Market Overview

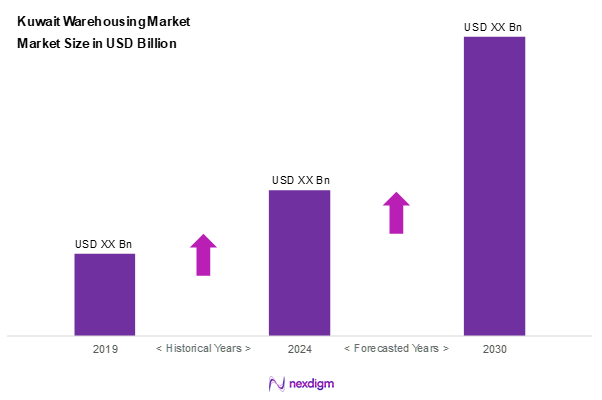

As of 2024, the Kuwait warehousing market is valued at USD ~ billion, with a growing CAGR of 5.4% from 2024 to 2030, driven by the rapid growth of e-commerce, which has led to increased demand for storage solutions. Investment in infrastructure has also contributed to this growth, as companies seek efficient systems for logistics and distribution. The market shows robust potential, with projections indicating further expansion in subsequent years due to ongoing developments and streamlining of supply chains.

Kuwait City dominates the warehousing market due to its strategic location as a trade hub in the Gulf region. Its extensive port facilities enhance logistics operations, making it appealing for regional and global companies. Other significant contributors include Al Ahmadi, known for its industrial activities, and Hawalli, which benefits from its proximity to urban centers and increasing retail demands. The concentration of businesses in these areas facilitates enhanced service delivery and operational efficiency.

Market Segmentation

By Warehouse Type

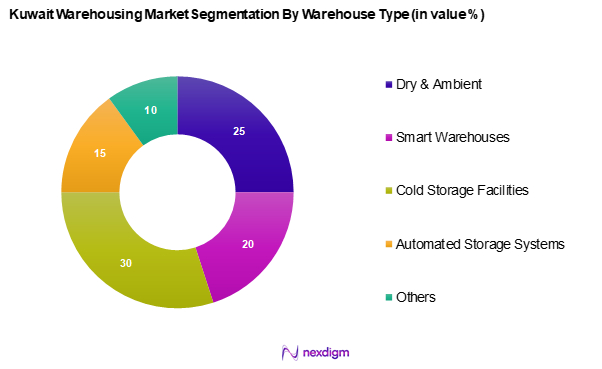

The Kuwait warehousing market is segmented into dry & ambient, smart warehouses, cold storage facilities, automated storage systems, and others. Cold storage facilities hold a dominant share in the market. The growth in food and pharmaceutical sectors, which require temperature-controlled environments to ensure product longevity and safety, fuels this segment’s expansion. With increasing import volumes of perishable goods, companies are investing in advanced cold storage solutions, reflecting the urgent need for efficient supply chains in a growing economy.

By End User

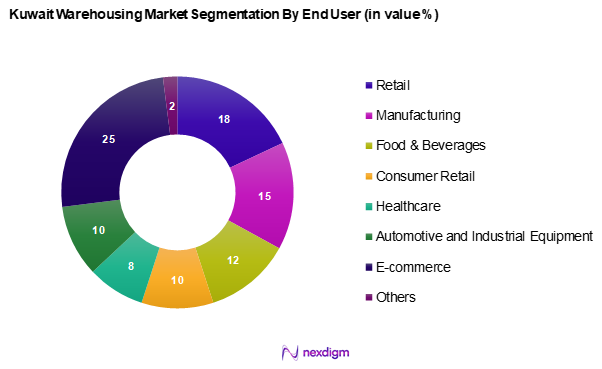

The Kuwait warehousing market is segmented by into retail, manufacturing, food & beverages, consumer retail, healthcare, automotive and industrial equipment, E-commerce, and others. The E-commerce segment is currently dominating the market share due to the surge in online shopping trends, particularly post-pandemic. As consumers increasingly prefer online purchases, businesses are adapting their supply chains to cater to this demand by establishing distribution centres that support prompt delivery and efficient order fulfilment, thereby necessitating greater warehousing capabilities.

Competitive Landscape

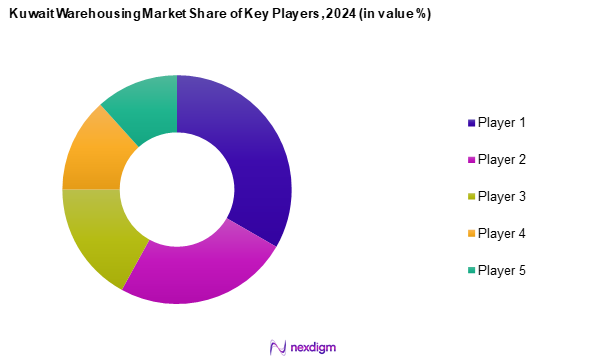

The Kuwait warehousing market is dominated by several key players including Agility Logistics, KGL Logistics, Al-Mutahidah Logistics, GWC, and Bader Al Mulla Group. This concentration of major companies underscores the competitive nature of the market, with these firms leveraging established networks, advanced technology, and comprehensive service portfolios to enhance their positioning in the rapidly evolving logistics landscape. Their operational capabilities, coupled with innovation and customer service excellence, keep them at the forefront of the market.

| Major Players | Establishment Year | Headquarters | Services Offered | Market Presence | Technology Adoption | Revenue (USD) |

| Agility Logistics | 1979 | Kuwait City | – | – | – | – |

| KGL Logistics | 1956 | Kuwait City | – | – | – | – |

| Al-Mutahidah Logistics | 1985 | Kuwait City | – | – | – | – |

| GWC | 2008 | Doha, Qatar | – | – | – | – |

| Bader Al Mulla Group | 1976 | Kuwait City | – | – | – | – |

Kuwait Warehousing Market Analysis

Growth Drivers

Increasing E-commerce Growth

E-commerce in Kuwait has experienced significant expansion, creating a heightened demand for warehousing solutions. As consumer behaviour shifts toward online shopping, businesses are investing in storage facilities to ensure efficient order fulfilment and timely deliveries. This trend has gained momentum, particularly in the post-pandemic era, prompting companies to scale their logistics infrastructure. The growing volume of e-commerce transactions is strengthening the need for advanced warehousing and distribution networks, reinforcing the market’s growth trajectory.

Infrastructure Development Initiatives

Kuwait has been actively investing in infrastructure improvements to enhance its logistics sector. Government-led initiatives focus on modernizing transportation networks, trade hubs, and warehousing facilities to streamline supply chain operations. These large-scale projects are designed to improve trade facilitation and support economic diversification goals. As new industrial zones and logistical hubs emerge, the demand for warehousing solutions continues to grow, fostering a more efficient distribution ecosystem.

Market Challenges

Regulatory Compliance Issues

Warehousing businesses in Kuwait operate within a highly regulated environment, requiring adherence to stringent safety and operational standards. Compliance with evolving regulations presents challenges for logistics firms, as it necessitates continuous investment in infrastructure and processes. The oversight from agencies such as the Ministry of Commerce and Industry reported many of non-compliance in the recent year, impacting the operational efficiency of warehouses. This regulatory burden can lead to increased operational costs and restrict the ability of firms to quickly adapt to market demands.

High Operational Costs

The warehousing sector in Kuwait faces rising operational expenses due to economic fluctuations impacting labour, energy, and raw material costs. These financial pressures make it challenging for logistics providers, particularly smaller firms, to sustain profitability while remaining competitive. The increased cost of operations also affects investment in modern warehousing technologies, potentially slowing advancements in automation and sustainability.

Opportunities

Investment in Green Warehousing

Sustainability initiatives in Kuwait’s logistics sector are gaining prominence, with businesses and government entities emphasizing eco-friendly practices. Investments in renewable energy solutions for warehouses, such as solar power and energy-efficient storage systems, are becoming a priority. The focus on reducing carbon footprints aligns with global environmental trends and enhances corporate responsibility efforts. Warehousing firms adopting green solutions are positioned to attract sustainability-conscious clients while improving long-term cost efficiency and regulatory compliance.

Partnerships with Tech Companies

Technological advancements are transforming the warehousing landscape, with increased adoption of automation, artificial intelligence, and the Internet of Things. Collaborations between logistics firms and technology providers are facilitating the integration of smart warehousing solutions, enhancing operational efficiency and scalability. The shift toward digital transformation supports omni-channel distribution models, improving inventory management and customer responsiveness. These innovations present opportunities for businesses to optimize supply chain operations and drive future growth in the warehousing market.

Future Outlook

Over the next five years, the Kuwait warehousing market is expected to experience substantial growth driven by technological advancements, an increase in e-commerce activities, and government initiatives to modernize logistics infrastructure. The push toward green warehousing and sustainability will further propel investment in innovative warehousing solutions, making the market resilient and adaptive to future demands. Additionally, collaborations with tech companies for enhanced automation may significantly reshape the logistics landscape in Kuwait.

Major Players

- Agility Logistics

- KGL Logistics

- Al-Mutahidah Logistics

- GWC

- Bader Al Mulla Group

- United Warehousing Company

- National Logistics Services

- Al Mousherji

- Kuwait Shipping Company

- Al-Tasnim Enterprises

- Seda Gulf

- Ahlia Logistics

- Tristar Group

- Eland Group

- Emirates Logistics

- DHL Kuwait

- APL Logistics

- Aramex

- City Group

- TransCrate Logistics

Key Target Audience

- E-commerce Companies

- Retail Corporations

- Logistics and Supply Chain Firms

- Food and Beverage Distributors

- Healthcare Providers

- Government and Regulatory Bodies (e.g., Ministry of Communications and Ministry of Trade and Industry)

- Investors and Venture Capitalist Firms

- Construction and Infrastructure Development Firms

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves understanding the dynamics of the Kuwait warehousing market by mapping out all critical stakeholders. This step utilizes extensive secondary data from industry reports, market studies, and trusted databases to establish a thorough understanding of the key variables driving market dynamics.

Step 2: Market Analysis and Construction

In this phase, historical data regarding the warehousing market’s performance in Kuwait is compiled, focusing on market penetration and revenue generation across various segments. The analysis includes assessing the trends and operational metrics to ensure accuracy in the revenue forecasts.

Step 3: Hypothesis Validation and Expert Consultation

Formulated hypotheses based on data analyses are validated through consultations with industry experts and stakeholders. This process utilizes structured interviews and surveys to gain insights into operational practices and future market expectations, which enhances the reliability of the conclusions drawn.

Step 4: Research Synthesis and Final Output

The final stage consists of consolidating all findings and insights obtained from the previous phases. Engagement with various players within the warehousing sector ensures a comprehensive understanding of trends, customer preferences, and challenges, which leads to a validated and precise overview of the Kuwait warehousing market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Market Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain & Value Chain Analysis

- Growth Drivers

Increasing E-commerce Growth

Infrastructure Development Initiatives - Market Challenges

Regulatory Compliance Issues

High Operational Costs - Opportunities

Investment in Green Warehousing

Partnerships with Tech Companies - Trends

Growth of Omni-Channel Distribution

Adoption of AI and Automation - Government Regulations

Safety Standards Logistics

Environmental Regulations - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Warehouse Type, 2019-2024 (In Value %)

Dry & Ambient

Smart Warehouses

Cold Storage Facilities

Automated Storage Systems

Others - By End User, 2019-2024 (In Value %)

Retail

Manufacturing

Food & Beverages

Consumer Retail

Healthcare

Automotive and Industrial Equipment

E-commerce - By Technology Adoption, 2019-2024 (In Value %)

IoT Solutions

AI and Robotics

Warehouse Management Systems (WMS) - By Region, 2019-2024 (In Value %)

Kuwait City

Hawalli

Ahmadi

Al Jahra - By Storage Capacity, 2019-2024 (In Value %)

Less than 10,000 sq. ft.

10,000 – 50,000 sq. ft.

More than 50,000 sq. ft. - By Commercial Models, 2019-2024 (In Value %)

Built to Suit Model

Long Term Leasing Model

Rental Models by 3PL - By Grade, 2019-2024 (In Value %)

Grade A

Grade B

Others

- Market Share of Major Players on the Basis of Value/Volume, 2014

Market Share of Major Players by Type of Warehouse Segment, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strength, Weakness, Organizational Structure, Revenues, Distribution Channels, Market Reach, Technology Adoption, Customer Service Metrics)

- SWOT Analysis of Major Players

- Pricing Analysis Basis SKUs for Major Players

- Detailed Profiles of Major Companies

Agility Logistics

KGL Logistics

Al-Mutahidah Logistics

GWC

Bader Al Mulla Group

United Warehousing Company

National Logistics Services

Al Mousherji Shipping Company

Kuwait Shipping Company

Al-Tasnim Enterprises

Seda Gulf

Ahlia Logistics

Tristar Group

Eland Group

Emirates Logistics

DHL Kuwait

APL Logistics

Aramex

City Group

TransCrate Logistics

Others

- Market Demand and Utilization

- Purchasing Behavior

- Regulatory and Compliance Requirements

- Needs, Desires, and Pain Points

- Decision Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030