638.8 million in medicinal and pharmaceutical products—indicates a strong domestic demand footprint that local producers could capture. As healthcare infrastructure continues to expand—with 20 public hospitals and 16 private hospitals plus mega-projects like Sheikh Jaber Al-Ahmad Hospital—the expanding utilization of homecare and point-of-care devices offers manufacturers entry points aligned with national priorities. By leveraging import volumes and infrastructure scale, FDI-backed local production and manufacturing partnerships could tap into a stable, institutional demand base and reduce dependence on imported goods, positioning early entrants favorably in the evolving local ecosystem.

Future Outlook

Over the forecast period, the Kuwait Medical Devices market is set to experience robust expansion. Growth will be propelled by continued government commitments under Vision 2035, escalating demand for advanced diagnostics and home care solutions, and technological integration such as AI and telehealth. Hospitals and clinics will lead capital investments in cutting-edge systems, while consumer awareness will boost home monitoring adoption

Major Players

- Siemens Healthineers

- GE Healthcare

- Philips Healthcare

- Medtronic

- Stryker

- Roche Diagnostics

- Abbott Laboratories

- Braun Melsungen

- Canon Medical Systems

- Mindray

- Boston Scientific

- Olympus Corporation

- Zimmer Biomet

- Fujifilm Healthcare

- Johnson & Johnson (Ethicon & other device divisions)

Key Target Audience

- Senior Executives at Public Hospitals Procurement Departments

- Heads of Supply Chain in Private Hospital Networks

- Chief Medical Officers at Diagnostic Laboratories

- Directors at Kuwait Ministry of Health & Central Drug Control Department (CDCD)

- Government Investment Authority (Public Health Infrastructure Investment Unit)

- Sovereign Wealth Fund investment teams (e.g., Kuwait Investment Authority evaluating healthcare manufacturing)

- Healthcare-focused Venture Capital Firms

- Corporate Strategic Partnerships Division at Medical Device OEMs seeking Kuwait expansion

Research Methodology

Step 1: Identification of Key Variables

The initial stage involved constructing a Kuwait medical device ecosystem map spanning stakeholders—government agencies, healthcare providers, OEMs, and distributors—using secondary intelligence and databases to define market variables such as device categories, end-user demand, and procurement dynamics.

Step 2: Market Analysis and Construction

Historical data from 2018 to 2023 on revenues, device imports, and hospital deployments were compiled. Device penetration rates and revenue performance across subsegments helped establish market baselines and validate the USD 0.7 billion valuation.

Step 3: Hypothesis Validation and Expert Consultation

Emerging hypotheses on growth drivers—such as healthcare infrastructure spending and aging population—were validated via structured interviews with procurement leads in major hospitals and distributors, ensuring alignment with ground realities.

Step 4: Research Synthesis and Final Output

Engagements with OEMs and regulatory officials further tested assumptions, with demand projections and forecast CAGR (10.4%) refined to reflect bottom-up aggregation of segment projections, culminating in a robust and verified analysis.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Industry Validation via Key Opinion Leaders, Primary and Secondary Sources, Limitations and Future Assumptions)

- Definition and Scope

- Sector Genesis and Market Evolution

- Healthcare Spending Trends in Kuwait

- Historical Regulatory Landscape and Reforms

- Import Dependency and Foreign Participation

- Value Chain and Procurement Flow

- Lifecycle Assessment of Medical Devices in Kuwait

- Growth Drivers

Government Spending

Healthcare Digitization

UHC Expansion

NCD Burden - Market Challenges

Import Barriers

Regulatory Delays

Skill Gaps - Market Opportunities

FDI in Local Manufacturing

Homecare Devices Demand - Market Trends

Telemedicine Devices

AI-enabled Diagnostics

Smart Wearables - Government Regulation and Public Procurement Policies

- SWOT Analysis

- Stakeholder Ecosystem (Hospitals, MoH, Distributors, OEMs)

- Porter’s Five Forces Analysis

- Supply Gap Analysis and Market Imbalance

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price of Key Device Categories, 2019-2024

- By Product Type (In Value %)

Diagnostic Imaging Devices

Patient Monitoring Devices

Surgical Instruments & Equipment

Consumables & Disposables

Orthopedic and Prosthetic Devices - By End User (In Value %)

Public Hospitals

Private Hospitals and Clinics

Diagnostic Laboratories

Home Healthcare Providers

Military and Government Health Facilities - By Mode of Procurement (In Value %)

Direct Purchase

Tender-Based Procurement

Long-term Lease Agreements

Group Purchasing Organizations (GPOs) - By Distribution Channel (In Value %)

Local Distributors

Direct Manufacturer Supply

E-commerce Platforms

Third-party Logistics & Resellers - By Region (In Value %)

Capital Region (Kuwait City)

Al Jahra Region

Hawalli and Farwaniya

Ahmadi and Fahaheel

Sabah Al Ahmad & New Health Zones

- Market Share of Major Players (By Value and Segment Presence)

- Cross Comparison Parameters (Company Overview, Product Portfolio Breadth, Kuwait-specific Device Registrations, Regulatory Approval Timelines, Number of Local Distributors/Partners, Logistics and Warehousing Presence, Tender Participation History, Import Volume Trends)

- SWOT Analysis of Major Competitors

- Pricing Analysis of Key Devices (e.g., MRI, CT, Syringe Pumps)

- Detailed Profiles of Key Market Players

Siemens Healthineers

GE Healthcare

Medtronic

Philips Healthcare

Roche Diagnostics

Abbott Laboratories

Stryker

B. Braun Melsungen

Smith & Nephew

Canon Medical Systems

Mindray

Boston Scientific

Olympus Corporation

Zimmer Biomet

Fujifilm Healthcare

- Device Utilization Patterns across Public vs. Private Sector

- Healthcare Facility Demand Profiles

- Investment and Budget Allocation Cycles

- Procurement Preferences and Constraints

- Unmet Needs and Buying Triggers

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030