Market Overview

The Kuwait nuclear decommissioning services market is valued at USD ~ million in 2025, driven by the increasing number of nuclear facilities reaching the end of their operational life. The demand for decommissioning services has been growing steadily due to government regulations, which require a proper and safe dismantling of nuclear power plants and research reactors. The market is influenced by the substantial investments made by the government and private sectors in ensuring the safe disposal of nuclear waste. Additionally, advances in decommissioning technologies and safety measures are playing a critical role in expanding the market. The market is expected to continue its growth due to stringent safety protocols and rising environmental concerns.

Kuwait is the key country dominating the nuclear decommissioning services market in the region. The country is heavily investing in infrastructure development and nuclear energy safety following global concerns about nuclear waste management. The presence of several aging reactors, with plans for decommissioning, has amplified the demand for specialized services. While Kuwait does not have a large number of operational reactors, its strategic position in the Middle East and reliance on international collaborations for energy solutions make it a hub for decommissioning activities. Other dominant countries in the region include the UAE and Saudi Arabia, both investing heavily in energy diversification and nuclear plant management.

Market Segmentation

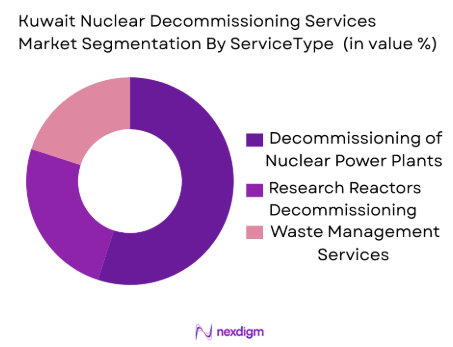

By Service Type

The Kuwait nuclear decommissioning services market is segmented into decommissioning of nuclear power plants, research reactors, and waste management services. The decommissioning of nuclear power plants holds the dominant market share due to the greater number of aging plants and international standards for their closure. Decommissioning services for nuclear power plants involve the dismantling of reactors and the safe disposal of radioactive materials. With the nuclear energy sector expanding globally, many countries, including Kuwait, are seeking specialized services for the safe and compliant closure of these facilities.

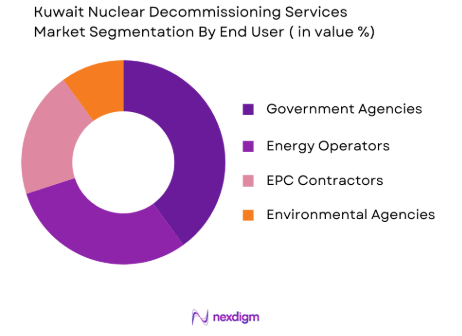

By End-User

The Kuwait nuclear decommissioning services market is also segmented by end-users, including government agencies, energy operators, EPC contractors, and environmental agencies. Government bodies dominate the market, as they are primarily responsible for overseeing decommissioning projects and ensuring safety compliance with nuclear energy regulations. With significant investments in infrastructure and nuclear waste management, these bodies are key drivers in the demand for decommissioning services. Energy operators also play a significant role, as the closure of plants requires safe and expert services to handle radioactive waste and dismantle the reactors efficiently.

Competitive Landscape

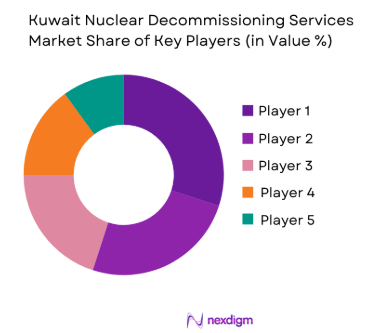

The Kuwait nuclear decommissioning services market is dominated by a few major players, including both global service providers and local firms. This consolidation highlights the significant influence of these key companies. Global giants such as Bechtel and Fluor Corporation have established strongholds in the region, offering their extensive decommissioning expertise. The market also sees participation from specialized local players who have expertise in the regulatory landscape and environmental standards unique to Kuwait.

| Company Name | Year of Establishment | Headquarters | Service Offerings | Technology Expertise | Key Markets Served | Market Focus |

| Bechtel | 1898 | USA | ~ | ~ | ~ | ~ |

| Fluor Corporation | 1949 | USA | ~ | ~ | ~ | ~ |

| Amentum | 2003 | USA | ~ | ~ | ~ | ~ |

| Tetra Tech | 1966 | USA | ~ | ~ | ~ | ~ |

| Jacobs Engineering Group | 1947 | USA | ~ | ~ | ~ | ~ |

Kuwait Nuclear Decommissioning Services Analysis

Growth Drivers

Increasing Government Regulations and Safety Standards

As Kuwait continues to focus on improving its energy sector, particularly with its nuclear energy potential, strict regulations and enhanced safety standards are becoming significant drivers for the nuclear decommissioning services market. The government’s commitment to ensuring the safe dismantling of aging nuclear reactors and proper disposal of radioactive waste creates a continuous demand for decommissioning services. Kuwait’s regulatory bodies are working closely with international standards to safeguard both the environment and public health. These regulations mandate that decommissioning be carried out following stringent safety protocols, leading to the demand for specialized service providers with the technical expertise required for these tasks. As nuclear energy plants age and reach the end of their lifecycle, regulations necessitate proper waste management and safe dismantling, making this a critical growth driver for the market.

Technological Advancements in Decommissioning Processes

Technological innovation is another key growth driver in the Kuwait nuclear decommissioning services market. With continuous advancements in robotics, automation, and radiation detection systems, the decommissioning process has become more efficient, cost-effective, and safer. These technologies allow for precise dismantling and reduce the time required to decommission nuclear facilities. Innovations such as remote-controlled equipment and automated systems ensure that workers are not exposed to hazardous environments, which is crucial for the success of decommissioning projects. These advancements in technology are not only improving the safety and efficiency of the decommissioning process but also reducing the overall cost, making it a more attractive solution for nuclear plant operators and government bodies, thus fueling market growth in Kuwait.

Market Challenges

High Costs of Decommissioning Services

One of the main challenges in the Kuwait nuclear decommissioning services market is the high cost associated with decommissioning nuclear plants and managing nuclear waste. The process of dismantling complex nuclear reactors and managing radioactive materials requires specialized equipment, technologies, and highly skilled personnel, all of which contribute to significant operational expenses. Additionally, the long duration of these projects and the complexities involved in meeting environmental and safety regulations can drive costs further. For many companies, the financial burden of decommissioning can be overwhelming, especially if they do not have the necessary expertise in handling hazardous materials. Despite these challenges, the demand for decommissioning services remains strong, and companies are exploring innovative ways to lower costs while maintaining high safety standards.

Lack of Skilled Workforce

The nuclear decommissioning industry in Kuwait faces a shortage of skilled professionals who are trained in handling complex nuclear dismantling projects. The specialized nature of decommissioning nuclear facilities requires highly trained workers who are proficient in radiation safety, radioactive waste management, and the intricate processes involved in plant decommissioning. As the industry grows, there is an increasing demand for professionals with expertise in these areas, but there is a limited pool of qualified labor. This shortage can cause delays in decommissioning projects, as well as increase costs due to the need to import skilled labor or invest in training programs. Additionally, the lack of local expertise in nuclear decommissioning could hinder Kuwait’s efforts to develop a sustainable and self-reliant nuclear energy sector, adding to the challenge faced by the market.

Opportunities

Partnerships for Technological Innovations

There is a growing opportunity in Kuwait for partnerships between local and international firms to advance technological innovations in nuclear decommissioning. As decommissioning projects become more complex and require cutting-edge solutions, partnerships with companies specializing in advanced decommissioning technologies and automation can significantly enhance the efficiency and safety of these projects. Collaboration with international players also allows local firms to benefit from global expertise and better adhere to international standards, helping Kuwait maintain a competitive edge in the nuclear energy sector. These partnerships can lead to the development of more efficient, environmentally friendly, and cost-effective decommissioning processes, ensuring that the market can meet growing demand in the coming years while adhering to the stringent safety and environmental regulations that govern nuclear decommissioning.

Regional Expansion and Cross-Border Decommissioning Projects

Kuwait has the potential to expand its nuclear decommissioning services to neighboring countries, where decommissioning activities are also increasing due to the aging of nuclear reactors. Countries in the Middle East, including the UAE, Saudi Arabia, and others, are making significant investments in nuclear energy, which will eventually require decommissioning as their reactors reach the end of their lifecycle. Kuwait’s expertise in nuclear decommissioning, backed by its regulatory framework and government support, positions it as a regional leader in providing decommissioning services. Expanding services to other countries in the region offers tremendous growth opportunities for Kuwait’s nuclear decommissioning market. Cross-border projects will not only enhance the market’s revenue potential but also solidify Kuwait’s position as a hub for nuclear safety and waste management in the Middle East.

Future Outlook

Over the next decade, the Kuwait nuclear decommissioning services market is expected to witness significant growth. This growth is primarily driven by rising environmental awareness, the need for stringent nuclear safety measures, and the decommissioning of aging nuclear reactors. Continuous governmental support and advancements in decommissioning technologies will further fuel the market’s expansion. The market is also poised for growth due to collaborations between international and local firms to ensure safe and compliant plant closures, which will contribute to an increase in the demand for nuclear waste management services.

Major Players

- Bechtel

- Fluor Corporation

- Amentum

- Tetra Tech

- Jacobs Engineering Group

- Westinghouse Electric Company

- Orano

- Babcock International Group

- Nuvia

- KBR

- SNC-Lavalin

- Amec Foster Wheeler

- Hitachi-GE Nuclear Energy

- Areva

- Doosan Heavy Industries

Key Target Audience

- Energy Operators

- Government and Regulatory Bodies

- EPC Contractors

- Nuclear Decommissioning Service Providers

- Environmental Agencies

- Investments and Venture Capitalist Firms

- Nuclear Plant Operators

- Waste Management Authorities

Research Methodology

Step 1: Identification of Key Variables

The first phase focuses on identifying the key variables driving the market for nuclear decommissioning services in Kuwait. This involves desk research, including secondary data sources like government reports, nuclear safety standards, and industry publications, to create a comprehensive market map.

Step 2: Market Analysis and Construction

This phase involves analysing historical market data, including the number of operational reactors, decommissioning projects, and waste management trends. The analysis will also focus on understanding the volume of waste generated and demand for services based on the number of nuclear facilities in the region.

Step 3: Hypothesis Validation and Expert Consultation

Consultations with industry experts, including government regulators and decommissioning service providers, will be conducted to validate market assumptions. These discussions will help refine hypotheses about growth drivers, market challenges, and key opportunities.

Step 4: Research Synthesis and Final Output

The final step is the synthesis of all collected data, followed by the verification of data through interviews with industry professionals. The objective is to provide a comprehensive, accurate, and validated market report based on industry inputs and expert analysis.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

Market Definition and Scope

Value Chain & Stakeholder Ecosystem

Regulatory / Certification Landscape

Sector Dynamics Affecting Demand

Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Growing number of aging nuclear power plants in the region

Increased government focus on nuclear safety and environmental concerns

Advancements in decommissioning technologies and methods - Market Challenges

High costs associated with nuclear decommissioning projects

Lack of skilled workforce and specialized equipment

Complex regulatory and certification requirements - Opportunities

Expansion of decommissioning services to countries with retiring nuclear plants

Technological innovations to reduce decommissioning costs

Collaborations between government and private sectors for efficient decommissioning - Trends

Increased use of automation in decommissioning processes

Shift toward environmentally friendly and sustainable decommissioning practices

Growing demand for third-party decommissioning service providers

- By Market Value 2020-2025

- By Installed Units 2020-2025

- By Average System Price 2020-2025

- By System Complexity Tier 2020-2025

- By System Type (In Value%)

Decommissioning Services for Nuclear Power Plants

Decommissioning Services for Research Reactors

Nuclear Waste Management Systems

Nuclear Plant Dismantling and Demolition Services

Nuclear Site Remediation Services - By Platform Type (In Value%)

Land-Based Decommissioning Services

Offshore Nuclear Decommissioning Platforms

Integrated Decommissioning Platforms

Automated Decommissioning Equipment

Modular Decommissioning Units - By Fitment Type (In Value%)

Turnkey Decommissioning Solutions

Modular Decommissioning Systems

Custom Decommissioning Packages

Partial Decommissioning Systems

Specialized Nuclear Equipment for Decommissioning - By End User Segment (In Value%)

Government and Regulatory Bodies

Nuclear Energy Providers

Engineering, Procurement & Construction (EPC) Companies

Environmental Agencies

Decommissioning Service Providers - By Procurement Channel (In Value%)

Direct Procurement from Manufacturers

Procurement via Government Contracts

Procurement through EPC Contractors

Public-Private Partnership Procurement Models

Procurement via Strategic Alliances

- Market Share Analysis

- Cross Comparison Parameters (Market Share, Technology Adoption, Regulatory Compliance, Cost Efficiency, Geographical Coverage)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Porter’s Five Forces

- Key Players

Bechtel

Amentum

Fluor Corporation

Westinghouse Electric Company

Jacobs Engineering Group

Cameco Corporation

Tetra Tech

Areva

Orano

Babcock International Group

Korea Electric Power Corporation (KEPCO)

Exelon Corporation

SNC-Lavalin

Amec Foster Wheeler

Nuvia

- Government bodies prioritizing nuclear plant safety and environmental standards

- Nuclear plant operators increasingly focusing on lifecycle management

- Service providers targeting long-term maintenance contracts

- Rising demand for independent decommissioning services

- Forecast Market Value 2026-2035

- Forecast Installed Units 2026-2035

- Price Forecast by System Tier 2026-2035

- Future Demand by Platform 2026-2035