Market Overview

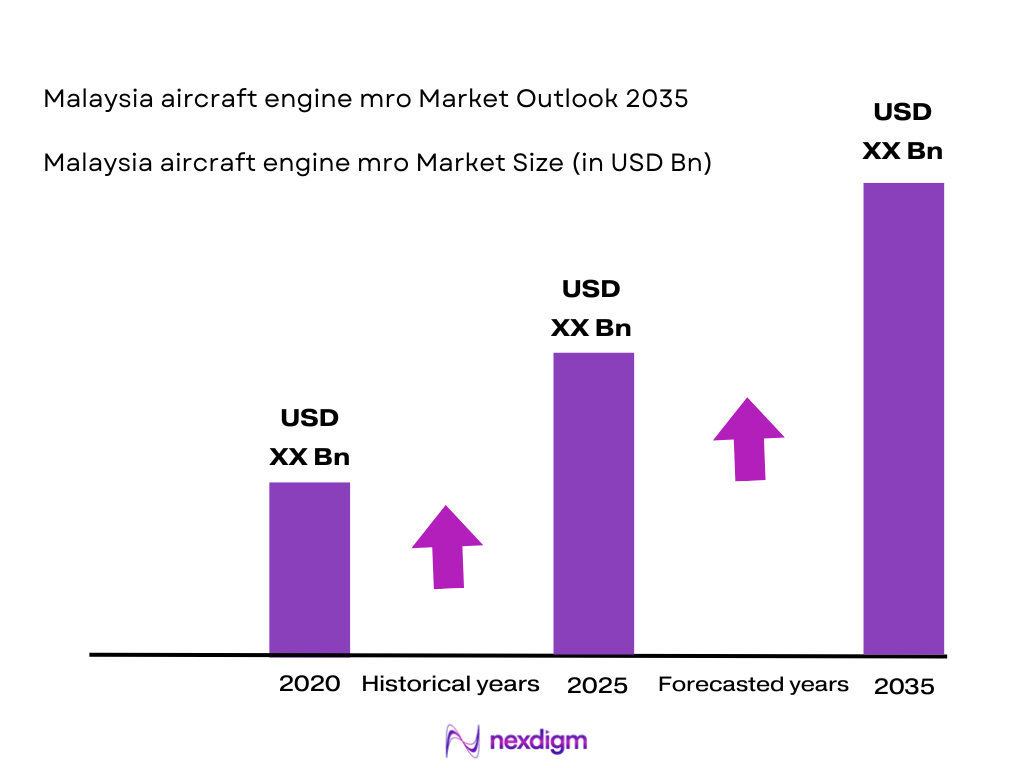

Based on a recent historical assessment, the Malaysia aircraft engine MRO market was valued at approximately USD ~ billion, driven primarily by sustained commercial aviation activity, a high concentration of in-service turbofan engines, and Malaysia’s role as a regional maintenance hub. Demand is supported by recurring engine shop visits, long-term service agreements with OEMs, and growing reliance on third-party MRO providers by airlines seeking cost efficiency. Fleet utilization of intensity, engine life-cycle requirements, and regulatory compliance obligations continue to underpin steady service revenues across the market.

Based on a recent historical assessment, Kuala Lumpur and Selangor dominate the Malaysia aircraft engine MRO market due to the presence of certified MRO clusters, proximity to major international airports, and established aerospace infrastructure. Malaysia’s dominance is further reinforced by strong connectivity with Southeast Asian aviation markets, skilled technical labor availability, and long-standing OEM partnerships. Regional airlines from neighboring countries route engine maintenance work to Malaysian facilities, supported by favorable regulatory alignment and competitive operating environments compared with other regional hubs.

Market Segmentation

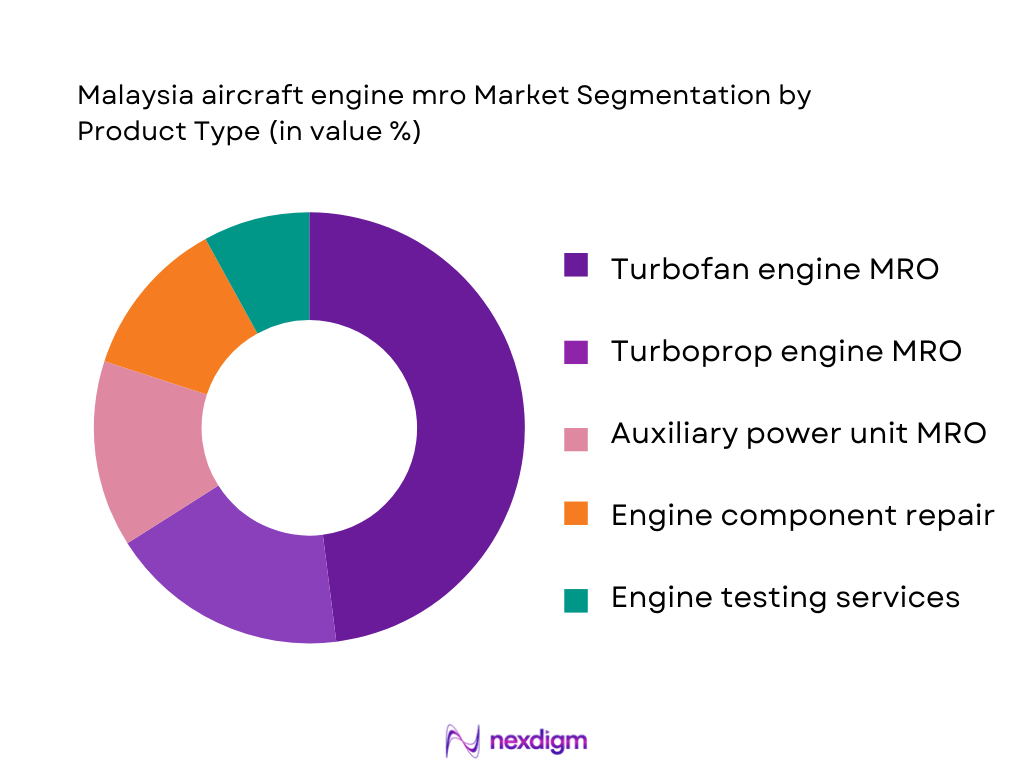

By Product Type

Malaysia aircraft engine mro market is segmented by product type into turbofan engine MRO, turboprop engine MRO, auxiliary power unit MRO, engine component repair, and engine testing services. Recently, turbofan engine MRO had a dominant market share due to the high concentration of narrow-body and wide-body commercial aircraft operating across Southeast Asia. Airlines prioritize turbofan maintenance because these engines account for the highest maintenance expenditure over their life cycle and require frequent inspections, module repairs, and overhauls. Malaysia’s certified facilities are optimized for turbofan platforms from major OEMs, enabling faster turnaround times. Long-term service agreements further concentrate on demand in this segment, reinforcing its leadership position.

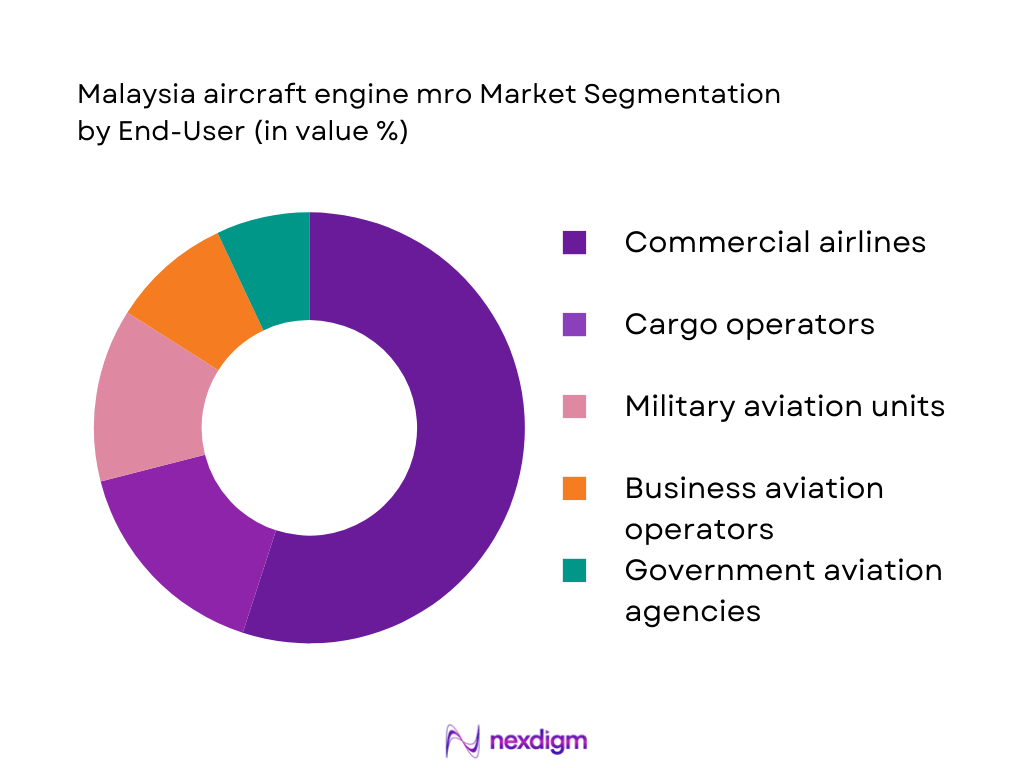

By End User

Malaysia aircraft engine mro market is segmented by end user into commercial airlines, cargo operators, military aviation units, business aviation operators, and government aviation agencies. Recently, commercial airlines have a dominant market share due to continuous fleet operations and strict engine maintenance schedules mandated by aviation authorities. High aircraft utilization rates increase the frequency of engine shop visits, while cost optimization strategies drive airlines toward specialized third-party MRO providers. Malaysia’s geographic position allows airlines to minimize ferry time and logistics costs. Established airline–MRO partnerships further strengthen this segment’s dominance across the national and regional market.

Competitive Landscape

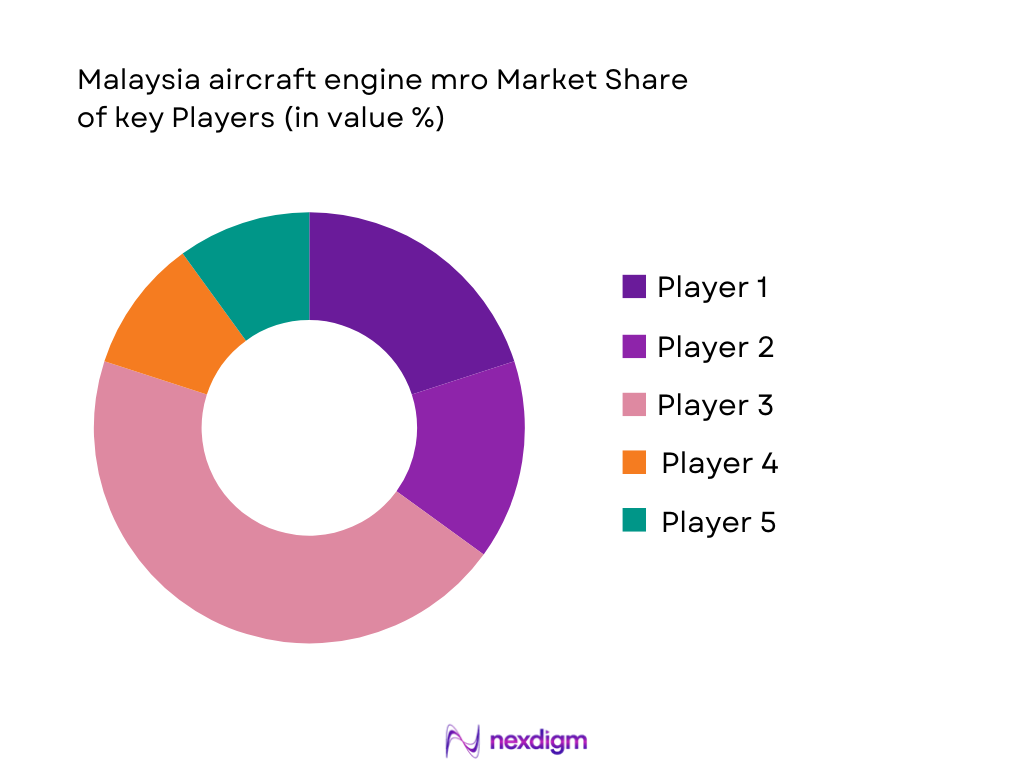

The Malaysia aircraft engine mro market exhibits moderate consolidation, with a limited number of certified providers controlling a significant share of high-value engine maintenance contracts. Major players benefit from OEM authorizations, skilled labor pools, and long-term airline agreements, creating high entry barriers. Competitive differentiation is largely driven by turnaround time, engine platform coverage, and cost efficiency, while regional expansion strategies strengthen market positioning.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Engine Platforms Supported |

| Lufthansa Technik Malaysia | 2003 | Malaysia | ~ | ~ | ~ | ~ | ~ |

| Asia Digital Engineering | 2020 | Malaysia | ~ | ~ | ~ | ~ | ~ |

| ST Aerospace | 1970 | Singapore | ~ | ~ | ~ | ~ | ~ |

| Safran Aircraft Engines | 1905 | France | ~ | ~ | ~ | ~ | ~ |

| Rolls-Royce TotalCare | 1997 | UK | ~ | ~ | ~ | ~ | ~ |

Malaysia aircraft engine mro Market Analysis

Growth Drivers

Expansion of Commercial Aviation Fleet in Southeast Asia

Expansion of commercial aviation fleet in Southeast Asia explanation continues in the same sentence. Expansion of commercial aviation fleet in Southeast Asia is driving sustained demand for engine maintenance as airlines increase aircraft utilization to meet passenger and cargo traffic growth. Malaysia benefits from its proximity to high-traffic air routes, enabling airlines to schedule engine shop visits with minimal operational disruption. Narrow-body aircraft deliveries increase turbofan engine volumes requiring regular inspection and overhaul. Fleet standardization further concentrates maintenance demand on specific engine platforms. Airlines increasingly outsource engine maintenance to specialized providers to reduce fixed costs. Regulatory mandates enforce strict maintenance intervals, ensuring recurring revenue streams. Regional airline partnerships channel cross-border engine work into Malaysian facilities. This structural fleet growth underpins long-term market expansion.

Rising Adoption of Long-Term Engine Service Agreements

Rising adoption of long-term engine service agreements explanation continues in the same sentence. Airlines increasingly favor power-by-the-hour and long-term maintenance contracts to stabilize operating costs and improve fleet reliability. These agreements guarantee consistent engine shop visit volumes for MRO providers. Malaysia’s certified facilities attract such contracts due to competitive labor costs and OEM approvals. Predictable revenue streams support capacity expansion and technology investment. Long-term contracts also deepen collaboration between airlines and MRO providers. This model reduces downtime risk for operators. It strengthens Malaysia’s role as a regional engine maintenance hub. The contractual shift significantly supports market growth.

Market Challenges

Dependence on OEM Certifications and Parts Supply

Dependence on OEM certifications and parts supply explanation continues in the same sentence. Engine MRO providers in Malaysia rely heavily on OEM approvals to service modern engine platforms. Certification requirements limit the number of eligible service providers. Parts of supply constraints can delay maintenance schedules and increase costs. OEM control over proprietary components reduces pricing flexibility. Compliance costs for certification renewal remain high. Skilled workforce requirements further increase operational expenses. Delays in parts logistics affect turnaround times. This dependency constrains competitive dynamics within the market.

Skilled Workforce Availability Constraints

Skilled workforce availability constraints explanation continues in the same sentence. Aircraft engine maintenance requires licensed engineers with specialized training and certifications. Malaysia faces competition from other aviation hubs for experienced talent. Training timelines are long and capital intensive. Workforce shortages can limit throughput capacity. Rising labor costs pressure operating margins. Retention challenges increase recruitment expenses. Regulatory requirements restrict rapid workforce scaling. These factors collectively challenge sustainable expansion.

Opportunities

Positioning Malaysia as a Regional Engine MRO Hub

Positioning Malaysia as a regional engine MRO hub explanation continues in the same sentence. Malaysia has the opportunity to strengthen its hub status by attracting cross-border engine maintenance demand. Strategic investments in capacity expansion can support regional airlines. Government support enhances infrastructure competitiveness. Proximity to ASEAN markets reduces logistics costs. OEM partnerships expand engine platform coverage. Competitive pricing attracts long-term contracts. Digital maintenance capabilities improve efficiency. This positioning unlocks sustained growth opportunities.

Integration of Digital Engine Health Monitoring Solutions

Integration of digital engine health monitoring solutions explanation continues in the same sentence. Adoption of predictive analytics enables early fault detection and optimized maintenance scheduling. Digital solutions reduce unscheduled engine removals. Airlines benefit from improved reliability and cost control. MRO providers gain data-driven insights for capacity planning. Malaysia’s digital aviation initiatives support technology integration. OEM collaboration accelerates adoption. Enhanced transparency strengthens customer trust. This opportunity supports service differentiation.

Future Outlook

The Malaysia aircraft engine mro market is expected to maintain steady expansion over the next five years, supported by regional fleet growth and sustained airline operations. Technological advancements in engine diagnostics will improve maintenance efficiency. Regulatory alignment with international aviation standards will continue to support cross-border businesses. Demand from commercial and cargo aviation segments will remain strong. Overall, the market outlook reflects stable, long-term growth fundamentals.

Major Players

- Lufthansa Technik Malaysia

- Asia Digital Engineering

- ST Aerospace

- Safran Aircraft Engines

- Rolls-Royce TotalCare

- MTU Maintenance

- SIA Engineering

- StandardAero

- HAECO

- GMF AeroAsia

- Pratt & Whitney Engine Services

- SR Technics

- Ameco

- AAR Corp

- FL Technics

Key Target Audience

- Commercial airlines

- Cargo airlines

- Business aviation operators

- Military aviation units

- Government and regulatory bodies

- Airport authorities

- Aircraft lessors

- Investments and venture capitalist firms

Research Methodology

Step 1: Identification of Key Variables

Key variables related to engine maintenance demand, fleet size, service cycles, and regulatory requirements were identified. Industry definitions and scope boundaries were established. Core assumptions were validated using secondary aviation data.

Step 2: Market Analysis and Construction

Historical data on engine MRO activity and fleet operations were analyzed. The market structure and segmentation were constructed. Demand patterns were mapped across end users and engine types.

Step 3: Hypothesis Validation and Expert Consultation

Findings were validated through expert interviews and industry feedback. Assumptions were refined based on practitioner insights. Data consistency checks were conducted.

Step 4: Research Synthesis and Final Output

Validated data and insights were synthesized into a cohesive report. Analytical models were applied to ensure logical consistency. Final outputs were reviewed for accuracy and relevance.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Rising commercial aircraft fleet operations in Southeast Asia

Expansion of low-cost carrier networks in Malaysia

Increasing engine maintenance outsourcing by airlines - Market Challenges

High capital investment for certified engine MRO facilities

Shortage of licensed and skilled aviation technicians

Dependence on OEM approvals and parts availability - Market Opportunities

Growth in regional hub positioning for engine MRO services

Increasing military aircraft engine sustainment programs

Adoption of digital engine health monitoring solutions - Trends

Shift toward performance-based engine maintenance contracts

Increased use of predictive maintenance analytics

Higher demand for quick turnaround engine shop visit - Government Regulations

Civil aviation authority compliance and certification requirements

Defense procurement and offset policy frameworks

Environmental regulations on engine emissions and waste handling - SWOT Analysis

- Porter’s Five Forces

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Turbofan engine maintenance and overhaul

Turboprop engine maintenance and overhaul

Turbojet engine maintenance and overhaul

Auxiliary power unit maintenance services

Engine component repair and refurbishment - By Platform Type (In Value%)

Commercial narrow body aircraft engines

Commercial wide body aircraft engines

Regional aircraft engines

Military transport and patrol aircraft engines

Business jet aircraft engines - By Fitment Type (In Value%)

Line maintenance engine services

Base maintenance engine services

Engine shop visit services

On-wing engine inspection services

Off-wing engine overhaul services - By EndUser Segment (In Value%)

Commercial airlines

Cargo and freight operators

Military and defense aviation units

Business aviation operators

Government and special mission operators - By Procurement Channel (In Value%)

Direct OEM contracts

Independent MRO service providers

Airline in-house MRO units

Government and defense tenders

Long-term service agreement contracts

- Market Share Analysis

- Cross Comparison Parameters (Service portfolio breadth, Engine type capability, Turnaround time, Certification coverage, Cost competitiveness, Geographic service reach, OEM partnership strength, Digital MRO capabilities, Spare parts availability, Workforce skill depth)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Lufthansa Technik Malaysia

GMF AeroAsia

Asia Digital Engineering

Singapore Technologies Aerospace

Safran Aircraft Engines Services Asia

Rolls-Royce TotalCare Services Malaysia

MTU Maintenance Asia-Pacific

StandardAero Asia

HAECO Asia

SIA Engineering Company

Pratt & Whitney Engine Services Asia

SR Technics Asia

FL Technics Indonesia

Ameco Asia

AAR Asia Pacific

- Commercial airlines prioritizing cost efficient engine maintenance cycles

- Defense operators emphasizing long term engine availability and reliability

- Cargo operators requiring high utilization engine support models

- Business aviation users demanding rapid turnaround and flexibility

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035